- MakerDAO announced a new proposal that would remove REN BTC vaults

- Their revenue through real-world assets increased, however, TVL declined

In a tweet dated 10 December, MakerDAO revealed that they would be off-boarding various vault types with risk exposure. One of them would be REN-BTC vaults if the new proposal is passed.

This is an important reminder to all RENBTC-A users.

The RENBTC-A vault type will be offboarded from the Maker Protocol if the currently active Executive Vote passes.

— Maker (@MakerDAO) December 10, 2022

Read MakerDAO’s [MKR] Price Prediction 2023-2024

New proposals on MakerDAO

If the proposal passes, all RENBTC-A positions with a collateralization ratio below 5000% will be liquidated. Users won’t be able to avoid liquidation unless they pay off their remaining DAI debt.

This proactive approach of the DAO, to ensure the safety of its users, could be received positively by the crypto community.

The amount of revenue generated by MakerDAO from real-world assets increased as well. At the time of writing, 75% of all revenue generated by MakerDAO had been through real-world assets.

Due to this growth in revenue, the DAO governance rewarded a 1% yield to DAI holders.

A rare exponential curve in this bear market. @MakerDAO

75% of revenues are now RWA (incl. GUSD rewards).

Governance also decided to distribute 1% reward yield to DAI holders.

Gradually, then suddenly.https://t.co/KUPrEWXsde pic.twitter.com/Y2aMF3teWR

— Sébastien Derivaux (@SebVentures) December 7, 2022

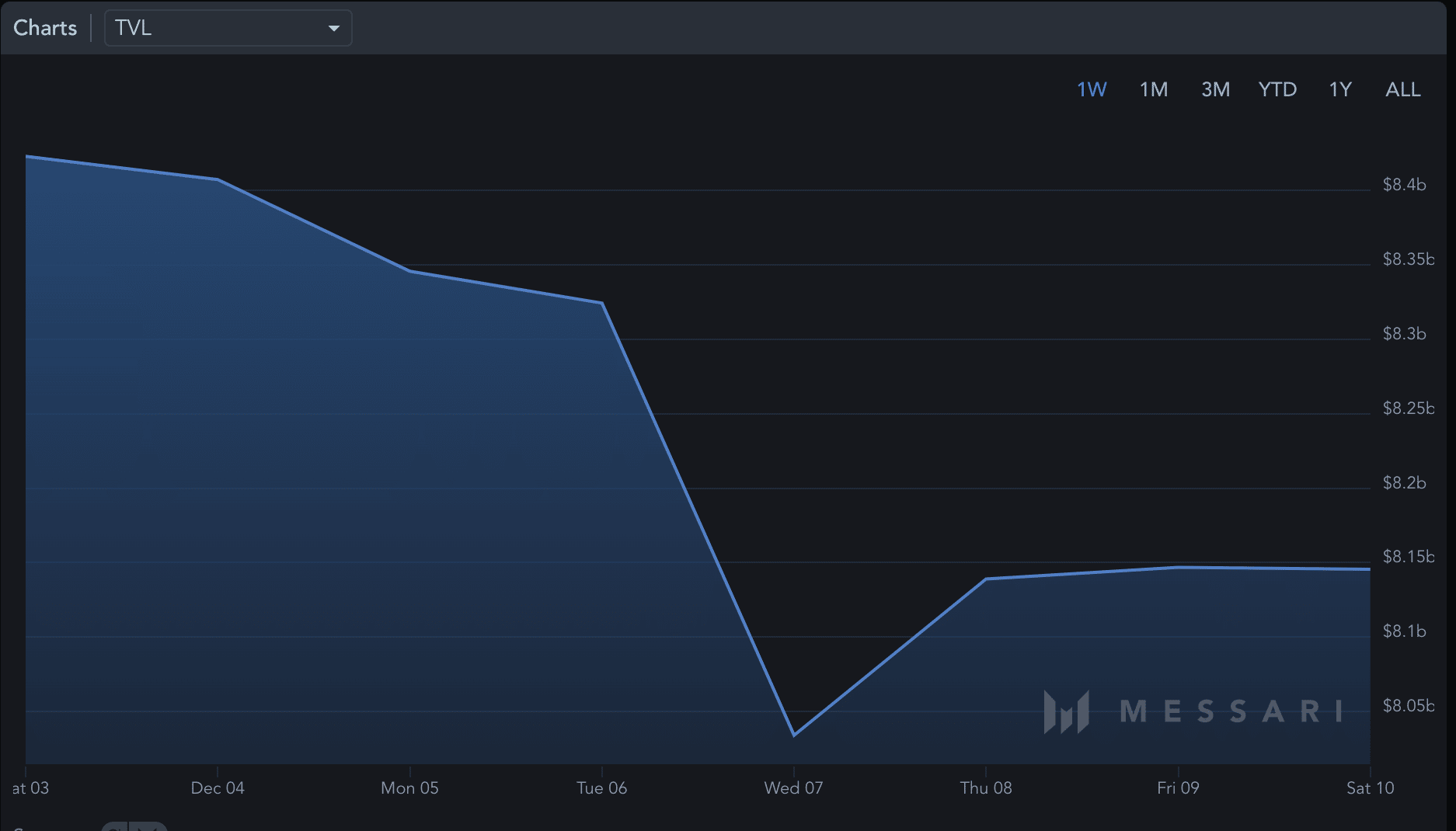

Despite the growing revenue, MakerDAO’s total value locked (TVL) declined significantly over the last week. At press time, the MakerDAO‘s TVL stood at $6.34 billion, according to data provided by DeFi Llama.

Looking at the token

MakerDAO’s token, MKR wasn’t able to fare well either. The number of daily active addresses for the MKR token declined significantly over the past month. Furthermore, MKR’s velocity depreciated as well. A declining velocity indicated that the frequency at which MKR was being exchanged amongst addresses had reduced.

MKR’s token holders weren’t able to make any profits as well. From the image below, it can be seen that the volume of transactions that were made in profit had reduced significantly.

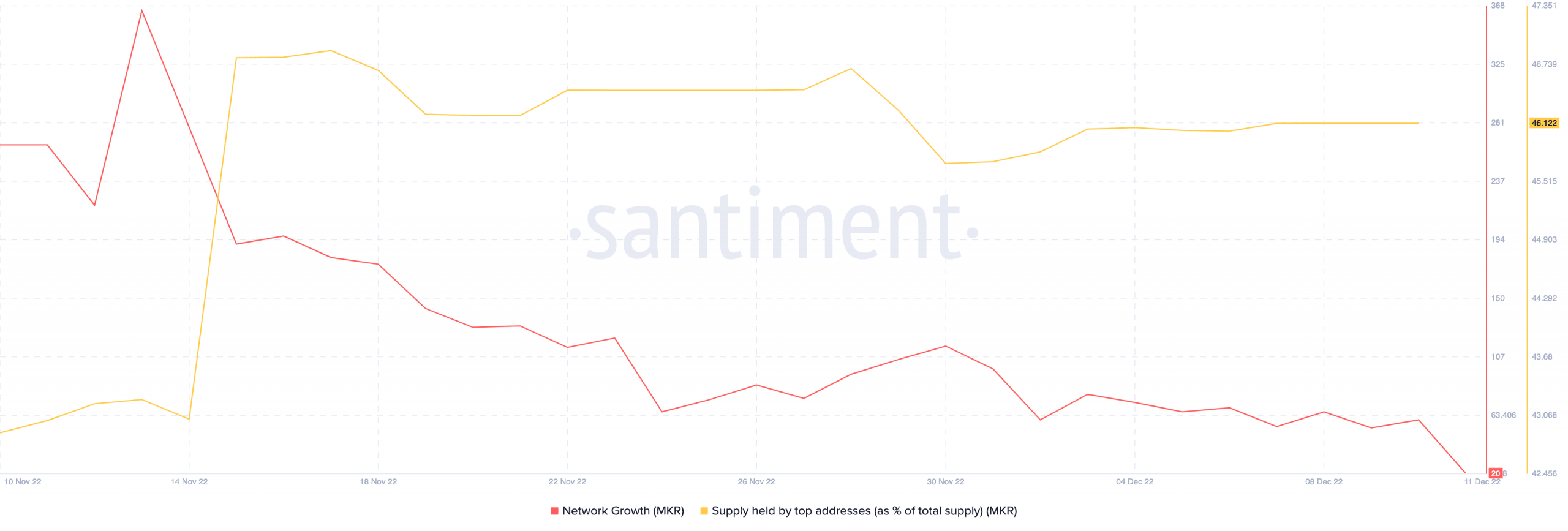

MKR’s token wasn’t able to garner interest from new addresses as well. The network growth for the token declined during the last 30 days. This implied that the number of new addresses transferring MKR had reduced.

Surprisingly, despite these factors, MKR witnessed a spike in interest from large addresses from 14 November. After this, interest remained consistent throughout the past month.

This implied that large addresses remained undeterred by market volatility and continued to show faith in the token.

At the time of writing, MKR was trading at $612.35. Its price fell by 0.32% in the last 24 hours.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Stellar

Stellar  Shiba Inu

Shiba Inu  LEO Token

LEO Token  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Litecoin

Litecoin  Polkadot

Polkadot  USDS

USDS  WETH

WETH  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Pepe

Pepe  Pi Network

Pi Network  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Dai

Dai  Uniswap

Uniswap  Aave

Aave  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Cronos

Cronos  Ethereum Classic

Ethereum Classic