Get the best data-driven crypto insights and analysis every week:

By: Tanay Ved

-

Staking on the Ethereum network has grown tremendously, with 31M ETH (~26% of supply and $120B in value) staked on the Beacon chain

-

9.8M ETH has been staked through Lido, representing a 31% market share

-

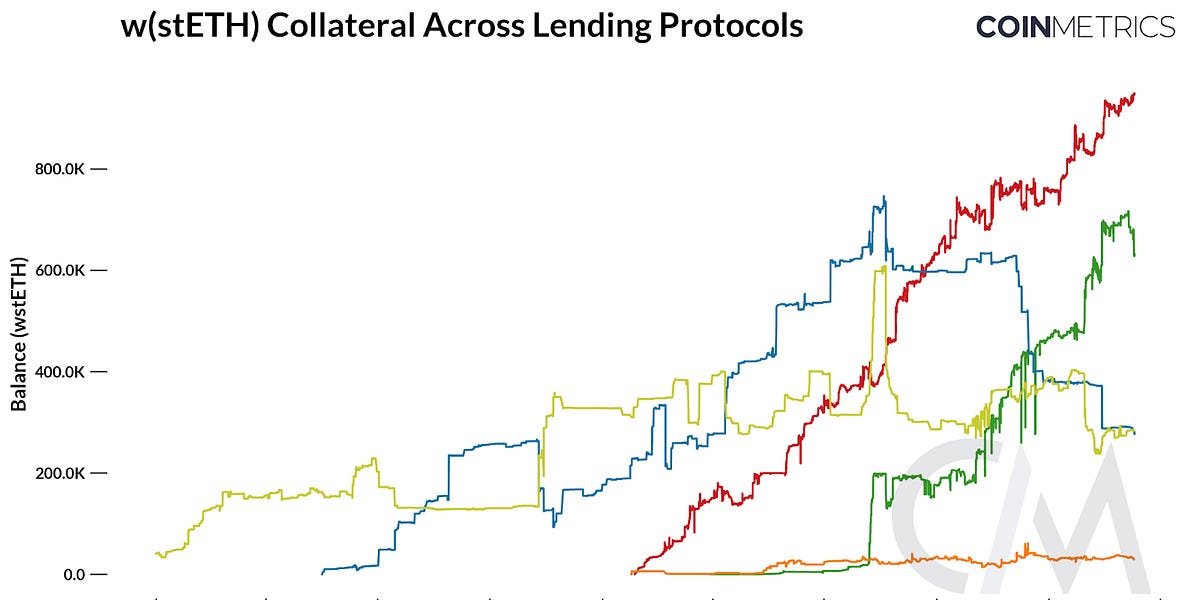

Liquid Staking Tokens (LST’s) like Lido’s stETH & wstETH represent 33% of deposits on Aave V2 & $9.5B in collateral across DeFi lending markets

-

The prevalence of LST’s across the on-chain ecosystem comes with potential market risks, including de-pegging, liquidity or liquidation risk

As a fundamental aspect of validating and securing proof of stake (PoS) blockchains, staking on the Ethereum network has captured significant attention since “The Merge.” Today, over 31M ETH (~26% of supply and $120B in value) has been staked, with nearly 980K active validators securing the Ethereum network. This robust security foundation renders attacks against the network prohibitively costly, as examined in a recent paper, Breaking Byzantine Fault Tolerance.

Source: Coin Metrics Network Data

Fundamentally, staking pools and custodial staking platforms bring together ETH stakers and infrastructure providers (i.e., node-operators), allowing deposits of any ETH increment in return for a tokenized claim on capital staked—known as a liquid staking derivative (LSD). As a result of lower barriers to entry and greater accessibility to get yield on ETH, adoption of this sector has grown tremendously.

A vibrant ecosystem of LSD’s have emerged from Lido’s stETH to Coinbase’s cbETH and Rocket Pool’s rETH, with diverse token models. Boosted by their fungibility, composability, and yield, liquid staking tokens are a predominant form of liquidity on decentralized exchanges (DEX’s) and collateral across lending markets, stablecoin products, Layer-2’s and now restaking applications, showcasing their utility across the ecosystem. In prior issues, we have introduced the concept of liquid staking, and the dynamics of staking through the lens of Lido. In light of the proliferation of liquid staking derivatives, in this issue of State of the Network we focus on the market dynamics and risks of this sector, looking at the largest one’s in the market today.

The dominance of a single staking pool crossing critical thresholds of 33% has been a major concern. As the largest staking pool commanding 9.8M ETH staked, Lido has often been under the spotlight, with its market share representing 31% of all staked ETH. While this has ramifications for stake centralization and has drawn criticism from the community, it’s important to note that Lido is currently composed of 39 node operators, and is actively pursuing the adoption of distributed validator technology (DVT), enhancing the decentralization and resilience of its operator set. Moreover, possessing liquid staking tokens does not grant direct control over block creation or the process of verifying transactions; instead, these tokens serve to preserve the liquidity of staked assets.

Source: Coin Metrics Network Data

Another potential risk vector involves governance and control mechanisms, which vary across liquid staking providers. Some, like Lido, operate as a decentralized autonomous organization (DAO) governed by LDO token holders, who can implement changes such as smart contract upgrades or the management of node operator and oracle registries. In contrast, centralized exchanges offering staking services, such as Coinbase (cbETH) and Binance (BETH), provide a custodial service, meaning they maintain control over users’ staked assets and execute decisions within their centralized organizational framework.

Given the varying governance models, centralization risks and expanding utility, understanding the associated market risks of liquid staking tokens is crucial as their on-chain integration deepens.

A major risk associated with liquid staking tokens (LSTs) is their potential to diverge in price from the underlying staked asset. The token model adopted by each LST influences various factors, including price dynamics, method of accruing yield, user experience and integration with on-chain applications.

LSTs generally follow either a “rebasing” or “reward-bearing” token model. Rebasing tokens dynamically adjust their total supply to distribute staking rewards, while reward-bearing tokens increase the value of each token without changing the supply.

Lido’s stETH, a rebasing token, adjusts its supply to mirror staking rewards or penalties, aiming for a 1:1 peg with ETH in the primary market. However, on secondary markets like decentralized exchanges (DEXs), stETH’s price has occassionally deviated from this peg, as observed during the Terra Luna collapse in May 2022, when stETH traded at $0.935 (a 6.5% deviation) on Curve Finance. This dislocation triggered cascading liquidations and substantial capital losses for entities leveraged on stETH, such as Three Arrows Capital, as well as losses across lending protocols.

Rebasing tokens like stETH provide a better user experience by automatically adjusting balances without requiring manual user interventions; however, their integration with on-chain applications poses challenges, prompting the creation of the reward-bearing wrapped staked ETH token (wstETH). Reward-bearing tokens, such as Coinbase’s cbETH, RocketPool’s rETH, and wstETH, tend to trade at a premium over the underlying ETH. This premium results from the tokens’ increasing value as staking rewards accumulate on the principal (minus slashing penalties), with the exchange rate defining this appreciation. For instance, cbETH began trading at a premium five months after its introduction in February 2023, and despite volatility in March, it currently trades at $1.06, reflecting a premium.

Source: Coin Metrics Market Data

Price dislocations between liquid staking tokens (LSTs) and their underlying assets create arbitrage opportunities across different markets. While arbitrage helps mitigate price discrepancies during normal conditions, it can be hindered during significant market events, potentially exacerbating risks when prices diverge sharply or liquidity dries up.

Ample liquidity in primary and secondary markets is essential for enabling seamless redemptions of staked ETH, minimizing the potential for adverse price impacts. Since the introduction of withdrawals with the Shapella Upgrade, users can redeem their staked ETH directly through the primary market (i.e., ETH buffer for Lido stETH), through validator exits, or via secondary markets.

Lido employs a liquidity buffer, acting as a “working capital” reserve, by pooling ETH from execution layer rewards, withdrawal vaults, and incoming deposits. This buffer serves as a liquidity reserve to handle stETH redemptions at various levels, providing a safety net against prolonged price deviations. The mechanism played a crucial role in facilitating Celsius’ withdrawal of 428K ETH in May 2023 as there was ample ETH in the buffer to absorb the impact. As Ethereum’s staking ratio evolves, monitoring the liquidity buffer size, withdrawal demand, and the validator exit queue’s size becomes essential to assess the primary market’s liquidity.

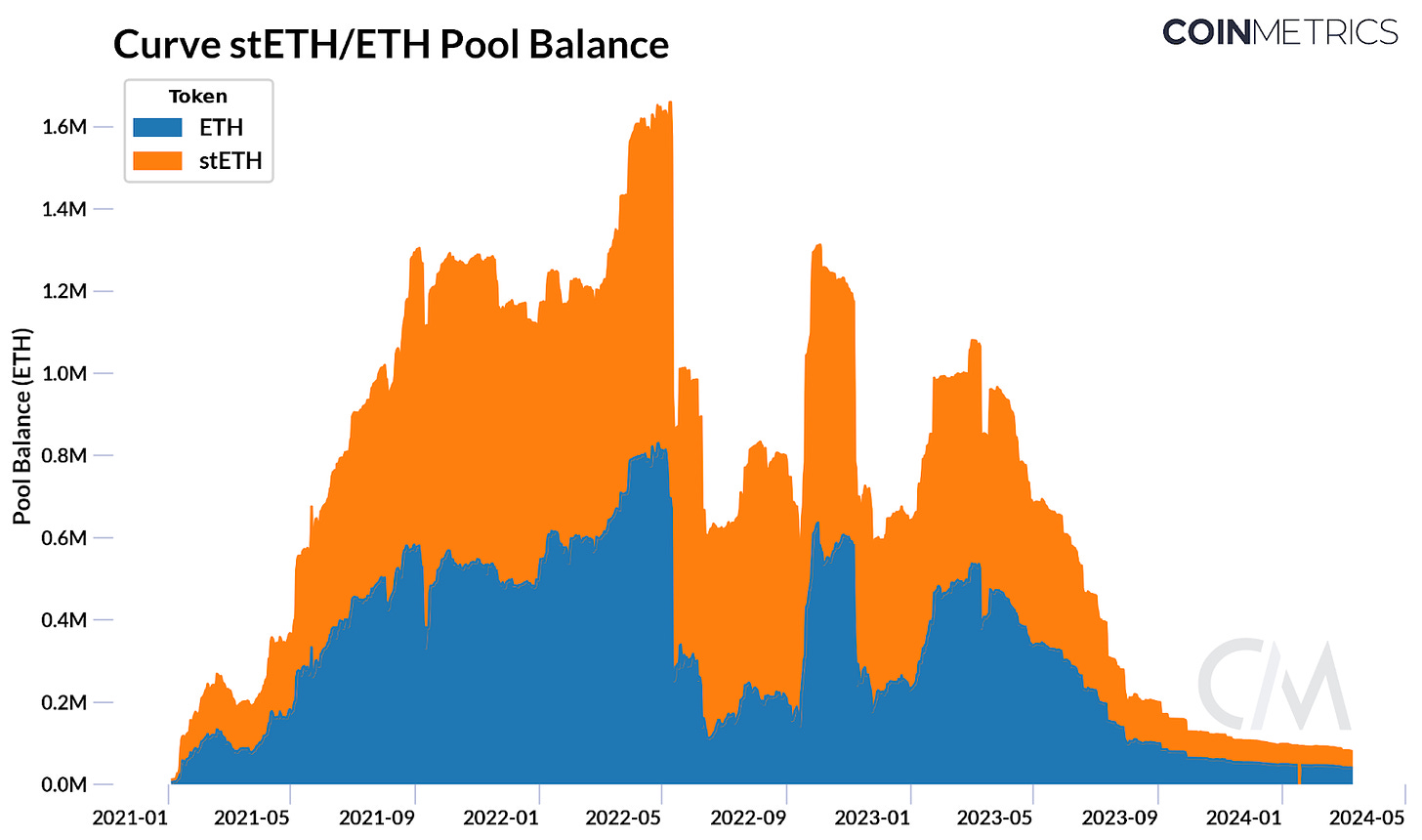

Liquidity on secondary markets, including centralized exchanges (CEXs) and decentralized exchanges (DEXs), is crucial for enabling users to enter and exit staked positions without significant slippage. While liquidity levels for LSTs vary across venues, the Curve stETH/ETH pool is currently the most liquid market for stETH. This pool has experienced notable liquidity fluctuations, such as during the UST/Luna collapse, the FTX fallout, and a general decline post-Shapella upgrade due to the removal of liquidity provider incentives. This has not had any adverse impacts on stETH price, despite relatively lower liquidity levels—41K stETH and a pool TVL of $317M—partly because of lower utilization of liquidity. However, the concentration of the majority of liquidity on Curve could present risks.

It’s worth noting that off-chain exchange liquidity, although comparatively lower, is rising, with stETH listed on Bybit, OKX, Huobi, Gate.io, and MEXC across stablecoin and ETH pairs. Notably, OKX’s ETH market demonstrated a peak in January 2024, with bids and asks within 2% of the mid-price reaching 540 ETH and 871 ETH, respectively. Ensuring broad liquidity distribution on and off-chain is crucial for mitigating potential market risks.

Liquid staking tokens (LSTs) such as Lido’s stETH and wstETH have gained significant network effects as a prominent form of collateral across various lending protocols, as well as for stablecoin and restaking positions. The significant utility of LSTs as collateral comes with crucial implications, as any major price dislocations, coupled with low liquidity and high demand for redemptions could trigger liquidations of these positions—as seen during the Luna/UST debacle.

For instance, stETH alone accounts for $1.18 billion in deposits on Aave V2, representing 33% of the platform’s total deposits. This growth stems from the popularity of leveraged looping strategies, where users deposit staked ETH, borrow more ETH, stake the ETH again and repeat the process, compounding the staking yield. This dynamic is not only limited to Aave V2; wstETH is also a major form of collateral on Aave V3, Maker, and Spark Protocol, with approximately $9.5B in stETH underpinning loans across these markets.

Given the substantial amount of collateral tied up in LSTs, it is imperative to manage the associated lending market risks. This involves prudent onboarding of LSTs as collateral and setting appropriate loan-to-value ratios that reflect the current liquidity and leverage conditions. Such measures are essential to prevent the unwinding of loans and the accumulation of bad debt, particularly during periods of market turbulence.

Liquid staking tokens also have a unique role to play in the emerging practice of “restaking”—a concept popularized by EigenLayer. Users can either deposit liquid staking tokens or restake “natively” by setting withdrawal credentials towards EigenLayer contracts, enhancing yield from validating other networks by leveraging Ethereum’s economic security. While this unlocks additional utility, it introduces implications around the concentration of LST’s into restaking protocols, liquidity in secondary markets and the integration of “liquid restaking tokens” (LRT’s) across the on-chain ecosystem. The intersection of liquid staking tokens within the restaking ecosystem constitutes a key trend to focus on as this sector continues to evolve.

Ethereum’s staking ecosystem has grown substantially, with staking pools and liquid staking tokens garnering meaningful adoption. Enhanced accessibility and utility have led to the deep integration of LST’s within the on-chain ecosystem. However, as highlighted in this report, this growth comes with crucial trade-offs, emphasizing the need to monitor associated market risks. With Ethereum stakeholders contemplating the implementation of staking related EIP’s (Ethereum Improvement Proposals), such as “max-effective balance”, “max churn-limit” and potential issuance changes, the trajectory of this sector is poised to evolve.

The rally in digital asset markets continued, with Bitcoin’s market cap surpassing $1.4T on strong ETF inflows, hitting a fresh all-time high of $72.8K on Monday. Ethereum (ETH) rose over $4K going into the Dencun upgrade. MakerDAO’s MKR token saw surging activity as the protocol implemented fee adjustments to bolster Dai reserves amid market volatility.

This week’s updates from the Coin Metrics team:

-

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

© 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.

Read More: coinmetrics.substack.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Stellar

Stellar  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Litecoin

Litecoin  Polkadot

Polkadot  Monero

Monero  USDS

USDS  WETH

WETH  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Pi Network

Pi Network  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pepe

Pepe  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Uniswap

Uniswap  Aave

Aave  Dai

Dai  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  Ondo

Ondo  Cronos

Cronos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ethereum Classic

Ethereum Classic  Official Trump

Official Trump