Get the best data-driven crypto insights and analysis every week:

By: Tanay Ved

-

We estimate Coinbase to report ~$2B in total revenue for Q4 2024, a 65% increase QoQ and 109% YoY, driven by a rebound in transaction revenue and steady growth in subscriptions & services.

-

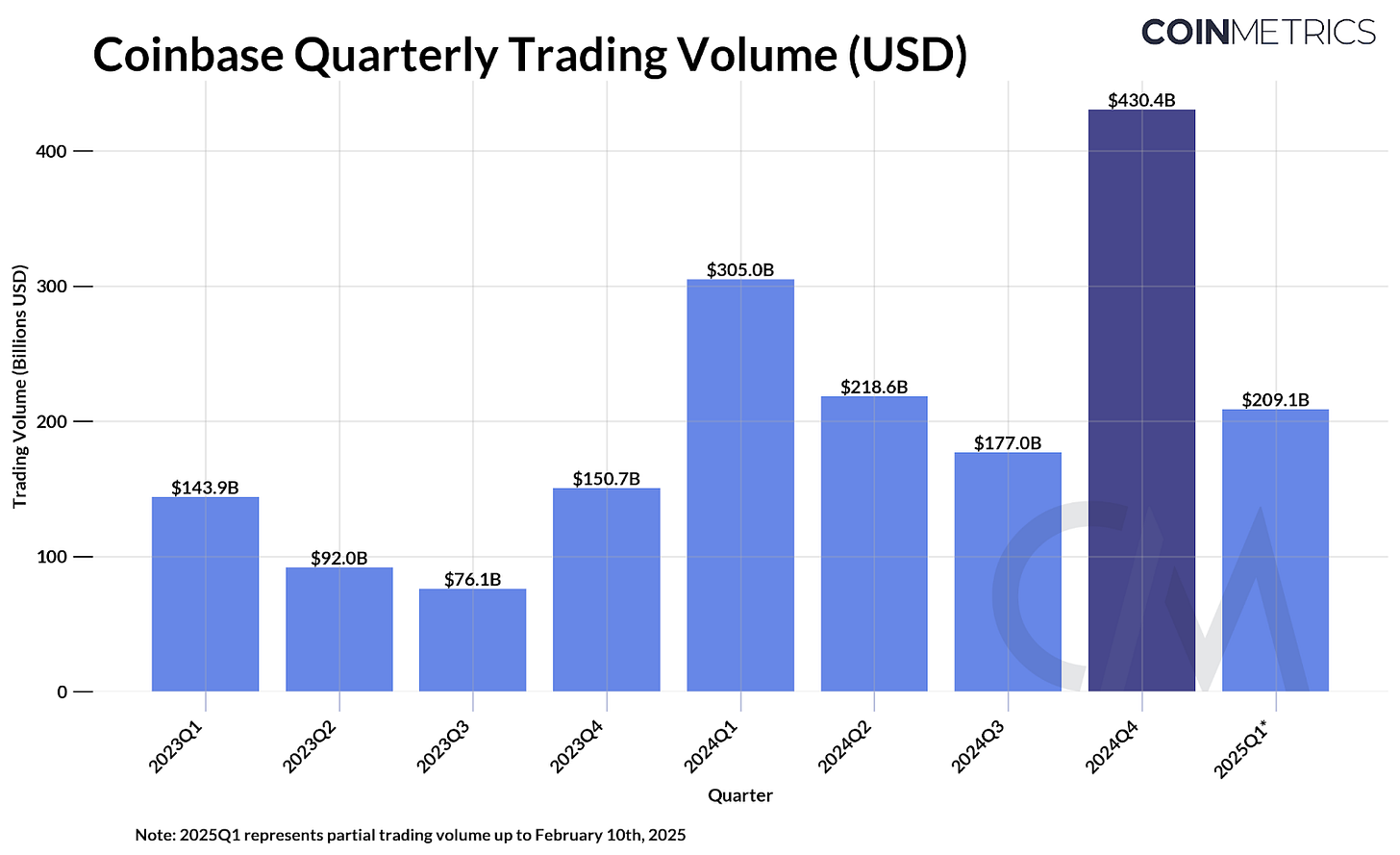

Trading volumes surged to ~$430B—the highest since Q4 2021—fueled by renewed market optimism post-U.S. election, while USDC supply grew 23%, likely boosting Coinbase’s stablecoin revenue.

-

Base generated 8,047 ETH ($26.36M) in sequencer revenue and 7,417 ETH ($24.18M) in profit, maintaining strong profitability as low settlement costs on Ethereum sustained high margins.

Coinbase Global Inc. (COIN) is set to report its Q4 2024 earnings results on February 13th . As the only publicly traded major cryptocurrency exchange listed on the U.S. stock market— and an increasingly diversified blockchain business— its financial performance will be closely watched by both crypto market participants and Wall Street alike. Q4 shaped up to be a bullish quarter, fueled in part by Donald Trump’s election victory, which helped drive renewed optimism in the space. Investors will now be eager to see how Coinbase capitalizes on this momentum, especially as an easing regulatory environment and expected growth in crypto IPO’s promise to bring competition from other prominent players in the industry.

In this issue of Coin Metrics’ State of the Network, we preview Coinbase’s Q4 2024 earnings using a combination of Coin Metrics’ suite of market data and on-chain data alongside publicly available information.

Going into the earnings results, analysts expect Coinabase to report $1.59B in total revenue, ~$300M higher than its Q3 2024 revenue of $1.2B and anticipate an earnings per share (EPS) of $1.13. While this projects quarterly revenue growth for the company, we believe Coinbase will exceed these expectations driven by a combination of growth in transaction revenues and subscription and services revenue, the two core segments of their revenue mix.

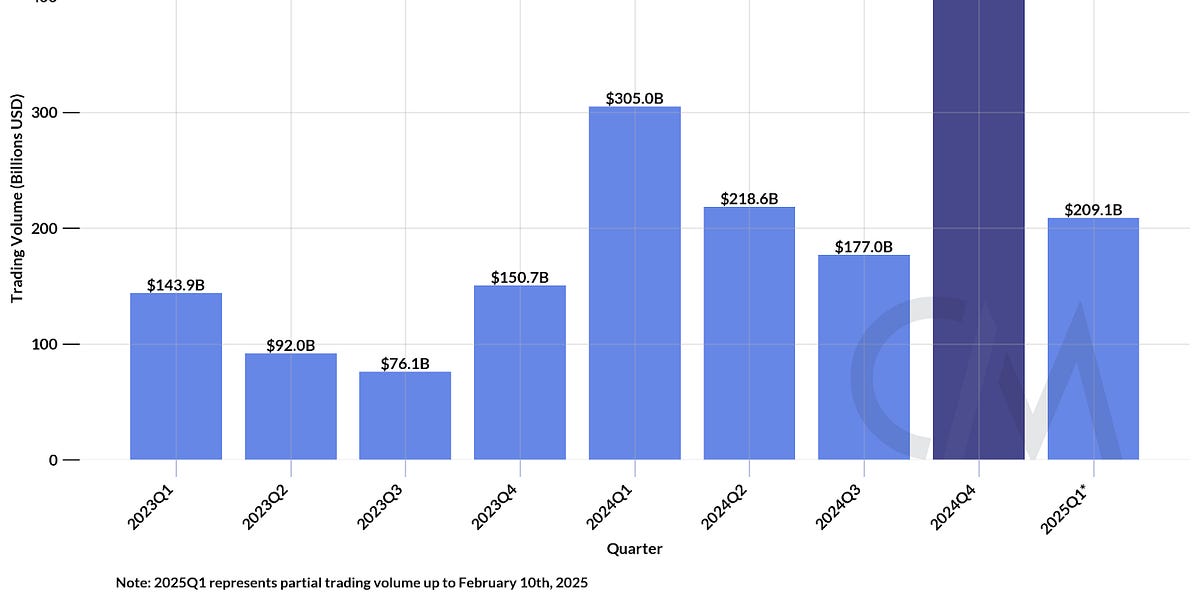

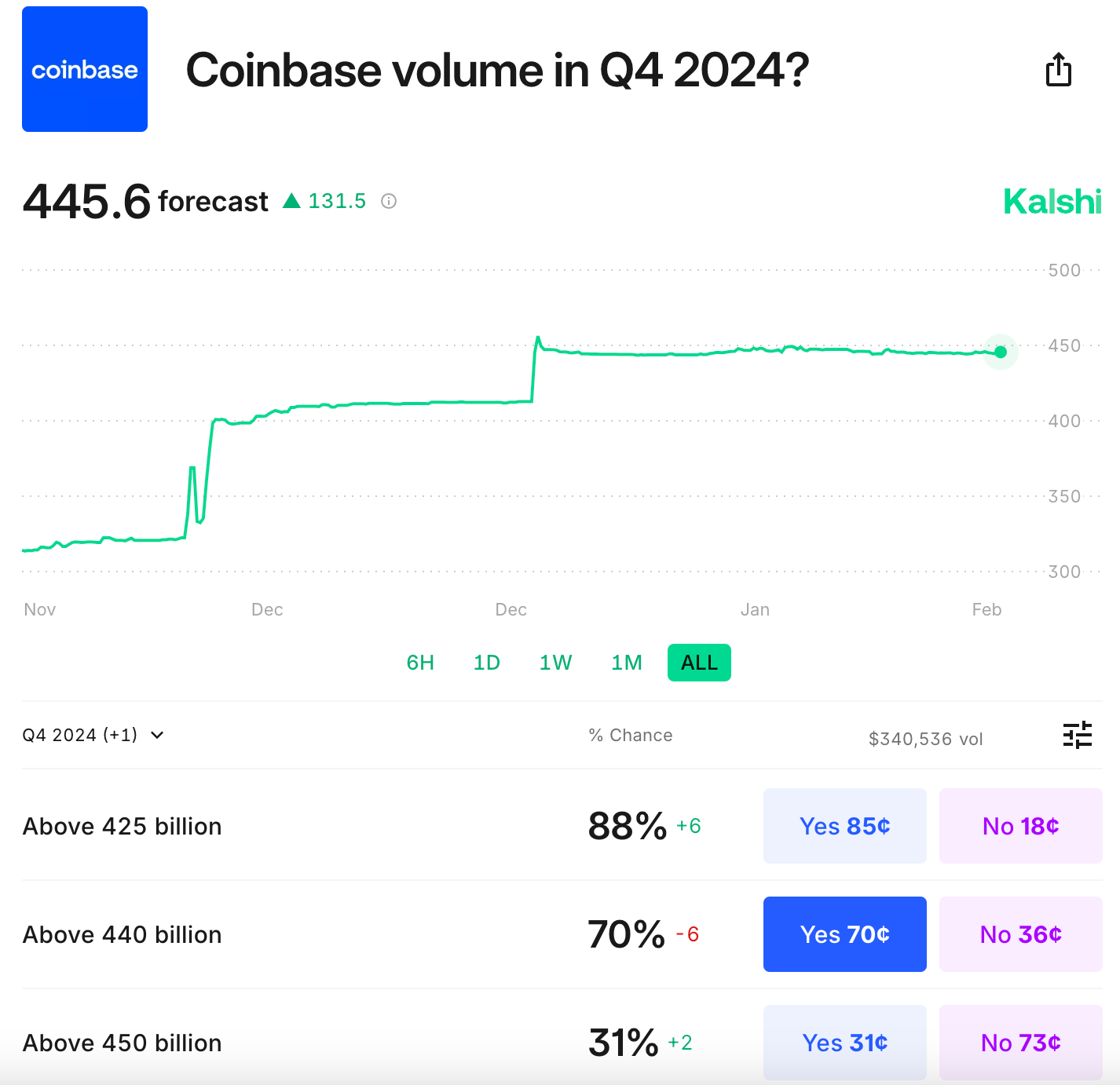

Looking at prediction markets like Kalshi, participants are forecasting $445B in total trading volume over the quarter with a 70% probability. This represents a 140% increase from Q3.

Coinbase’s transaction revenue consists of income earned from consumer and institutional trading, as well as their Layer-2 Base and payments related revenue, which was reclassified from consumer to “Other transaction revenue” in Q1 2024.

With Coinbase’s daily trading volume resampled to the past eight quarters, Q4 2024 stands out as the highest quarterly trading volume (~$430.4B) since Q4 2021. Donald Trump’s U.S. election in November has fueled substantially higher trading activity on the exchange. This increase should stem from both consumer and institutional cohorts, supported by improving sentiment, heightened crypto volatility, and regulatory momentum under a crypto-friendly administration, all of which are expected to boost retail and institutional participation in crypto markets and operations.

Source: Coin Metrics Market Data Feed

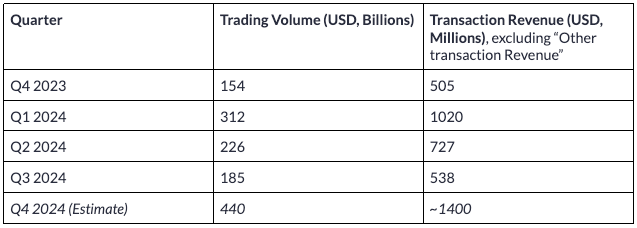

Based on a quarterly trading volume of $440B, we estimate Coinbase’s Q4 2024 transaction revenue at ~$1.4B, reflecting a 175% YoY increase. This is driven by:

-

Consumer trading contributing ~$1.3B, based on 20% of total trading volume and a 1.5% take rate assumption.

-

Institutional trading generating ~$102M, based on 80% of total trading volume and a 0.03% take rate assumption.

If materialized, Q4 2024 Transaction Revenue would eclipse Coinbase’s total revenue in Q3 2024 of $1.2B. Having completed only one month of the quarter, Q1 2025 also points to a strong start, reversing the trend of suppressed transaction revenue in recent quarters.

Source: Coin Metrics Market Data Feed & Coinbase Q3 2024 Shareholder Letter

We can also dive deeper to understand the markets and assets that compose trading volumes on Coinbase’s exchange. Utilizing Coin Metrics’ candles data, we can see the top stablecoin (or fiat) and non-stablecoin markets by trading volume over the quarter. Among stablecoin-fiat markets, USDT-USD led with $49.4B in volume, suggesting Tether’s strong demand as a key on/off-ramp for USD. Meanwhile, USDC-EUR ranked fourth with $2B, reflecting its growing adoption in euro-based markets, likely supported by regulatory clarity from MiCA compliance. BTC, ETH, XRP and DOGE saw high demand, while ETH-BTC was the most traded non-stablecoin market, at $1.6B for the quarter.

Source: Coin Metrics Market Data Feed

Since November, Coinbase has gradually eased on its measured approach to exchange listings, adding memecoins like PEPE and dogwifhat (WIF) which could continue to support consumer trading volumes.

Base is Coinbase’s optimistic rollup, an Ethereum Layer-2 built on Optimism’s OP stack which is an increasingly important part of Coinbase’s on-chain footprint. Base exemplifies that operating a Layer-2 on the Ethereum network is a profitable business model, reinforcing why firms like Kraken, Sony, and Deutsche Bank are entering the space. As the sole sequencer, Coinbase earns revenue from transaction fees for ordering and processing transactions on Base, while incurring costs in the form of blob fees paid to Ethereum Layer-1 for settlement.

Source: Coin Metrics Network Data Pro, Coin Metrics Labs

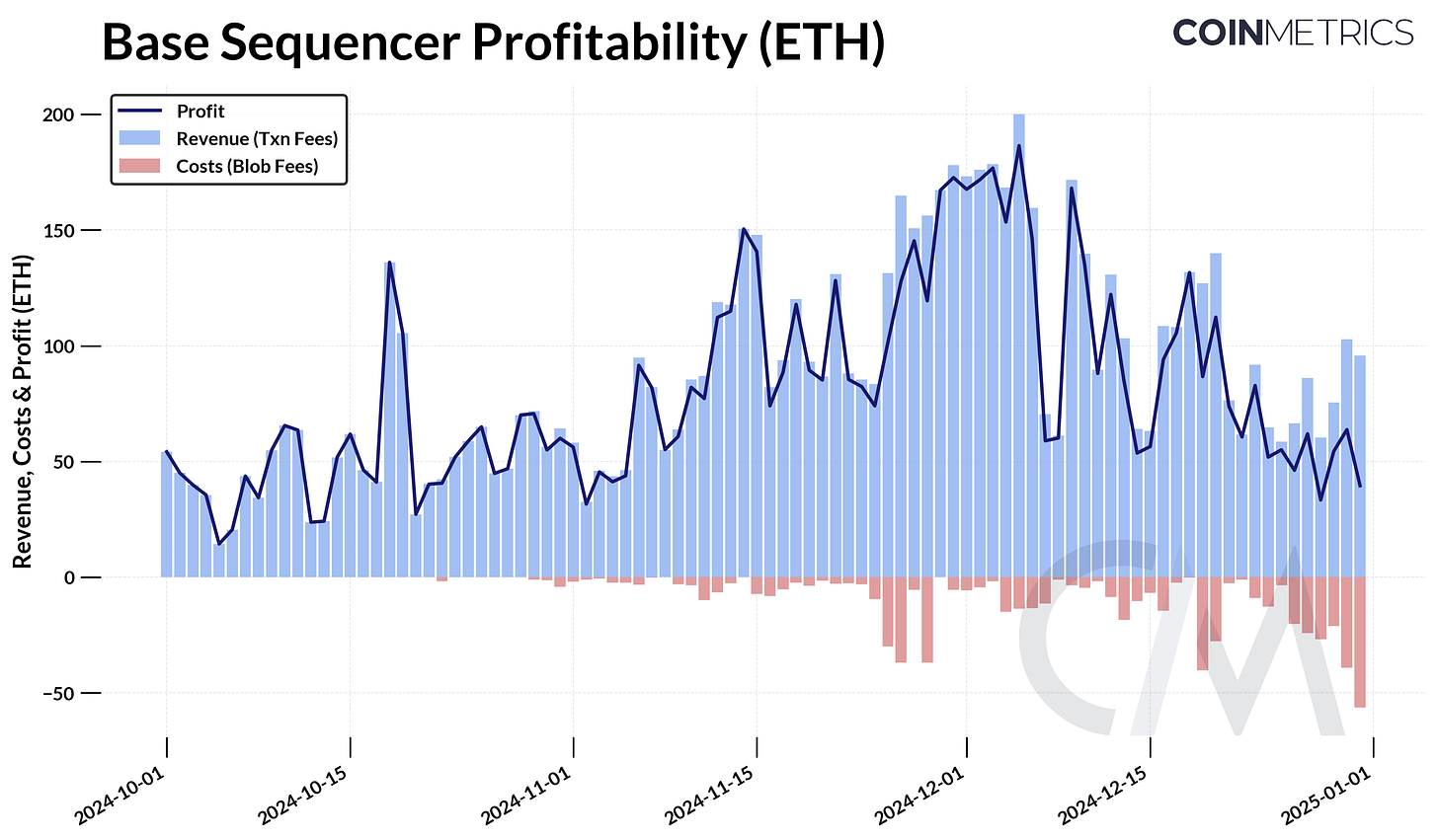

Over Q4 2024, Base generated 8,047 ETH ($26.36M) in total revenue, with 630 ETH ($2.18M) in blob fee costs, resulting in 7,417 ETH ($24.18M) in profit. For most of the quarter, profit margins remained between 80-100%, but declined to ~45% by late December as settlement costs (blob fees) increased. Q4 looks to be a strong quarter for Base, driven by sustained demand for Layer-2 transactions and a broader surge in on-chain activity, reinforcing its role as a leading L2 on Ethereum.

Over recent quarters, Coinbase’s revenue from subscriptions and services—which includes blockchain rewards from their staking business, stablecoin revenue from Circle’s USDC and custody revenue from U.S. spot ETFs—has accounted for ~30%-50% of net revenue. In a prior analysis of Coinbase, we learned how the company displays a growing, but varying correlation to variables like stablecoin supply or staked balances. In Q3, this segment represented $556M in revenue, with the majority coming from stablecoin and blockchain rewards.

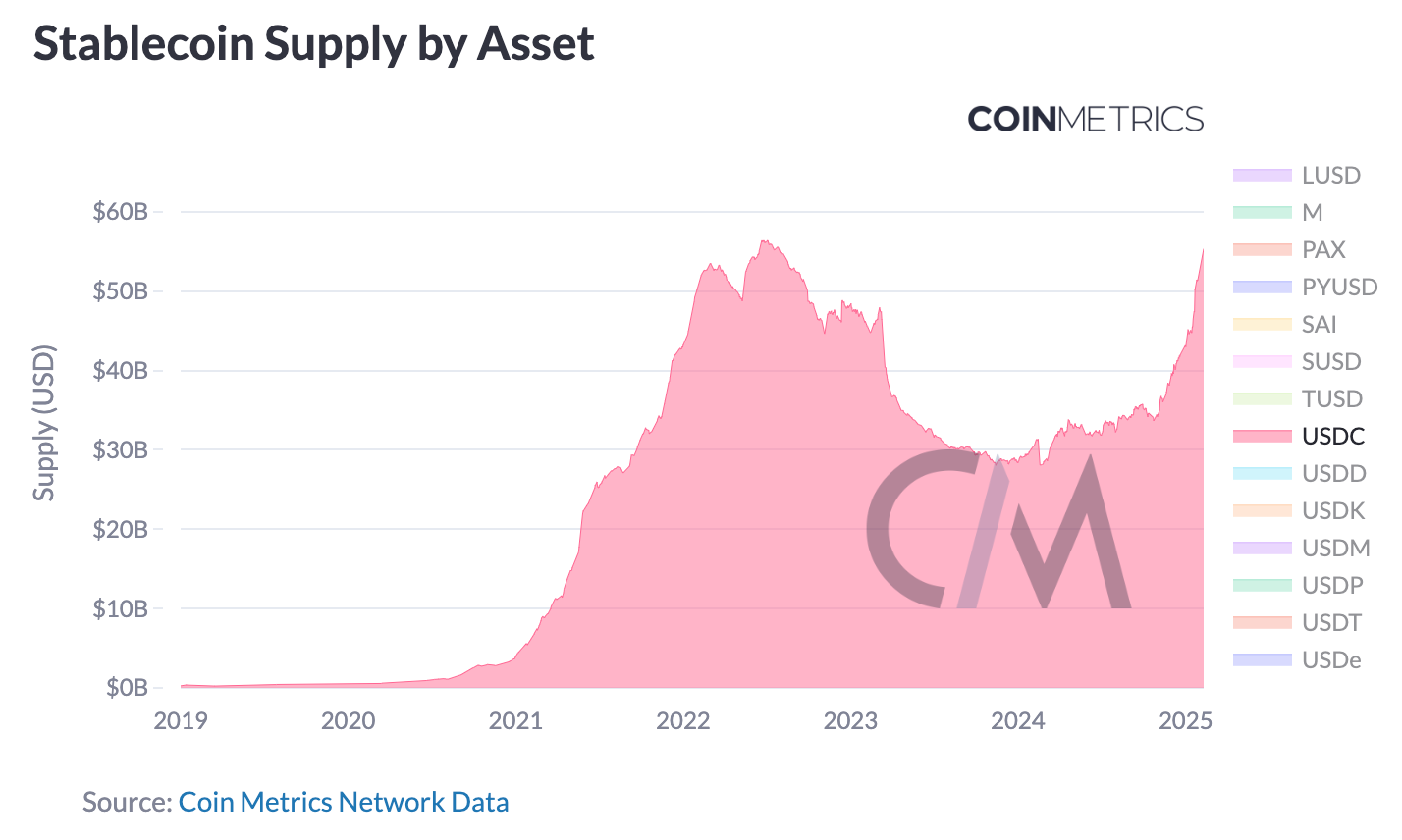

Coinbase earns revenue from the USDC stablecoin primarily through interest income on reserves via a revenue-sharing agreement with Circle. In Q4 2024, USDC supply grew 23% to 43.2B and now stands near 55B, likely boosting Coinbase’s platform balances. As they continue to integrate USDC, users globally can earn ~4.5% APY on holdings or borrow USDC against Bitcoin expanding its utility.

However, lower treasury yields compared to prior quarters may limit the revenue impact of USDC’s supply growth. Based on these factors, we estimate stablecoin revenue at ~$250M, a modest increase from prior quarters.

Source: Coin Metrics Stablecoin Dashboard

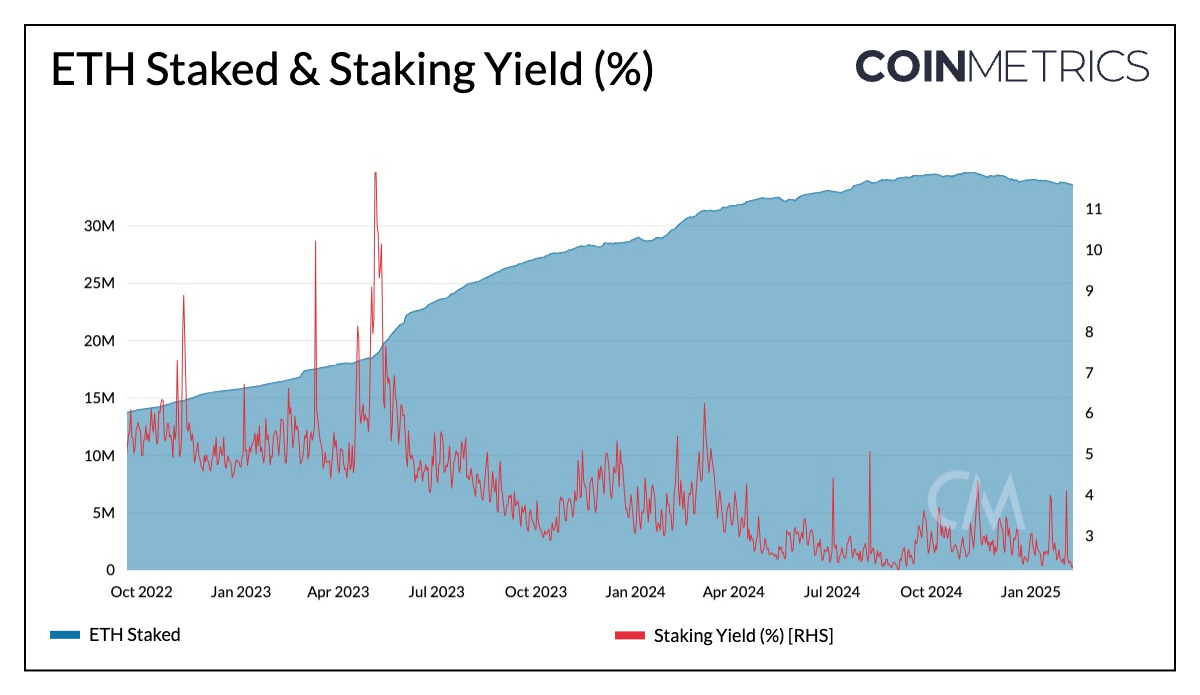

Blockchain rewards were the second-largest revenue source in Coinbase’s Subscriptions and Services segment, generating $154 million in Q3 2024. Although ETH and SOL staking balances remained relatively flat quarter-over-quarter, higher average asset prices likely drove a moderate increase in USD-denominated revenue.

Source: Coin Metrics Network Data Pro

With custody balances exceeding 1.1M BTC and additional revenue as the primary custodian of spot Bitcoin and Ether ETFs, custodial fee revenue is expected to rise above $35M. Coinbase also stands to gain from the adoption of FASB accounting rules, which allow public companies to report crypto holdings at fair value, potentially boosting earnings amid rising asset prices.

Beyond custody, Coinbase continues to expand its product suite with assets like cbBTC, a tokenized version of Bitcoin usable in Ethereum and Solana applications, Bitcoin lending through Morpho, and enhancements to Coinbase Wallet, strengthening its role as an infrastructure layer in the crypto ecosystem. Including corporate interest and other income, we estimate Subscription and Services revenue to come in at ~$570-600M.

Coinbase is firing on all cylinders and appears well-positioned to extend its market leadership. With transaction revenue rebounding and subscriptions & services revenue remaining strong, we estimate Coinbase will report ~$2B in revenue—a 65% quarterly rise and 109% YoY increase. COIN shares currently trade at ~$280 and show a moderate correlation to the NASDAQ. As transaction revenues improve, Coinbase’s strong distribution, expanding stablecoin footprint, and Base’s dominance position it for long-term growth and deeper integration within the crypto ecosystem. As Coinbase matures with its diverse revenue streams, it continues to blur the lines between a bank, brokerage, and payments company, reinforcing its role in bringing the world on-chain.

Source: Coin Metrics Network Data Pro

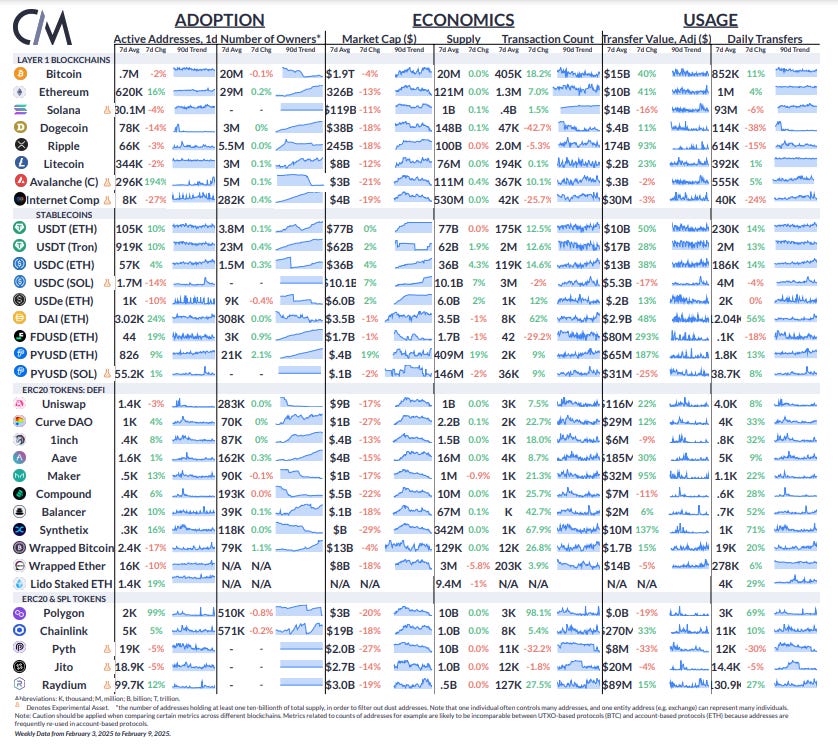

Ethereum’s active addresses increased by 16%, while Avalanche C-chain saw a 194% growth over the past week. Adjusted transfer value for USDT grew by 50% on Ethereum and 28% on Tron, while USDC on Ethereum rose by 38% by the same measure.

-

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

© 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.

Read More: coinmetrics.substack.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  LEO Token

LEO Token  Shiba Inu

Shiba Inu  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Litecoin

Litecoin  USDS

USDS  WETH

WETH  Polkadot

Polkadot  Wrapped eETH

Wrapped eETH  Monero

Monero  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pepe

Pepe  Ethena USDe

Ethena USDe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Aave

Aave  Dai

Dai  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ethena Staked USDe

Ethena Staked USDe  Ondo

Ondo  Cronos

Cronos  Internet Computer

Internet Computer  Tokenize Xchange

Tokenize Xchange