[ad_1]

More investors than ever before are holding bitcoin (BTC) for the long term – or in industry parlance, HODL.

According to Glassnode data, a record 68% of bitcoins have been held for at least one year, 55% have been held for at least two years, and 55% have been held for three years. The coin has reached 40%.

Many analysts are bullish on Bitcoin as investors choose to hold it for the long term. The spread of long-term holdings in crypto assets contrasts with the long-term shift in US stocks. In U.S. stocks, investors are holding assets for much shorter periods than they used to.

FundStrat’s head of digital asset research Sean Farrell said long-term holdings tend to gain more traction over time. The exception is when the market becomes active and investors who bought in a downturn sell long-held assets to buyers who are willing to buy.

“This trend is bullish insofar as it implies price gains in this cycle and could result in a small supply squeeze if current long-term holders hold off on selling,” said Farrell.

He added that long-term holder behavior is not always useful as a short-term price signal.

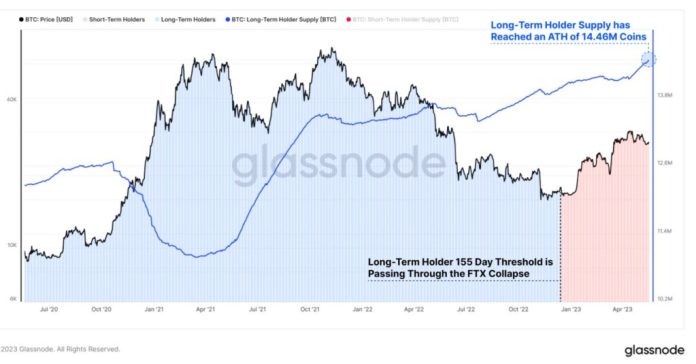

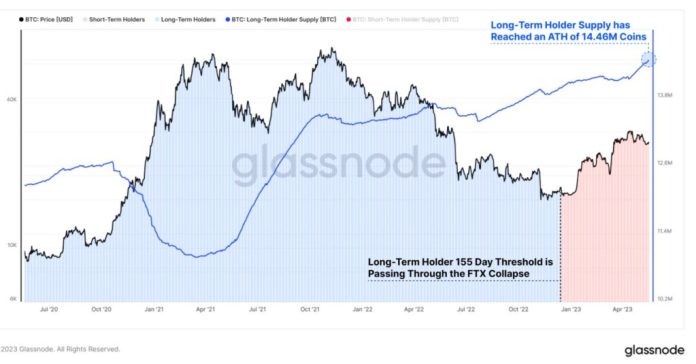

Glassnode Long-Term-Holder Supply (amount of bitcoin held for 155 days or longer) also reached a record high of 14.46 million bitcoins. “It reflects the maturity of the coins purchased in the immediate aftermath of the FTX bankruptcy into a long-term holding landscape,” Glassnode wrote in its report.

Glassnode’s Liveliness index, which compares the relative balance between long-term holdings (HODLing) and spending behavior, also shows investors’ long-term holdings, dropping to its lowest level since December 2020.

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

| Image: Glassnode

|Original: Bitcoin HODLing Has Never Been More Popular

[ad_2]

Read More: bitcoinwarrior.net

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  USDS

USDS  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Aave

Aave  Pi Network

Pi Network  Pepe

Pepe  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Aptos

Aptos  Bittensor

Bittensor  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Cronos

Cronos  Ethereum Classic

Ethereum Classic  sUSDS

sUSDS