Chip Somodevilla/Getty Images News

Introduction

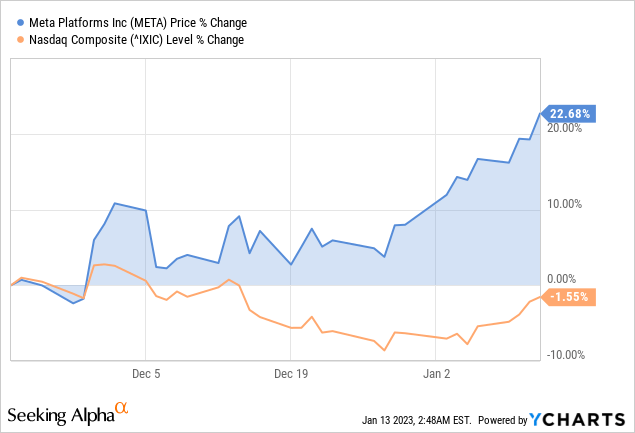

In the past ten years, Meta Platforms, Inc. (NASDAQ:META) has been under fire for a wide range of issues; the spread of false information, its negative consequences on American democracy, and the use of its platform to incite violence abroad are just a few. Three months ago, the sentiment for META stock reached its maximum pessimism levels as fear of an upcoming recession and increasing concerns for the company’s huge CapEx on the metaverse have plunged the stock.

Although living in a headgear might sound like a science fiction movie, Mark Zuckerberg believes it will be a reality within a few years. Meta’s core business is a cash cow, and I view the metaverse project as a moonshot investment that, in case it materializes, will send the stock back to very high multiples in the next 3-5 years.

In today’s analysis, we explore Meta’s never-ending regulatory hurdles as well as its strategic moves in the metaverse space that attracted FTC scrutiny over antitrust concerns. Nevertheless, META’s outlook seems to have improved and has substantial upside potential from current levels.

The Metaverse Is Happening

As with any new technology, gamers are the first to experiment with it, then regular users who wish to use social interaction. Mark Zuckerberg claims that you have already entered the metaverse if you buckle up for a Peloton bike. Fitness apps, like Peloton, represent the third stage in the growth of virtual reality since their technology brings people together globally through physical activity.

The most popular VR headset on the market right now, Meta’s Quest 2, shipped around 471k in Q3 at an average price of $429. Although Meta’s Quest 2 is hailed as the industry’s high water mark and is estimated by IDC to have shipped over 15 million units thus far, it is insignificant when compared to other goods in the console, smartphone, and PC gaming industries.

Regarding new products, Apple Inc. (AAPL) often prefers to observe other market participants’ moves and then strike back with a better product. Thus Apple’s long-awaited is more real than ever, and it is expected in 2023. A VR/AR headset from Sony Group Corporation (SONY) and Apple’s involvement is a strong vote of confidence for the metaverse community, but Meta enjoys the first-mover advantage. Nevertheless, 2023 won’t be the best year for the VR headset considering the tightening consumer budgets, but it might mark the beginning of broader recognition and adoption.

biz.crast.net

‘Within’ Acquisition Is A Growth Catalyst

Meta has agreed to close the acquisition deal of Within on January 31, awaiting a decision by FTC. On October 22, 2021, Meta agreed to purchase Within for about $400 million, part of a plan to expand its presence in the VR fitness space. Within, a software maker that develops apps for VR devices owns a popular fitness app called Supernatural, which is exclusively available for Oculus, Meta’s VR headset brand. Meta does not have an equivalent VR fitness app but does own Beat Saber, a game that results in some cardiovascular activity.

Zuckerberg sees fitness apps like Peloton as the third stage in the growth of virtual reality because they employ technology to link individuals worldwide through physical activity. Thus, I consider the acquisition of Within another strategic move for conquering the metaverse, and the approval will be a growth catalyst over the long term.

Since January 2020, Meta has acquired several VR app studios, including Ready at Dawn, BigBox VR, Sanzaru Games, Downpour Interactive, Twisted Pixel, and Unit 2 Games. As a result, the FTC’s legal challenge to Meta-Within will likely be an uphill battle for the agency. The FTC claims that Beat Saber could easily be adapted into a fitness app that competes with Supernatural and that Meta would have endeavored to do so but for its purchase of Within.

Its allegations of harm are difficult to prove in court, lack recent supportive legal precedent, and involve a nascent and evolving marketplace. The theories of harm that the FTC relies on to stop the deal are novel and lack significant legal precedent. Because Meta and Within don’t compete head-on in the VR fitness app space, the deal doesn’t increase concentration.

The FTC claims that Meta’s acquisition of Within is likely to reduce competition because if not for the deal, Meta would’ve created its own VR fitness app and competed with Within. It’s still determined whether the evidence supports these claims due to extensive redaction in the court filings. However, the allegations are still speculative and difficult to prove, particularly given VR’s nascent nature.

An FTC staff recommendation against bringing a suit, reported by Bloomberg, also suggests a weak case. The FTC’s challenge may fail, but it has larger implications for Meta’s ambitions. It’s a signal that this FTC, haunted by past clearances of Facebook’s Instagram and WhatsApp purchases, will vigilantly try to hinder the social media giant’s efforts to entrench itself into and dominate the burgeoning virtual-reality world via acquisitions.

If the FTC wins, this will block the deal’s closing pending an internal litigation process, called Part 3, before an FTC administrative law judge. The judge would ultimately determine whether the deal violates the antitrust laws if the hearing proceeds. If this occurs, the companies have said they’d abandon the deal, as the process would take too long. However, if Meta and Within win in court, they will probably be able to close the deal.

Initially, Meta intended to complete the acquisition of Within before the start of the new year. However, in a recent court filing, Meta stated that it would delay the transaction’s closing until January 31, 2023, awaiting the court’s decision on the validity of the transaction.

EU Privacy Ruling

According to a recent article by the WSJ, EU privacy authorities have ruled that Meta should not need users to consent to tailored advertising based on their online activities. This judgment might limit the data Meta can access to sell targeted ads.

On Monday, a board representing all EU privacy regulators approved a series of decisions, ruling that EU privacy law doesn’t allow Meta to use its terms of service to justify allowing personalized, targeted advertising. Since Meta’s European headquarters are located in Ireland, the ruling calls on the Irish authorities to make public orders and fines that match its decisions. If the decision is upheld, the ruling will make it harder for Meta and other platforms (TikTok/Snap) to show targeted ads based on data collected through users’ on-platform behavior.

Although the advisory board’s decisions will not create an immediate revenue impact as there could be a significant delay to implementation on the back of potential lengthy litigation, the worst-case outcome could significantly impact Meta’s advertising practices in Europe.

The Impact Likely Won’t Be Material

Assuming Meta would be required to seek user opt-in for data collection and targeted advertising, ATT/IDFA can be looked at as a gauge for potential consumer consent. Based on recent industry data, post-ATT/IDFA, and GDPR implementation, the average user opt-in rates were 25-30%. Given that the new rules are designed to limit the usage and collection of on-platform data, any associated revenue headwind will be incremental on top of the current ATT/IDFA-related impact.

By my estimate, the removal of IDFA impacted Meta’s European FY22 ad revenue by roughly $2 billion. The ruling could have an impact along the same line on the company’s revenue. Europe has long been the most conservative region regarding privacy, but I certainly would not entirely rule out further contagion.

In addition, this recent headwind brings about a return of the theme of regulation and the potential negative implications for Meta, which have been noticeably absent over the last two years. Further, with recent investor focus increasingly shifting to likely OpEx savings, the potential incremental costs associated with this new headwind could dampen confidence in more meaningful OpEx savings over the next 18 months.

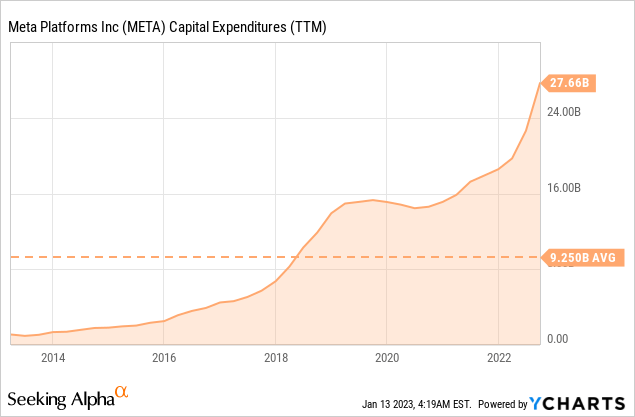

CapEx Investments More Than Doubled Since 2020

Meta continues to invest in long-term initiatives. Meta’s investments have more than doubled between 2020 and 2022, from $15 billion to an expected $32.5 billion. In addition, Meta’s guidance suggests a 9% CapEx increase at the midpoint for 2023 as the company continues to catch up on AI infrastructure related to content discovery and ad technology. Meta continues to build out new data centers but is doubling down on AI investments supporting:

- Content recommendations & discovery, especially tied to Reels.

- Rebuilding ad tech capabilities to offset signal loss following Apple’s privacy changes.

Meta is shifting away from its legacy CPU architecture to new GPU clusters, which requires a further step-up in investment near-term to support the company’s AI efforts over time. As a result, the $2 billion reduction at the high end of Meta’s 2023 CapEx outlook (now $34 billion -$37 billion) was entirely due to non-AI spending.

Meta’s $725 Million Settlement Curtails Risk

Meta has agreed to pay $725 million to settle the class-action lawsuit (Cambridge Analytica scandal) alleging the company shared users’ personal information with multiple third parties. Judge Vince Chhabria now must approve the pact, and he’s been hard on Meta in this case. However, since the deal covers an enormous class size, with over 250 million people, $725 million is a relatively small price, which equates to less than $3 per person.

Factors specific to this case threatened Meta with billions of dollars in risk. It’s a high-profile case, already tied to a $5 billion FTC settlement, and Meta could have been hit with statutory damages of $1,000 a person under plaintiffs’ lead claim. Meta faces a skeptical Judge Vince Chhabria, who’s weighing imposing sanctions on the company’s lawyer. The case has also involved massive discovery, and settlement would let Meta avoid having CEO Mark Zuckerberg be deposed.

Management Remains Confident In Metaverse

Meta has been under criticism lately for its investments into the metaverse as many investors remain skeptical of the company pumping approximately $10 billion each year into research and development of its metaverse bet. The management, on the other hand, remains confident, and CTO Andrew Bosworth recently in a post on social media stated that Meta would continue to put money into developing techs like AR/VR and the technologies that enable to power the metaverse, including eye-tracking and graphic processing.

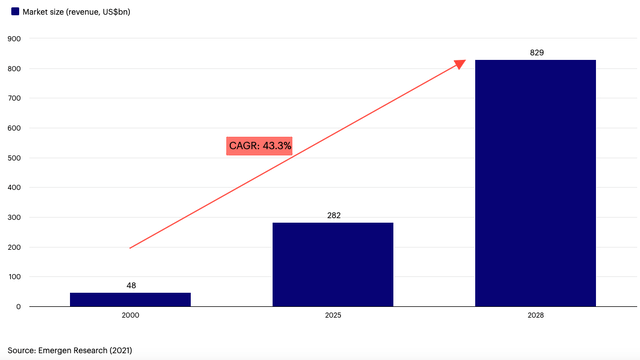

Meta is one of many major companies investing in the metaverse. Alphabet (GOOG) (GOOGL), Microsoft (MSFT), Adobe (ADBE) , and Snap (SNAP) are also investing heavily in the space. Nonetheless, broad acceptance of the metaverse will need a fundamental paradigm shift requiring people to not only accept the concept of socializing in virtual reality but also have a functional grasp of and faith in the value of next-generation technologies such as blockchain and NFTs.

Nevertheless, the metaverse remains a long-term opportunity with a huge TAM. Only the components and hardware elements of the Metaverse Value Chain are anticipated to grow at a compound annual growth rate of 43% over the next decade, reaching nearly $300 billion by 2025 and $830 billion by 2028.

Undoubtedly, the metaverse will not be constructed over-night, and there is still some time left before companies like Meta can reap the benefits of their early exposure to the sector; with the release of Horizon Worlds and a metaverse-ready virtual reality headset, Quest Pro, it is clear that the Meta team is attempting to accomplish is take innovation to the next level, and looking at revenue streams to generate a return on invested capital.

Concluding Thoughts

Meta constantly suffers from regulatory scrutiny and currently undergoes tight regulatory headwinds, but there’s a light at the end of the tunnel. Other key tech players also entering the metaverse ecosystem, investing billions of dollars, and despite the broad adoption being years ahead, Meta’s CapEx towards it will eventually be fruitful over the long run.

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Toncoin

Toncoin  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Litecoin

Litecoin  Uniswap

Uniswap  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Render

Render  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Arbitrum

Arbitrum  Filecoin

Filecoin  Celestia

Celestia  Algorand

Algorand  Dai

Dai  Stacks

Stacks  Bonk

Bonk  WhiteBIT Coin

WhiteBIT Coin  Cosmos Hub

Cosmos Hub