[ad_1]

- Optimism outperformed Arbitrum in terms of user retention.

- OP’s revenue increased, but on-chain metrics and market indicators remained bearish.

On 2 March, Messari published a report comparing Optimism [OP] and Arbitrum. The report mentioned that while Arbitrum may have relied on organic growth, Optimism concentrated on providing incentives for users to reach its 3-million unique user milestone throughout the previous year.

4/ To better comprehend retention rates on @arbitrum and @optimismFND based on cohort analysis and application level retention, check out the full Pro report from @0xallyzach.https://t.co/ZO8rcglfL5

— Messari (@MessariCrypto) March 2, 2023

How much are 1,10,100 OPs worth today?

Optimism’s user retention is praiseworthy

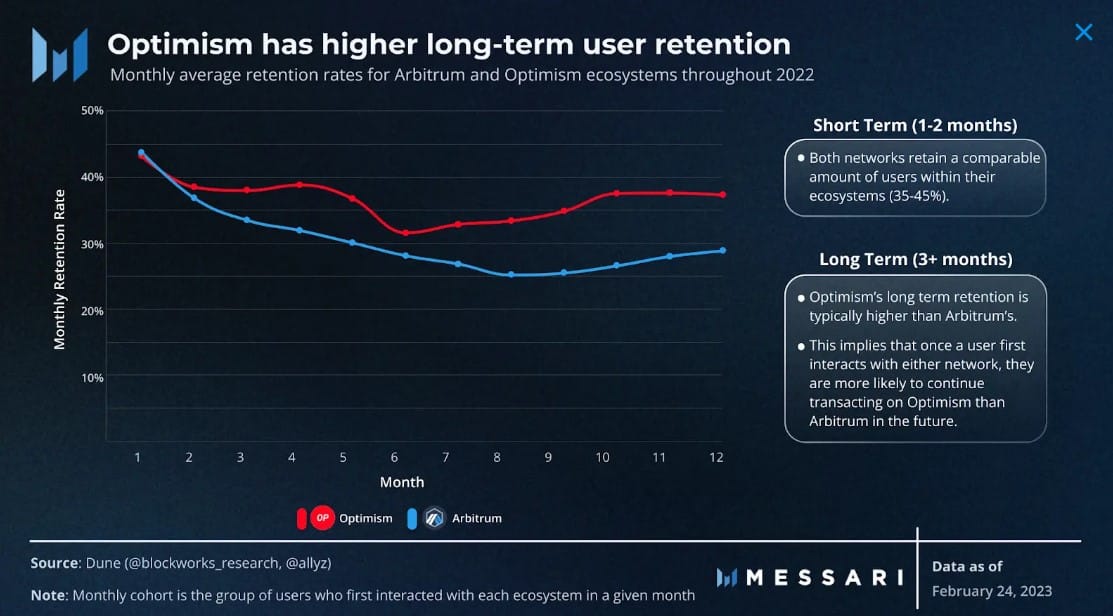

As per the report, in the short term, 35–45% of new users were retained by both Arbitrum and Optimism, although Optimism retained a larger percentage of its long-term user base. Though both the short- and long-term retention rates are valuable metrics, the latter is more important in order to understand the value of a blockchain.

Moreover, Optimism’s long-term retention was considerably higher than that of Arbtrum, suggesting more users’ trust in the L2 blockchain.

Interestingly, while OP’s retention rate registered a hike, Token Terminal’s data revealed that the same remained true for the blockchain’s fees. OP’s network fees and revenue both went up over the last 30 days, indicating increased usage.

Further growth in the Optimism network can be expected as the blockchain approaches the date of the much-awaited Bedrock upgrade. The new upgrade is expected to go live in March, and it will considerably reduce usage fees on the mainnet.

OP, however, was feeling the heat

While the aforementioned data pointed out strong performance on the network, Optimism’s native token had reasons for concern as its price declined by over 17% in the last seven days. According to CoinMarketCap, OP was down by 5.5% in the last 24 hours alone, and at the time of writing, it was trading at $2.56 with a market capitalization of over $805 million.

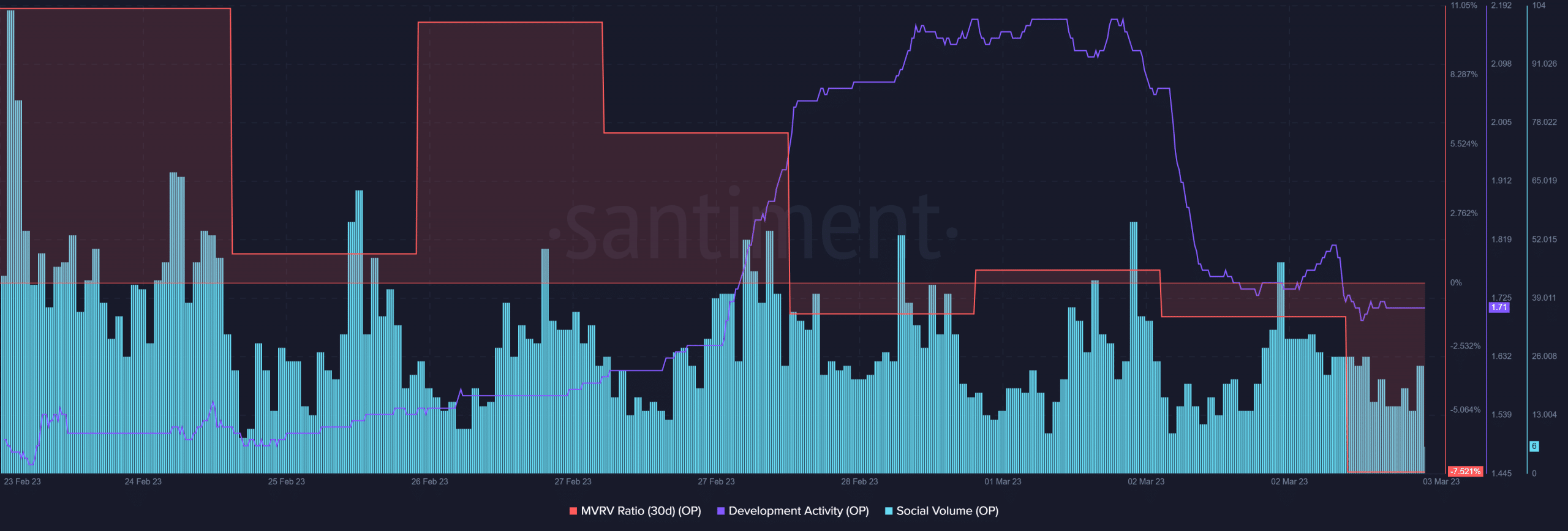

OP’s MVRV Ratio registered a sharp decline, which can be attributed to the fall in the token’s price. Another negative signal was that the network’s development activity went down in the last few days. OP’s performance on the social front also fell, which was evident from its social volume.

Realistic or not, here’s OP market cap in BTC‘s terms

Investors should be cautious

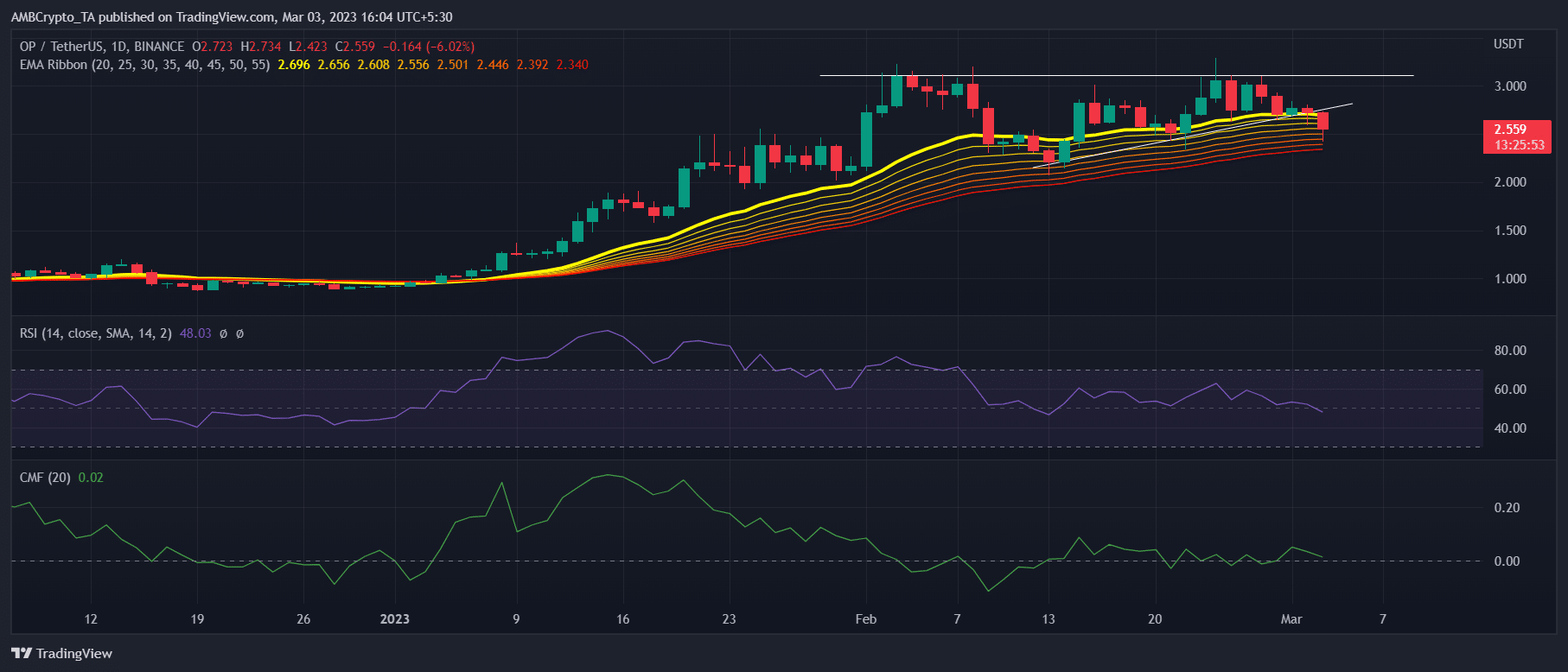

A look at OP’s daily chart revealed the formation of an ascending triangle pattern, which generally is a bullish signal. However, in this case, the opposite was true as OP’s price plummeted. Other market indicators also supported the bears.

For instance, the Relative Strength Index (RSI) registered a downtick. The same remained true for the Chaikin Money Flow (CMF), which was a bearish signal. Nonetheless, OP’s Exponential Moving Average (EMA) Ribbon was still bullish, as the 20-day EMA was comfortably above the 55-day EMA.

[ad_2]

Read More: ambcrypto.com

![Optimism [OP] overtakes Arbitrum, but what’s troubling investors? Optimism [OP] overtakes Arbitrum, but what’s troubling investors?](https://ambcrypto.com/wp-content/uploads/2023/03/OP-1000x600.jpg)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  USDS

USDS  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  Cronos

Cronos  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  sUSDS

sUSDS  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic