Luis Alvarez

Two days after the disappointing earnings release marks the anniversary of Mark’s bold move of rebranding Facebook into Meta (NASDAQ:META). However, the earning results reflected that the Metaverse is still in the very early stages of its silver linings. The Reality Labs segment is no different from a start-up burning cash, except it is supported by Meta’s excellent balance sheet.

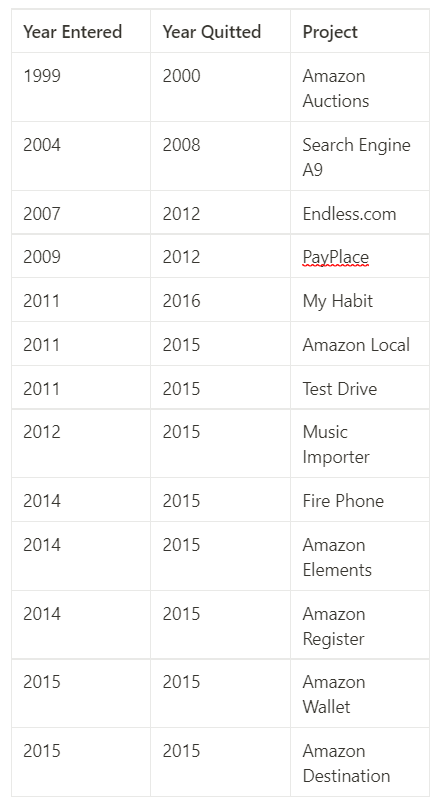

I have a conviction that Meta requires to scale down or even quit its Metaverse (Reality Labs) business. Amazon would be a great example. Numerous businesses had Amazon (AMZN) entered and quitted in less than five years. The core business of Meta is still sound and profitable. In order to reinstate its leading status, the move is necessary.

A Quick Earnings Review

Meta delivered disappointing earnings results, which led the stock to plummet an shocking 24.5% on 27 Oct alone. Below tabled a summary of Meta’s earnings data.

| META | Year over Year Growth | |

| Total revenue | $27.71 Bil | -4.5% |

| Total expenses | $22.1 Bil | 17% |

| Earnings per Share | $1.64 | -49% |

| Family daily active people | 2.93 Bil | 4% |

| Family monthly active people | 3.71 Bil | 4% |

| Facebook daily active users | 1.98 Bil | 3% |

| Facebook monthly active users | 2.96 Bil | 2% |

| R&D Expenditures | – | 45% |

| Free Cash Flow | $316 Mil | -96.8% |

(Above Data Abstracted from Conference Call and Gurufocus)

There are two segments that Meta is operating in: “Family of Apps” and “Reality Labs”. Reality Labs, the focus of this article, generates revenue from sales of consumer hardware products, software and content. Examples include Meta Quest, Facebook Portal and related software.

As Meta further explained:

Reality Labs’ augmented and virtual reality products help people feel connected, anytime, anywhere. Meta Quest lets people defy distance with cutting-edge VR hardware, software, and content. Facebook Portal video calling devices help friends and families stay connected and share the moments that matter in meaningful ways.

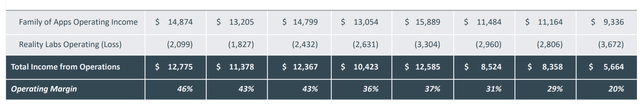

One of the deteriorating factors that led Meta to such an appalling result is Mark Zuckerberg’s visionary Metaverse. Revenue in Reality Labs dropped three consecutive quarters to $285mil, about half of a year ago ($558mil in Q3 2021). Sales of Quest 2 were discouraging after the price hike. The operating loss of the segment expanded to $3,672mil, representing a 37% increase YoY.

Reality Labs expenses were $4 billion, up 24% due to active hiring activities and R&D expenses. Expenses of this segment are around fourteen-fold of its income, or one-seventh of the company’s total revenue, and the management expected to escalate further in 2023 as headcount rose.

A Lesson from Amazon

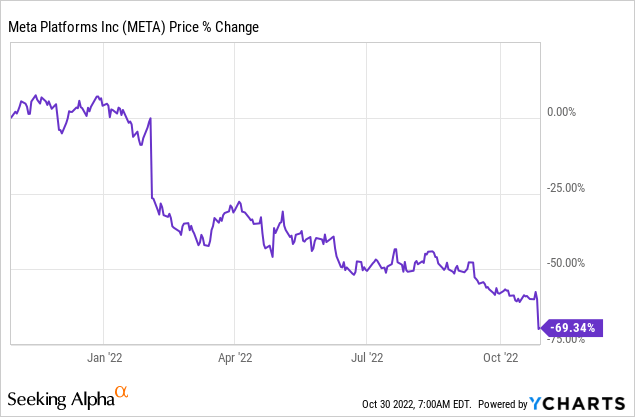

Meta defines the Metaverse as the next evolution in social connection and the successor to the mobile internet. No doubt, the Metaverse is visionary and may have an obvious prospect. I like the idea of Metaverse and have been immersed in the gaming experiences of Sandbox (SAND-USD). But investors dissent on the company’s adventurous move. Shares of Meta plummeted almost 70% after the announcement on 28 Oct 2021.

As the great man Ben Graham wrote in his iconic book “The Intelligent Investor”:

Obvious prospect for physical growth in a business do not translate into obvious profits for investors.

Metaverse may have great prospects decades ahead, but it is very much in doubt about this segment’s profitability. Perhaps, Mark Zuckerberg has something to learn from Amazon in order to maintain Meta’s profitability.

Former Japan Microsoft President Naruke Makoto had a book about the domination of Amazon. He believes two reasons that Amazon prevails are the company’s strong cash flow and the ability to make a decisive move to shut down unsuccessful businesses.

Here is a long list of numerous projects where Amazon entered but ceased their development in less than 5 years of running.

Naruke Makoto

Who still remembers Amazon once launched a Fire Phone? The product had decent specifications, and tech fans were excited.

However, it turned out to be a failure due to its innovative Fire OS (which means incompatibility with other operating systems) and aggressive pricing strategy. Sales were extremely disappointing despite the price cut, as no one bought the Fire Phone. It cost Amazon about $170mil of operating loss, and $83mil worth of Fire Phone went unsold.

Problems Lying Ahead

Something similar was unveiled in Mark’s Metaverse but in a larger scale.

Meta’s Horizon Worlds struggled to attract and retain users. The platform only has fewer than 200,000 monthly active users, way less than the company’s target of half a million by the end of 2022. Less than 50 people visited over 90% of the world, and most lands remain unvisited. There is still a marathon if Meta wants to turn it into a platform that millions of people will use actively, like Facebook, Instagram and WhatsApp.

Besides, headsets are not that affordable. Meta raised the price of the lower spec Meta Quest 2 to US$399.99 in July, while the newly launched Meta Quest Pro costs US$1499.99, which costs more than a 512GB iPhone 14 Pro Max. Without these VR equipment, you will be unable to enjoy the experiences in Horizon Worlds. With headline inflation data clinging at nearly 10%, the public would not show great interest in purchasing these expensive equipment. The effect of the price hike on Meta Quest 2 was reflected in the poor top-line results in the previous quarter. Estimates predicted over 10 million headsets were sold, but Meta did not disclose the sales number.

In the latest conference call, Meta called the Meta Quest Pro a device to enable more people to get their work done in virtual and mixed reality. I believe there are several problems that the company has to tackle before making it mainstream:

-

Lack of economies of scale and competition

-

Technological enhancement takes years

-

Ethical issues inside the virtual world

-

Discomfort from wearing the VR headset

-

Health Concerns

Let’s not forget there was Friendster before MySpace before Facebook.

Time to Quit

As Mark accentuated in the conference call:

Our goal is to grow Family of Apps operating income such that even with our AI infrastructure and Reality Labs investments, we can still meaningfully grow our overall company operating income in the long term.

Growth in Family of Apps is attainable but difficult to achieve under such a challenging macro backdrop. However, the development is unlikely to wipe out the losses generated from the Reality Lab segment, which is accountable for around $3.7 billion and is on an upward trend. So, Mark’s goal is highly unattainable.

Meta’s Earnings Presentation

It is time to quit to protect the hard work over the last decade.

Conclusion

The core business of Meta is still sound and profitable despite the challenges from TikTok and the gloomy economic environment. After plummeting nearly 70% since the stock ticker changed to Meta, the company’s valuation is well below the historical level.

Forward PE ratio, Price/FCF, and EV/EBITDA are half its 5-year average. I believe the Street has priced in Meta’s struggle to maintain profitability and cash flow due to the rapid expansion of the Reality Lab segment.

If Meta scales down or quits its Metaverse business, the company will be a buy with this attractive valuation. But for now, we will wait and see how things develop.

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  LEO Token

LEO Token  USDS

USDS  Toncoin

Toncoin  Chainlink

Chainlink  Stellar

Stellar  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Sui

Sui  Hedera

Hedera  Wrapped stETH

Wrapped stETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Hyperliquid

Hyperliquid  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Pi Network

Pi Network  Monero

Monero  Wrapped eETH

Wrapped eETH  Dai

Dai  sUSDS

sUSDS  OKB

OKB  Uniswap

Uniswap  Aptos

Aptos  Pepe

Pepe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Gate

Gate  Tokenize Xchange

Tokenize Xchange  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Internet Computer

Internet Computer  Mantle

Mantle  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe