In June 2022, following the Terra collapse, the demand for puts rose while implied volatility collapsed, the same as in the recent crypto bear market after the fall of FTX.

The performance of the options market and implied volatility both reflected a strong correlation to the collapse of the Terra blockchain. These elements can provide important insights into the behavior of the crypto market, including when to expect sudden price fluctuations, place stop-loss orders, or deposit sufficient margin for leveraged trading.

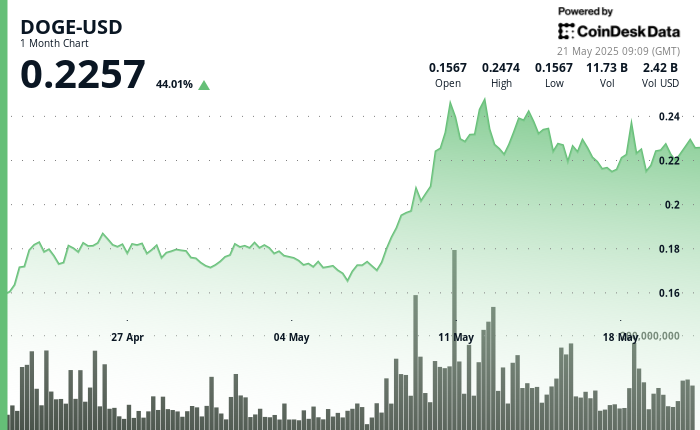

Data provided by Glassnode shows Bitcoin’s 7-days implied volatility dropped to an annualized 50% in December, attaining the same levels as the implied volatility after Terra collapse. The chart below represents this information:

The Luna collapse was characterized by an increase in implied volatility. This was seen as a sign of the market’s fear and uncertainty with cryptocurrency prices, which drove the prices of the underlying assets down.

The options market became a way for analysts to measure potential price swings by determining the level of fear and incoming volatility through higher premiums.

If the market goes up, the option will be exercised, and the investor will make a profit based on the option’s strike price. Conversely, if the market goes down, the option will not be exercised, and the investor will not lose any money.

Another strategy that can be used to protect against a decline in the market is buying a put option. A put option gives the investor the right to sell a security at a predetermined price.

If the market goes down, the investor can exercise their option to sell the security at the predetermined price, resulting in a profit. Conversely, if the market goes up, the option will not be exercised, and the investor will not lose any money.

Options market performance is a measure of the market’s sentiment towards a particular asset. Bearish sentiment forces traders to sell off the underlying assets, as shown on the recent Options 25 chart above.

Conversely, when the sentiment is bullish, the options market will be more likely to bid up the underlying asset price. Conversely, when the analyst records high implied volatility, the market anticipates a more volatile price movement and vice versa.

Overall, the performance of the options market and implied volatility both provide essential insights into the behavior of the crypto market, especially when it comes to predicting sudden drops. However, the metric fails to denote either a bullish or bearish trend using volatility fluctuations because it only reflects uncertainty and doubt among traders.

Read More: cryptoslate.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Litecoin

Litecoin  Polkadot

Polkadot  USDS

USDS  WETH

WETH  Monero

Monero  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pi Network

Pi Network  Pepe

Pepe  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Cronos

Cronos  Official Trump

Official Trump