[ad_1]

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

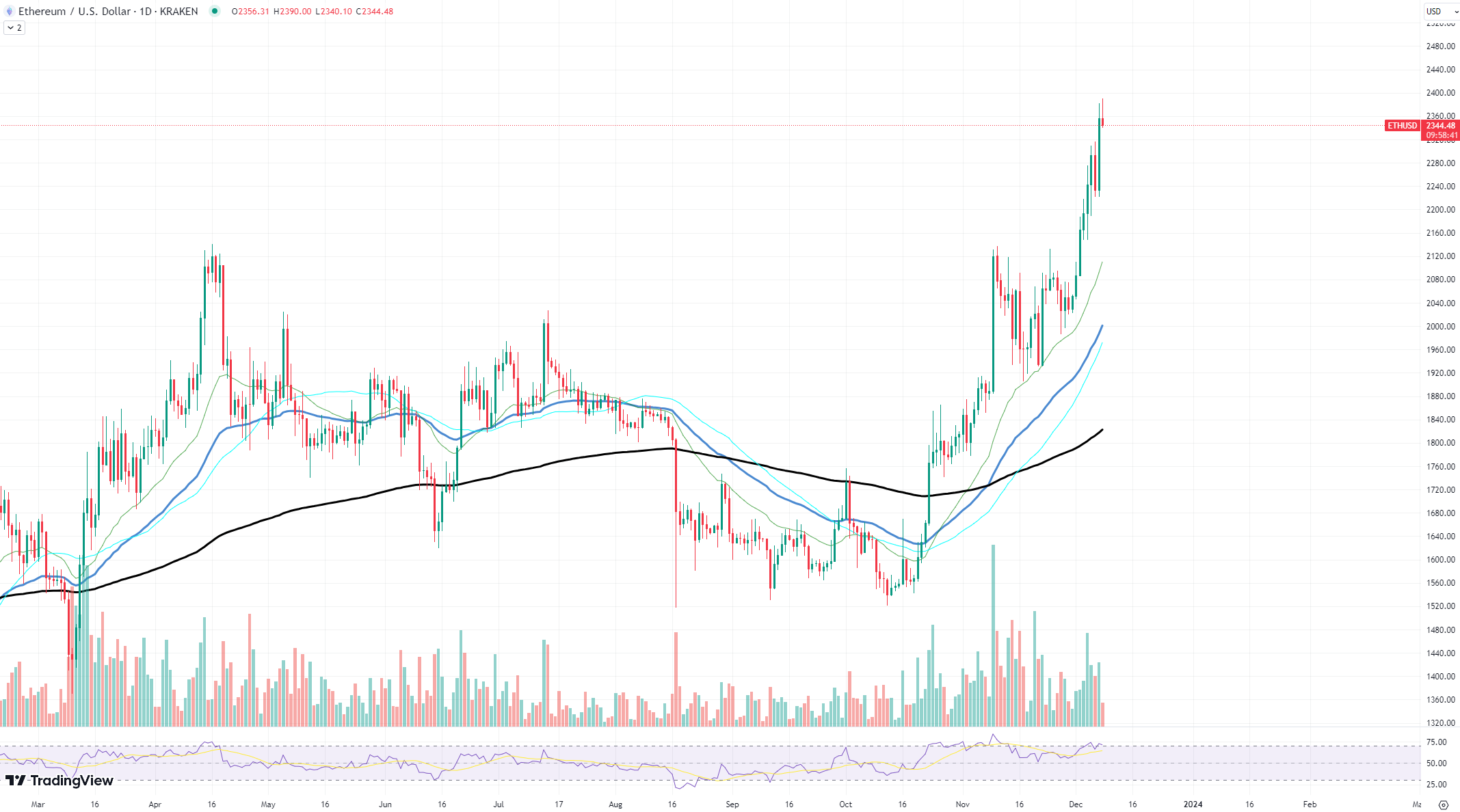

Ethereum is showing signs of a potential new era of growth amid a market that is increasingly favoring Layer-1 (L1) solutions like Solana. Ethereum’s price movement has not yet shown the explosiveness the majority of the market had been expecting. However, the cryptocurrency might still show us what it’s got.

The price trajectory of Ethereum has been robust, with recent trends suggesting that the momentum behind its surge is far from over. Despite lagging behind some of its L1 counterparts, Ethereum holds a unique position on the market due to its extensive developer community, widespread adoption and the significant role it plays in decentralized finance (DeFi) and other blockchain applications.

While Ethereum has not experienced the same intensity in its price surge as Solana, the potential for profit on the ongoing bull market remains substantial. Ethereum continues to be an attractive investment due to its size, liquidity and status as the leading platform for smart contracts. This suggests that any further gains on the broader market could amplify ETH’s price performance.

Technical analysis reveals that Ethereum is poised for growth, with key resistance levels being tested. A breakthrough above these levels could signal a continuation of the bull run, enticing both retail and institutional investors.

Solana is king

Solana (SOL) has been a standout on the cryptocurrency market, displaying a price momentum that far exceeds expectations, especially in the wake of the Jito airdrop. The drop injected fresh funds into the SOL ecosystem, boosting its already impressive performance.

The price movement analysis of Solana reveals a steep upward trajectory, signifying not just a recovery, but dominance in the digital asset space. The resilience and rapid growth of SOL are indicative of a robust and well-engaged network. The asset’s performance is not only impressive when viewed in isolation but also when compared to other cryptocurrencies, whose surges have been less intense.

The potential for Solana to breach the symbolic $100 mark, a level not seen since its collapse in 2021, has been a topic of speculation among market watchers. Prominent figures in the cryptocurrency game, such as Arthur Hayes, have expressed belief in Solana’s ability to reach this milestone. With the current price action, Solana is not just fulfilling these predictions; it is surpassing them, setting new highs and establishing a strong presence on the market.

Solana’s ascent is particularly noteworthy given the broader context of the market. While other assets struggle to maintain momentum, SOL’s surge is a testament to its underlying technology and the confidence it instills in investors. The blockchain’s high throughput and low transaction fees position it as a strong competitor in the space, capable of sustaining growth even in a turbulent market.

Bitcoin remains neutral

Bitcoin’s recent price reversal could be construed as a beacon of positivity for the altcoin markets. After a period of consolidation and bearish trends, Bitcoin’s turnaround has begun to inject optimism into the crypto ecosystem. This shift in momentum often has a ripple effect on altcoins, which can experience amplified movements in response to Bitcoin’s falling dominance.

Its dominant position means that positive price action can lead to increased investor confidence, which often spills over to the altcoin markets. When Bitcoin’s price stabilizes or starts to climb, it can provide the necessary reassurance for investors to start diversifying their portfolios with altcoins, hence, driving up their prices.

Bitcoin’s reversal comes at a pivotal moment when many altcoins have been developing their ecosystems and strengthening their use cases. With the leading cryptocurrency regaining ground, it could be the catalyst that altcoins need to attract more attention and investment. A bullish Bitcoin could mean more capital flowing into the crypto market as a whole, and altcoins are well-positioned to benefit from this influx.

Furthermore, when Bitcoin surges, it can lead to a reallocation of profits from Bitcoin to altcoins as investors seek to maximize returns by investing in assets with higher potential upside. This can be particularly beneficial for well-established altcoins with solid fundamentals and for emerging coins that capture the market’s imagination.

[ad_2]

Read More: u.today

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  USDS

USDS  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Polkadot

Polkadot  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  Uniswap

Uniswap  Pepe

Pepe  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Aptos

Aptos  OKB

OKB  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Cronos

Cronos  Ethereum Classic

Ethereum Classic  sUSDS

sUSDS