[ad_1]

- PancakeSwap daily users increased significantly and broke into the top five.

- CAKE was overbought and selling pressure could increase.

With a Daily Active Users (DAU) of 127,790, PancakeSwap [CAKE] was able to climb to fourth per the metric, Token Terminal revealed. According to blockchain data analytics platforms, it took a 12.1% increase in 24 hours for CAKE to hit the milestone.

@PancakeSwap climbing up the DAU ladder pic.twitter.com/tFPuryH3iD

— Token Terminal (@tokenterminal) January 30, 2023

Read PancakeSwap’s [CAKE] Price Prediction 2023-2024

The metric increase indicated a surge in address interaction and transactions. Also, CAKE was now only behind the Binance Coin [BNB], Polygon [MATIC], and Ethereum [ETH] in that regard.

Investors selling hot CAKEs?

Despite the upturn in usage, CAKE failed to register a price increase even though the automated market maker rose into the top five.

At press time, Binance Smart Chain token had lost 2.56% of its value in the last 24 hours. The performance in the last seven days was similar. However, in the past 30 days, CAKE increased by 26.53%, according to CoinMarketCap.

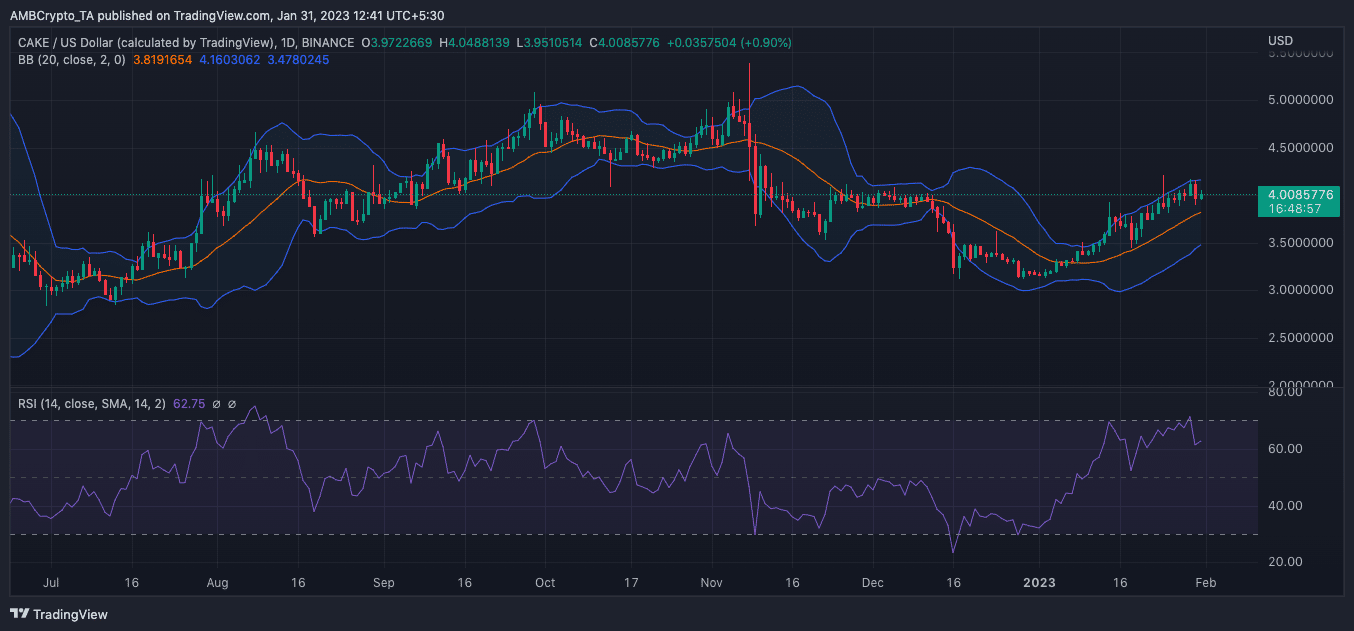

Hence, the recent decline could be linked to a slack in market momentum and profit-taking by CAKE investors. The Relative Strength Index (RSI) also displayed its agreement regarding a possible sell pressure.

Based on the daily chart, the RSI was 62.75. But between 24 – 29 January, the indicator was around the 70 overbought region. So, it might not be surprising that there was been a reversal, although not necessarily significant. Due to this, it is likely that CAKE eventually falls to a bearish momentum.

Regarding its volatility, the Bollinger Bands (BB) showed that it was not extreme nor did it obviously contract. However, the CAKE price continually hit the BB’s upper band as displayed above.

Since this was the case, it aligned with the RSI view of an overbought status. So, a price reversal lower than the aforementioned decline could be impending.

Time for a quick resolve

Meanwhile, PancakeSwap was looking to make changes to its emissions by streamlining activity. And the decision rests in the hands of its community. Voting started on 30 January and would end in 24 hours.

How much are 1,10,100 CAKEs worth today?

The proposal aimed to alternate the distribution process of staking, farming, and trading. But it would not completely change the total emissions. According to the proposal,

“The Staking allocation will primarily be used for the CAKE Pool while the Other allocation includes gamification, side products, and generic protocol.”

At the time of writing, 97.72% had voted in favor of the scheme. 2.28% of the voting populace did not consider the submission worthy of approval.

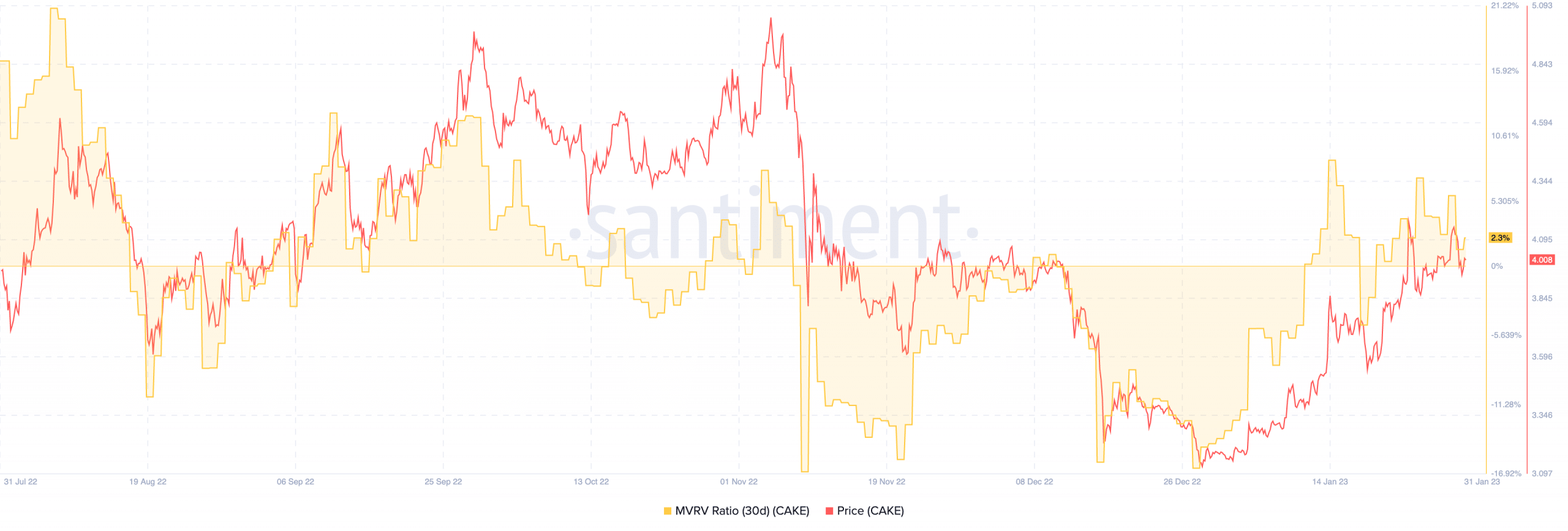

Additionally, Santiment revealed that the CAKE Market Value to Realized Value ratio (MVRV) was 2.3%. A few days back, it was as high as 5.91%. Still, there were signs of an upturn which could result in further selling pressure from investors.

[ad_2]

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  USDS

USDS  Toncoin

Toncoin  Shiba Inu

Shiba Inu  WhiteBIT Coin

WhiteBIT Coin  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  Uniswap

Uniswap  Aave

Aave  Pepe

Pepe  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Aptos

Aptos  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Cronos

Cronos  Ethereum Classic

Ethereum Classic  sUSDS

sUSDS