Runes have accounted for less than 50% of Bitcoin transactions in only nine of the past thirty days. Meanwhile, interest in Ordinals has plummeted.

Memecoins are dominating a Bitcoin Ordinals ecosystem plagued with low transaction throughput.

According to Geniidata, Runes, Bitcoin’s version of memecoins, have dominated transactions on the network over the past month. In only nine of the past thirty days, these types of transactions have been below the 50% mark, while the figure soared to 70% on Aug. 18.

Meanwhile, Ordinals average less than 10% of transactions on most days of the month, and the remaining 30% belongs to monetary transactions – users sending BTC.

Ordinals is a protocol unveiled by Bitcoin developer Casey Rodarmor in early 2023. Much like Ethereum NFTs, it allows for non-financial data to be inscribed onto Bitcoin, attaching the information onto the smallest denomination of a Bitcoin, dubbed a satoshi.

Runes is a protocol also created by Rodarmor, and allows for fungible tokens to exist on Bitcoin. They live on the Bitcoin UTXO set, which enables more efficient inscriptions onto already existing transaction structures, thus minimizing their on-chain footprint. Advocates for Runes tout it as a more efficient alternative to the data-dense BRC-20 token standard that emerged from Rodarmor’s earlier invention.

They’re nothing short of controversial, with Bitcoin ossifiers claiming these types of transactions are a type of attack on the monetary value of the network, while its defenders claim it is creating a renaissance of art, development, and capital on the oldest blockchain in the industry.

Ordinals, however, are showing signs of a downtrodden ecosystem.

To get a sense of how badly battered Ordinals are, Charlie Spears, host of the Bitcoin Season II podcast, shared on Aug. 20 that he was the first person in seven days to run the Dune dashboard that tracks inscriptions.

Spears also pointed out that a dashboard built by the creator of Dune Analytics, Domo, which tracks marketplace health with metrics like users, trades, and volume, hadn’t been updated in three days – when he ran the numbers.

“All marketplaces for Ordinals are anemic and declining,” he said.

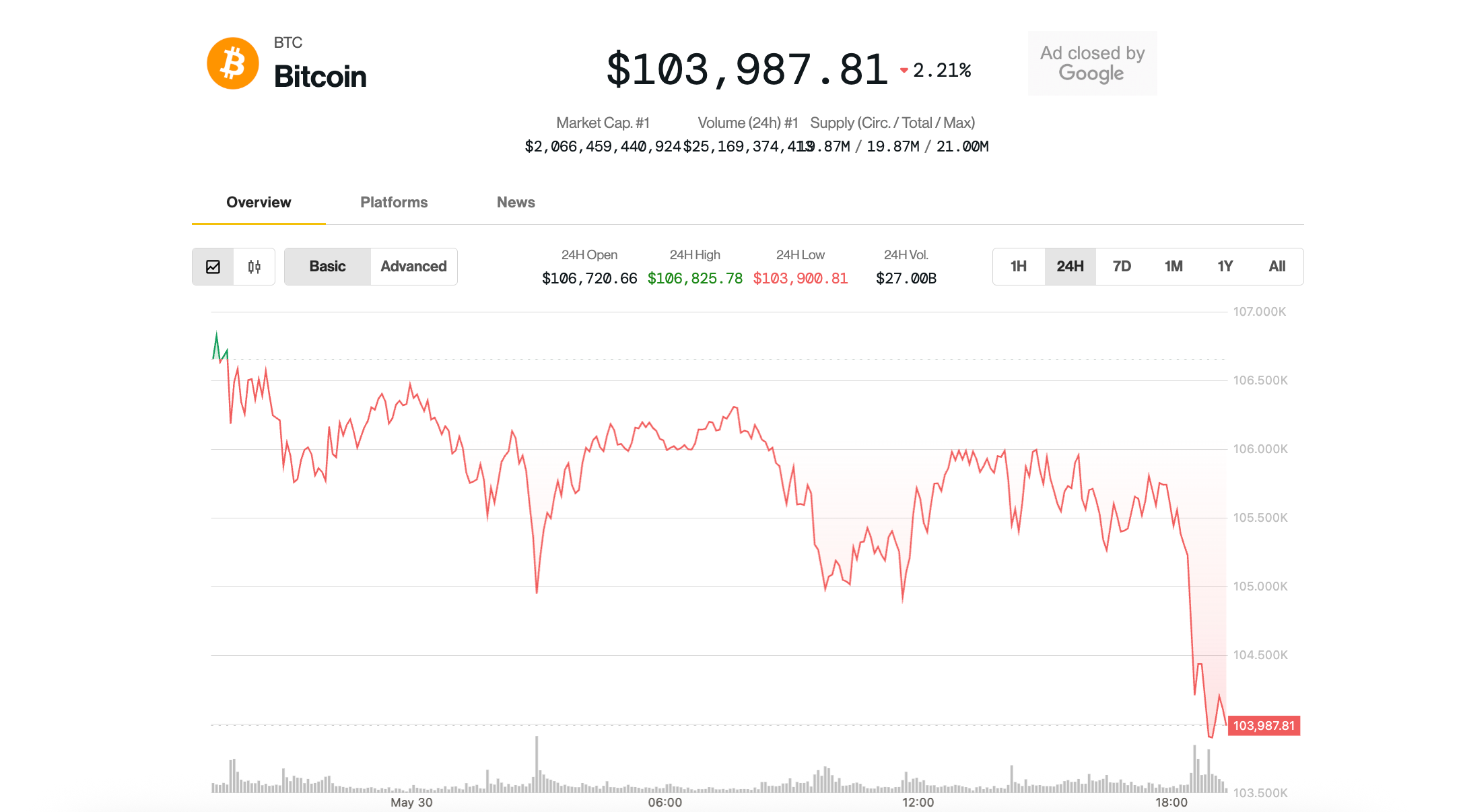

Declining interest in Ordinals contrasts with the general Bitcoin blockchain, which continues to process more transactions than years prior. Average daily transactions bottomed at around 400,000, the top of previous cycles, and has peaked at around 900,000.

Conflicting numbers like these only show that Bitcoin is living through an odd period of existence.

Overall activity on the network continues to increase, in line with the popularity spurred by Bitcoin ETFs, but Ordinals have caught the brunt of the summer doldrums and appear to be stagnating as the ecosystem awaits the next wave of products and collections to launch.

Read More: thedefiant.io

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  Aave

Aave  Uniswap

Uniswap  Bittensor

Bittensor  OKB

OKB  Aptos

Aptos  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jito Staked SOL

Jito Staked SOL  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  Ethereum Classic

Ethereum Classic