Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Monero has traded within a range since mid-September

- XMR is poised for a breakout, but a pullback could also materialize

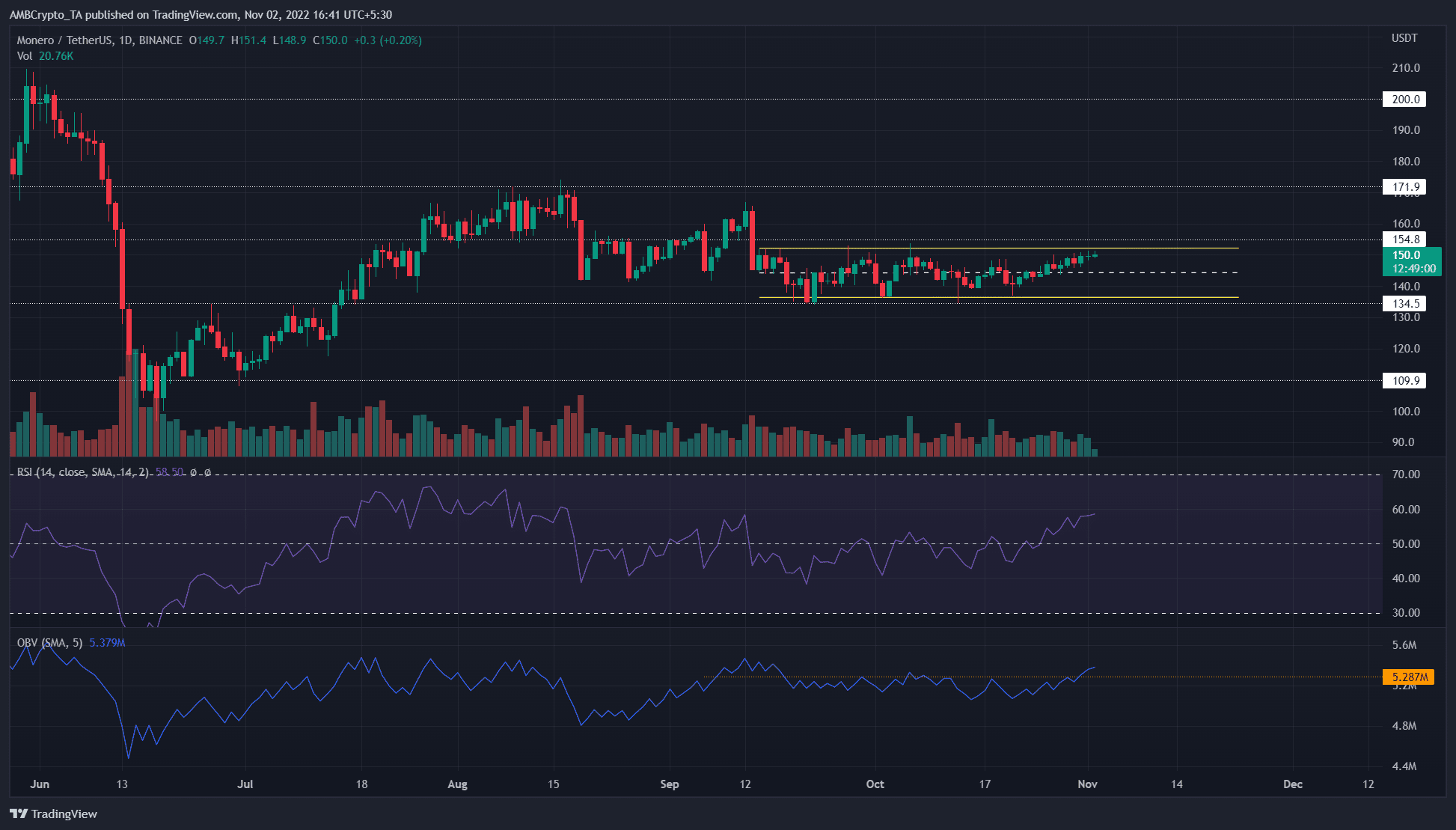

Monero has traded within a range between $152 and $136 since September. Technical indicators showed good buying pressure and a likely breakout to the upside.

Here’s AMBCrypto’s Price Prediction for Monero [XMR] in 2022-23

A recent article highlighted the bearish signals that Monero flashed in recent weeks. For instance, the transaction count decreased in September but saw a recovery in October.

Bulls threaten a breakout but volatility could see a pullback

The price action showed XMR approached the highs of a near two-month range. This region of resistance was one that XMR bulls have struggled to crack since late September.

The technical indicators showed some bullish signs. The RSI on the 12-hour chart climbed above neutral 50 to denote bulls have found some strength in the market. Meanwhile, the OBV also climbed above a level of resistance from mid-September.

Together, these findings showed that the market began to show some bullish intent in the past few days. However, the trading volume has been average in recent weeks. If the price climbed past $156 without a surge in volume, it could be an early indication of a failed breakout.

Weighted sentiment finally flips positive and a rally could ensue

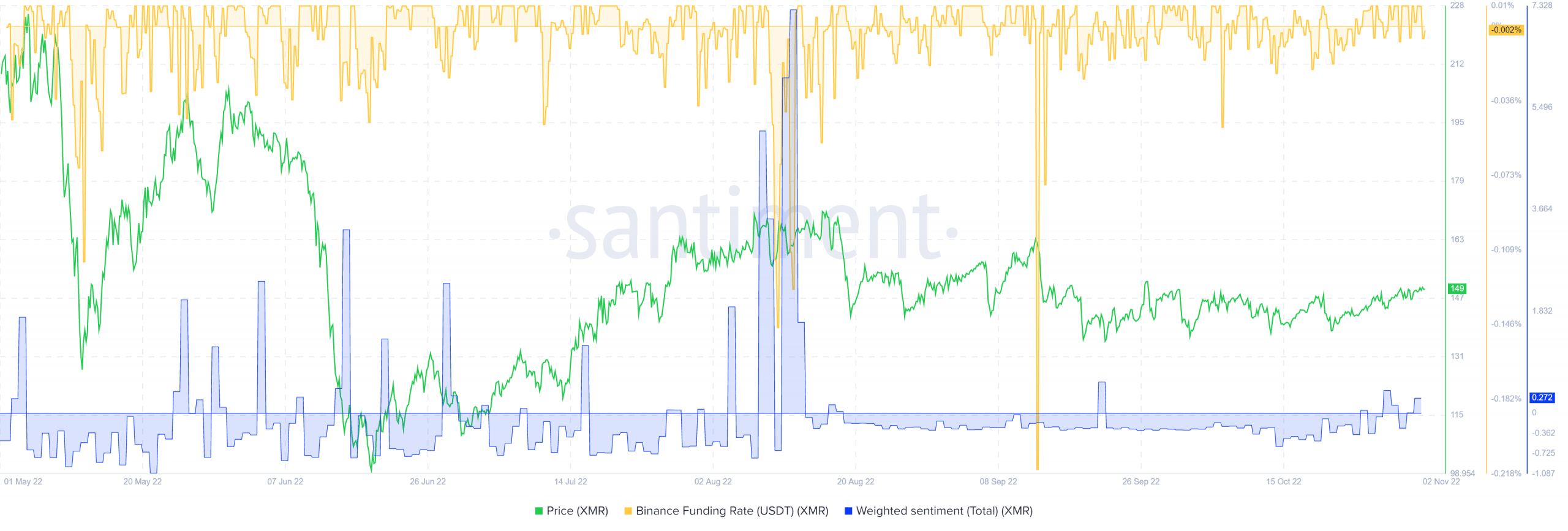

Source: Santiment

Santiment data showed funding rate was positive in recent days for XMR. At press time, it entered negative territory. However, overall the inference is that the futures market participants have been bullish in the past few days.

This occurred alongside the rally in price. Data from Coinglass also showed funding rates on major exchanges such as Binance to flip to positive.

The weighted sentiment has been weakly negative since August. However, this began to change. The sentiment appeared to have shifted into a slightly positive zone. If social interactions continue to remain so, bullish intent could quickly cascade and a rally upward can materialize.

In summation, traders might want to wait for a breakout past the range on significant volume. Thereafter a retest of the range highs near $156 can offer a buying opportunity targeting $172 and $200. Invalidation of this idea would be a session close below $148.

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Cardano

Cardano  Dogecoin

Dogecoin  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  LEO Token

LEO Token  Chainlink

Chainlink  Toncoin

Toncoin  Stellar

Stellar  USDS

USDS  Wrapped stETH

Wrapped stETH  Pi Network

Pi Network  Hedera

Hedera  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Sui

Sui  MANTRA

MANTRA  Polkadot

Polkadot  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  WETH

WETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hyperliquid

Hyperliquid  Wrapped eETH

Wrapped eETH  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Monero

Monero  sUSDS

sUSDS  Aptos

Aptos  Dai

Dai  OKB

OKB  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Gate

Gate  Ondo

Ondo  Aave

Aave  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Tokenize Xchange

Tokenize Xchange