The last article I wrote on Arbitrum’s airdrop analysing how much they paid per user was received really well by you all, so I thought I’d write something similar. This time, about NFT marketplaces and how their airdrops stack up against each other. In case you didn’t read the first article, here you go:

Today’s article will be based off the following Dune dashboard by @jhackworth: https://dune.com/jhackworth/olxb.

This is the first protocol in the NFT we can run some fresh and easy math on what’s going on here. This airdrop was over a year ago so finding data on this was a bit harder than I hoped but I still managed to do so.

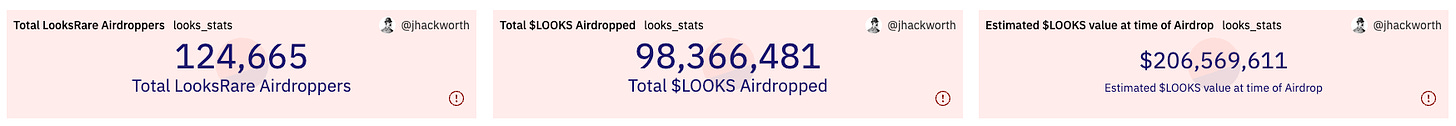

$206,569,611 distributed to 124,665 airdrop users. Our initial math gives us:

These results are fairly similar to the Arbitrum airdrop which was priced at $2,175/user.

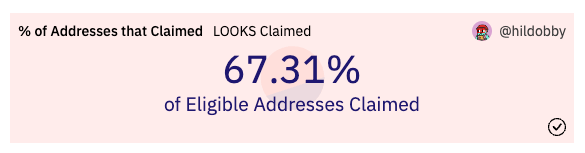

You know me, I’m not going to stop here. Let’s keep digging. On another Dune dashboard I found out that only 67% of the eligible addresses claimed their airdrop! Source: https://dune.com/hildobby/LOOKS-Airdrop.

That means our math needs to change.

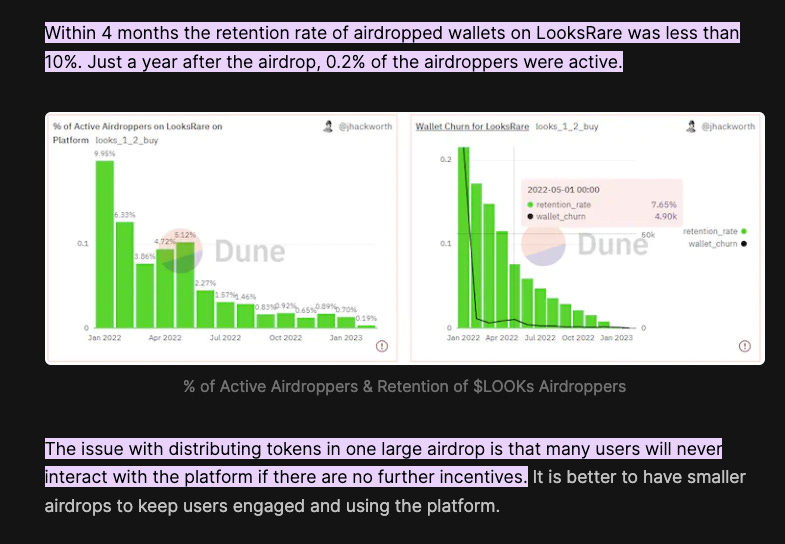

Now we’re kind of getting close to Arbitrum levels of customer acquisition costs. Interesting how both numbers fall at around the ~$2,000/wallet mark. Unfortunately the Dune dashboard that has the retention data is broken. However, an article from RabbitHole that references this data (https://rabbithole.mirror.xyz/s1BFIgK1oIDAiQnUpyIJtsfx18zvN0U6tWh4fW76DV8) mentions that as of Feb 2023, the retention rate of these wallets was sub 10% and only 0.2% of the airdroppers were active.

While I would have liked to have more detailed data, we have enough to proceed with our analysis. Let’s update our CAC analysis with the generous (haha yes I know) assumption that 10% of LOOKS airdrop recipients still hold the token.

Insanity. Although also not too far off from our Arbitrum numbers surprisingly enough. Let’s zoom out for a second though and evaluate how LooksRare’s financial and product performance has been as a result of this customer acquisition campaign.

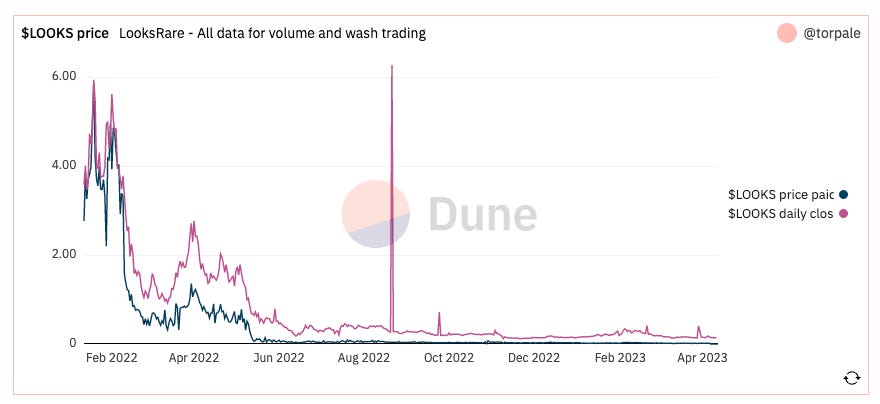

Fairly expected. When it first launched it was obvious that all the volume on LooksRare was washtraded volume, although that never stopped your favourite crypto influencer from shilling it to the moon. What’s even more interesting is the following Dune dashboard that tracks fake volume and the price of the token: https://dune.com/torpale/LooksRare-Wash-trading

Do you see how corrupt this is? I mean, if this is what a better financial system or “web3” looks like then I’m afraid we’re directionally in a very bad state as an industry. In the last article I wrote:

One of the points I made was talking about how fake data is terrible and rewarding fake activity is net negative. I hope that the above chart shows why. Even if you like your numbers being pumped, eventually those same people will have no incentive to prop up your numbers and gradually remove their liquidity to pump and dump the next platform that keeps the casino going.

Why bother even trying once you’ve made life-changing sums amount of money and moved onto pump the next thing under a pseudonymous brand? Ultimately you need to think, where did $30m of real value come from?

People who bought into the narrative that LooksRare was a viable contender against OpenSea because the metrics and hype justified it. This is precisely why normies hate crypto. There are *so* many predatory schemes that go unchecked in this industry. It’s like the worst of banking and technology combined. Discerning truth from lies requires extreme sophistication which can only be acquired after a good 2-4 years of extreme industry experience. I’m in my 5th year and am in the position where I can write about this and connect the pieces having lived through this whole fiasco.

It really is tiresome. Now this isn’t to say the LooksRare team is predatory. I personally don’t know them and it looks like they’re still shipping stuff:

https://twitter.com/LooksRare/status/1644007629243715585

However, it’s clear that there’s a very broken incentive problem at play.

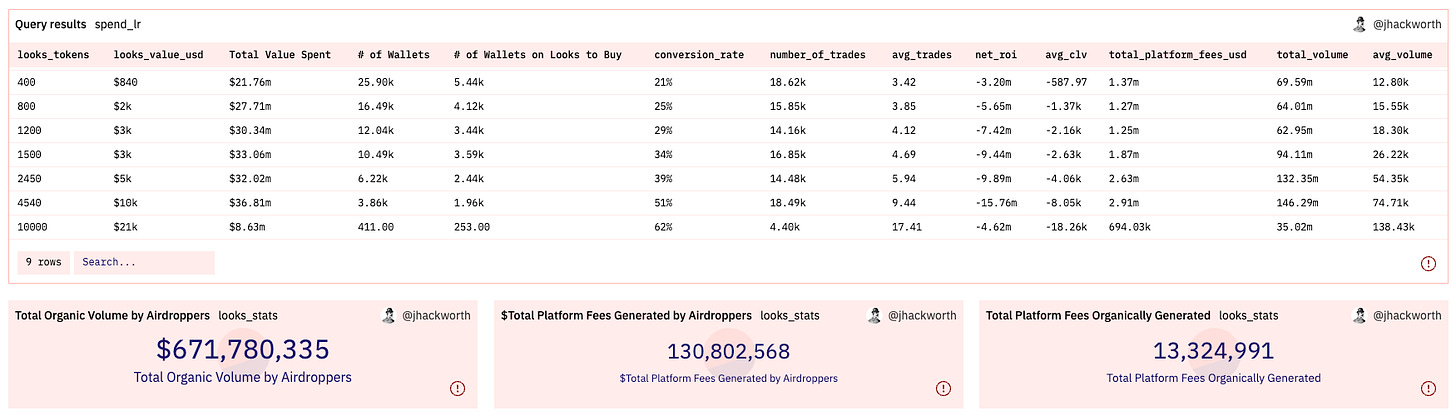

One interesting part of the Dune dashboard above was the fact that it covered how much $ each user generated for the platform since LooksRare actually charged a % fee on each trade. There’s another, newer NFT marketplace on the block that doesn’t but I’ll cover that next week maybe.

What’s interesting here is that despite LooksRare spending $206m on the airdrop, they did earn $130m in fees from those airdrop users and another $13m in organic fees from non-airdropped users. I got the user counts from this Dune Dashboard: https://dune.com/hildobby/LooksRare. From here we can generate a more nuanced equation:

These numbers are very rough but they are at least partially correct and enough for us to construct more granular equations from. If we use our first CAC equation where we look at the raw cost to acquire all users who claimed the airdrop (second equation) versus our LTV figure we start to get some interesting dynamics starting to form.

We now have:

-

$2,473/user on the CAC side

-

$859/user on the LTV side

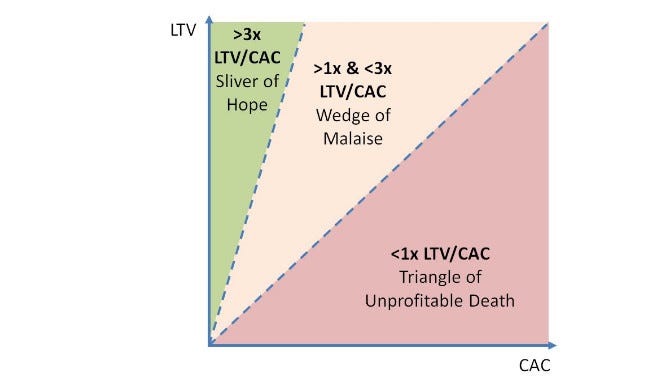

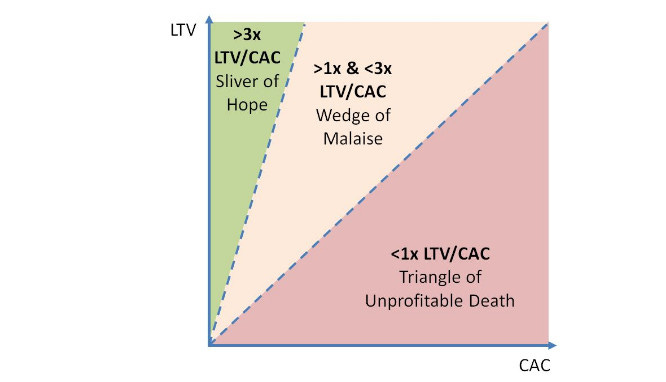

In Web2, the TVL/CAC ratio tells us a lot about the return profile of a company. For LooksRare we have

In case it isn’t clear. This is a terrible number. Typical industry benchmarks for business are somewhere along the following lines:

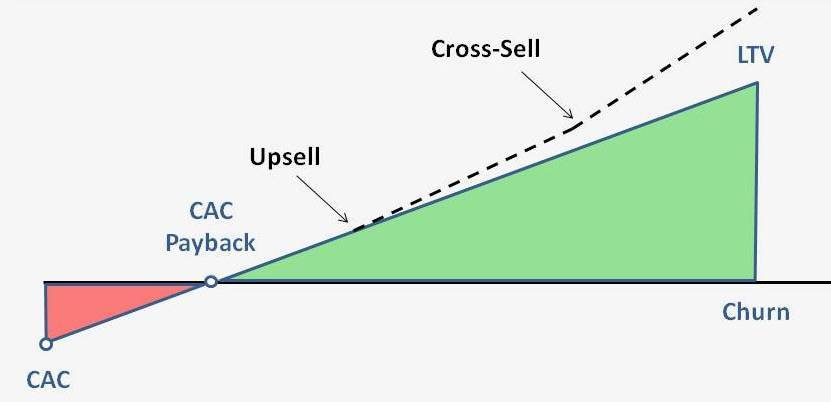

Even if you’re less than 1, you ideally want to be able to construct the following chart in your business where eventually you break even.

Unfortunately in LooksRare’s current form, I have no idea how they achieve this or if they’re even thinking to do so. What I do find amazing is that it still has a fully diluted valuation of $100m+.

There’s lots more I could write and explore here although I am getting to the limit of Substack’s email length! There’s some really interesting ideas I’m having as I continue to write this piece that I would love to explore in future pieces. In the meantime I’d love to hear your thoughts on this piece and if you have any criticisms on the methodology/line of thinking used here!

If you’re keen to chat about this more, join the Telegram group here: https://t.me/+T-XpBMSS1ylUz0ej

Read More: kermankohli.substack.com

Shadow Token

Shadow Token  Euler

Euler  Kujira

Kujira  Alien Worlds

Alien Worlds  Metadium

Metadium  Access Protocol

Access Protocol  Peapods Finance

Peapods Finance  Portal

Portal  OMG Network

OMG Network  Aergo

Aergo  ArbDoge AI

ArbDoge AI  Hoppy

Hoppy  Bertram The Pomeranian

Bertram The Pomeranian  Heroes of Mavia

Heroes of Mavia  YES Money

YES Money  Ethernity Chain

Ethernity Chain  BUSD

BUSD  REI Network

REI Network  Project89

Project89  Gearbox

Gearbox  DIMO

DIMO  Perpetual Protocol

Perpetual Protocol  Onyxcoin

Onyxcoin  Sanctum Infinity

Sanctum Infinity  Orchid Protocol

Orchid Protocol  Opus

Opus  crvUSD

crvUSD  Gemini Dollar

Gemini Dollar  Dione

Dione  USDX

USDX  tokenbot

tokenbot  Keyboard Cat (Base)

Keyboard Cat (Base)  WATCoin

WATCoin  INSURANCE

INSURANCE  Matr1x Fire

Matr1x Fire  Magpie

Magpie  Liquity USD

Liquity USD  OmniFlix Network

OmniFlix Network  Manta mETH

Manta mETH  Mainframe

Mainframe  Save

Save  Vector Smart Gas

Vector Smart Gas  Reef

Reef  TANUKI•WISDOM (Runes)

TANUKI•WISDOM (Runes)  Loom Network (OLD)

Loom Network (OLD)  Contentos

Contentos  GOGGLES

GOGGLES