- Polygon’s revenue increased, but TVL continued to fall

- MVRV Ratio and social dominance down

Polygon [MATIC] again became a hot topic in the community as it ranked third on the list of top DeFi projects in terms of revenue in the last 24 hours, only behind Uniswap [UNI] and QuickSwap [QUICK].

Top DeFi Projects by Fees and Revenue on @0xPolygon Ecosystem Last 24H $UNI @Uniswap$QUICK @QuickswapDEX$MATIC @0xPolygon$AAVE @AaveAave$DODO @BreederDodo$MVX @MetavaultTRADE$SUSHI @SushiSwap$CRV @CurveFinance$WOO @WOOnetwork$FSX @fraxfinance#POLYGON $MATIC pic.twitter.com/45yIlkvTkZ

— Polygon Daily

(@PolygonDaily) November 16, 2022

Despite the growth in revenue, Polygon’s DeFi space did not look quite optimistic as its total value locked (TVL) was declining continuously. DeFiLlama’s data revealed that over the last day, Polygon’s TVL decreased by 1.22%; at the time of writing, the value was $1.52 billion.

Read Polygon’s [MATIC] price prediction 2023-24

Despite the negative growth in the DeFi ecosystem, a few positive updates did happen that gave investors hope. For instance, Polygon Technologies recently bagged funding of $450 million, and with this new capital, the network wants to make a place for itself in the web3 industry.

Not only this, but Polygon has also become one of the top blockchain service providers around the globe that has partnered with more top-tier brands. A few notable brands include Nike, Starbucks, Coca-Cola, Meta, and Adidas, among others.

Some of the biggest brands in the world are adopting Polygon.@0xPolygon has become one of the top blockchain service providers around the globe that has partnered with more than top-tier brands.

— Ethereum Daily (@ETH_Daily) November 16, 2022

Though these developments looked pretty ambitious, nothing seemed to reflect on MATIC’s chart, which was painted red. As per CoinMarketCap, Polygon’s price was down by nearly 7% in the last 24 hours, and at press time, it was trading at $0.8886 with a market capitalization of more than $7.7 billion.

Is a revival possible?

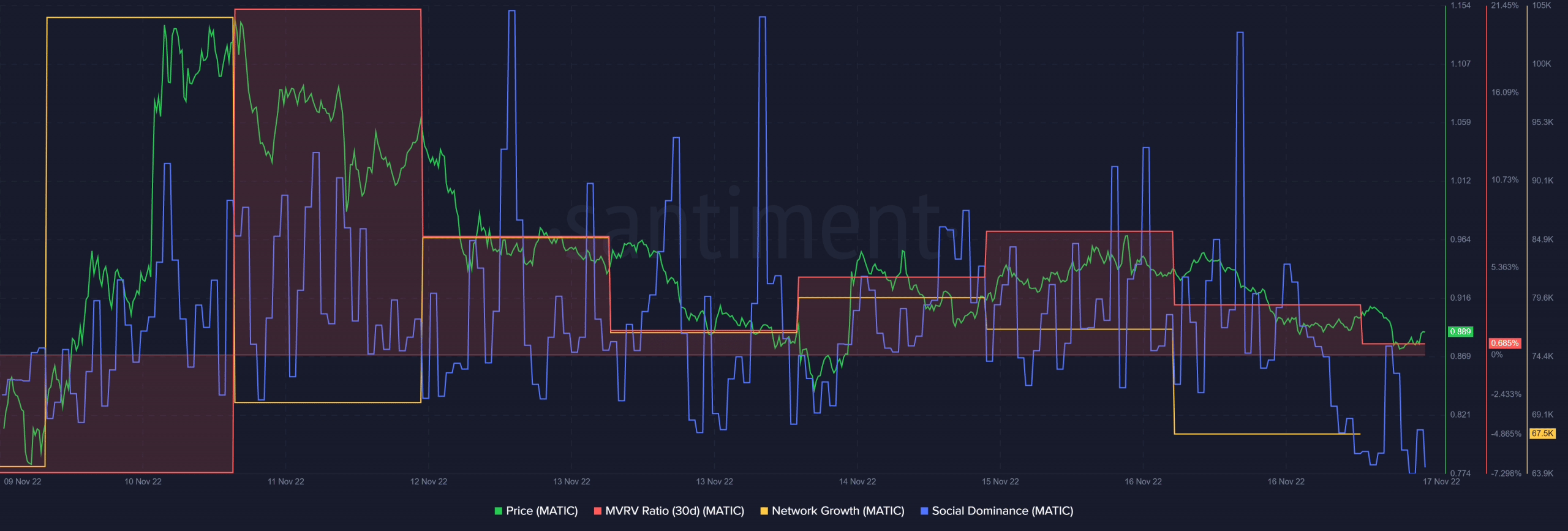

Interestingly, MATIC’s metrics were not completely supportive of a price hike or a decline. MATIC’s MVRV Ratio registered a downtick, which was a bearish signal.

Moreover, after a spike, MATIC’s social dominance also started to decrease. Thus, indicating less popularity of the token in the crypto community. The network growth also followed a similar route and went down in the last few days.

However, CryptoQuant’s data gave some relief as it revealed that things might get better in the coming days. MATIC’s exchange reserve continued to fall, indicating lower selling pressure. Furthermore, the number of active addresses and transactions was also increasing, which by and large is a positive signal for any network.

The bulls’ advantage might end soon

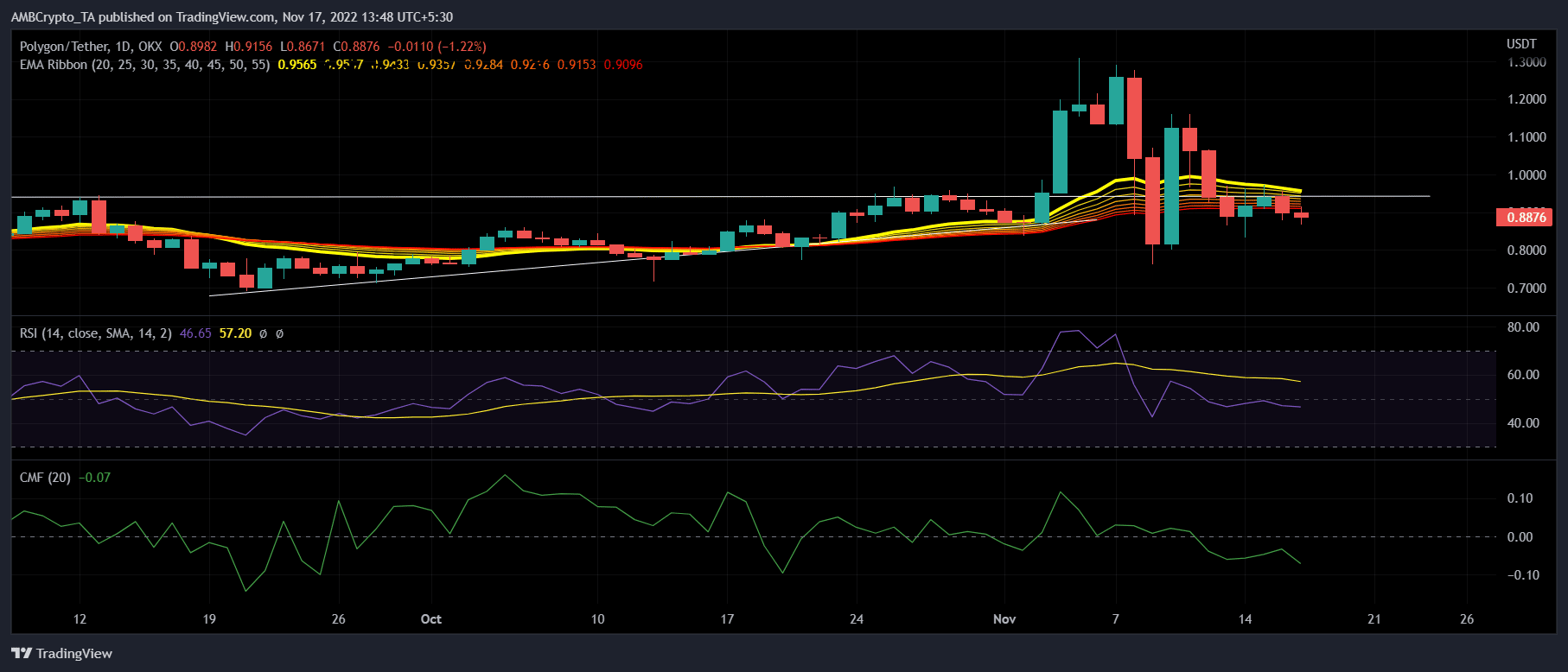

A look at MATIC’s daily chart made it clear that though the bulls seemed to have an advantage in the market, the bears might take over the throne soon.

According to the Exponential Moving Average (EMA) Ribbon, the distance between the 20-day EMA and the 55-day EMA was reducing, increasing the chances of a bearish crossover.

Furthermore, the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) both registered downticks and were headed further below the neutral mark, which might be troublesome for MATIC in the coming days.

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  LEO Token

LEO Token  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Litecoin

Litecoin  Polkadot

Polkadot  USDS

USDS  WETH

WETH  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Pepe

Pepe  Pi Network

Pi Network  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Dai

Dai  Uniswap

Uniswap  Aave

Aave  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer