The balance of available Ether (ETH) across crypto exchanges dropped to a five-year low on May 26, bringing the total amount of Ether held on exchanges to 17.86 million. A drastic decline in the exchange supply of ETH like this has not been seen since April 2018.

According to Glassnode data, only 14.85% of the total Ether supply is currently held on centralized exchanges, compared with the 25–26% of supply held during the 2021 bull run.

The drop in ETH supply began in September 2022, dropping significantly after the FTX crisis in November. Apart from a decline in the exchange balance, Ethereum wallet addresses holding more than 100 ETH have also declined to a six-month low.

#Ethereum $ETH Number of Addresses Holding 100+ Coins just reached a 6-month low of 46,858

View metric:https://t.co/FbjiMG3uFX pic.twitter.com/uzHN7H2qRy

— glassnode alerts (@glassnodealerts) May 18, 2023

Two significant events could have influenced the decline in ETH balances on centralized exchanges in the recent past. The first is the collapse of the FTX crypto exchange, prompting many to move their crypto assets from exchange wallets to self-custody wallets; the second, and most important, is the Shapella upgrade.

Shapella made way for thousands of validators to withdraw their staked ETH. However, contrary to popular belief, a minority of validators decided to unstake, while the majority only withdrew their staking rewards.

The movement of assets away from exchanges is considered a bullish sign, indicating traders are not looking to sell at the current price. In Ethereum’s case, re-staking ETH is the most apparent reason for the declining exchange supply.

Related: Ethereum price metrics hint that ETH might not sell off after the Shapella hard fork

Major crypto exchanges like Binance, Bitfinex, Kraken and others that supported the Shapella upgrade saw a significant outflow of ETH from their exchange wallets, leading to the current balance decline.

As Cointelegraph reported earlier, in the week after the Shapella upgrade, the amount of ETH being staked surpassed the amount of ETH being withdrawn. Another report from Glassnode estimated that less than 1% of staked ETH was expected to be sold. Thus, a significant chunk of ETH moving away from centralized exchanges returned to staking.

Magazine: 2023 is a make-or-break year for blockchain gaming: Play-to-own

Read More: cointelegraph.com

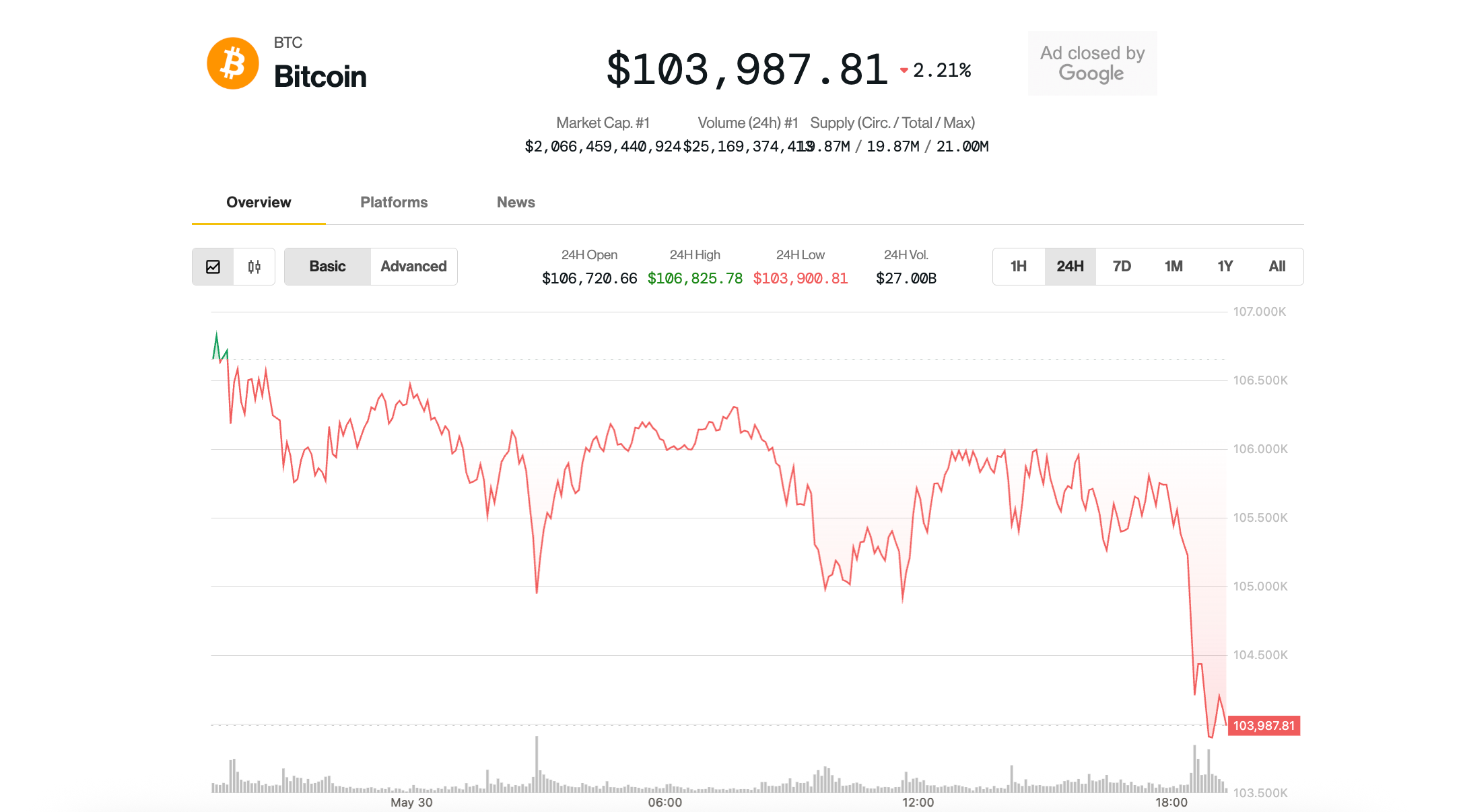

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Aave

Aave  Uniswap

Uniswap  Bittensor

Bittensor  Cronos

Cronos  OKB

OKB  Ethena Staked USDe

Ethena Staked USDe  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  Ethereum Classic

Ethereum Classic