Howdy family!

Welcome to Poly Pulse – your guide to staying up-to-date on the latest trends in the Polygon DeFi ecosystem.

This newsletter breaks down top stories, developments, updates, and trends from the last week of May 2022.

During the last week of May 2022, the bear market effects seem to be kicking in. The daily active users took a dig from 307K in the fourth week of May 2022, to 282K users in the last week of May 2022. The transaction per day also fell from 3.64 Million to 2.82 Million per day.

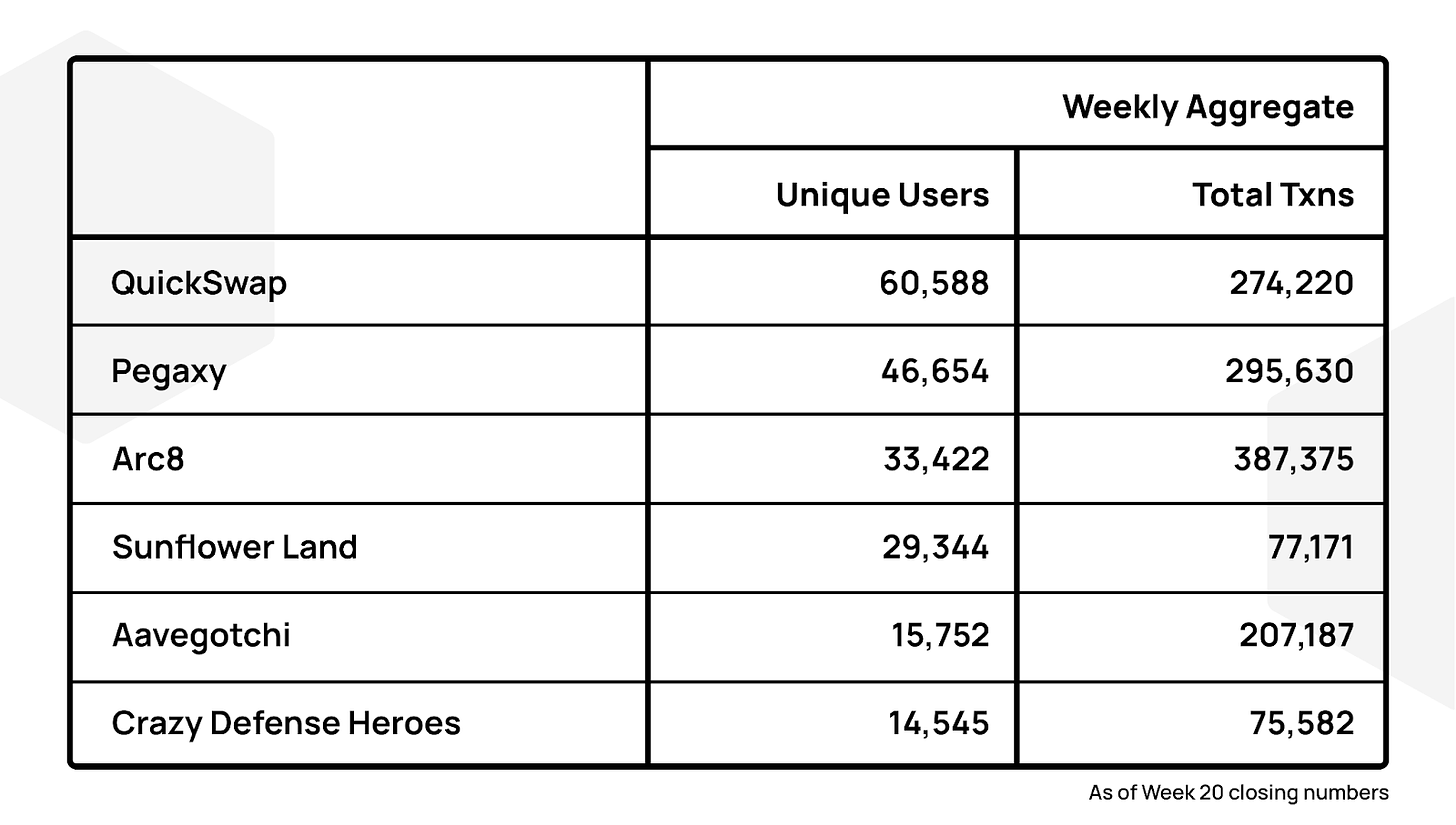

Quickswap remained the top dApp of the month with around 60K users and a total of around 275K transactions.

Introducing KPI-based Liquidity Mining for Active Managers on Uniswap

Back in April, the Polygon foundation introduced a liquidity mining campaign of $15M for Uniswap v3. It partnered with Arrakis Finance to kickstart the liquidity mining campaign on Uniswap v3 for the first 3 months ending Jun 30, 2022.

Starting in July, it will be giving out $1M in MATIC liquidity mining incentives each month to the best active manager on Polygon that has built on top of Uniswap v3. In order to avoid cherry picking, Polygon has decided to distribute most of the remaining $12M entirely on the basis of individual merit.

Polygon will be partnering with UMA Protocol to launch a 100% KPI-based liquidity mining program for Uniswap v3. Below is a diagrammatic representation of what this would look like:

Polygon will shortlist “n” Uniswap v3 pairs that are eligible for rewards. The pairs selected would be the pairs that generate the most fees in Uniswap v3. Since total monthly rewards are $1M, each pair is eligible to receive “$1M / n” in wMATIC. All active managers are invited to participate and create strategies for however many of the “n” pairs they wish.

The above example shows the “wMATIC/USDC (0.05)”. The manager that has the highest “Fees / Weighted Liquidity over 1 month” for “wMATIC/USDC (0.05)” would be eligible for the entire amount of $1M / n. Since active manager “F” has the highest fees, the entire wMATIC reward goes to manager “F”.

Similarly, rewards for every single one of the “n” pairs are up for grabs by the best performing active manager for that particular pair. By following this approach, it will ensure that the best managers are rewarded for their hard work and the polygon community is able to enjoy the best Uniswap v3 yields.

If you are a dApp which manages liquidity on Uniswap actively and are on Polygon please fill the form here.

👉 Are you a DeFi freelancer writer/researcher? We’re hiring!

With the conclusion of the second month of the Polygon DAO’s initiative “Polygon Village”, it has completed the evaluation of over 150 projects. Out of the projects who applied, 70 projects have been extended support in the form of grants, audit and marketing vouchers as well as other services that the DAO provides through its multiple collaborations and affiliations. The DAO will be working on…

Read More: yieldfarmer.substack.com

Vana

Vana  PAX Gold

PAX Gold  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)  Dash

Dash  Trust Wallet

Trust Wallet  Creditcoin

Creditcoin  Ether.fi

Ether.fi  Goatseus Maximus

Goatseus Maximus  Astar

Astar  PayPal USD

PayPal USD  Telcoin

Telcoin  TrueUSD

TrueUSD  GRIFFAIN

GRIFFAIN  Theta Fuel

Theta Fuel  io.net

io.net  Stader ETHx

Stader ETHx  Usual

Usual  AgentFun.AI

AgentFun.AI  Swell Ethereum

Swell Ethereum  BOOK OF MEME

BOOK OF MEME  CHEX Token

CHEX Token  Zerebro

Zerebro  Swarms

Swarms  Zilliqa

Zilliqa  Moca Network

Moca Network  WOO

WOO  Holo

Holo  tBTC

tBTC  Super OETH

Super OETH  0x Protocol

0x Protocol  Horizen

Horizen  JUST

JUST  Ondo US Dollar Yield

Ondo US Dollar Yield  Neiro

Neiro  Enjin Coin

Enjin Coin  GMT

GMT  Magic Eden

Magic Eden  Aethir

Aethir  Golem

Golem  Bridged USDC (Polygon PoS Bridge)

Bridged USDC (Polygon PoS Bridge)  AI Rig Complex

AI Rig Complex  Convex Finance

Convex Finance  QuantixAI

QuantixAI  DeepBook

DeepBook  Celo

Celo  Basic Attention

Basic Attention  Verus

Verus  Memecoin

Memecoin  Ankr Network

Ankr Network