- Most traders are opting for for bullish bets despite the coin’s movement

- DOGE’s hike to $0.29 now stalled thanks to the market’s correction

AMBCrypto’s analysis of the market revealed that traders have been bullish on Dogecoin [DOGE], despite its recent struggles. Previously, DOGE looked like it was heading to $0.30. However, for some weeks, the price has been stuck between $0.18 and $0.22. At the time of writing, it was down to $0.17 after a 13% fall owing to Bitcoin losing over 5% of its value in the last 12 hours.

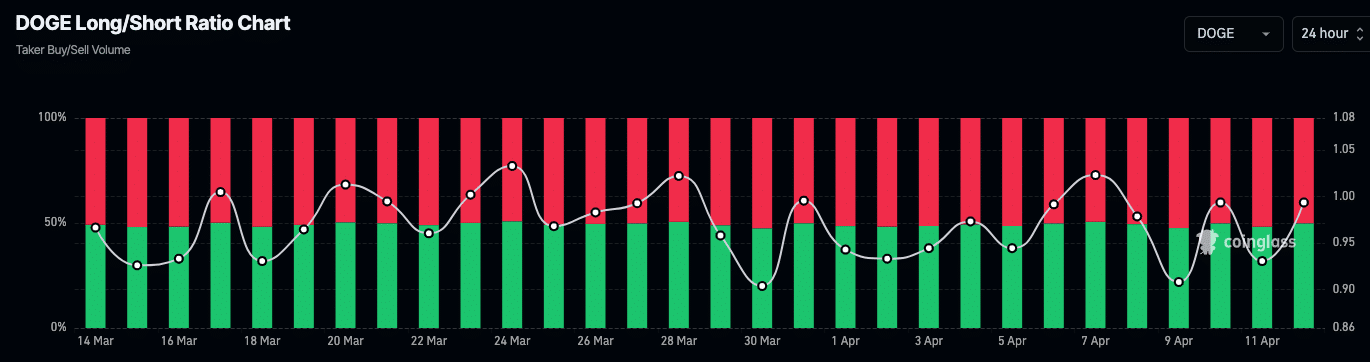

However, information obtained from the Long/Short ratio revealed that traders were unfazed by the performance. In fact, according to Coinglass’ data, Dogecoin’s 24-hour Long/Short ratio was 1.02.

The Long/Short ratio is a significant metric used to check the sentiment of Futures traders. A reading below 1 shows the dominance of shorts. On the other hand, values above 1 indicate bullish sentiment and more long positions.

DOGE is not ready yet

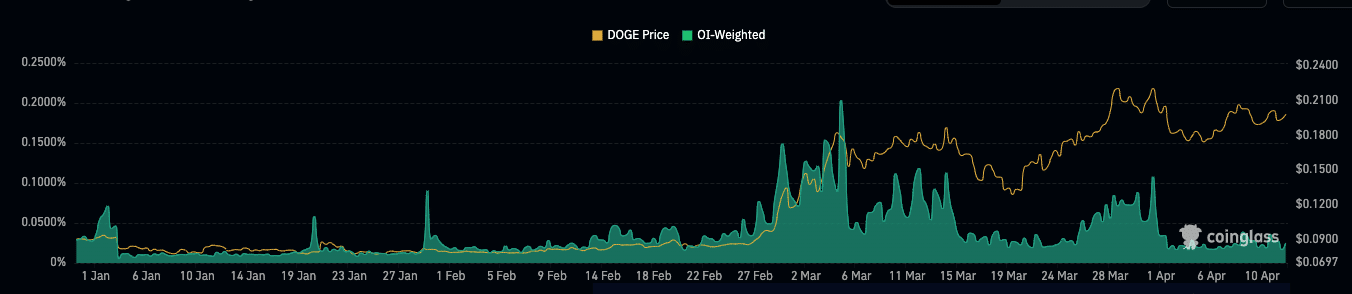

Alas, sentiment alone won’t take DOGE out of its tight-trading range. This was why AMBCrypto considered other indicators. Open Interest (OI) was one of the indicators we evaluated.

OI monitors information about liquidity and interest in specific contracts in the market. This helps traders understand trends and potential movements. An increase in OI implies that market participants are increasing their net positions.

In this case, buyers have been more aggressive than sellers. On the contrary, when the OI decreases, it is the other way around.

At press time, Dogecoin’s OI was $1.29 billion, despite the latest market correction. This is a sign that net positioning by traders has been fairly stable, despite the market’s volatility.

Therefore, the effect on the price, outside of external elements, might be minimal. If the OI holds and the market steadies itself, DOGE can resume its uptrend again and maybe, attempt to climb past $020 and later, $0.25.

On the other hand, a massive closure in net positions might invalidate this prediction, and DOGE might drop further on the charts.

Calm before chaos?

From a technical point of view, the DOGE/USD chart revealed that the coin’s momentum had become weak, especially after the latest market-wide correction. In fact, the crypto’s Relative Strength Index (RSI) had fallen below midpoint at 0.50.

Similarly, the Parabolic SAR’s dotted markers switched position to above the price candles – A pretty bearish sign.

Is your portfolio green? Check the Dogecoin Profit Calculator

If the market stabilizes itself, DOGE has the potential to arrest its downtrend and break out from its consolidation phase. However, the altcoin is likely to continue trading within its existing price range over the next few days.

Bullish sentiment in the market and a surge in capital flow might trigger the hike. A tweet from Elon Musk might do the trick too.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  LEO Token

LEO Token  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  Wrapped stETH

Wrapped stETH  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  WETH

WETH  Ethena USDe

Ethena USDe  Pi Network

Pi Network  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Wrapped eETH

Wrapped eETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Uniswap

Uniswap  Aptos

Aptos  Dai

Dai  OKB

OKB  Ondo

Ondo  NEAR Protocol

NEAR Protocol  Bittensor

Bittensor  Gate

Gate  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  sUSDS

sUSDS  Official Trump

Official Trump  Tokenize Xchange

Tokenize Xchange