[ad_1]

Get the best data-driven crypto insights and analysis every week:

By: Tanay Ved & Matías Andrade

-

The total market capitalization of meme coins currently stands at $60B, with a growing presence across Layer-1 networks like Ethereum, Solana and Layer-2’s like Base

-

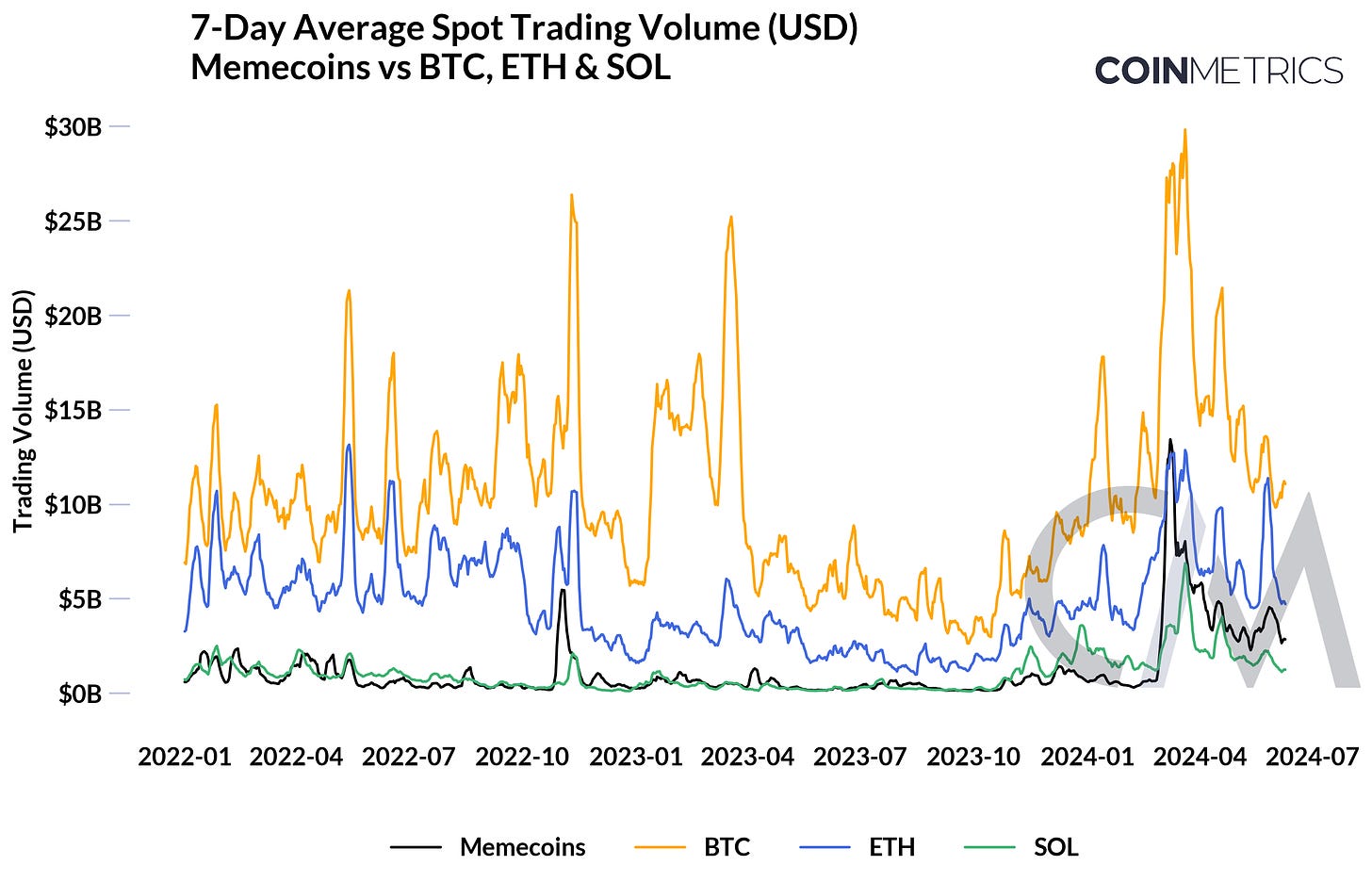

In March, meme coins recorded $13B in spot trading volumes (7-day average) on exchanges, eclipsing major blue-chip crypto assets like Ethereum (ETH) and Solana (SOL)

-

The high concentration of assets among holders for meme coins highlights a significant concentration of assets among a few holders, posing risks such as potential market manipulation and liquidity issues.

Memes form an integral part of human culture, transforming and adapting through various mediums over the years. The term “meme” was coined by a British evolutionist Richard Dawkins in his seminal 1976 book “The Selfish Gene,” describing a meme as a unit of cultural transmission—including “tunes, ideas, and catch-phrases”—emphasizing their similarity to genes in biological evolution.

The propagation of memes has evolved significantly throughout history, influenced by social, cultural, and technological changes. In ancient times, folk tales and religious symbols served as early forms of memes, shared orally or through manuscripts. During World War II, the graffiti meme “Kilroy was here” became popular, symbolizing the presence of American soldiers. In the digital age, memes have found new carriers in the form of viral videos and image macros like “Doge,” diffusing rapidly through the internet and social media platforms, allowing cultural ideas to spread more widely than ever before.

Recently, memes have further expanded into phenomena such as meme stocks, exemplified by GameStop’s dramatic surge in value due to collective efforts on online forums like Reddit’s /r/wallstreetbets. Similarly, meme coins like Dogecoin and Pepe have garnered tremendous mindshare in the crypto-asset world, leveraging blockchains and on-chain communities to create forms of digital value. Memes are inherent to human nature, reflecting our yearning for connection and a sense of belonging through shared ideas.

In this week’s issue of Coin Metrics’ State of the Network, we aim to bring some context into the surge of meme coin activity on networks like Ethereum and Solana, highlighting key market trends driven by the meme coin sector.

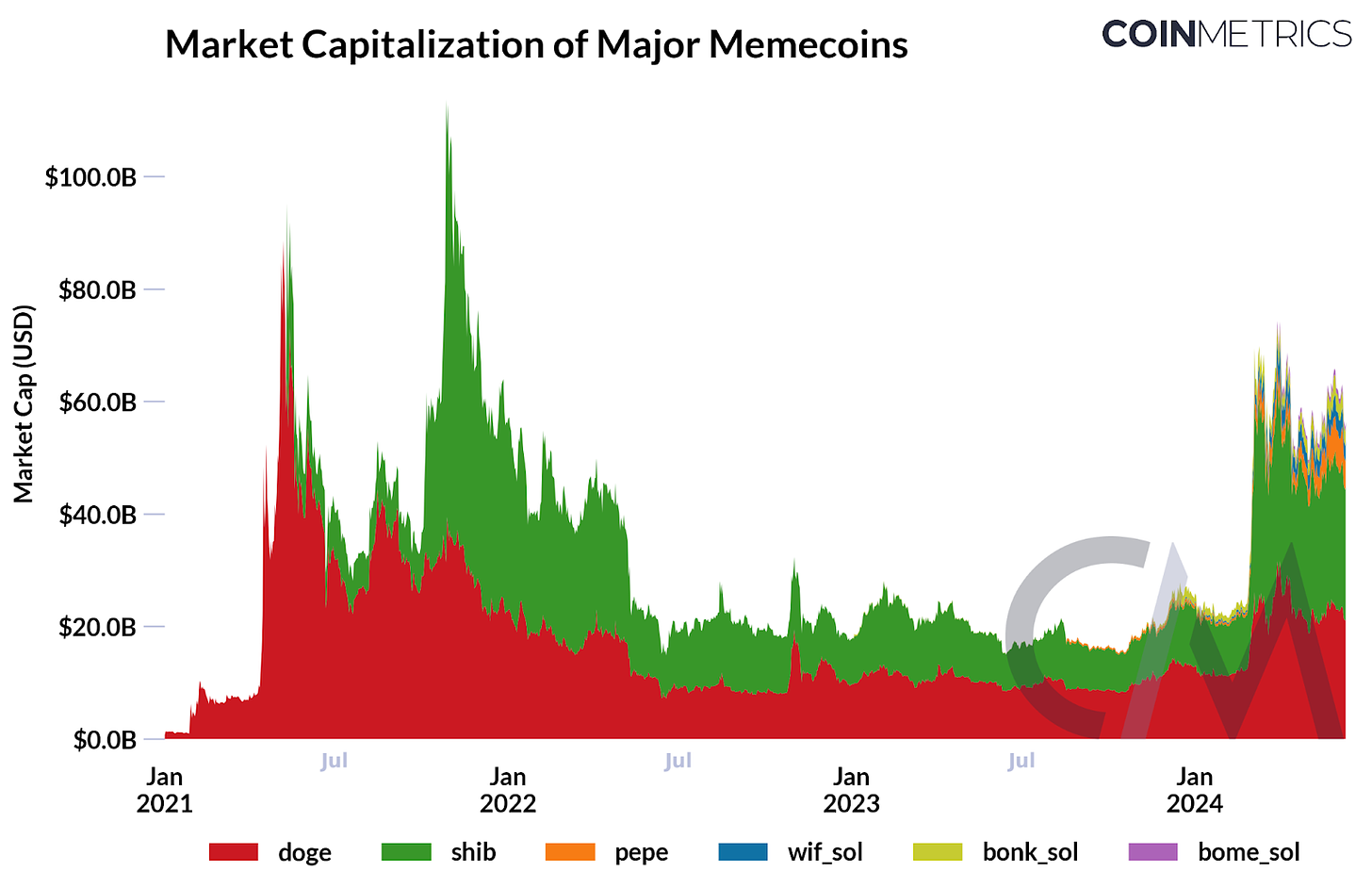

Since the introduction of Dogecoin in 2013, the meme coin sector has expanded tremendously, ballooning to a total market capitalization of $60B as of June 2024. The sector is characterized by crypto-assets representing familiar animals, characters and most recently political figures with elements of humor to attract attention and drive community-driven engagement. Their growth stems from highly speculative nature, driven largely by market sentiment rather than intrinsic value.

Source: Coin Metrics Network Data Pro & Coin Metrics Labs

(Note: Solana meme coins and other SPL tokens will be released soon as an extension to Solana Network Data)

The most valuable meme coins today include Dogecoin (DOGE), which operates as a standalone Proof-of-Work blockchain, and ERC-20 tokens like Shiba Inu (SHIB) and Pepe (PEPE), growing to over $100B in market value in 2021. Recently, Solana has been a hotbed for meme coins with several Solana Program Library (SPL) tokens being deployed as a result of low transaction fees, a growing ecosystem and ease of token creation through platforms like pump.fun, fueling the rise of meme coins like dogwifhat (WIF) and Jeo Boden (BODEN).

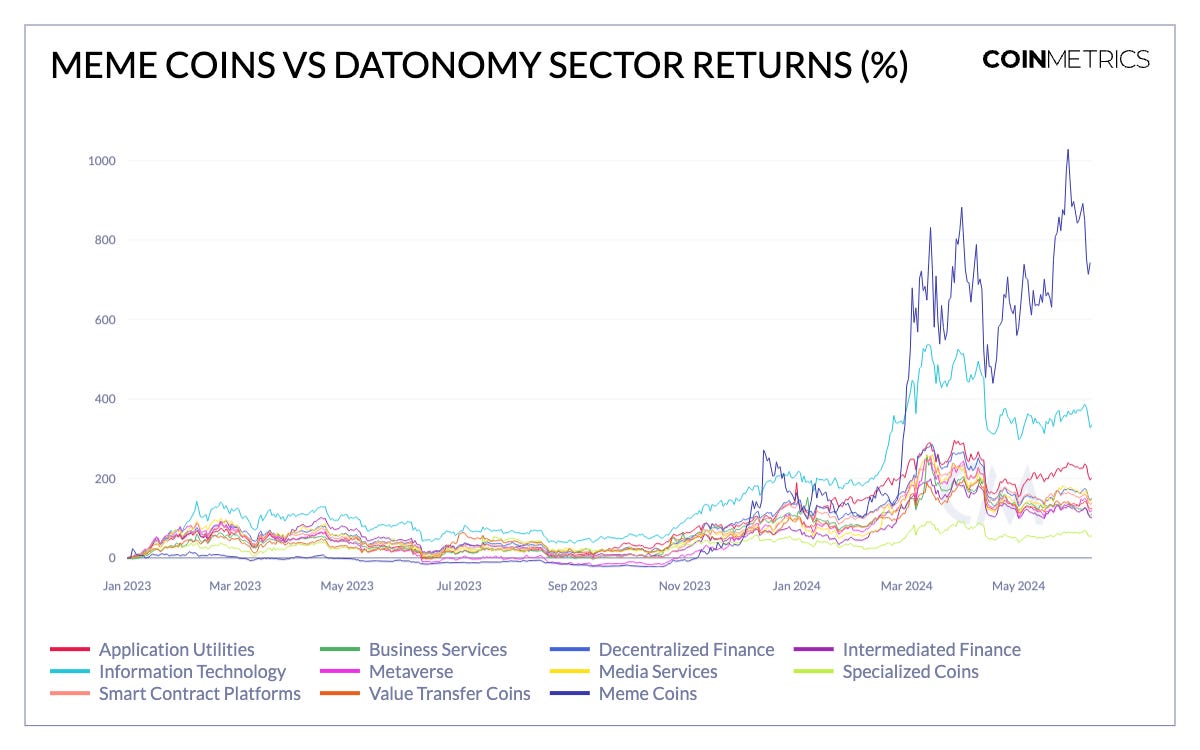

Source: Coin Metrics datonomy™ & Coin Metrics Labs

The meme coin sector has seen notable outperformance compared to other sectors of the crypto-asset ecosystem, as covered by Coin Metrics’ datonomy™ classification. Meme coins have showcased strength relative to major blue-chip crypto assets and also outpaced the Information Technology sector, which gained ground from developments at the intersection of decentralized compute and artificial intelligence (AI) applications.

This is particularly evident from October 2023 into 2024, with meme coins averaging 740% returns as of June. This has also fueled the growth of meme coin indexes, such as the GMCI Meme Index, reflecting efforts to quantify the sectors performance. Despite being associated with speculative phases of market cycles, this performance is reflective of the recent growth in mindshare of this sector, among both retail and institutional investors.

Growing attention around the meme coin sector has further driven activity in digital asset markets. While trading volumes have generally moved in tandem with the broader market, in March, meme coins recorded $13B in spot trading volumes (7-day average) across centralized exchanges, even eclipsing major assets like Ethereum (ETH) and Solana (SOL). Decentralized exchanges (DEXs) also play a crucial role in the meme coin ecosystem, providing essential infrastructure for pool creation and asset trading, fostering liquidity and accessibility for a wide range of users.

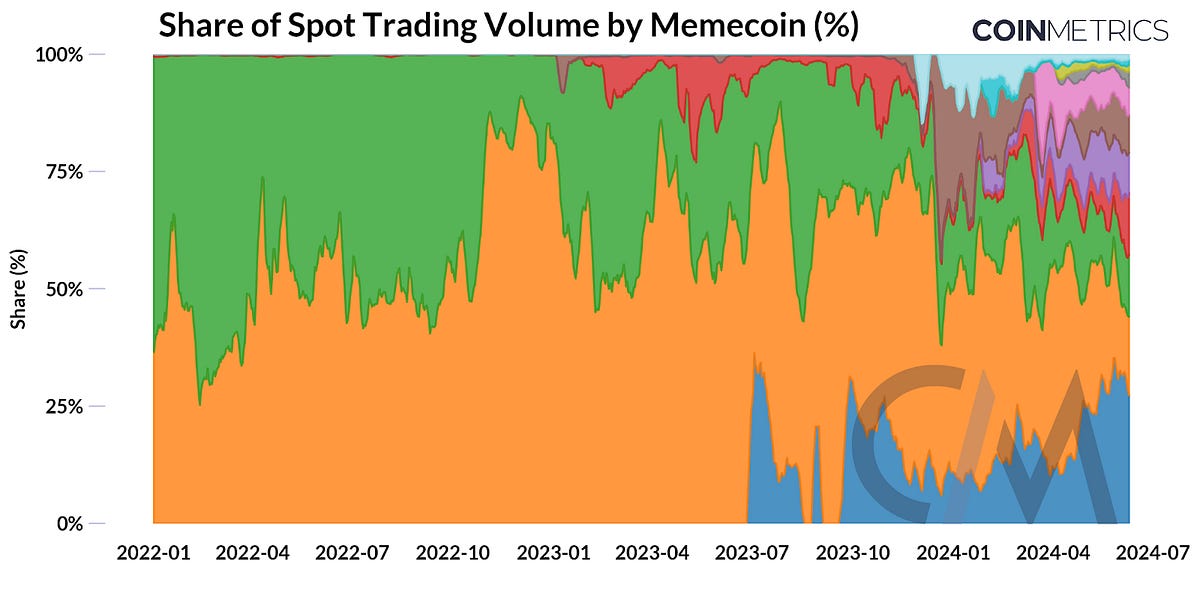

Source: Coin Metrics Market Data Feed

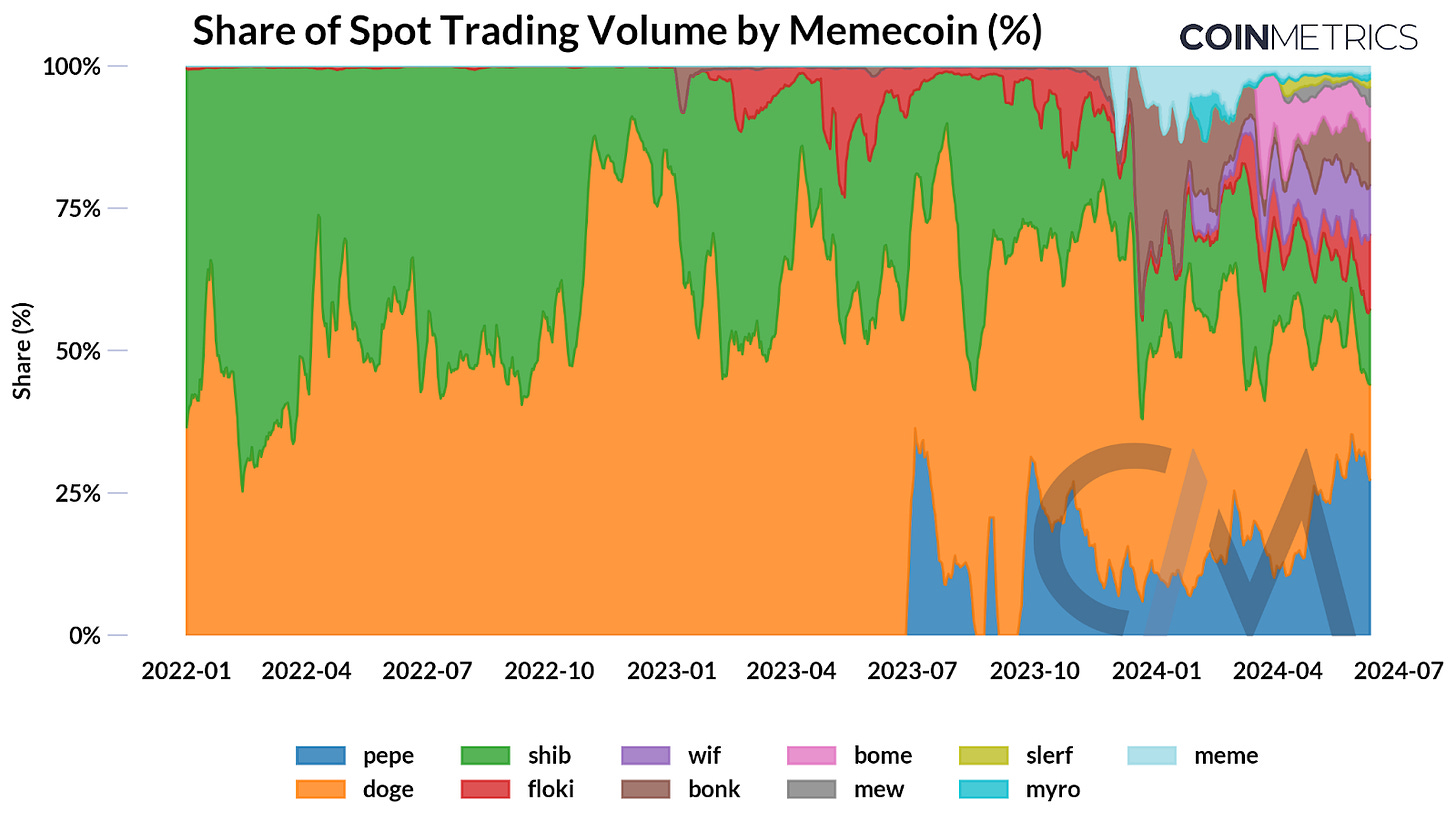

When viewed through the lens of relative trading volumes, the influence of older meme coins like DOGE and SHIB seem to be waning, while PEPE and a suite of new Solana meme coins have gained popularity, representing over 50% of trading volume collectively. This reflects the recent investor preference towards newer memecoins, stemming from growing communities, blockchain ecosystems and the potential for higher returns. Despite this, the liquidity and longer track record of incumbent meme coins remains a significant factor for prospective investors.

Source: Coin Metrics Market Data Feed

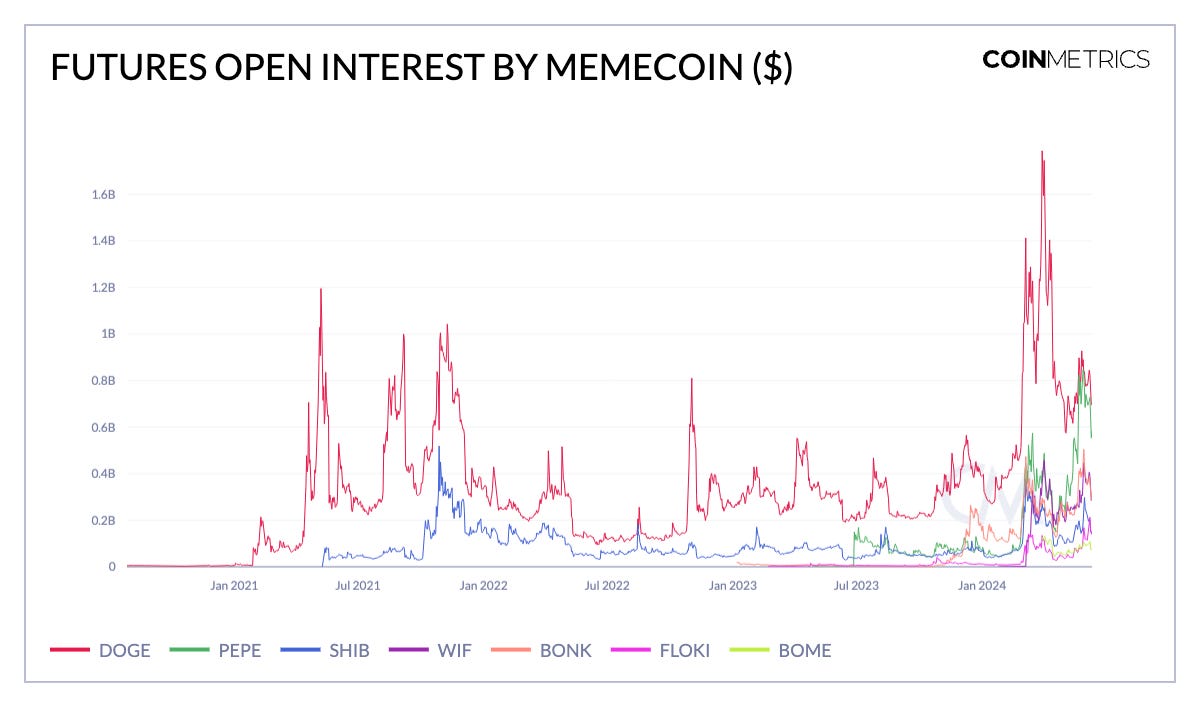

Similarly, high futures open interest underscores their significant market presence and indicates heightened speculative trading activity. Open interest for DOGE reached a record $1.8B recently, while open interest for PEPE spiked by nearly 50% to $850M in May. This surge in open interest, collectively reaching over $3B, points to increased price volatility and highlights that investors are progressively leveraging futures positions to hedge their exposure to meme coins. Keeping track of open interest remains one of the fundamental tools to understand the flows of speculative capital, especially in volatile instruments which can be indicative of shifting market interest or harbinger of liquidations.

Source: Coin Metrics Market Data Feed

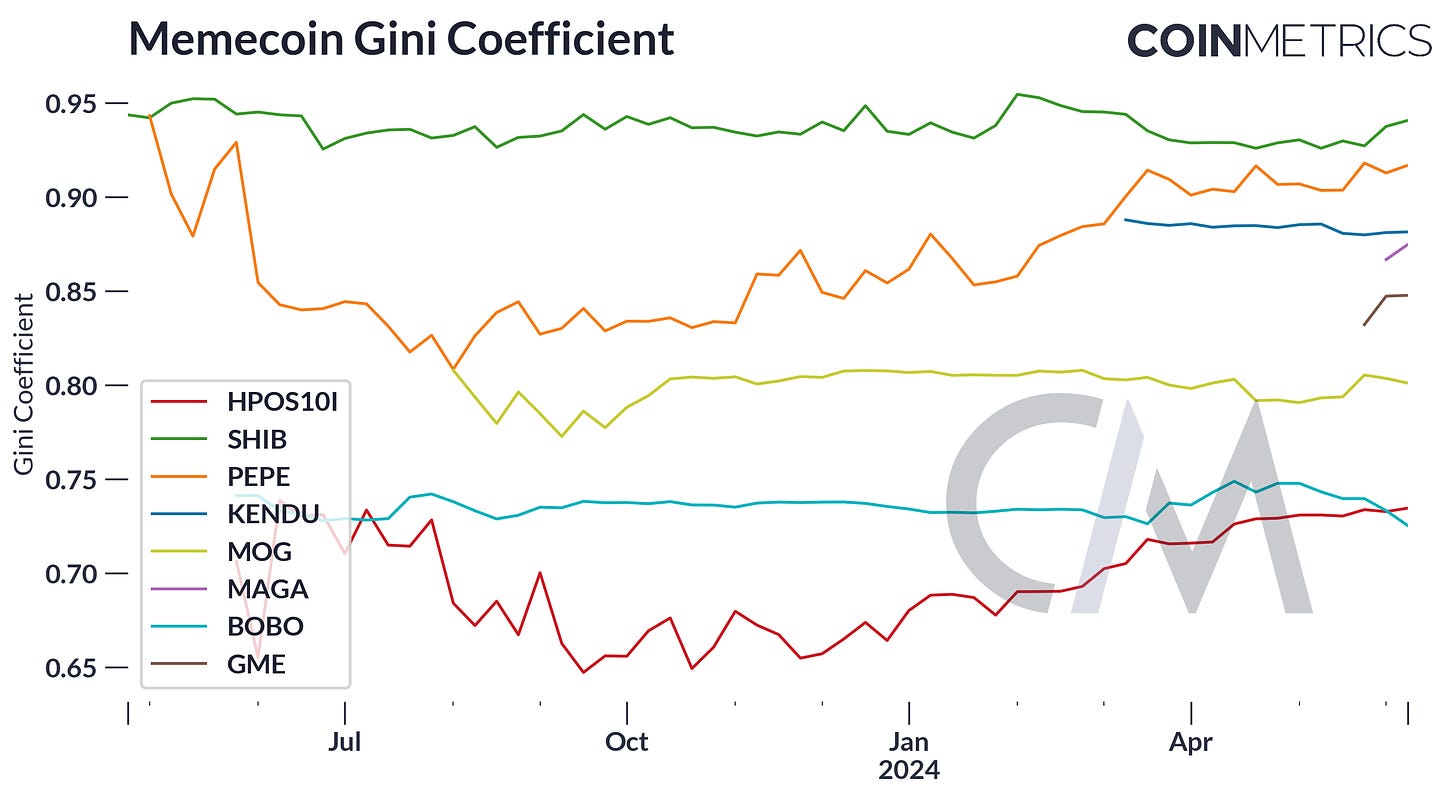

While the market presence and user growth of meme coins have risen in tandem, it’s important to note the risks associated with the sector. The Gini coefficient is a measure of income or wealth distribution within a population, ranging from 0 (perfect equality) to 1 (maximal inequality). In the context of meme coins, the Gini coefficient can be used to assess the distribution of token holdings among different addresses.

High concentration of token ownership increases the risk of market manipulation. Large holders, often referred to as “whales,” can significantly influence the token’s price by buying or selling large amounts at once, creating bouts of volatility. Additionally, if a few addresses hold most of the tokens, it may lead to liquidity issues, which can be exacerbated by concentration in the provision of liquidity by addresses controlled by few entities across decentralized exchanges.

Source: Coin Metrics Network Data Pro & CM Labs

The high Gini coefficient of ~0.8 for these meme coins highlights a substantial centralization of token holdings. This centralization poses various risks, including potential market manipulation, liquidity issues, and investor caution, all of which should be carefully considered when evaluating these tokens. Before considering any investments into the memecoin sector, understanding these dynamics is crucial for assessing the stability and potential risks associated with these digital assets.

The meme coin sector has demonstrated significant growth and influence within the cryptocurrency market, finding a strong foothold on blockchains due to the viral nature of memes and their ease of propagation. The sector’s strong performance, alongside Bitcoin since the launch of spot ETFs, underscores its growing appeal among both retail and institutional investors. However, the high Gini coefficient of ~0.8 indicates a substantial centralization of token holdings, posing risks such as market manipulation and liquidity issues, in addition to a degree of volatility that is intolerable for most investors. As the sector continues to evolve, understanding these dynamics is crucial for assessing the evolution and potential risks associated with meme coins.

Source: Coin Metrics Network Data Pro

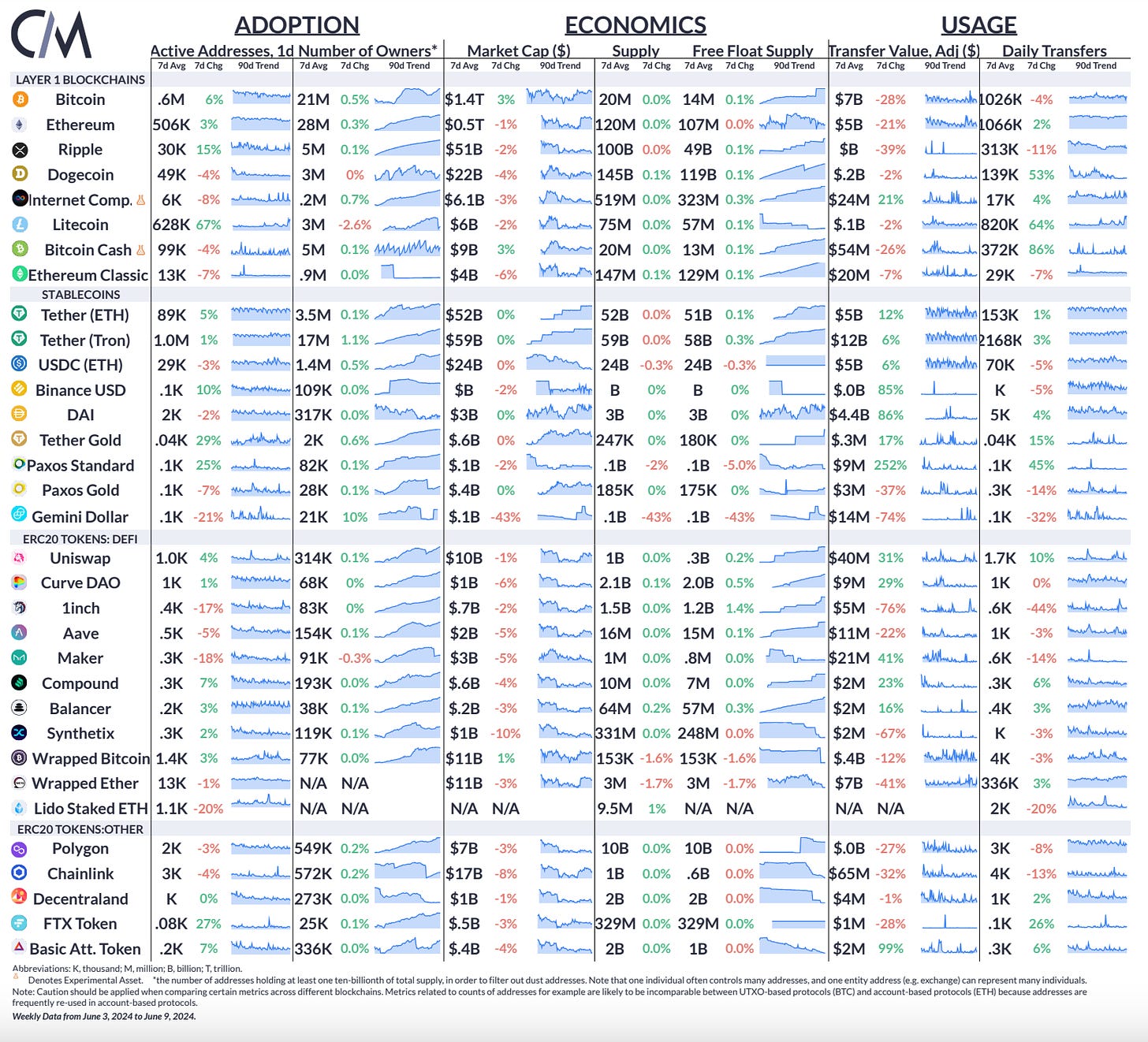

The transfer value (adjusted) on the Bitcoin network decreased by 28% and decreased by 21% on the Ethereum network over last week. Active addresses on Bitcoin rose by 6%, along with active addresses on Ethereum, which rose by 3%.

This week’s updates from the Coin Metrics team:

-

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

© 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.

[ad_2]

Read More: coinmetrics.substack.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Shiba Inu

Shiba Inu  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  OKB

OKB  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Aptos

Aptos  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic