pcess609

To date, there seems to be strong skepticism about Meta’s investment in the reality labs segment, which is partly justified since the costs incurred in its development far outweigh the revenues achieved so far. Meta’s plummeting stock price is proof that the market does not believe in these long-term projects, but what if they are wrong?

Growing confidence in the reality labs segment

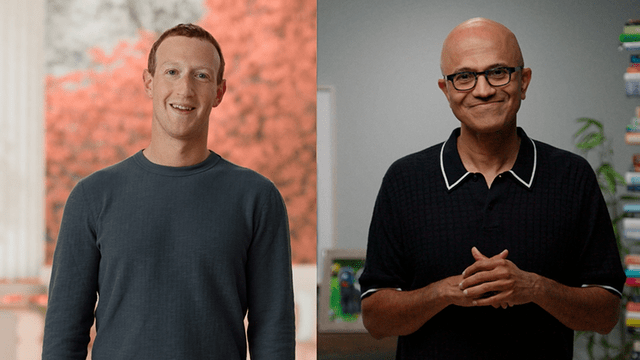

Public opinion is tarring this company, however, more and more partnerships are being established with first-tier companies. At the time the reality labs segment was created, Meta had considerable difficulty gaining any credibility in what it was investing in because it was a highly speculative market. Even today it remains so, but after Meta Quest 2 sold 14.8 million units in just under 2 years surely the perception of this market has changed. To give an idea of how high this number is, 20 million PlayStation 5 consoles and about 14 million Xbox Series X & S have been sold since their launch. To date, Meta (NASDAQ:META) has entered new partnerships with companies such as Qualcomm (QCOM) and Microsoft (MSFT), which certainly would not have been possible in the past. On this aspect, Mark Zuckerberg’s comment in the interview for Stratechery may best clarify this concept:

Before Quest 2, I think the conversations were very different. A company like Microsoft wouldn’t have wanted to put this many resources on this, because there just weren’t that many units. But I think that now they can see the trajectory of it and they’re like, “Okay, so this isn’t huge yet. There’s millions of units, it’s not billions of units, but it’s kind of going in a direction where this is going to be a major computing platform”. I think similar with Qualcomm, similar with other folks. The terms on which we could work with them, if at all, were not sufficient before we demonstrated the success with Quest 2, which meant that we had to go build a lot of these things ourselves.

The new partnerships, beyond the purely economic aspect, are a sign of confidence from first-tier companies in Meta, but the market has shown no signs of rebounding. My impression is that until the reality labs segment has unassailable numbers the sentiment will remain negative regardless; however, it is not reasonable to expect to buy Meta at less than $130 per share if it were to consolidate its position.

The partnership with Microsoft

As previously anticipated, Meta has entered a new partnership with Microsoft announced during Meta Connect 2022. This agreement aims to entice more and more companies to work in virtual environments, but what does it consist of?

Meta will provide its new Meta Quest Pro and platforms, while Microsoft will provide solutions for business, cloud, and gaming. The goal is for Office and Windows to introduce new features related to virtual reality, and thus to create virtual meetings within Meta Horizon Workrooms. The reason Meta has chosen to collaborate with Microsoft stems from the huge competitive advantage the latter has in the workspace. Suffice it to say that Microsoft Teams alone has about 270 million monthly users, so no other platform could be better suited to develop new work connections within virtual reality. On the other hand, it is also quite intuitable why Microsoft decided to partner with Meta: no company in the world has a greater market share in the extended reality market.

Personally, I see this partnership as an excellent way to increase both companies’ exposure in such a promising market. The extended Reality (XR) market was valued $42.86 billion in 2021 and is expected to grow to $465.26 billion by 2027, registering a massive 46.20% CAGR. In addition, in terms of global AR/VR visor shipments, 50 million units are expected by 2026, registering a 35.1% CAGR. The analysts’ estimates could be wrong, but there is no question how huge the expectations of this market are. If they turn out to be correct, the perception toward Meta would totally change.

At this point, however, a question arises, why would Microsoft make such a deal with Meta if it is already focused on developing its HoloLens VR visor? Satya Nadella wants to increasingly expand the scope of Microsoft’s services and sees Meta as a quick way to spread them into a totally new market like virtual reality. Here are his words on the subject during his interview for Stratechery:

Obviously a lot of what we are doing in Mixed Reality has been informed with what we have done in HoloLens and what we are seeing in terms there, especially since we focused it very quickly after its initial launch on the enterprise and the business use cases and we’ve learned a lot. But the way I come at it, Ben, is that I like to separate out, “What is the system, what are the apps”? Of course, we want to bring the two things together where we can create magic, but at the same time, I also want our application experiences in particular to be available on all platforms, that’s very central to how our strategy is.

Finally, Microsoft’s service offering will greatly enrich the Quest line through Xbox’s cloud game offering. Overall, the partnership was entered primarily to disrupt the way people work, but certainly offering a significant additional number of games for the Quest line can only benefit Meta. As futuristic as this project may seem, both Nadella and Zuckerberg believe that this is the right time in history to lay the groundwork for such a change in the work environment. Pandemic was an opportunity to realize that remote work is possible, and that a future in which many people will be able to work from any location is not that far off.

Other partnerships

The partnership with Microsoft is the most recent and probably the most important one for the reality labs segment, however, the company has recently announced many others.

- Last month at IFA 2022 in Berlin a multi-year agreement was signed with Qualcomm, the current manufacturer of the Snapdragon XR2, the chip that powers the Meta Quest 2. This agreement practically manifests Meta’s willingness not to create its own processor in the development of the Metaverse, at least not in the short to medium term.

- During Meta Connect 2022, in addition to the collaboration with Microsoft, those with Zoom and Accenture were also announced. All these collaborations were made with the intent of making Meta Quest Pro an integral part of the working environment. Zoom (ZM) and Microsoft teams are the most widely used platforms in business to conduct meetings, Accenture (ACN) will use its professional services network to help companies use virtual reality. The latter has deployed 60,000 Meta Quest 2 headsets in the past year.

- Also announced during Meta Connect 2022 was a partnership with NBC Universal, with the intention of further expanding the range of activities available to Horizon Worlds. In addition, keeping with the theme, Meta also stated that it is working on an adapted version of Horizon Worlds also available for PC and mobile. The ultimate goal is still the same: to bring as much content and people as possible into the Metaverse.

Focus on professionals

At Meta Connect 2022, the launch of the next-generation Meta Quest Pro visor was made official, and right from the start it caused a stir since it costs $1500, about 3 times as much as the Meta Quest 2. But why was it priced so high? The target customers being referred to has changed. If the Meta Quest 2 was targeted toward any consumer, the Meta Quest Pro is a visor designed for professionals so that they can enhance their creativity through virtual reality. A teenager who simply wants to play The Walking Dead does not need a $1500 Meta Quest Pro, but an architect working on a new project probably does. To date, Meta’s goal is to focus its economic resources on developing innovations that are useful to the working field and then implementing and adapting them to new products offered to the average consumer. Conceptually, the successor to the Meta Quest 2 is not the Meta Quest Pro, but the Meta Quest 3, a cheaper model designed for the average consumer.

It’s not this year, but there will be a Quest 3 and that’s in the price range of $300, $400, or $500, that zone. Then you have this Pro work line where I think high-end professionals and knowledge workers are willing to pay $1,500 for a laptop, $2,000 for a laptop for your workstation, and that basically gives us the ability to build in a lot of technology there, and also improve that technology and build out the development ecosystem before we can get that down to the price point that’ll fit with consumers.

According to Mark Zuckerberg’s words about Meta Quest 3, right now the only certainties are that it will cost between $300-$500 and that it will not be released this year. In any case, the not-so-distant expectation of the Meta Quest 3 release may discourage the purchase of new units of Meta Quest 2, which is not positive for the reality labs segment from a revenue standpoint, at least in the short-to-medium term. The official release date is unpredictable, but estimates speak of late 2023 or early 2024. In any case, the hype about Meta Quest 3 is already high. Last year half of the reality labs segment’s revenue came in Q4, so we’ll see if this year proves to be the most profitable quarter again.

Unjustified sell-off

Meta’s price per share is currently the same as it was in July 2016, just to give you an idea of how much it has collapsed. 67% may not be enough, but as long as the company generates huge free cash flow through the family of apps segment and enters strategic partnerships for the reality labs segment, I am hopeful of a recovery sooner or later.

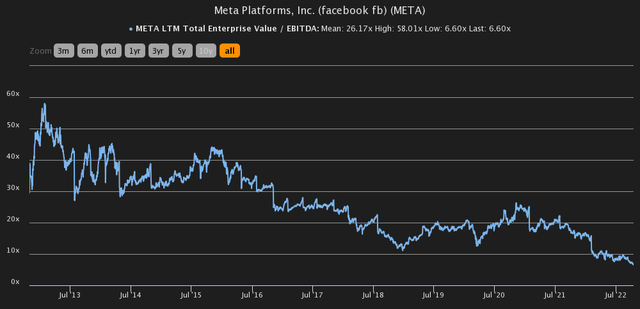

The weekly RSI has sunk into the oversold threshold for months now but shows a divergence from price. In technical analysis such a divergence is often associated with a change in the trend; we shall see if it is confirmed. The price may continue its inexorable collapse, but objectively how far can a company that generates free cash flow of tens of billions collapse? Price multiples have already reached unreasonable levels in my opinion.

Since the IPO, Meta has never achieved such a low EV/EBITDA. The historical average is 26.17x while currently it is only 6.60x. I agree that the historical average is too high and that the growth prospects are uncertain compared to the past (this does not imply that it will never grow again) but does all this justify an EV/EBITDA of only 6.60x? I am not hiding the speculative nature of a potential investment in Meta, but in my opinion there is a basis for it to be a bargain at less than $130 per share. Certainly, the bottom may not have been reached, but as long as the company’s fundamentals remain intact my thesis remains bullish.

Read More: seekingalpha.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Toncoin

Toncoin  Stellar

Stellar  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Hedera

Hedera  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  LEO Token

LEO Token  Litecoin

Litecoin  Pepe

Pepe  Hyperliquid

Hyperliquid  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  USDS

USDS  Internet Computer

Internet Computer  Aptos

Aptos  Aave

Aave  Mantle

Mantle  Render

Render  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  Ethereum Classic

Ethereum Classic  MANTRA

MANTRA  WhiteBIT Coin

WhiteBIT Coin  Virtuals Protocol

Virtuals Protocol  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Tokenize Xchange

Tokenize Xchange  Monero

Monero  Dai

Dai