Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- Momentum on the daily timeframe flipped in favor of the sellers.

- If XMR can defend $135, lower timeframe traders could look for buying opportunities.

It was a red week for the S&P 500 which fell 6.4% from Tuesday’s (13 December) open at 4092 to a low of 3829 on Friday (16 December). This began to hurt Bitcoin on Wednesday (14 December) when BTC tested the $18.2k level as resistance. Monero also fell by 6.2% in the same period.

Read Monero’s Price Prediction 2023-24

Despite the selling pressure in recent days, XMR has strong support in the $135 zone. Whether the bulls can force an uptrend from there depends largely on Bitcoin. The weekend could see a slow move up across the crypto market, followed by a crash on Monday, given SPX breached the 3911 support level a few days ago.

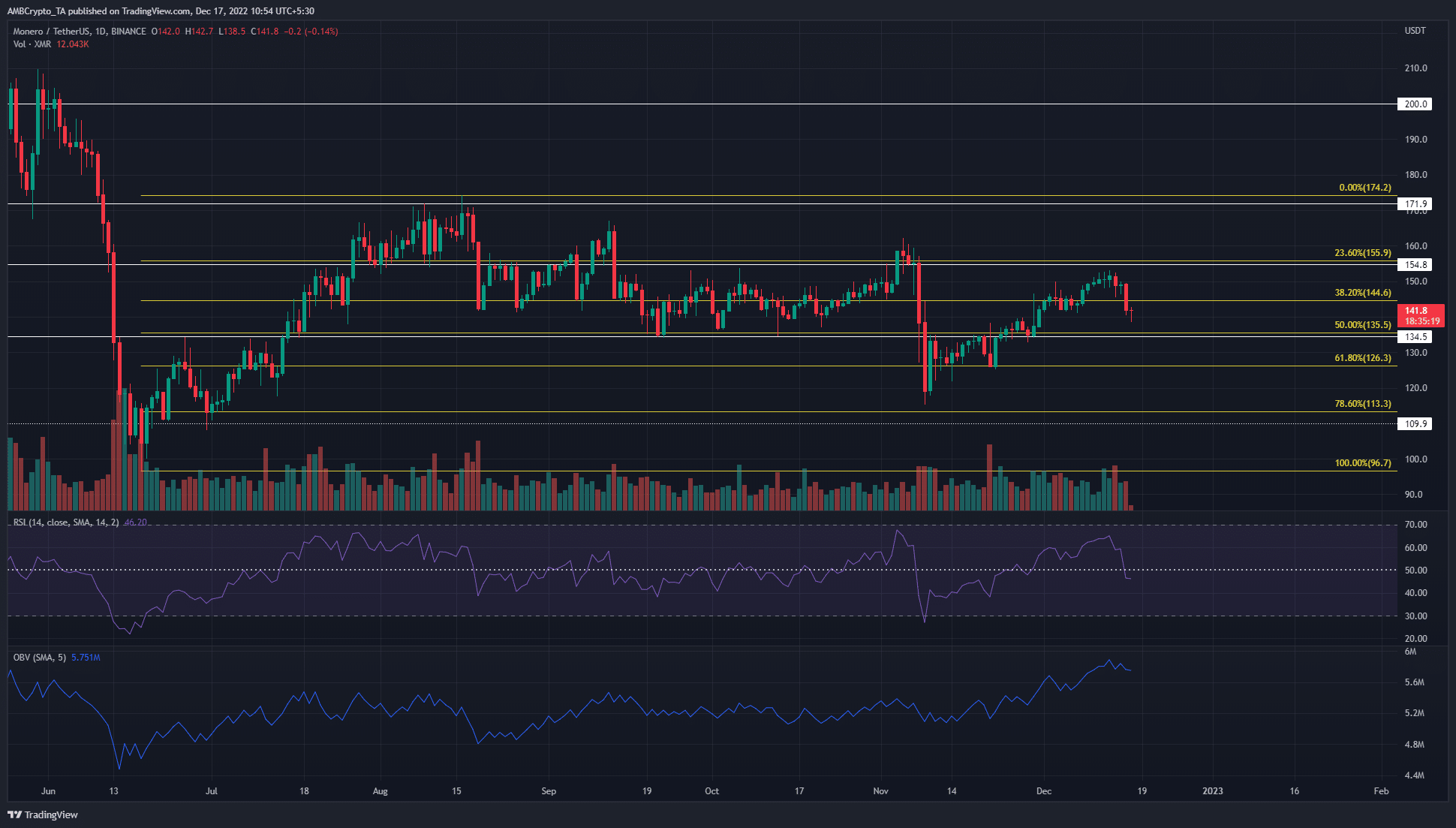

Monero is unable to break out past $150, but the selling volume was only average

On the daily timeframe, the trading volume of Monero was similar to the highs that the asset saw since September. The OBV showed that overall the buying pressure was greater over the past four months. The evidence for this was the higher lows seen on the OBV.

However, since August, the price has set a series of lower highs. This indicated a downtrend, interrupted by lower timeframe rallies. After the November sell-off, XMR fell from $158 to $119. Since then, the price did trend upward to reach $151 but fell to $141 over the past couple of days.

The RSI breached the neutral 50 mark and indicated that momentum favored the bears. Yet, there was strong support at $135.5. It was the 50% retracement level based on a move Monero made on the charts over June and July.

Long-term investors need to be wary. The trend on higher timeframes did not favor the bulls, despite the OBV’s higher lows. Lower timeframe traders can seek buying opportunities at the $135 mark.

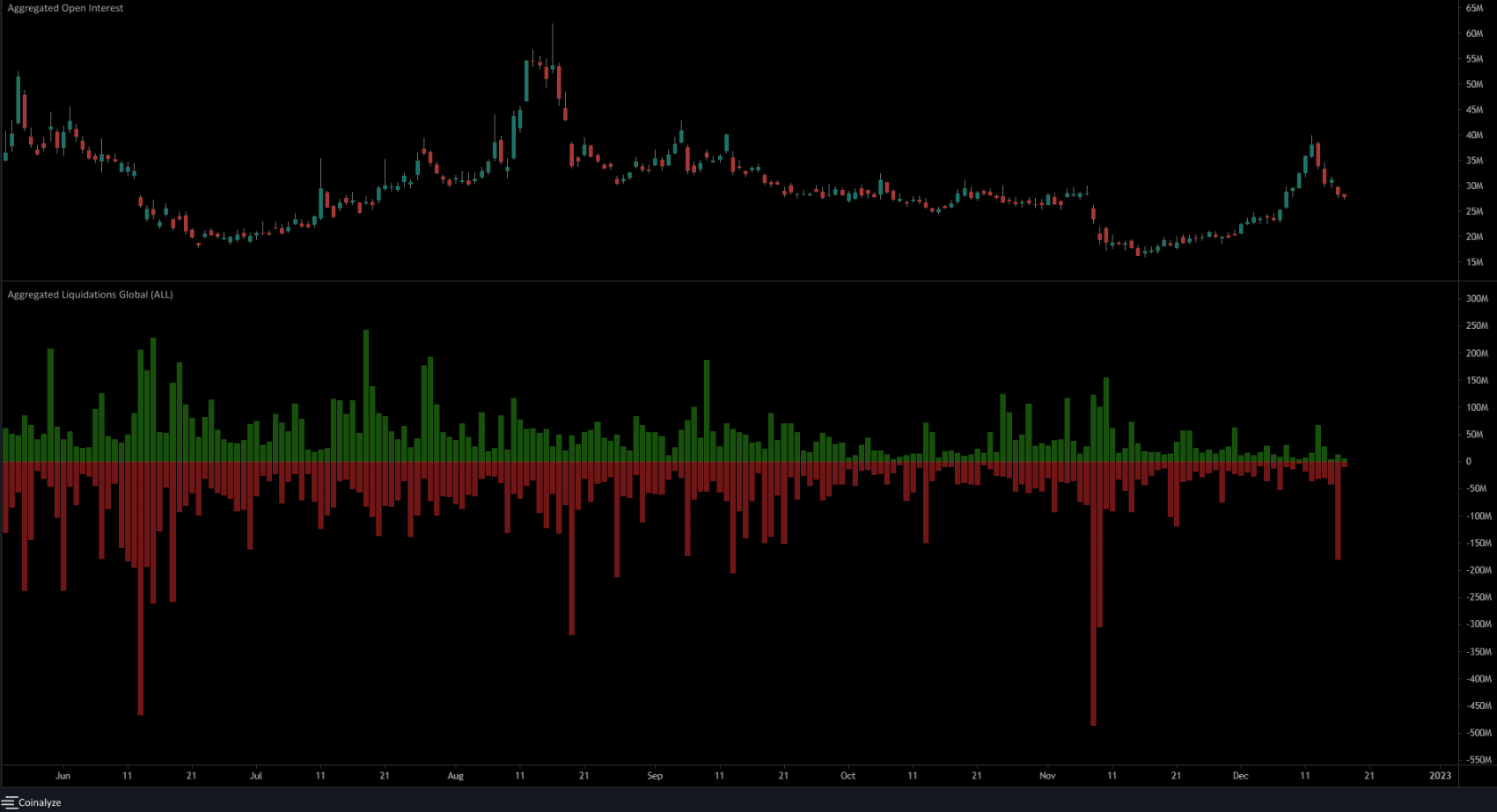

Long positions see large liquidations and Open Interest takes a hit too

Source: Coinalyze

Coinalyze data showed that positions worth $179.6m of long positions were liquidated on 16 December. The closed long positions added to the selling pressure. Meanwhile, the funding rate remained in the bearish territory at -0.022%.

The Open Interest also fell by 9% in the 24 hours that preceded press time. Since 12 December, the OI has dropped from $38.2m to $27.7m, which indicated bulls were forced to close but did not yet signal a strong bearish trend.

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  LEO Token

LEO Token  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  Litecoin

Litecoin  WETH

WETH  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  Internet Computer

Internet Computer  Aptos

Aptos  Cronos

Cronos  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jito Staked SOL

Jito Staked SOL  Ondo

Ondo  sUSDS

sUSDS