[ad_1]

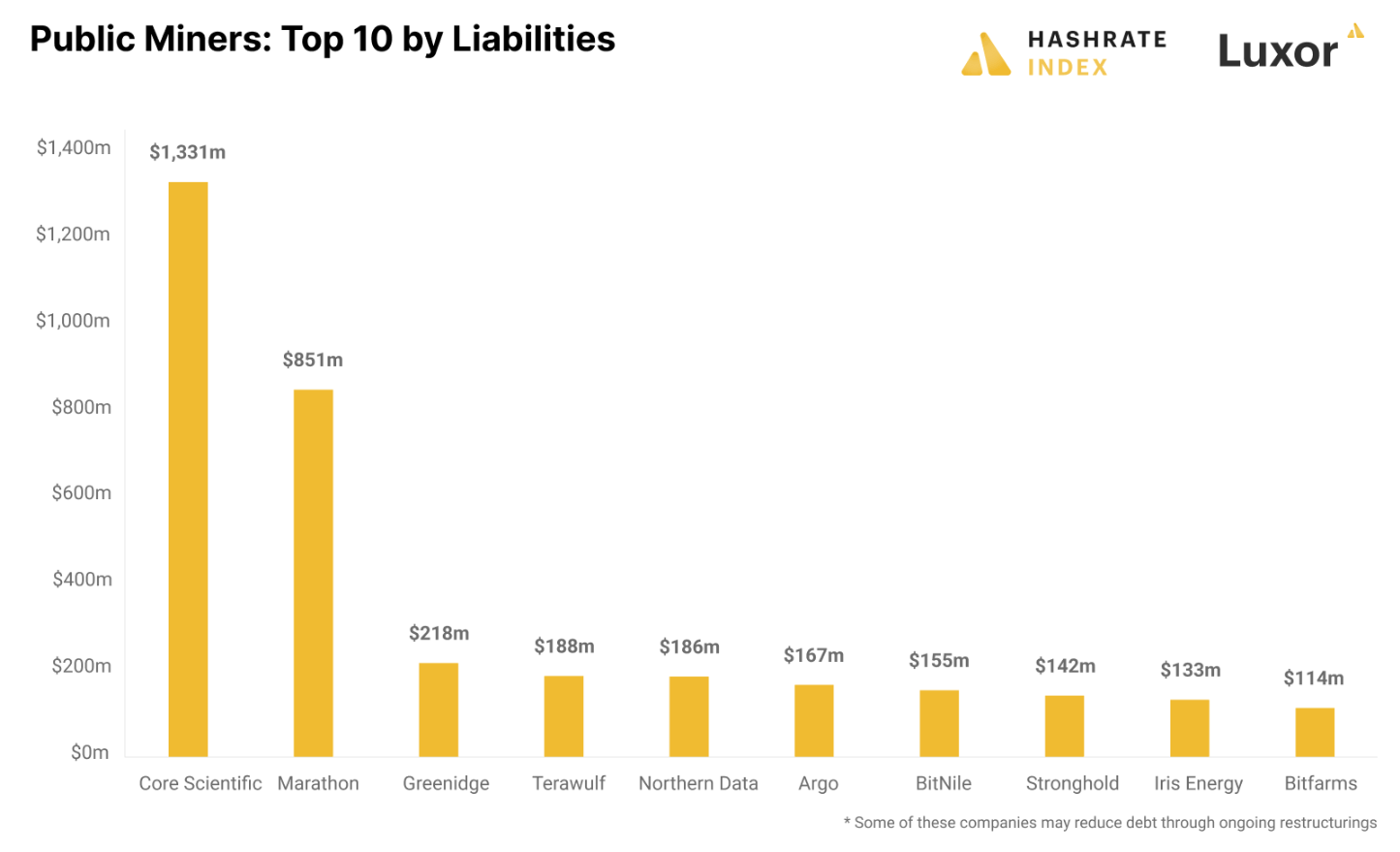

Public Bitcoin (BTC) mining companies collectively have liabilities that amass to over $4 billion, according to Hashrate Index.

Owing the most in liabilities, Core Scientific debt sat at approximately $1.3 billion on Sept. 30, according to a company statement.

The BTC mining industry has seen significant fluctuations during this bear market — the recent bankruptcy of Core Scientific stands as a testament to volatility of the sector.

Though it is the largest public BTC miner by hashrate, Core Scientific has struggled under debt for many months — unable to pay off monthly debt service payments, according to Hashrate Index.

Warning: Hard Hats must be worn

Core Scientific is not the only public miner struggling with debt. Marathon, the second-largest debtor, owes $851 million, mostly in the form of convertible notes that give holders the option to convert them to stock.

Greenidge, the third-biggest debtor, owes $218 million and is undergoing a restructuring process to reduce its debt.

Deep in Debt

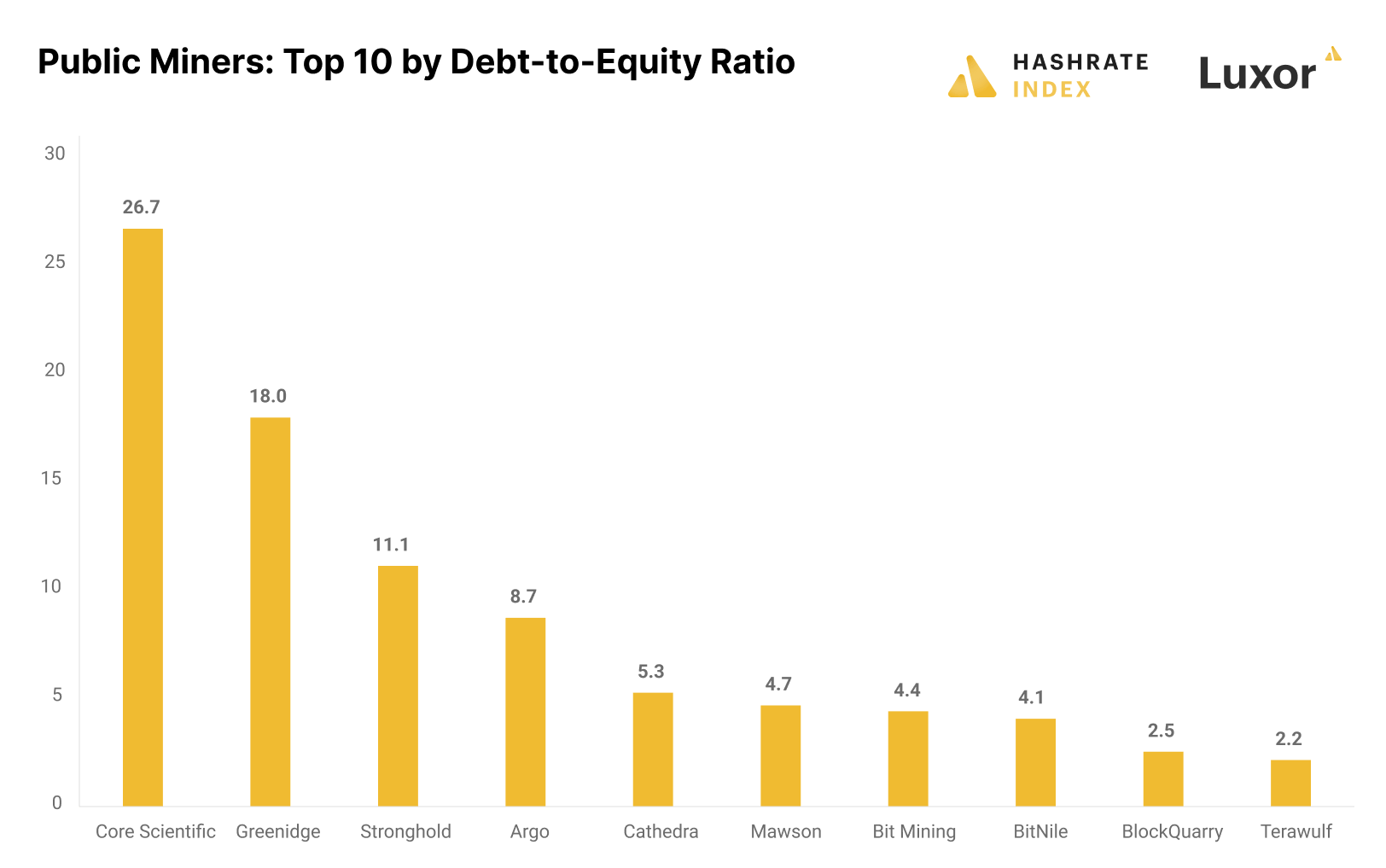

When looking at the debt-to-equity ratio, a measure of how much a company owes relative to its equity, it becomes clear that many public miners have significantly high levels of debt.

Luxor analyst, Jaran Mellerud, stated that, generally:

“A debt-to-equity ratio of 2 or higher is considered risky, but in a volatile Bitcoin mining industry, it should be substantially lower. In the chart below, we can see that there are many public miners with extremely high debt-to-equity ratios.”

Core Scientific has the highest ratio at 26.7, followed by Greenidge at 18 and Stronghold at 11.1.

Argo are In fourth position with a ratio of 5.3 — having accidentally revealed plans for bankruptcy — stated that it is “negotiating to sell some of its assets and carry out an equipment financing transaction to reduce its debt and improve liquidity,” according to Mellerud.

“Due to the unsustainably high debt levels in the industry, we will likely continue to see more restructurings and potentially some bankruptcies. We have started to enter the part of the cycle where the weak players are flushed out.”

[ad_2]

Read More: cryptoslate.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  Wrapped eETH

Wrapped eETH  WETH

WETH  USDS

USDS  Hedera

Hedera  Litecoin

Litecoin  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Uniswap

Uniswap  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  Aptos

Aptos  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic  Ondo

Ondo