Lido has suffered multiple months of outflows as liquid restaking protocols grow.

Lido, the leading Ethereum liquid staking protocol, wants to foster new restaking architecture built around its stETH token.

On May 13, Steakhouse Financial, a web3 financial advisory firm, published a proposal advocating for establishing the Lido Alliance to endorse “Ethereum-aligned” projects through an “umbrella framework for endorsement and partnership.”

The alliance would focus on restaking by promoting the development of infrastructure built around Lido’s liquid staking token (LST), stETH. Steakhouse outlined three types of protocols that the alliance seeks to promote, including new projects providing permissionless restaking architecture, building permissionless restaking tokens (LRTs), or developing actively delegated services (AVSs).

“Lido Alliance is a framework… for Lido DAO to identify and recognize projects that share the same values and mission, and have a way to positively contribute to the stETH ecosystem,” the proposal said. “Growing an Ethereum-aligned ecosystem around stETH helps decentralize the network.”

If passed, Lido would establish an Alliance workgroup tasked with assessing prospective members, assisting existing members, and offboarding members deemed to be violating the alliance’s principles of Ethereum or stETH alignment.

The Alliance’s operations and membership would be governed by LDO tokenholders.

Lido suffers outflows as LRTs rise

The proposal comes as Lido faces stiff competition from liquid restaking token (LRT) protocols and EigenLayer for market share over staked Ethereum.

Restaking allows users to earn additional yields on top of Ethereum staking rewards by delegating staked assets to validate third-party AVSs deployed on EigenLayer, which is currently positioned as Ethereum’s sole major restaking protocol.

The growing popularity of restaking has recently come at the expense of Lido’s market share, with users pulling $1.4 billion worth of Ether from Lido in 30 days as of April 24. For comparison, the LRT protocols EtherFi and Renzo enjoyed respective inflows of $1.2 billion and $429 million over the same period.

The trend of LRT protocols eating Lido’s lunch has continued to persist since, with EtherFi and Renzo boasting inflows of $396.4 million and $324.5 million over the past 30 days as $151.7 million worth of Ether exited Lido.

StETH currently accounts for 28.7% of the supply of staked ETH, down from a high of 32.5% in September. As such, Lido ranks as the largest DeFi protocol with a total value locked (TVL) of $27.4 billion, followed by EigenLayer with nearly $14.5 billion, according to DeFi Llama.

On May 10, Hasu, a strategic advisor to Lido, similarly posted a governance proposal seeking to formalize Lido’s stance concerning restaking.

The proposal aims to affirm that stETH should remain an LST token and not migrate to an LRT, establish stETH as the leading collateral asset used within restaking, and support “Ethereum-aligned validator services.”

“The staking market is dominated by network effects, leading to a winner-take-most dynamic,” Hasu said. “Lido should react to the changing tides.”

Read More: thedefiant.io

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

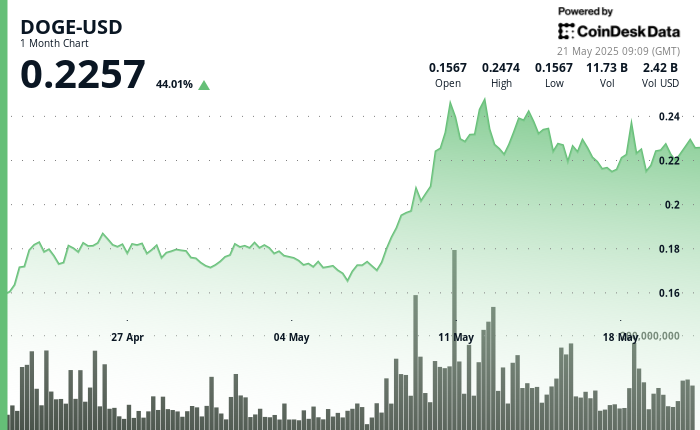

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Litecoin

Litecoin  Polkadot

Polkadot  USDS

USDS  WETH

WETH  Monero

Monero  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pi Network

Pi Network  Pepe

Pepe  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Official Trump

Official Trump  Cronos

Cronos  Tokenize Xchange

Tokenize Xchange