Chip Somodevilla

Mark Zuckerberg’s decision to double down on the money-losing metaverse project could easily backfire given Meta Platforms, Inc.’s (NASDAQ:META) unsuccessful pivots to other non-core projects in the past. In my latest article on the company, I’ve already highlighted the ongoing shareholder revolt that was caused by the management’s decision to accelerate the spending of the available cash on Reality Labs, which is on track to generate more than $10 billion in losses this year. This article aims at presenting detailed arguments about why there’s every reason to believe that Meta’s metaverse project is doomed to fail, and how much shareholder value is being destroyed by the pivot to the metaverse.

Why Metaverse?

A few months ago, Wall Street Journal reported that Meta and Apple (AAPL) held several talks in recent years about launching a subscription-based version of Facebook. Apple’s executives were displeased at that time with the fact that their company was making no revenues from Meta’s apps, which are constantly one of the most downloadable apps on the App Store. After both parties failed to find any common ground, Apple decided to release a 14.5 iOS update to iPhones back in April of 2021, which gave its users the ability to decide whether to share their personal data with third parties such as Facebook or Instagram.

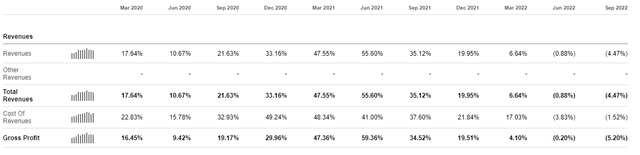

As a result of this decision, Meta started to struggle with efficiently tracking its users. The same WSJ article stated that only 37% of iOS users agreed to share their data, which lead to a weaker return on advertising spend for advertisers and resulted in the decline of the company’s advertising revenues. The table below shows that the percentage growth of Meta’s Y/Y revenues started to gradually decline after Q2’21 and in the last two quarters became negative. While the recent decline could be attributed to the overall decline in advertising spending caused by macroeconomic events, the advertising market nevertheless was aggressively growing in the second half of 2021, which is a sign that Apple’s privacy update is mostly to blame for Meta’s weakening performance in the last year and a half.

Meta’s Top-Line Performance (Seeking Alpha)

Considering this, it becomes obvious to all shareholders that Meta’s management needs to do something in order to stop the bleeding and reverse the trend. The problem is that it appears that the company’s leadership with Mark Zuckerberg at the helm took a turn in the wrong direction, which already negatively affects the business’s financials.

Right now, Mark Zuckerberg’s solution to the growth issue is to double down on Meta’s metaverse project. There are numerous problems with this. First of all, there’s still no clear definition of what exactly the metaverse is, as the name itself came from a dystopian science fiction written a couple of decades ago that’s set in a virtual world. Meta’s description of the metaverse is as follows:

The “metaverse” is a set of virtual spaces where you can create and explore with other people who aren’t in the same physical space as you. You’ll be able to hang out with friends, work, play, learn, shop, create and more. It’s not necessarily about spending more time online — it’s about making the time you do spend online more meaningful.

In addition, a year ago, when Meta was rebranding itself, The Verge wrote a piece about the company in which it stated that Mark Zuckerberg believes the metaverse to be the future of the internet where people would be spending time in fully immersive 3D worlds to interact with each other. Even though we can’t really know whether that’s going to be the case in the first place, Meta nevertheless continues to double down on Mark Zuckerberg’s vision.

In order to fully execute that vision, Meta has been actively developing hardware and software solutions, which would help it to create an immersive metaverse environment. On the hardware front, the company has recently launched two of its own headsets called Meta Quest 2 and Meta Quest Pro, which are sold for $399.99 and $1499.99, respectively. On the software front, the company has released its own video game called Horizon Worlds, which users could access for free if they own the company’s headset, where they could interact with each other in a virtual world. However, despite those developments, we still can’t really figure out how exactly are they going to fix Meta’s declining business in the foreseeable future.

What’s Next?

It appears that Meta’s biggest problem is that it can’t provide an easy fix to the growth problem caused by the change in Apple’s tracking policy and as a result, it has now pivoted to the non-core solution that doesn’t guarantee to show any meaningful returns at all anytime soon. At the latest shareholder meeting with the shareholders, Meta’s management hasn’t provided any concrete reasons on why should the company pivot from being a social media firm to being a metaverse business and it also failed to provide any real solutions on how to monetize the metaverse itself.

Even if we assume that the company aims to track the eye movements of its users in headsets to learn about their behavior within Horizon Worlds and based on that data show the relevant ads across its platforms to improve the efficiency of its advertising tools, then we could assume that there are at least several flaws with such an approach. First of all, there’s no guarantee that Meta’s headsets would be able to correctly track such movements with high accuracy in the first place. Secondly, Meta’s customer acquisition cost alone would skyrocket then if that’s the approach with which it plans to proceed. Let’s not forget that it takes nothing for users to join Facebook or Instagram, as those apps are free, which gives Meta more data to work with. In the case of an eye tracking option, a user first needs to buy an expensive headset, which already decreases a potential user base due to the high cost of buying such a headset in the first place.

At the same time, in order for the user to buy such an expensive headset, there needs to be an attractive software offering as well, so that the headset doesn’t collect dust on a shelf. And that’s where another problem lies. In my latest article on the company, I’ve already quoted Meta’s internal leak, which stated that Horizon Worlds is too buggy at this stage, which makes the game less appealing to users. It already has countless one-star reviews and it seems that Meta has nothing interesting to offer to its users to smoothen their experience at this stage. One of the interesting things is that after announcing a month ago that users would be able to add legs to their virtual avatars in Horizon Worlds, users still can’t able to do so, which just shows the current poor state of Horizon Worlds. Considering that in the past, Meta failed to properly launch and scale its non-core projects, it won’t surprise me if Horizon Worlds and the whole metaverse project fail over time as well.

However, even if we assume that Meta manages to solve all the issues described above and becomes the biggest metaverse company in the world, then the question would be how big of a market the metaverse itself really is. Considering that Meta believes the metaverse to be an immersive 3D world, it would make sense to figure out how big the virtual reality market is in the first place. From what I found out, some reports suggest that the VR market was worth $28.42 billion in 2021 and is forecasted to be worth $87 billion by the end of the decade. That could be considered a big figure, but in reality, even if Meta owned the whole VR market solely to itself, it would still generate significantly less revenue from it than it generates from its digital advertising business.

In addition, there are reports, that state that the metaverse market itself was worth nearly ~$60 billion in 2021 and could be worth north of $1 trillion by 2030. However, there are problems with such reports, as they highly rely on the growth in value of various NFTs, which themselves became worthless in recent months as the crypto market burst. It’s hard to see how a crypto market would recover in the current environment during which the Fed continues to raise rates and engages in a quantitative tightening, and as a result, it’s very unlikely that the NFTs would once again gain momentum anytime soon. Therefore, reports, that state that the metaverse market could be worth over $1 trillion in the following years are questionable at best.

Considering all of this, even if the 2021 numbers from those reports are correct, it’s still hard to justify Meta’s investments into the metaverse field, as its core digital advertising business annually generates more than the supposed size of the whole metaverse market, despite all the issues that were caused by the change of Apple’s privacy policy. What’s worse is that it seems that Meta’s management doesn’t care about this, as over the last few years they poured $36 billion into the metaverse projects and plan to continue to aggressively spend more money on it, even though the Reality Labs division is already on track to report more than $10 billion in losses this year alone.

On top of that, for FY22 and FY23, the capital expenditures alone are expected to be $32-33 billion and $34-39 billion, respectfully, significantly above its historical averages, and similar to the capital expenditures of Google (GOOG, GOOGL), even though the latter generates twice as many revenues than Meta. The justification for the increase in CapEx is relatively vague as well.

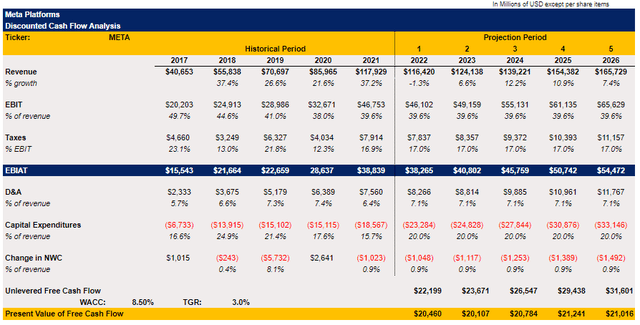

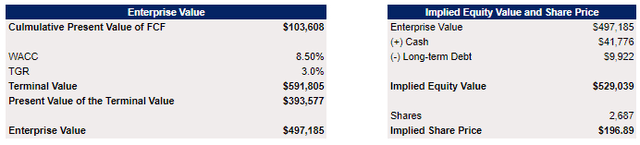

To understand how big of a deal all of this is, I’ve created a new DCF model to show how much shareholder value is being destroyed due to Meta’s obsession with the metaverse and the need to spend more during a market downturn. If, in my latest article on the company, my DCF model showed Meta’s fair value to be $161.37 per share, then this new model shows that the fair value of the company could’ve been $196.89 per share, if the business’s capital expenditures would’ve stayed within its historical averages. However, since that’s not the case, the upside for Meta’s investors is significantly smaller than it could’ve been if the management focus on fixing its core business and decided not to pivot to the non-core solutions, which are questionable at best.

Meta’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

Meta’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

The Bottom Line

There’s no denying that Meta’s core business has been struggling in recent quarters due to the decrease in advertising spending caused by the turbulent macroeconomic environment along with the inability to efficiently track its users as a result of Apple’s new privacy policy. In light of those events, it becomes obvious that Meta can’t be complacent if it wants to stay relevant. The problem is that pivoting to the metaverse doesn’t appear to be the right solution.

If we look at the company’s latest earnings report, we’ll see that despite the cyclical decline in revenues caused mostly by the decrease in advertising spending, the core business nevertheless continues to reach new major milestones. In Q3, Meta once again experienced an increase in users across its family of apps, which include Facebook, Instagram, and WhatsApp. At the same time, the company’s Reels product is on track to generate $3 billion in revenues this year alone, which is going to help Meta mitigate some of the risks caused by the change in Apple’s tracking policy, and prove that there are opportunities within the core digital advertising business that the management should seize. In addition, if TikTok is banned in the United States, then Meta could even become the biggest platform for short-form video content in North America, which would open new monetization opportunities within its core digital advertising business.

Considering this, there is every reason to believe that Meta’s metaverse is nothing more than a money pit, as so far it appears that there is no clear understanding of how to make it profitable. The losses continue to mount and Meta Platforms shareholder value is being destroyed even though the core business recently showed decent results.

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Sui

Sui  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Stellar

Stellar  Shiba Inu

Shiba Inu  Hedera

Hedera  Hyperliquid

Hyperliquid  Toncoin

Toncoin  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Pi Network

Pi Network  Litecoin

Litecoin  Polkadot

Polkadot  USDS

USDS  WETH

WETH  Monero

Monero  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Dai

Dai  Aave

Aave  OKB

OKB  Ondo

Ondo  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Cronos

Cronos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange