If you listen to crypto haters like Peter Schiff, they’ll tell you Bitcoin’s been left behind and looking lost amid the latest little stocks surge. Under the surface, though, it looks like BTC whales are accumulating.

And it’s true that Bitcoin and the crypto market as a whole are struggling for a bit of direction at this present moment. In fact, if there was an award for the best-performing sideways-moving asset outside of stablecoins, then Bitcoin would be in with a great shout.

Here was Peter “I Bar Up Over Gold More Than Francisco Pizzaro” Schiff’s latest Bitcoin-related comment, by the way:

Just in case HODLers aren’t paying attention #Bitcoin hasn’t participated in the recent rally and is barely above $19K. If Bitcoin can’t rise with other risk assets, imagine how much it will fall when risk assets resume their decline. In fact, Bitcoin may lead the next leg down.

— Peter Schiff (@PeterSchiff) October 18, 2022

However, there’s the odd bit of on-chain research popping up here and there in our content feeds that would indicate at least some potential for a positive break out of the excruciatingly low Bitcoin/crypto volatility we’re currently in.

Bitcoin-gobbling whales

For instance, data from the blockchain research firm Santiment indicates whales (holders of large amounts of a given asset) are accumulating Bitcoin at these US$19k-ish levels.

As BTC’s price continues its crab impression, addresses holding between 10,000 to 100,000 BTC have apparently reached their highest level since February 2021. That, by the way, turned out to be a pretty bullish month for crypto, although past performance is not indicative of future resu… ah, you know.

🐳🦈 The number of #Bitcoin addresses holding 10,000 to 100,000 $BTC & addresses holding 10 to 100 $BTC have reached their highest amount of respective addresses since Feb, 2021. As the number of addresses on a network rise, utility should follow suit. https://t.co/mSMnSOVf6L pic.twitter.com/iKA2BwwTyc

— Santiment (@santimentfeed) October 18, 2022

$940m in Bitcoin exits exchanges

And another little nugget of possibly positive info has come from another blockchain analytics firm, CryptoQuant, which suggests that about US$940 million worth of Bitcoin (48k BTC) has just moved off major crypto exchange Coinbase.

This sort of large BTC movement is sometimes regarded as a good sign, indicating whale holders are looking to secure their asset in cold storage reducing the likelihood of selling/trading.

Dormant #Bitcoin moved out from Coinbase Pro

“The outflow of 48K $BTC is coming from #Coinbase Pro and has a dollar value of $940.032.000,00″

by @JA_MaartunRead More👇https://t.co/Y72JCFGsHf

— CryptoQuant.com (@cryptoquant_com) October 18, 2022

Additionally, more than 121,000 BTC (over US$2.3 billion), has left exchanges in the past 30 days.

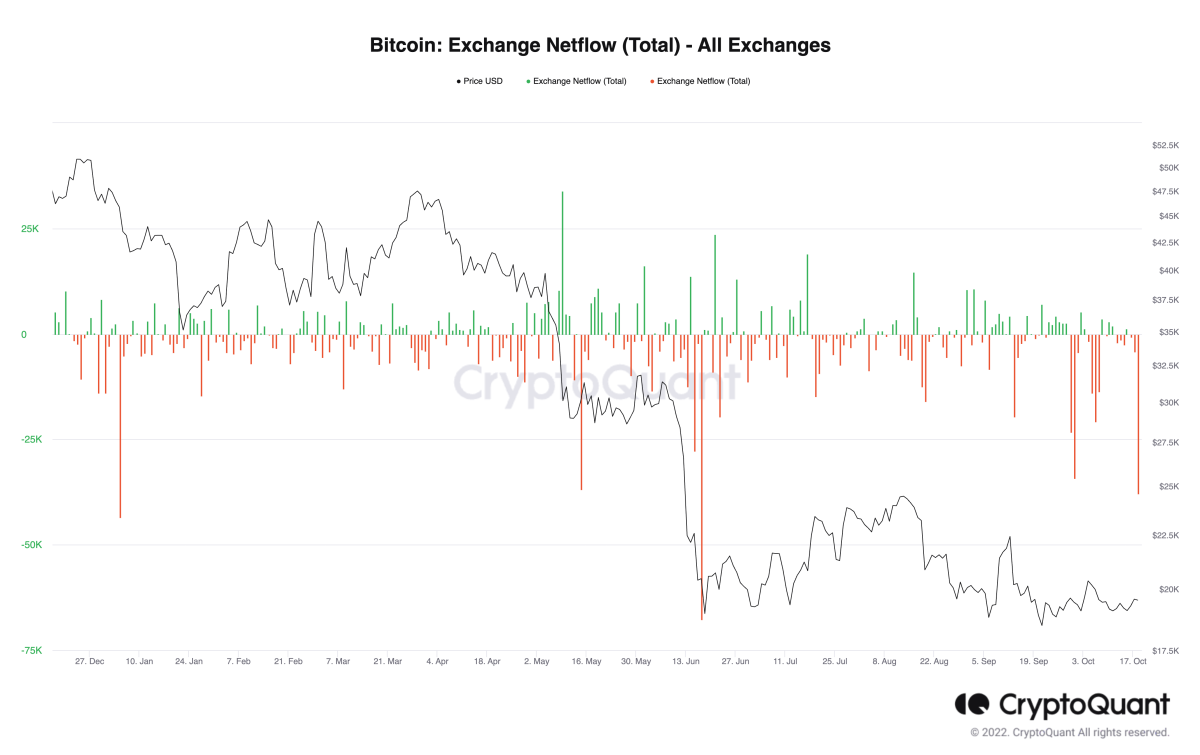

The red lines on the CryptoQuant chart below indicate exchange outflows. It doesn’t always follow that the outflow spikes are harbingers for price rallies, but that big outflow that occurred in mid June certainly saw some subsequent positive price action.

This latest exchange outflow is the biggest since June.

Onto some daily price action.

Top 10 overview

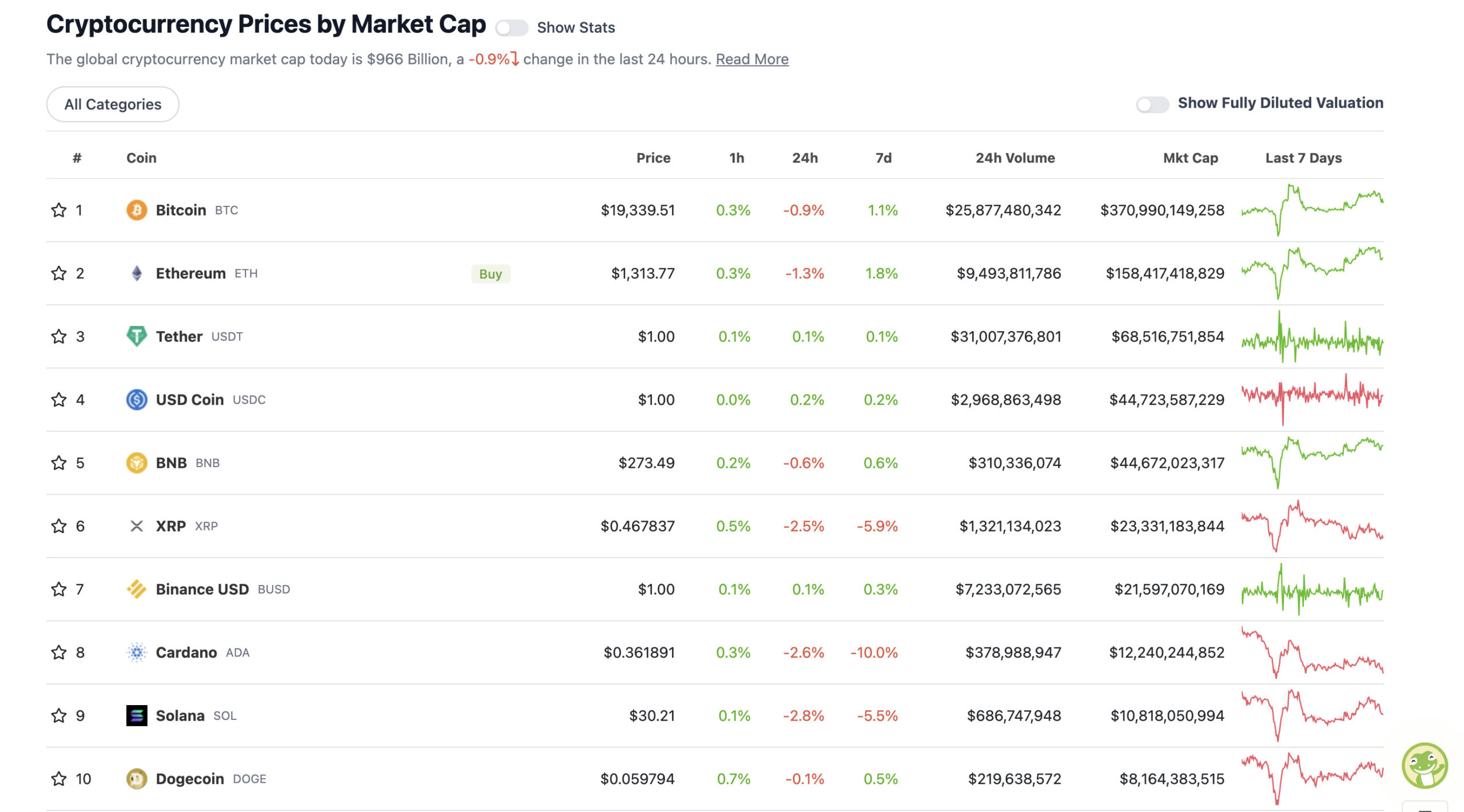

With the overall crypto market cap at US$966 billion, down about 1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

As indicated above, Bitcoin and its fancy top 10 friends are still hanging out somewhere on the Nullarbor Plain, dreaming of mountain-range visual stimulation.

Clocking into some well-known go-to Crypto Twitter analysts, and the feeling is mixed. Justin Bennett, for one, doesn’t actually sound so confident any more that a rally is particularly imminent, citing “unfinished business sub $19k”.

$BTC is struggling to stay above $19,370 support and looks relatively weak here. Wouldn’t be surprised to see longs get taken out below this area.

Most will try to bid $19k, but I think we go a bit lower. Seems there’s unfinished business sub $19k. Let’s see.#Bitcoin pic.twitter.com/x5mleUxm2G

— Justin Bennett (@JustinBennettFX) October 18, 2022

However, “il Capo of Crypto” is satisfied there’s been a double touch of support around the low $19k level and is going, er, “long and strong” on a potential double bottom…

Double touch of support, liquidity gap to the upside and funding going down.

I’m long and strong.

Good night! pic.twitter.com/5EO4jymxzD

— il Capo Of Crypto (@CryptoCapo_) October 18, 2022

Meanwhile, just touching on the leading layer 1 smart-contract blockchain for half a second, Aussie Ethereum educator Anthony Sassano points out some post-Merge issuance reduction for ETH in this tweet below. A very good thing for the crypto’s deflationary-asset narrative.

~6.5k ETH ($8.5 million) issued since merge including the burn

Under PoW, it would’ve been ~400,000 ETH ($528 million) including the burn

~98.4% reduction in ETH issuance in just over 4 weeks

— sassal.eth 🦇🔊🕯️🌊 (@sassal0x) October 18, 2022

Aptos makes rocky debut

Aptos, yet another layer 1 blockchain hitting the crypto space has made its highly anticipated mainnet debut.

Anticipated, because it’s borne from Meta’s defunct Diem blockchain project, and there has been millions of VC dollars pumped into this one from the likes of Parafi, Andreessen Horowitz (a16z), FTX, and Multicoin Capital.

The blockchain’s native APT token is now set to make its debut on the market, however, Aptos has been copping a barrage of criticism for its lack of transparency so far with regards to its token distribution model.

News has leaked that some 51% of the initial 1 billion APT supply is sitting with VCs, with another 190 million going to core developers for the project.

This hasn’t gone down well.

Aptos tokenomics remind me of the ICP debacle.

The Foundation owns 16.5%. The community takes 51% but it is composed by 20% Aptos Labs and 80% by the Foundation itself.

Lets see how high this will go before FTX lists the perp and Alameda activates farm & dump. pic.twitter.com/MKpKg3b8m0— Don (@Don_100x) October 18, 2022

It’s not great that FTX/Binance etc are all listing Aptos without any tokenomics transparency at all. Surely it should be a prerequisite to listing something that users can have the basic information on what they’re buying lol

— Cobie (@cobie) October 18, 2022

At the time of writing, the APT token is listed on crypto market aggregation sites such as CoinGecko and CoinMarketCap, however, there is no price data available yet, and the project will be featured as an “untracked listing” for the moment until full support is integrated from crypto-trading platforms.

#Aptos is off to a rocky start with many pointing out major flaws in its tokenomics and lacklustre transactions per second (TPS) of only 4.

Here’s what you need to know 👇🧵

— CoinGecko (@coingecko) October 18, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.16 billion to about US$392 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Frax Share (FXS),(market cap: US$453 million) +10%

• Aave (AAVE), (mc: US$1.17 billion) +5%

• Arweave (AR), (mc: US$515 million) +3%

• Curve DAO (CRV), (mc: US$500 million) +2%

• Polygon (MATIC), (mc: US$6.45 million) +2%

DAILY SLUMPERS

• Quant (QNT), (market cap: US$2.68 billion) -11%

• EthereumPoW (ETHW), (mc: US$738 million) -5%

• LEO Token (LEO), (mc: US$4 billion) -4%

• Lido DAO (LDO), (mc: US$4 billion) -1%

• The Graph (GRT), (mc: US$618 million) -4%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

JUST IN: Guinness World Records featured #Bitcoin in the latest edition of its record book 🙌

— Bitcoin Magazine (@BitcoinMagazine) October 18, 2022

Macro in Five Charts, No 4. – Enduring Bull vs. Bear: Bitcoin and Crude Oil – That #Bitcoin didn’t exist in 2007, when WTI #crudeoil first traded the price on Oct. 14 around $86 a barrel, may indicate the appreciation advantage of the nascent technology/asset. pic.twitter.com/8kRoxCxAAQ

— Mike McGlone (@mikemcglone11) October 18, 2022

When you strip out the three 50% bear markets of ’74, 2001 and 2008 the average is 28%. 50%+ bear markets are very rare

— Raoul Pal (@RaoulGMI) October 17, 2022

NEW – Fidelity Digital Assets: #Bitcoin “has no counterparty risk and has a supply schedule that cannot be changed.” ✊ pic.twitter.com/ntGo1k5TkD

— Bitcoin Magazine (@BitcoinMagazine) October 18, 2022

when your hyped nft reveals to be shitty fiverr art pic.twitter.com/obhkqQstnJ

— kmoney (@kmoney_69) October 18, 2022

this guy is not gonna make it #btc pic.twitter.com/QA82KYhmwn

— Sheikh Roberto (@roberto_saudi) October 18, 2022

Read More: stockhead.com.au

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Toncoin

Toncoin  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Litecoin

Litecoin  Uniswap

Uniswap  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  Arbitrum

Arbitrum  Filecoin

Filecoin  Celestia

Celestia  Dai

Dai  Algorand

Algorand  Stacks

Stacks  Bonk

Bonk  WhiteBIT Coin

WhiteBIT Coin  Cosmos Hub

Cosmos Hub