This is an opinion editorial by Buck O Perley, a software engineer at Unchained Capital helping build bitcoin-native financial services.

This is part one of a two part article set that describes crypto-governance and the dangers of faction.

Preface

I originally wrote this post in late 2017, after the “Big Blockers” had forked off to start their own chain with Bitcoin Cash and Segwit activation but before anything had been settled with SegWit2x.

While the debates around the technical merits and risks of the various paths forward were interesting on their own I was finding there to be another aspect of the debate that was both underexplored and in my opinion far more consequential: How human beings make decisions while preserving liberty and minimizing the costs of wrong decisions.

Authoritarianism has a universal appeal. It is easy and comfortable to be taken care of, to put your trust in authority. Liberty is risky. It takes work. It also takes humility. There is a hubris inherent in knowing you are right and aiming for a system that makes it as easy as possible for you to get your way. It is much harder to believe you’re right but to understand you might not be and to live in a system with people with whom you might disagree.

This is the problem of governance. This was the problem at the heart of The Blocksize War and is one we continue to grapple with, whether in talking about Taproot activation or what the next upgrade to the network should be. They are also currently being brought to light in the Ethereum community with questions being raised about transaction censorship and decision making around the merge.

This isn’t a new problem either and what I was finding most missing from the discussions at the time, an absence that continues today, is an appreciation for the lessons of those that had spent years thinking of these same problems centuries before us.

There is a tendency humans have for recency bias. We believe humans of the present know better. We are more advanced. We’ve evolved past the issues and limitations of our ancestors.

The fact is that human nature is constant. It doesn’t represent a problem to be solved but rather a reality that must always be grappled with, harnessed, leveraged and restricted. These are the ideas that I wanted to explore.

A Tale of Two Genesis

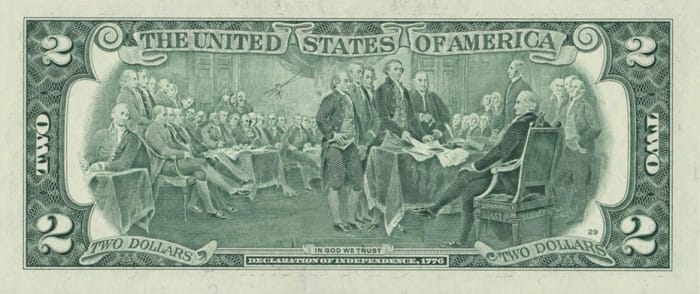

On July 4, 1776, Thomas Jefferson wrote in the Declaration of Independence:

“When in the Course of human events it becomes necessary for one people to dissolve the political bands which have connected them with another and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature’s God entitle them, a decent respect to the opinions of mankind requires that they should declare the causes which impel them to the separation.”

What launched from this declaration was one of the most radical experiments in popular self-governance in history, and one that has endured for more than 200 years.

In comparison, since the end of the American Revolution, France has undergone two revolutions of their own, and are currently in their fifth iteration of a republic. To the north, it wasn’t until the Canada Act of 1982 that the Crown and British Parliament’s ability to pass laws over Canada finally ended. This is to say nothing of the plague of fascist and communist regimes that beset the world in the 20th Century as further experiments in alternative governance schemes.

The American Revolution was in many ways the first, if imperfect, realization of the theories of the Enlightenment, debated in Europe for nearly a century before, and the Lockean ideals of self-sovereignty, natural rights and private property.

On January 3, 2009, Satoshi Nakamoto wrote what may eventually be looked on as an equally monumental turning point in the story of human self-governance.

000000000019d6689c085ae165831e934ff763ae46a2a6c172b3f1b60a8ce26f

For those not familiar with the inner workings of Bitcoin, the above is a hash of the Genesis Block of the Bitcoin blockchain.

When decoded, there’s a lot of Bitcoin specific information embedded here, but of note is a newspaper headline from that day, encoded into the coinbase of that first block:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

This pointed reference to the greatest financial meltdown in nearly a century (along with the rest of the data in the Genesis Block), is a part of any and all full nodes that run on the Bitcoin network. This data will continue to be propagated by all participants in the network for as long as even a single machine continues to use it (a testament to the permanence of the blockchain’s immutability).

The launch of the Bitcoin network set into motion an unprecedented movement of innovation and wealth creation, an event akin to the launch of the internet, the founding of a new country and the U.S. leaving the gold standard wrapped in one. In the span of a decade, Bitcoin went from a market cap of a hard drive in someone’s garage to being worth hundreds of billions of dollars, spawned hundreds of other cryptocurrencies and blockchains and gave birth to a new, global, decentralized and non-governmental economy valued in the trillions.

While the mining of the Bitcoin Genesis Block may not quite have been the “shot heard round the world” that the American Revolution was, the challenge issued by Nakamoto to the global financial system was no less ambiguous. On the one hand, in the United States’ founding you have not just the first modern attempt at self-governance, but also the first attempt to codify governance and replace a monarch with a system of laws, (negative) rights and constrained government. On the other hand, with the creation of Bitcoin, you have the first attempt to literally write a system of rules governing human interaction into code run on machines, creating the first objective system of governance the world had ever seen. With the Bitcoin network, you don’t have to guess at the code’s intention or try to interpret it. It either runs or it doesn’t. By running the software and opting into the network, you are agreeing to its rules. Don’t like the rules and you’re free to leave … or free to attempt to change them if the correct mechanisms are put into place.

If money is how we transfer and express value within a society, Bitcoin codified an objective rule set governing that society for the first time ever.

Governance! What Is It Good For?

I bring all of this up because the subject of governance has become both a vigorously debated and yet also under-explored aspect within the cryptocurrency ecosystem and I think it bears comparison with the similar debate from centuries earlier among the architects of the U.S. Constitution.

Most contemporary discussions on this topic, both within and without the cryptocurrency world, tend to focus on how to most efficiently make and execute a decision. What often gets overlooked however is the harder question that will actually enable us to create a truly enduring, inclusive and global financial system: in a society with a diversity of opinions and interests, how do you determine what is the “right” decision to execute in the first place?

In much of the conversations on governance, I’ve noticed a lot of hand waving about fairness, the 99% versus the 1%, “democratized” decision making, what “the community” wants, and protections against “special interests.” Questions of whether code is law or what Nakamoto’s “original vision” for Bitcoin was or what constitutes the “real” or “true” version of Bitcoin litter social media and message boards. Arguments that more closely resemble religious fundamentalism or Marxist-Leninist propaganda have become stand-ins for reasoned debate.

New cryptocurrencies have been developed to create “digital commonwealths” and to allow for direct voting on protocol changes. Some people even claim that systems governing human interaction can exist without governance at all. Incredible research is taking place to explore more efficient rule enforcement mechanisms, such as proof-of-stake versus Bitcoin’s proof-of-work, but even these spend more time discussing how to more efficiently punish bad actors than the mechanisms that decide what constitutes a “bad actor” in the first place. This is like debating the most efficient way to put criminals in jail before discussing how to define and decide what makes someone a criminal in the first place.

To say that governance isn’t necessary at all, or that even wanting governance represents a kind of power play, seems to me to naively misunderstand the nature of humanity. Even in a system governed by code, this viewpoint assumes there exist objective, final truths. The problem though is that we all live in our own subjective worlds with subjective values all of varying degrees of validity. Distribution of information isn’t perfect, and distrust among groups is a natural byproduct. Most importantly, no human is infallible.

Further, to believe no governance is necessary is to ignore that, unlike gold which is physical and immutable, a cryptocurrency is comprised of code that can be improved and innovated on in an infinite number of ways. Even to choose not to innovate is an explicit, human-led choice.

This is something the U.S. founders were keenly aware of in the framing of a constitution — the capacity for humanity to evolve in unpredictable ways. So they created, however imperfectly practiced, a system based on universal and timeless values. In the words of Calvin Coolidge:

“About the Declaration there is a finality that is exceedingly restful… If all men are created equal, that is final. If governments derive their just powers from the consent of the governed, that is final. No advance, no progress can be made beyond these propositions. If anyone wishes to deny their truth or their soundness, the only direction in which he can proceed historically is not forward, but backward toward the time when there was no equality, no rights of the individual, no rule of the people.”

Because of these immutable laws of nature, not only is some form of governance necessary but it is also inevitable. To ignore these facts, especially in a system as complex and disruptive as a cryptocurrency, is not only naive but, as I’ll elaborate below, also dangerous.

What Is “Good Governance?”

If we can agree on this then the next question is if some form of governance will emerge, how do we build a system that can most benefit those it is meant to serve and ultimately protect itself from tyranny? This is where I think the quality of dialogue in the cryptocurrency community has most fallen short.

The problem in my opinion stems from the areas of expertise that our leaders come from. Whereas the leaders of the Enlightenment ranged from philosophers to lawyers to statesmen to religious leaders to economists to landholders and even at least one entrepreneur/scientist (Benjamin Franklin), most cryptocurrency designers and influencers today are either primarily engineers or entrepreneurs (or just shitposters). Where the former were concerned primarily with philosophical and objective questions such as the nature of mankind, the preservation of liberty, and the nature of discourse and compromise, the latter are, justifiably in their respective spheres, most interested in the far more subjective world of unilateral decision making for the good of their project or business. They are those who want to execute the most efficient and effective solution possible given a particular problem, an altogether subjective exercise.

“Put not your trust in princes.” — Psalms 146:3

While the signing of the Declaration of Independence is what most captures our attention today, it is often overlooked how much work, thought and iteration actually went into designing a government of, by, and for the people. The process encompassed the Albany Congress in 1754, three Continental Congresses including the passing of the Articles of Confederation, and finally to the Constitutional Convention and the ratification of the United States Constitution (which superseded the, by then, bankrupt and dysfunctional government under the Articles of Confederation). None of this even touches on the contributions made over the previous century by Enlightenment philosophers including Smith, Locke, Paine, Hume, Rousseau, Kant, Bacon, and many more.

One of the most contentious parts of the debate among the founders of the United States was centered around how best to preserve the liberty of the individual from any would-be attackers (both internal and external) while at the same time enabling the government to carry out its primary functions.

First and foremost they needed to protect themselves from foreign invaders and domestic insurrection (vulnerabilities cryptocurrencies also suffer no shortage of). This would take a certain amount of coordination among and between the states and their citizens. With a government so-enabled to repel these threats, the next priority was how to assemble such a body while at the same time preventing it from infringing on the very freedoms for which it was created to protect in the first place. As Thomas Jefferson said:

“The natural progress of things is for liberty to yield and government to gain ground.”

Now while you certainly could make a defensible claim that the American experiment has failed in the second aim (I would argue that the central failing in present-day America has been a lack of education, particularly decentralized education, which had been one of its defining strengths as noted by Tocqueville in Democracy in America,” but that’s a subject for another post!), the point is that a great deal of thought and debate, going back to John Locke in the 17th Century, went into creating a system of governance that began from the assumption that power was corruptible. It was designed with the acknowledgement that good governance was necessary (and in its absence tyrannical governance would fill the void), that it would need the capacity to change and adapt, that it was not just possible but likely that wrong decisions could be made (even by the “right” people) and that the structure of power in any form should always start from an assumption of mistrust.

One of the best places to get insight into the content of this debate is in the Federalist Papers. A collection of 85 essays written primarily by Alexander Hamilton with contributions from James Madison and John Jay published between 1787–88, the Federalist Papers represent one of the most thorough public defenses of the design of the United States Constitution available. The questions addressed that I think are most relevant to the world of cryptocurrency governance relate to the nature of power and the influence of faction.

The list of their concerns included:

Misguided Faith That Power Would Be In The Hands Of Those With Good Intentions

“It is in vain to say that enlightened statesmen will be able to adjust these clashing interests, and render them all subservient to the public good. Enlightened statesmen will not always be at the helm” — James Madison, Federalist #10: “The Utility of the Union as a Safeguard Against Domestic Faction And Insurrection”

The Tyranny Of The Majority

“The majority, having such coexistent passion or interest, must be rendered, by their number and local situation, unable to concert and carry into effect schemes of oppression.” — Madison, Federalist #10

“It has been observed that a pure democracy if it were practicable would be the most perfect government. Experience has proved that no position is more false than this. The ancient democracies in which the people themselves deliberated never possessed one good feature of government. Their very character was tyranny; their figure deformity.” — Hamilton, Speech in New York (21 June 1788)

Factions

“By a faction, I understand a number of citizens, whether amounting to a majority or a minority of the whole, who are united and actuated by some common impulse of passion, or of interest, adversed to the rights of other citizens, or to the permanent and aggregate interests of the community.

…

“Men of factious tempers, of local prejudices, or of sinister designs, may, by intrigue, by corruption, or by other means, first obtain the suffrages, and then betray the interests, of the people.” — Madison, Federalist #10

Those In Power

“The truth is that all men having power ought to be mistrusted.” — James Madison

And the most notable warning to my mind because of our natural human tendency to fall victim to the allure of paternalism:

Those In Positions Of Power Who Already Have The Trust Of The People

“For it is a truth, which the experience of ages has attested, that the people are always most in danger when the means of injuring their rights are in the possession of those of whom they entertain the least suspicion.” — Alexander Hamilton (The Federalist Papers #25)

What ties all of these points together is they all underscore a distrust of power in any form, even though many of these same people would soon be in a position to wield the power they were at present handicapping (five of the founding fathers would later become president).

They distrusted power in the hands of a selfish tyrant and in those of one with altruistic intentions.

They distrusted the rule of the majority and of the minority.

They distrusted factions and they distrusted philosopher kings.

Accept Compromise, Appreciate Gridlock

If we acknowledge that the point of a cryptocurrency, or at least the point of one whose goal is to be a global and distributed payment system (or world computer), is to create some system that encompasses peoples of a wide range of motivations and differing interests, and if we further acknowledge that engineering often involves the subjective practice of measuring trade-offs, security versus speed, memory versus performance, depth versus breadth of adoption, etc., then you need to take into account that a governing system needs to exist to unite these varying and usually all justifiable interests to push the entire ecosystem further.

“Early in my career as an engineer, I’d learned that all decisions were objective until the first line of code was written. After that, all decisions were emotional.” ― Ben Horowitz, The Hard Thing About Hard Things

This is all to say that if you create a system that will encompass different viewpoints and subjective interests, two things need to be taken into account:

1. Making a change should be very difficult.

2. Change to the system must be possible and under the assumption that it is entirely reasonable to expect positive (or at least non-negative) change to come from a faction with whom you disagree. I.e., trust the system more than your own judgment.

How these points manifest is in a system that should reward compromise with incremental but sustainable progress in order to encompass and promote the most diverse set of opinions and interests, while also punishing strong-arming with gridlock, even if the “pure” progress being proposed may appear to be the best way forward.

While Madison does indeed warn against the perniciousness of faction, in fact, Federalist No. 10 is mostly dedicated to this warning, at the heart of his argument is an acknowledgment that the vices of faction are a necessary evil when governing large and diverse groups of people:

“Liberty is to faction what air is to fire, an aliment without which it instantly expires. But it could not be less folly to abolish liberty, which is essential to political life, because it nourishes faction, than it would be to wish the annihilation of air, which is essential to animal life, because it imparts to fire its destructive agency.”

This is to say that disagreement needs to be accepted as a reality of life and thus a proper governing system must have built into it an understanding that factions will arise and that its effects must be absorbed if the system is to endure.

Indeed, Madison begins this section by pointing out that “[t]here are two methods of curing the mischiefs of faction: the one, by removing its causes; the other, by controlling its effects.” later only to explain that the first cure is “unwise” while the latter is “impracticable” for the promotion of liberty. Madison continues (emphasis my own):

“As long as the reason of man continues fallible and he is at liberty to exercise it, different opinions will be formed. As long as the connection subsists between his reason and his self-love, his opinions and his passions will have a reciprocal influence on each other.”

Part two of this article set continues with, “What Does All Of This Have To Do With Cryptocurrency?”

This is a guest post by Buck O Perley. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Read More: bitcoinmagazine.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Avalanche

Avalanche  LEO Token

LEO Token  Stellar

Stellar  Toncoin

Toncoin  Wrapped stETH

Wrapped stETH  USDS

USDS  Hedera

Hedera  Shiba Inu

Shiba Inu  Sui

Sui  Litecoin

Litecoin  Polkadot

Polkadot  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Pi Network

Pi Network  WETH

WETH  Ethena USDe

Ethena USDe  Hyperliquid

Hyperliquid  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Wrapped eETH

Wrapped eETH  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Pepe

Pepe  sUSDS

sUSDS  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Internet Computer

Internet Computer  Gate

Gate  Ondo

Ondo  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  Aave

Aave  Coinbase Wrapped BTC

Coinbase Wrapped BTC