[ad_1]

Restaking is one of the biggest crypto investing narratives of 2024, and with EigenLayer’s mainnet now up and running, the excitement is only growing.

EigenLayer is not just another protocol; it’s a money lego that can be used by others as a building block to create different financial applications. The coolest thing to emerge from this is the concept of liquid restaking. There are now apps that let you restake your ETH using EigenLayer, and they’re making waves in the ecosystem, attracting billions of dollars.

There’s a noticeable shift happening with how people are staking their ETH. More and more are choosing restaking protocols over the usual liquid staking options. In fact, Lido is seeing more ETH leaving than any other protocol. On the flip side, restaking platforms like Ether.fi and Renzo are getting the most new inflows.

Lido now has the highest ETH staking outflow of any protocol while @ether_fi & @RenzoProtocol have the highest inflows

src: https://t.co/EkK4n7QpXS pic.twitter.com/gElyNB8ZV3

— hildobby (@hildobby_) April 2, 2024

At the time of writing, Lido’s market share for staked ETH has dropped below 30% after a years-long climb. Moreover, Ether.fi recently flipped Rocket Pool in the amount of ETH staked, which really shows how people are moving their money to restaking protocols.

So why is everyone rushing to restake their ETH? And what does this mean for Lido’s future? We’re going to explore these questions and more today.

Welcome to Restaking Summer on Bankless

How big will the EigenLayer airdrop be?

Why are Liquid Restaking Protocols so Hot?

EigenLayer is touted to be a game-changer for the Ethereum ecosystem. There’s talk it could be the biggest airdrop in DeFi history.

From VCs to degens, everyone and their grandma wants a piece of EigenLayer and collecting EigenLayer’s Restaked Points is the best way to increase your chances for an airdrop.

There are several ways to collect those points!

- Native restaking — You can run an Ethereum Validator node and create an EigenPod to join in on Native Restaking. This method is a bit technical and might not appeal to everyone since it requires a good deal of effort.

- Liquid restaking with LSTs — An easier option is to restake Liquid Staking Tokens (LSTs) like Lido’s stETH or Rocket Pool’s rETH. Just deposit your LSTs into EigenLayer, and you’ll start collecting points. But there’s a catch: there have been caps on these deposits as EigenLayer approached its mainnet launch. This was to keep an eye on the system and ensure it stayed stable as more users joined in. It also left space for new protocols to emerge and kept the big players from taking over the restaking scene.

- Liquid restaking with LRTs — The latest trend is using liquid restaking protocols like Ether.fi and Renzo. Deposit your ETH or LSTs, and you’ll get a liquid restaking token (LRT) like Ether.fi’s eETH or Renzo’s ezETH. Holding LRTs can pay off in many ways: extra yield, more points, and the potential for airdrops from various protocols. That’s why everyone’s so excited about liquid restaking protocols right now.

When the right incentives are in place, crazy things can happen, and that’s exactly what’s happening with the adoption of liquid restaking protocols.

Let’s break down the flywheel of incentives that’s driving the restaking boom, using Ether.fi as an example:

- EigenLayer points — Ether.fi passes on 100% of the EigenLayer points and any other benefits to its users for holding eETH/weETH.

- Liquid restaking protocol points — On top of that, users get Ether.fi loyalty points and badges for certain actions. Since the beginning, there was clear communication from the Ether.fi team that these loyalty points will play a role in decentralized governance of the protocol, thus giving users a 2 in 1 airdrop farming opportunity. Recently, Ether.fi distributed 60 million of its native token, ETHFI, to users through an airdrop. But the rewards aren’t over. There are incentives for users to continue holding eETH after the airdrop as more tranches of the ETHFI airdrop are still left.

- Actively Validated Services (AVSs) airdrops — Protocols that use EigenLayer to create AVSs have announced additional airdrops for those who participate in restaking. For example, Ether.fi users got a nice bonus with AltLayer’s ALT airdrop earlier this year.

- Ethereum native staking rewards — Besides all these perks, users also earn the standard ~3.3% APR for staking ETH, which is what you’d get on the Ethereum network. And after the ETHFI airdrop, there are even more incentives to stake on the platform, with potential returns of over 50% APR in ETHFI.

- Future AVS yields — This part of the flywheel hasn’t even kicked in yet. The whole idea behind EigenLayer is to earn additional yield on your ETH by using it to secure other protocols and networks. Liquid restaking protocols will put your capital to work, securing AVSs and earning a yield in return.

Combine these incentives with a bull market’s energy, where investors are ready to take risks for higher rewards, and you’ve got a powerful growth engine.

Lido’s Future at Stake?

We’re witnessing this in real-time as new restaking protocols quickly amass billions in TVL. As these LRTs become more trusted and attract more capital, their rise seems unstoppable, drawing in even more users and investment.

However, the financial landscape seeks balance. As capital moves toward new opportunities, it often withdraws from others. In the restaking meta, it’s liquid staking protocols like Lido that are on the other end of the stick – Lido still holds over 29% market share for total staked ETH, but its share is slowly decreasing due to the emergence of restaking protocols.

The reason for this shift is straightforward: opportunity cost.

Why would users settle for single-digit APYs in liquid staking when restaking can offer the same yield plus additional benefits and the chance for lucrative airdrops? In a bull market, the choice seems obvious.

This isn’t to suggest Lido is fading away. Its role in securing the Ethereum network and promoting stability and decentralization is irreplaceable. Restaking protocols, while offering higher returns, come with increased risk, such as the potential for ETH slashing. Lido, in contrast, provides a safer, more reliable option for earning yield on ETH with lower slashing risks.

There’s a place for both in the ecosystem as they cater to users with different risk profiles. It remains to be seen if restaking protocols can sustain their growth and maintain TVL once the airdrop incentives dry up. However, this dynamic shows that even a giant like Lido can face competition if the incentives are right.

The rise of the restaking meta could prompt Lido to innovate and perhaps even launch its own restaking platform. Only time will tell how the market will evolve.

it is kind of funny how the “lido problem” is going to be “fixed” by onboarding an order of magnitude riskier products who are essentially underwriters of avs risk https://t.co/rwYMBZtnie

— ceteris (@ceterispar1bus) April 2, 2024

Top LRT Protocols to Consider

It’s not just Ether.fi leading the LRT boom. If you decide to embrace the restaking meta this cycle, here are the top three other restaking protocols to keep an eye on:

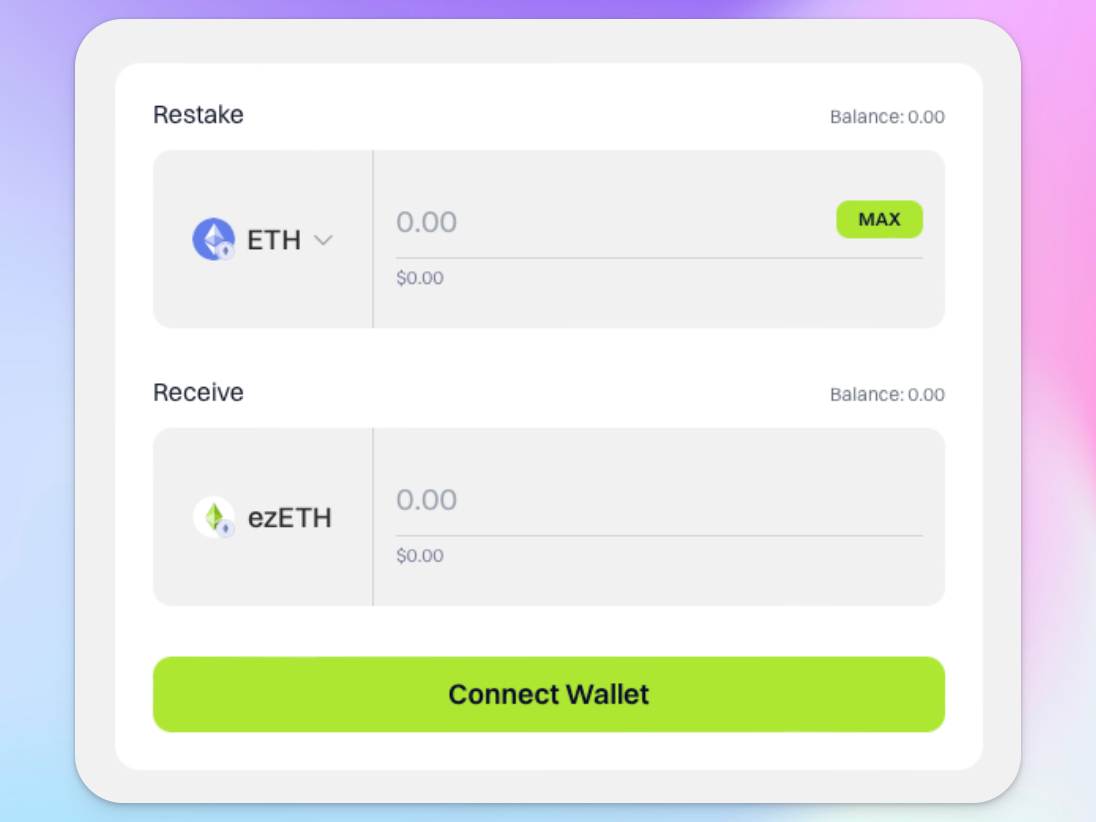

Renzo

Renzo

Renzo is a Liquid Restaking Token (LRT) and Strategy Manager for EigenLayer.

With nearly $3 billion in ETH restaked, Renzo is the second-largest LRT protocol in terms of ETH staked and has seen rapid growth, with over 510k ETH in net inflows over the past three months, rivaling Ether.fi.

Users can restake ETH, wETH, and LSTs (on select chains) with Renzo across multiple networks, including Ethereum, Arbitrum, BNB Chain, Mode, and Linea.

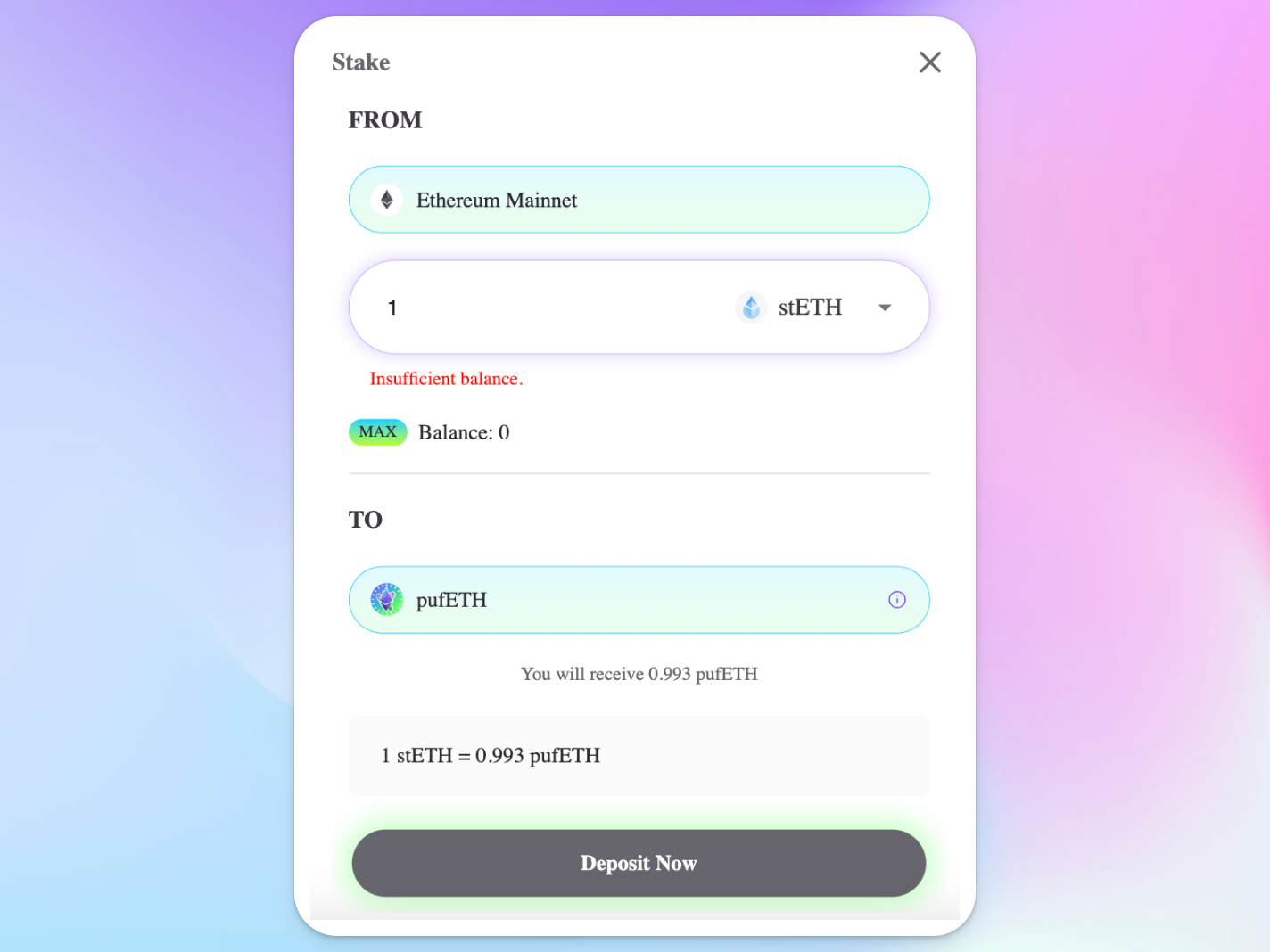

Puffer Finance

Puffer Finance

Puffer is a decentralized native liquid restaking protocol (nLRP) built on Eigenlayer. Puffer boasts over $1.3 billion in restaked ETH, holding nearly 14% of the total LRT market supply.

Staking stETH and wsETH with Puffer on Ethereum yields pufETH, which can be further utilized in liquidity pools on platforms like Pendle and Curve.

KelpDAO

KelpDAO

Kelp is a multi-chain liquid staking protocol that’s building an LRT solution, rsETH, on EigenLayer for Ethereum.

Kelp allows users to stake ETH and LSTs on Ethereum, as well as ETH on various L2s like Optimism, Base, Mode, Arbitrum, Blast, and Scroll.

Closing Thoughts

We live in a time where Vitalik is advocating for degen communism and there’s an ongoing bull market. With the prospect of EigenLayer potentially being one of the biggest airdrops in crypto history, it seems wise to position accordingly and embrace the restaking meta.

5 Can’t-Miss Restaking Airdrops on Bankless

gm Bankless Nation, it was a big week for airdrops, but there are plenty of opportunities left on the near horizon.

[ad_2]

Read More: www.bankless.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  USDS

USDS  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  Wrapped eETH

Wrapped eETH  WETH

WETH  Litecoin

Litecoin  Hedera

Hedera  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  Internet Computer

Internet Computer  Cronos

Cronos  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic