- Top Ethereum whales held more MANA than any other token

- MANA’s price action showed that it was demanding a bearish exit

According to a tweet posted by WhaleStats in the wee hours of 4 December, the top 500 Ethereum [ETH] whales preferred to hold Decentraland [MANA]. The database noted that these whales held about $1.05 million worth of MANA. This made the virtual reality platform token a favored one over Enjin Coin [ENJ].

The top 500 #ETH whales are hodling

$1,057,661 $MANA

$370,000 $ANT

$137,135 $ENJ

$103,813 $UTK

$51,747 $CVC

$35,084 $TKN

$34,245 $DAWN

$30,843 $SNTWhale leaderboard

https://t.co/tgYTpOm5ws pic.twitter.com/hEtF0QqqLp

— WhaleStats (tracking crypto whales) (@WhaleStats) December 4, 2022

Read Decentraland’s [MANA] Price Prediction 2023-2024

Although the holdings looked impressive, MANA eroded against the US Dollar (USD). At press time, the token was trading at $0.408, according to CoinMarketCap; a modest 1.50% decline in the last 24 hours. A scrutiny of its volume showed that MANA’s transactions fell 31.72%, leaving the 24-hour volume less than $50 million.

Ask for “MANA” and get what in return?

On the daily chart, MANA was struggling to exit its weakened position. As of this writing, altcoin’s Relative Strength Index (RSI) was 40.63. This zone signaled that MANA had not solidified its buying momentum.

However, since it had overcome dangling around the oversold region of the last week of November, the current position could mean solace was close. Nevertheless, there was still no justification indicating towards bullish momentum.

Furthermore, the Money Flow Index (MFI) showed that the Decentraland’s ecosystem was filled with active investors. At press time, the MFI surged to 61.30. At this rate, it signified that a good amount of liquidity had flowed into the MANA ecosystem. This had been the case since 23 November.

However, the potential upliftment from the RSI and MFI did not spread across every MANA section. As for the Directional Movement Index (DMI), it was time to lay powers to sellers. This was because the sellers’ strength (red), at 25.75, indicated strong control over buyers (green) at 16.28.

In addition, the Average Directional Index (ADX) supported a bearish movement in the short term. This was due to the ADX breaking above the solid value of 25, and remaining at 37.20. In a case where the ADX value was less than 25, then MANA could have a chance of changing the price channel.

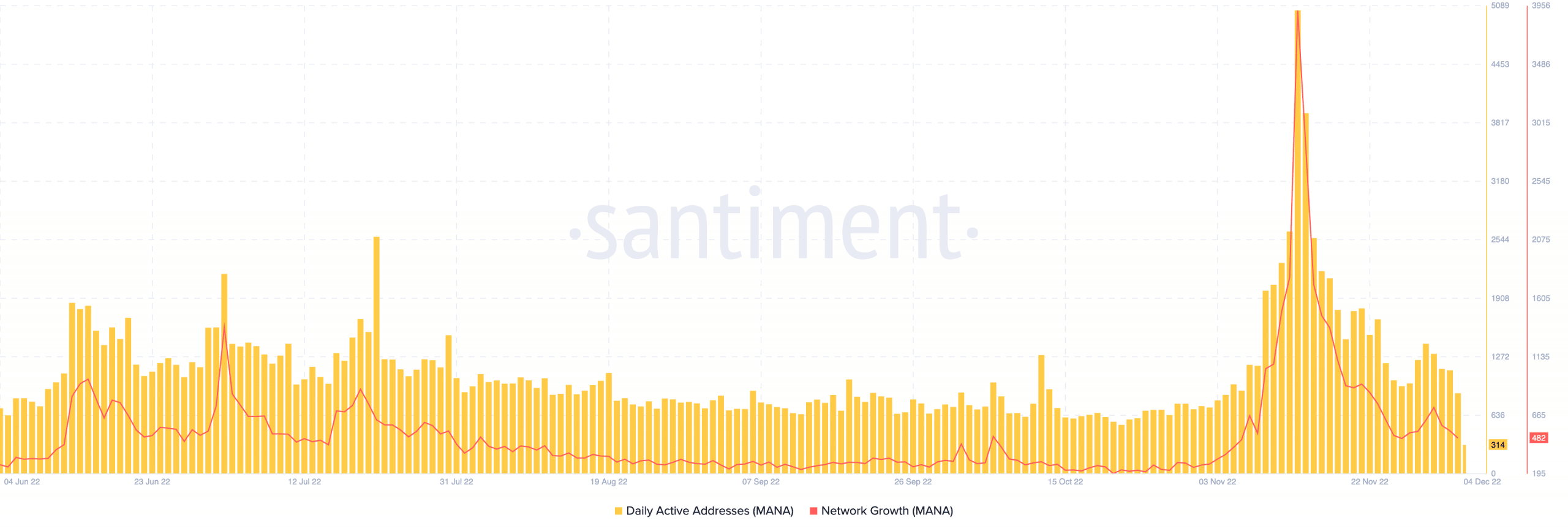

Network and addresses fall in the camp

Per its on-chain condition, Decentraland could not revive in some areas. According to Santiment, the network growth which increased tremendously in mid-November had plunged. Its value at 482 meant that new addresses were not cheery in taking part in MANA transactions.

Furthermore, active addresses, which spiked around the same period, followed a downtrend. As with its network growth, deposits have not been impressive.

Read More: ambcrypto.com

![Decentraland [MANA] price action](https://ambcrypto.com/wp-content/uploads/2022/12/MANAUSD_2022-12-04_12-02-40.png)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  Toncoin

Toncoin  Litecoin

Litecoin  Monero

Monero  Polkadot

Polkadot  WETH

WETH  USDS

USDS  Bitget Token

Bitget Token  Pepe

Pepe  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pi Network

Pi Network  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Bittensor

Bittensor  Aave

Aave  Dai

Dai  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  OKB

OKB  Ondo

Ondo  Cronos

Cronos  Internet Computer

Internet Computer  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ethereum Classic

Ethereum Classic