Get the best data-driven crypto insights and analysis every week:

By: Matías Andrade & Tanay Ved

-

The innovations taking place across Layer-1 platforms is heating up, bringing changes that require us to use data to compare and contrast the different features and trade-offs offered by these different L1s.

-

Bitcoin is evolving from a specialized chain primarily serving as a settlement layer to a more general-purpose platform leveraging its security for layer-2 functionalities, transitioning toward a more general-purpose platform.

-

Ethereum is moving towards a modular blockchain architecture with the recent Dencun upgrade, utilizing specialized layers for its functions, highlighting the differences between monolithic and modular networks.

Innovation once more appears to be heating up in the digital asset space as old paradigms are set aside and new horizons become realized. Bitcoin is evolving from a specialized chain whose primary purpose is to serve as a settlement layer for transactions to a more general-purpose platform that leverages its extraordinary security to serve layer-2 functionalities. Similarly, with the recent Dencun upgrade, Ethereum is moving towards a modular blockchain architecture, with specialized layers to handle its functions. We are also witnessing the birth of new layer-1 blockchain like Aptos, leveraging different virtual machines, and others like Monad, bringing parallel execution capabilities to the EVM.

In this issue of Coin Metrics’ State of the Network, we explore the diverse landscape of layer-1 blockchain networks and understand their implications for the broader crypto ecosystem.

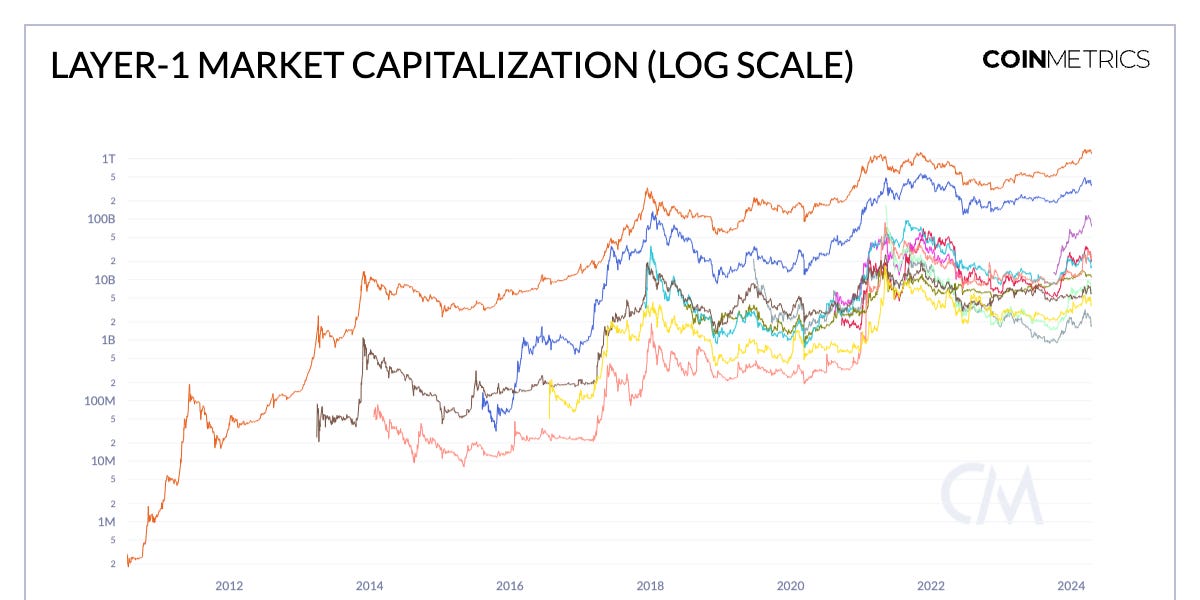

In the crypto ecosystem, a Layer-1 (or L1) is the base layer or the foundational blockchain network upon which other layers and applications are built. L1 blockchain networks are standalone, decentralized ledgers that operate independently and establish their own rules for consensus, transaction validation, and data storage. These networks serve as the infrastructure and provide the essential functionalities required for the development and deployment of decentralized applications (dApps) and other blockchain-based solutions. Numerous layer-1’s have emerged over the past cycles, with each gaining varying levels of traction and maturity.

Source: Coin Metrics Network Data Pro

While all L1 networks share the fundamental characteristics of being decentralized and securing their respective ecosystems, they can be broadly categorized into two types: specialized networks and general-purpose platforms.

Specialized Networks: These L1s are designed primarily to facilitate secure peer-to-peer transactions and serve as robust settlement layers. Examples include Bitcoin, Litecoin, and Dogecoin. While they may not directly support complex smart contracts or decentralized applications, their primary purpose is to leverage strong security guarantees and decentralization to provide a reliable and trustless transfer of value, even if additional functionality is added through protocols such as Omni or in the form of L2s or roll-ups built on top.

General-Purpose Platforms: These L1s are designed to serve as programmable platforms that can support a wide range of decentralized applications and smart contracts. Examples include Ethereum, Tron, Solana, Avalanche, and others. These networks often prioritize features such as programmability, scalability, and interoperability to enable the development and deployment of various decentralized solutions, including decentralized exchanges, lending and borrowing protocols as part of DeFi, etc.

Layer-1’s can be further categorized by their architectural differences or approaches to core blockchain functions, including execution, consensus, and settlement.

Source: Celestia Documentation

Monolithic: This includes L1’s such as Bitcoin and Solana, which handle the execution and settlement of transactions as well as the maintenance of consensus within a single layer.

Modular: This includes L1’s like Avalanche, Cosmos and recently Ethereum, with its rollup-centric roadmap. Modular blockchains separate these functions into distinct, specialized layers.

While these categories provide a high-level generalization, understanding the nuances and trade-offs between these categories of L1 networks is essential for comprehending the broader dynamics and potential of the decentralized ecosystem as it evolves. To get a deeper understanding of Layer-1s, we’ll take a data-driven look at how these networks span different approaches and provide innovative solutions to the underlying problems posed by decentralized networks.

The performance capabilities of L1 blockchains can be influenced by several technical factors such as their consensus mechanism, block size (amount of data that can fit in a block) and block time (time it takes to add a new block to the blockchain), to name a few. These factors can directly impact the transaction speed and network throughput of the L1 and therefore the user experience of the blockchain. Due to the unique design choices and architectural trade-offs of L1’s, these metrics do not serve as a direct comparison, but as a means to understand their technical differences.

Source: Coin Metrics Network Data Pro

Shorter average block times, as exhibited by Solana (approximately 0.4 seconds) and the Avalanche C-Chain (2 seconds), result in a faster execution of incoming transactions. This is particularly beneficial for high-frequency transactions such as financial trading on applications like decentralized exchanges (DEX’s), micro-transactions or gaming related interactions where speed is critical. Furthermore, AVAX-C and Ethereum also feature constant block times, which make for a very tight distribution around the average (with some outliers coming from missed blocks). On the other hand, Bitcoin and Litecoin have larger average block times (around 10 minutes for Bitcoin and 2.5 minutes for Litecoin), which prioritize network security over transaction speed.

Source: Coin Metrics Formula Builder

This same relationship can also be understood as a tradeoff between the ease of participation in the consensus process and the performance of the underlying network. This is evident when we consider the size of the blockchain as a function of the size and rate of creation of new blocks. Blockchains that have longer block times and “smaller” blocks, like Bitcoin, are easier to synchronize with as an independent node operator. Compared to Ethereum, the requirements are greater as the network performance requirements for including blocks on a faster basis add up to a larger download size and require a more performant computer and network infrastructure to maintain comparable oversight over the network as would be afforded.

A primary product of Layer-1 blockchains is blockspace. Users and applications access this valuable resource by paying fees, typically in the network’s native token (i.e., ETH on Ethereum). These transaction fees serve two crucial purposes: firstly, they disincentivize network spamming and secondly, they act as a subsidy or compensation for miners/validators responsible for constructing blocks. However, the specific construction of fee markets can vary across L1’s. While some blockchains like Ethereum employ an auction-based model where users bid for blockspace, others like Solana use a more static fee structure based on data size and computation required. These variations in fee structures mean that L1’s respond to changes in demand differently, thereby impacting the user experience of transacting on the blockchain.

Source: Coin Metrics Formula Builder

Solana hosts the lowest transaction fees among the L1’s depicted on the chart above. Although average fees rose to ~$0.059 recently due to increased congestion, its low fees make it one of the cheapest blockchains to transact on. The Avalanche X-chain, responsible for the transfer of AVAX, and the Avalanche C-chain where smart contracts reside, also have relatively low fees. The fee mechanism for Avalanche works similarly to Ethereum’s EIP-1559 with a dynamic base and priority fee that fluctuate based on the utilization of blockspace.

On the other hand, users on Ethereum have grappled with high transaction fees prior to the Dencun upgrade, which introduced an adjacent fee mechanism to price the use of blobspace. Although average fees on Ethereum L1 still remain relatively high (around $3), fees on Ethereum Layer-2 solutions are effectively costless. Bitcoin has typically seen average fees ranging between $1 to $4. However, on the day of its 4th halving, average fees surged to $124 due to a spike in demand for the newly released “Runes” protocol in the same block as the halving event.

Having grasped the technical capabilities and fee structures of various L1’s from a high level, we can delve into how they compare in terms of adoption and usage metrics. Active addresses (the count of unique addresses that were active in the network), have remained relatively flat for Bitcoin and Ethereum L1, at around 800K and 600K, respectively. Due to the existence of externally-owned accounts (EOA’s) and program-derived accounts (PDA’s) on Solana, the active address count can be misleading. However, unique wallets on Solana rose to 1.2M in March, before tapering off to ~900K. Other L1’s like Avalanche and Cardano have seen spikes, but have failed to sustain high levels of activity.

Source: Coin Metrics Formula Builder

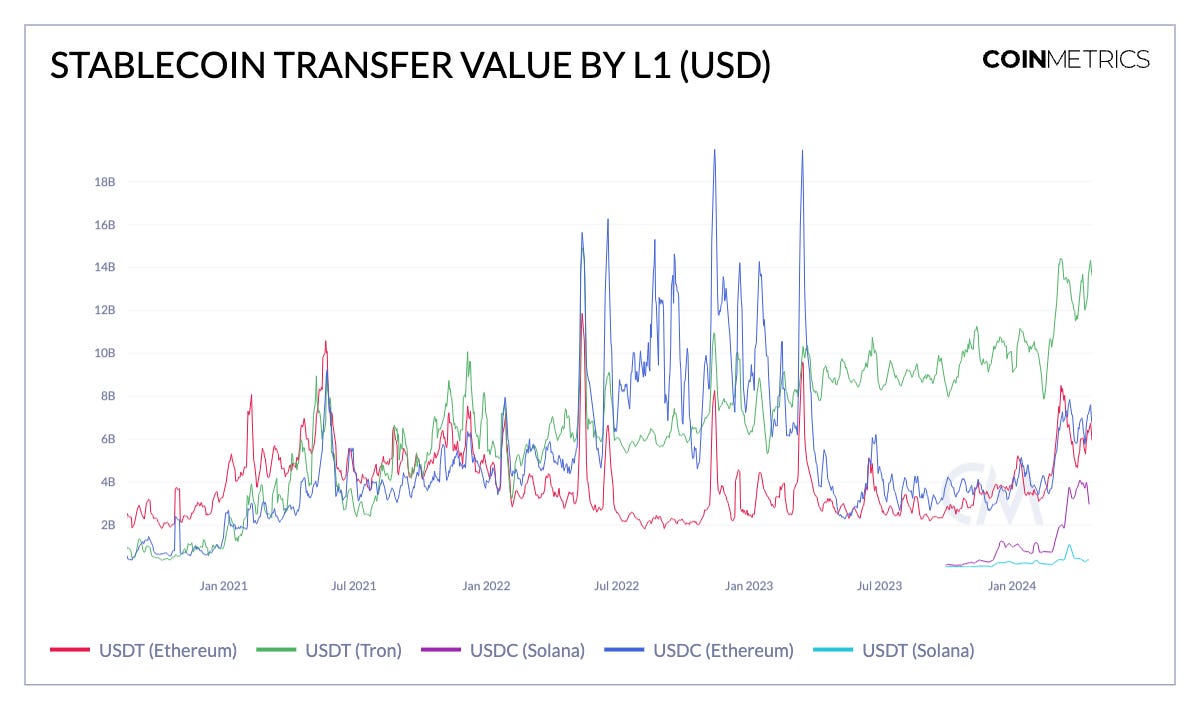

With stablecoins starting to proliferate across various L1’s, the value transferred in each stablecoin provides a crucial proxy for their usage across these blockchains. Tether (USDT) has maintained a strong footing on Tron due to its low fees and proclivity to emerging markets, with an adjusted transfer value of $14B and a median transfer value of $312.

Source: Coin Metrics Formula Builder

This is followed by USDC and USDT on Ethereum currently displaying a transfer value of ~$6B, with median transfers of ~$800 and ~$1000, respectively. With the re-emergence of the Solana ecosystem, USDC has also gained traction on the blockchain, with an adjusted transfer value of $3B. Due to its low fees, the median transfer value of stablecoins on Solana are the lowest—$20 for USDC and $75 for USDT, respectively.

Adoption and usage metrics provide insights into the traction of different L1 networks. Bitcoin and Ethereum L1 have maintained relatively stable active address counts, while Solana has seen growth in unique wallets. Stablecoins like Tether (USDT) and USDC have gained significant traction on various L1s, with Tron leading in USDT usage due to its low fees and appeal to emerging markets.

The landscape of Layer-1 blockchain networks has significant implications for the broader crypto ecosystem. As we have seen, L1 networks can be categorized based on their specialization (transaction settlement vs. general-purpose platforms) and their architectural approaches (monolithic vs. modular). These differences lead to variations in network performance, fee structures, and adoption metrics.

As the crypto ecosystem continues to evolve, understanding the nuances and trade-offs between different L1 networks will be crucial for comprehending the broader dynamics and potential of the decentralized ecosystem. The emergence of new L1s and the evolution of existing networks highlight the ongoing innovation and competition in the space, ultimately benefiting users and driving the growth of the decentralized economy.

Check out our Layer-1 Dashboard, which displays several metrics across the L1 landscape.

Source: Coin Metrics Network Data Pro

Following the Bitcoin network’s halving, we saw a rise in speculation around Ordinals and Runes that were being minted shortly thereafter, which brought a rapid rise in fees being paid to miners, with block #840,000 being worth around $2.5M in block rewards and fees.

This week’s updates from the Coin Metrics team:

-

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

© 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.

Read More: coinmetrics.substack.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  Litecoin

Litecoin  WETH

WETH  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Uniswap

Uniswap  Aave

Aave  Bittensor

Bittensor  Ethena Staked USDe

Ethena Staked USDe  Cronos

Cronos  OKB

OKB  Aptos

Aptos  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Ondo

Ondo  Ethereum Classic

Ethereum Classic