The Bitcoin and crypto exuberance continues. So far, it’s 12 straight days of consecutive price gains for BTC, which is actually nearing a record.

If it tips over 15 days, then it’s time to pop one of those little streamer things. Before considering whether you really shoulda skimmed off some of this price movement in your portfolio by now.

But regardless of personal trading strategies, the OG crypto has now cracked the US$21k mark once again, for the first time since early November, and has finally (after about 381 days) moved back above its 200-day moving average. A good thing.

Why Bitcoin’s increasing ‘mining difficulty’ is positive

What’s also a good thing, as crypto and markets analyst Simon Peters from eToro notes, is the fact the Bitcoin mining difficulty has just hit a fresh all-time high as of Sunday, rising rising 10.26% to 37.73 trillion.

“This comes as the Bitcoin hashrate set a new ATH on 6th January, too,” Peters said. “The difficulty and hashrate generally rises because of more competition between miners effectively crowding the network.”

The reason this is good, said the analyst in some commentary shared with Stockhead, is because the more miners on the Bitcoin network the more secure it is – although that doesn’t always necessarily correlate to price moves.

“It is also a signal that is common during or after bearish episodes where background usage and development keeps going despite headline price falls and can be construed as a positive long-term indicator,” added Peters.

“Miners have had difficulty in recent months as the price of bitcoin has wallowed at low levels, but with increases now taking place, they could find their operations becoming more profitable again.”

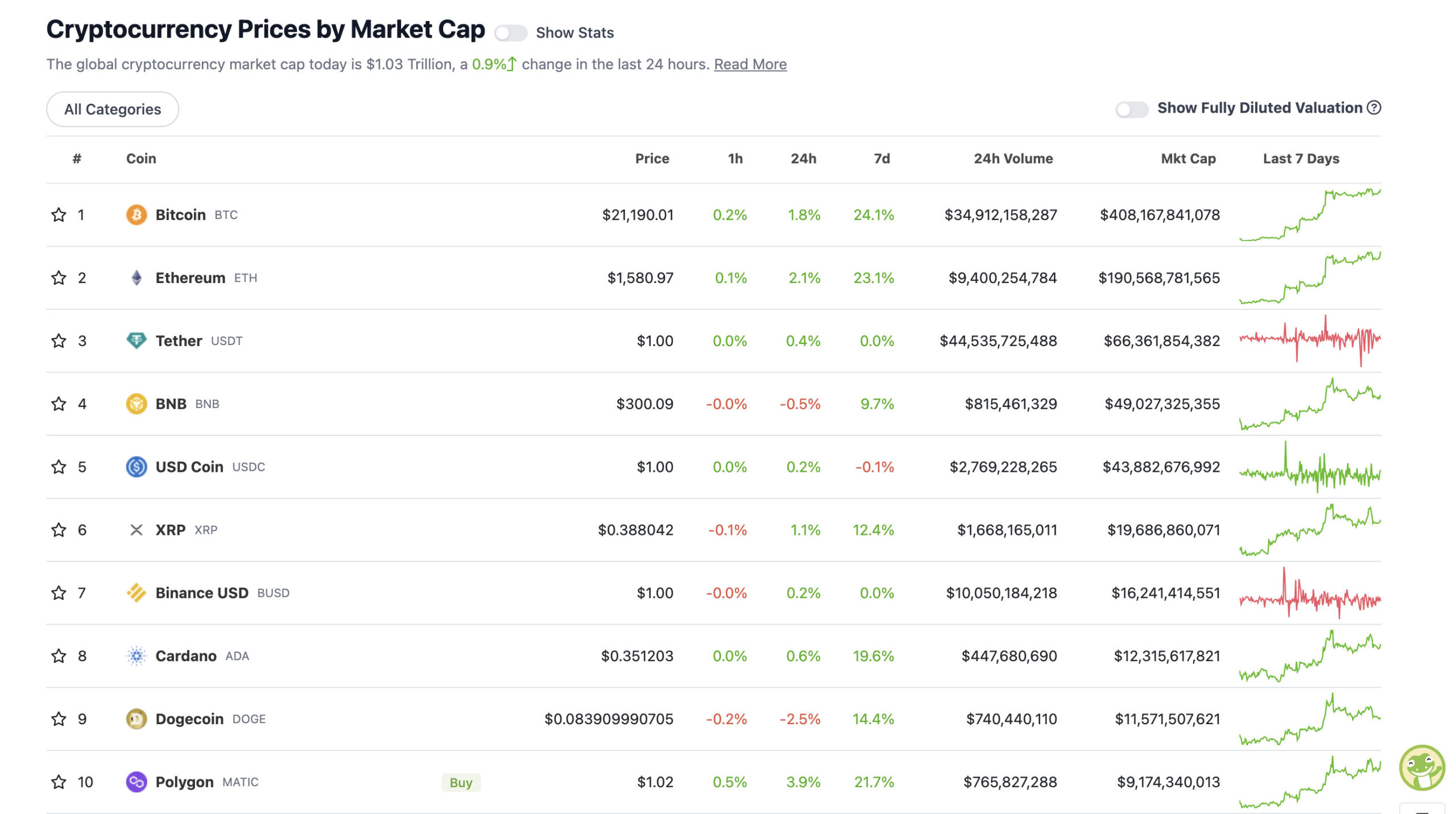

Top 10 overview

With the overall crypto market cap at US$1.03 trillion, up about 1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Cooling US inflation figures, hashrate and mining difficulty aside, one other thing that can be thrown in the stew of decent news for Bitcoin this week is the apparent accumulation of smaller “whale” addresses over the past eight weeks or so.

On-chain data provider Santiment has suggested that this group of whales (large holders of an asset) has been helping to push the latest Bitcoin rally:

Amongst many of the foreshadowing metrics for this 2023 breakout was the rapidly growing amount of addresses holding 100 to 1,000 $BTC. Price pumps generally occur marketwide when whales accumulate #Bitcoin. The #1 asset in #crypto is +26% in two weeks. https://t.co/JMh83m3mIu pic.twitter.com/FiRTLIc3LB

— Santiment (@santimentfeed) January 14, 2023

Santiment also revealed that more than 416 addresses hold 100-1000 BTC, which is an increase of 3.04% in eight weeks.

Stop selling your #Bitcoin to whales

pic.twitter.com/OPPuvJ2Yn1

— Bitcoin Magazine (@BitcoinMagazine) January 16, 2023

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8.7 billion to about US$382 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Cronos (CRO), (market cap: US$2 billion) +9%

• Quant (QNT), (mc: US$2 billion) +6%

• Ethereum Name Service (ENS), (mc: US$382 million) +5%

• Frax Share (FXS), (mc: US$648 million) +5%

• Zilliqua (ZIL), (mc: US$434 million) +5%

DAILY SLUMPERS

• Zcash (ZEC), (market cap: US$562 million) -5%

• Dash (DASH), (market cap: US$546 million) -5%

• Lido DAO (LDO), (mc: US$1.76 billion) -4%

• Monero (XMR), (mc: US$3 billion) -4%

• GMX (GMX), (mc: US$417 million) -4%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse…

Uh… the two founders of the imploded crypto hedge fund Three Arrows Capital (3AC), Su Zhu and Kyle Davies, are aiming to raise US$25m from investors for a new crypto exchange. They’re calling it GTX. Now why does that sound vaguely familiar?

3AC’s founders looking to raise $25M to launch a new crypto exchange called “GTX,” a spin on FTX “because G comes after F.”

— Tiffany Fong (@TiffanyFong_) January 16, 2023

— Watcher.Guru (@WatcherGuru) January 16, 2023

3AC and its founders have been outspoken and controversial figures in the crypto world in recent times. 3AC is notable for being one of the first domino to fall in the Terra Luna collapse midway through last year. Both Zhu and Davies were recently subpoenaed in the 3AC bankruptcy case.

So Su and Kyle start a new exchange called GTX.

After it blows up they are going to be traveling by BMX. pic.twitter.com/lZjqyAt0Aj

— Clark (@CanteringClark) January 16, 2023

To be clear, in my opinion current #bitcoin pump is not a bull trap but the (early) start of the next bull run

https://t.co/V74Y8VZaKW

— PlanB (@100trillionUSD) January 16, 2023

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Shiba Inu

Shiba Inu  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  LEO Token

LEO Token  Toncoin

Toncoin  Litecoin

Litecoin  Polkadot

Polkadot  WETH

WETH  Monero

Monero  USDS

USDS  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Pepe

Pepe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pi Network

Pi Network  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Aave

Aave  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  Dai

Dai  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  Ondo

Ondo  OKB

OKB  Official Trump

Official Trump  Cronos

Cronos  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic