Decentralized finance (DeFi) still demonstrates greater potential than the traditional financial industry, despite recent setbacks, a new report has found.

The report, prepared by the crypto-focused investment firm Hashkey Capital, said the scalability of DeFi solutions already surpass that of traditional financial services many times over.

“Considering the decentralized and autonomous nature of DeFi applications, their business model is highly scalable. We have seen cases where a smart contract developed by a single developer processes billions of dollars’ worth of transactions. DeFi has the potential to be many times more scalable than the traditional financial industry and more scalable than traditional [software-as-a-service (SaaS)] models,” the report said.

The report also stressed how resilient DeFi protocols are, which it said is due to them being “mostly autonomous.”

“For most DeFi applications, nearly all members work in product development, marketing, etc., and if none of them show up to work, the application wouldn’t be affected, and it would be able to continue processing millions of dollars. DeFi protocols don’t need to rely on labor to run,” Hashkey Capital’s report said, while contrasting this with how the traditional financial industry operates.

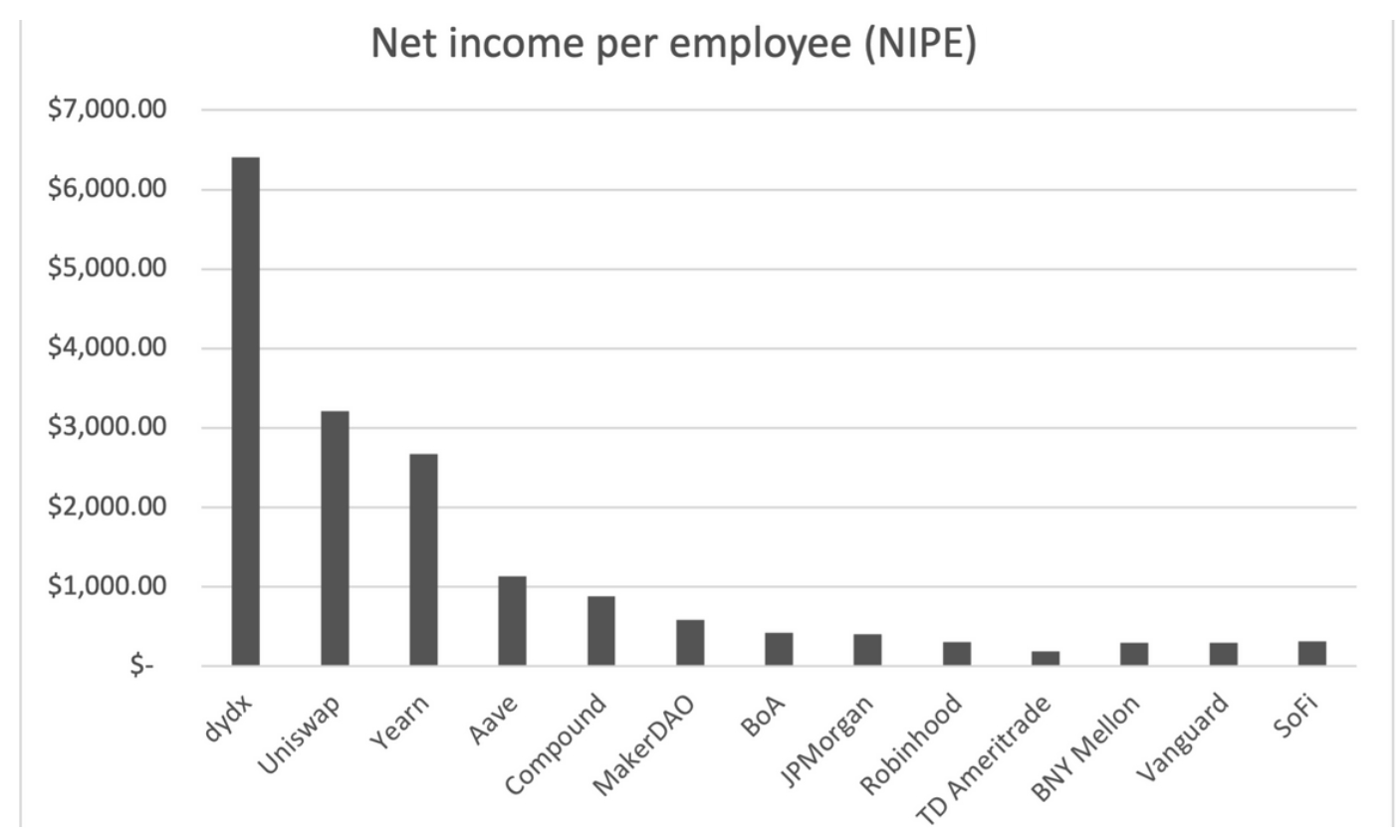

As a result of how autonomous DeFi protocols are, the net income they generate per employee is also at a completely different level than traditional services, the report pointed out.

Difficult year for DeFi

Despite the superiority over traditional financial services, DeFi protocols have had a difficult year in 2022. The sector has suffered from pessimism and lower prices across the crypto market, with for instance ETH down nearly 68% year-to-date.

ETH is the native token of Ethereum, the blockchain most DeFi protocols have been built on.

Black swans highlight DeFi’s strength

According to Hashkey Capital’s report, Black swan events like the Terra Luna collapse have served to highlight the strength of the DeFi market.

This is true because the collapse of Terra Luna mainly affected centralized finance (CeFi) companies, including crypto lender Celsius and crypto hedge fund Three Arrows Capital.

At the same time, decentralized protocols made it through the collapse “unscratched,” the report said, noting that these protocols have shown “great resilience in times of market volatility.”

Significant fall in TVL in 2022

The news that DeFi now outperforms traditional finance came as a new report from Nansen Research also confirmed that the total value locked (TVL) in DeFi protocols has dropped significantly through the year.

From highs of around $180bn at the end of last year, the TVL in DeFi protocols now stands at $41bn, Nansen’s report said, while adding that the price of many DeFi tokens have collapsed.

However, bright spots in the market exists, and there are reasons for optimism as we enter 2023, the Nansen report noted. It pointed to projects such as Aave (AAVE) and Uniswap (UNI) as protocols to keep an eye on.

“There are many exciting features in the roadmap for these protocols,” Nansen’s analysts wrote.

Read More: news.google.com

Vana

Vana  Polymesh

Polymesh  Ravencoin

Ravencoin  CoinEx

CoinEx  Toshi

Toshi  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Hamster Kombat

Hamster Kombat  DigiByte

DigiByte  Elixir deUSD

Elixir deUSD  yearn.finance

yearn.finance  Osmosis

Osmosis  aelf

aelf  Kadena

Kadena  Babylon

Babylon  Metaplex

Metaplex  Chia

Chia  Peanut the Squirrel

Peanut the Squirrel  GoMining Token

GoMining Token  ORDI

ORDI  Binance-Peg SOL

Binance-Peg SOL  RCGE

RCGE  Fluid

Fluid  Enjin Coin

Enjin Coin  Echelon Prime

Echelon Prime  Level USD

Level USD  Treehouse ETH

Treehouse ETH  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Kula

Kula  KOGE

KOGE  Bridged Ether (StarkGate)

Bridged Ether (StarkGate)  Drift Protocol

Drift Protocol  GMT

GMT  Orca

Orca  Maple Finance

Maple Finance  Euler

Euler  LCX

LCX  NEM

NEM  Horizen

Horizen  crvUSD

crvUSD  GMX

GMX  EthereumPoW

EthereumPoW  Falcon USD

Falcon USD  Kinesis Gold

Kinesis Gold  Constellation

Constellation  Alchemist AI

Alchemist AI  Conscious Token

Conscious Token  Freysa AI

Freysa AI