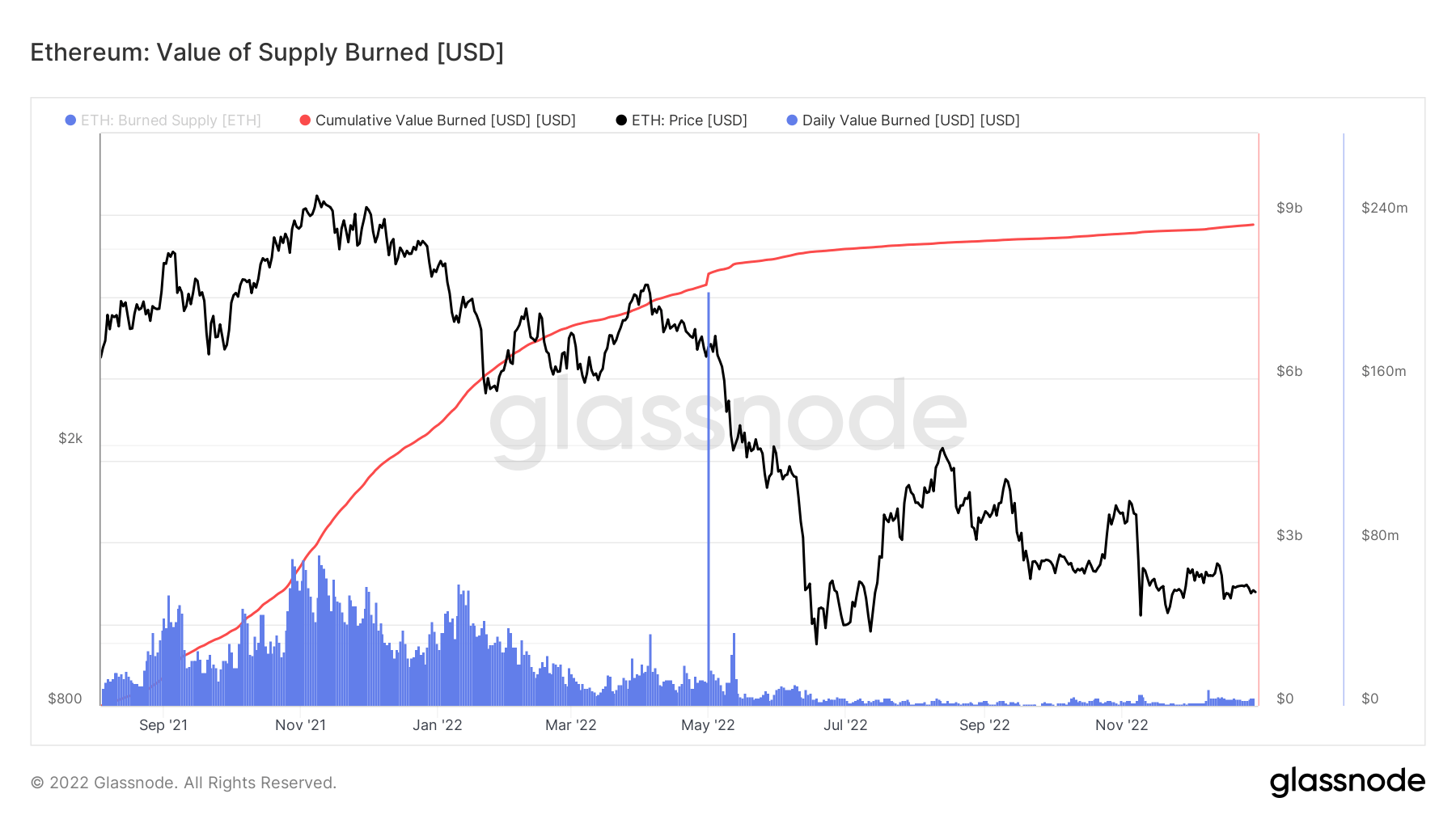

The second largest cryptocurrency by market cap, Ethereum (ETH), implemented a token burn mechanism on Aug. 5, 2021, through the Ethereum Improvement Proposal (EIP) 1559 upgrade. Since then, nearly $9 billion worth of tokens have been burned cumulatively, data from Glassnode indicates.

A total of around 2.8 million ETH tokens have been removed from the supply since the burn mechanism was instituted, according to data from ultrasound.money.

In the above chart from Glassnode, blue reflects the daily ETH supply burned at the spot price, while red stands for the cumulative value of ETH burned over time. An analysis of the Glassnode data by CryptoSlate suggests that Ethereum’s daily burn rate has decreased significantly and nearly stagnated since the collapse of Terra-Luna in May 2022.

During the bull run of 2021, $20 million to $75 million worth of ETH was being destroyed daily. This has fallen to only around $2 million to $4 million worth of ETH burned every day in December 2022. According to ultrasound.money, 1,896.30 ETH, worth around $2.2 million was burned over the past day.

It is to be noted that the fall in the daily burn rate of Ethereum is a direct reflection of the fall in Ethereum activity amid the current bear market.

Understanding the significance of ETH burn

Buring of tokens refers to sending tokens to an address from which the tokens become irretrievable. Also referred to as destroying tokens, burning tokens reduces the asset’s circulating supply and contracts overall supply over time. The burning mechanism aimed to regulate Ethereum’s gas fees — the fees paid for carrying out transactions on Ethereum.

Prior to the burn mechanism, Ethereum users had to guess the fees they had to pay to have their transactions included in the blockchain. This caused high volatility in Ethereum gas fees, especially during times of high network congestion.

With millions of users complaining about steep gas fees, the Ethereum network incorporated the token burn mechanism. As per the EIP 1559 upgrade, users are required to pay a base fee and a tip. This is equivalent to users paying a base fee for delivery and a tip to delivery executives for delivering on or before time. While the network burns all base fees, the tip is rewarded to miners.

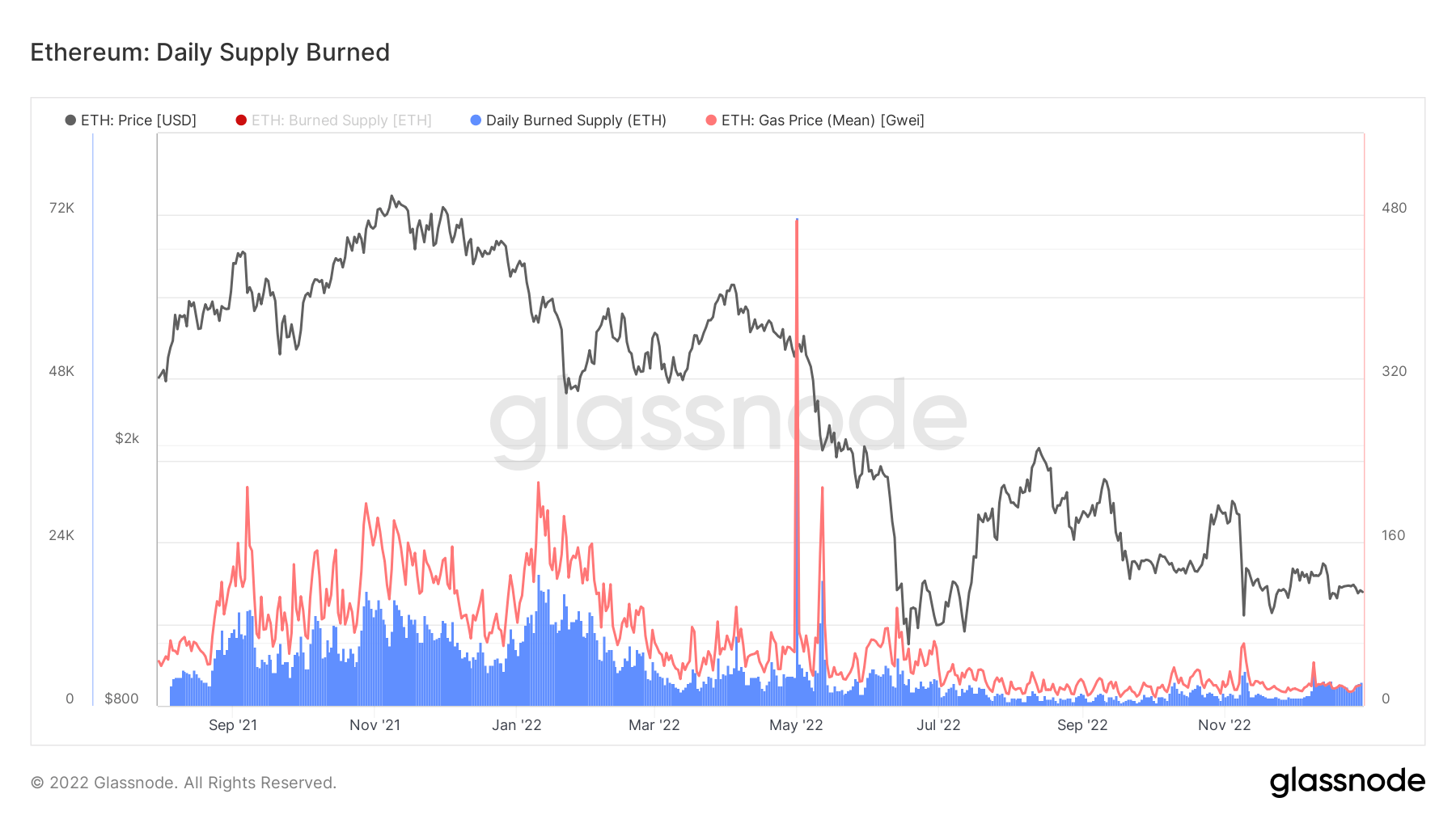

A deep dive into the daily ETH supply burned and gas fees data from Glassnode indicates that the mean gas fee has fallen significantly to around 15-20 Gwei from around 100 Gwei prior to the implementation of EIP 1559. For instance, the average gas fee ranged from 100 to 200 Gwei between January and April 2021, while it shot up beyond 200 Gwei during network congestion.

In other words, Ethereum’s average gas fees decreased by around 80% since the implementation of the burning mechanism.

The average Ethereum gas fee was 20.55 Gwei on Dec. 30, according to Etherscan data. Moreover, data from ultrasound.money indicates that the average Ethereum gas fees stood at 16.2 Gwei over the past 30 days.

In addition to regulating gas prices, the ETH burning mechanism was introduced to put deflationary pressure on the token. In other words, the burn mechanism reduces the supply of ETH which can cause the price of ETH to increase over time. This is because the price of any asset is affected by the demand and supply law, which states that a decrease in supply causes the price to increase.

At the time of writing, Ethereum’s inflation rate or its net issuance rate stood at 0.013% per year, as per ultrasound.money data. If Ethereum had not switched to a proof-of-stake (POS) consensus mechanism, its issuance rate would have stood at 3.588% per year. With the switch to POS, Ethereum’s inflation rate has fallen far below that of Bitcoin (BTC), which issues new coins at the rate of 1.716% per year.

As per ultrasound.money estimates, around 1.9 million ETH tokens are expected to be burned per year, while only 622,000 ETH tokens are expected to be issued each year.

Ethereum’s price is currently struggling amid the crypto winter — ETH was trading at $1,196.52 at the time of writing, down 67.88% for the year. However, with the token burn mechanism, ETH is expected to become deflationary, which could lead to an increase in its value in the long term.

Read More: cryptoslate.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Aave

Aave  Uniswap

Uniswap  Bittensor

Bittensor  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  Internet Computer

Internet Computer