In July, Kraken reinforced its dominance as the top platform for altcoin trading in the US.

Kaiko reports reveal that Kraken commanded nearly 50% of the market depth for the top 10 altcoins.

On Aug. 9, Kaiko’s research analyst, Dessislava Ianeva, spotlighted Kraken’s significant altcoin market influence.

Known for its impressive euro volume and liquidity, Kraken supports trading over 100 cryptocurrencies and seven fiat currencies. Founded in 2011 and launched in 2013, Kraken caters to over 8 million traders and institutional clients. Its prominence has grown, particularly after Binance and Coinbase faced SEC allegations.

Such allegations triggered tighter global regulations. Notably, Ethereum (ETH) co-founder Vitalik Buterin transferred $723,000 from Binance to Kraken shortly before the lawsuit announcement.

After Binance revealed its exit from Canada, Kraken confirmed its commitment to stay, contributing to its growth.

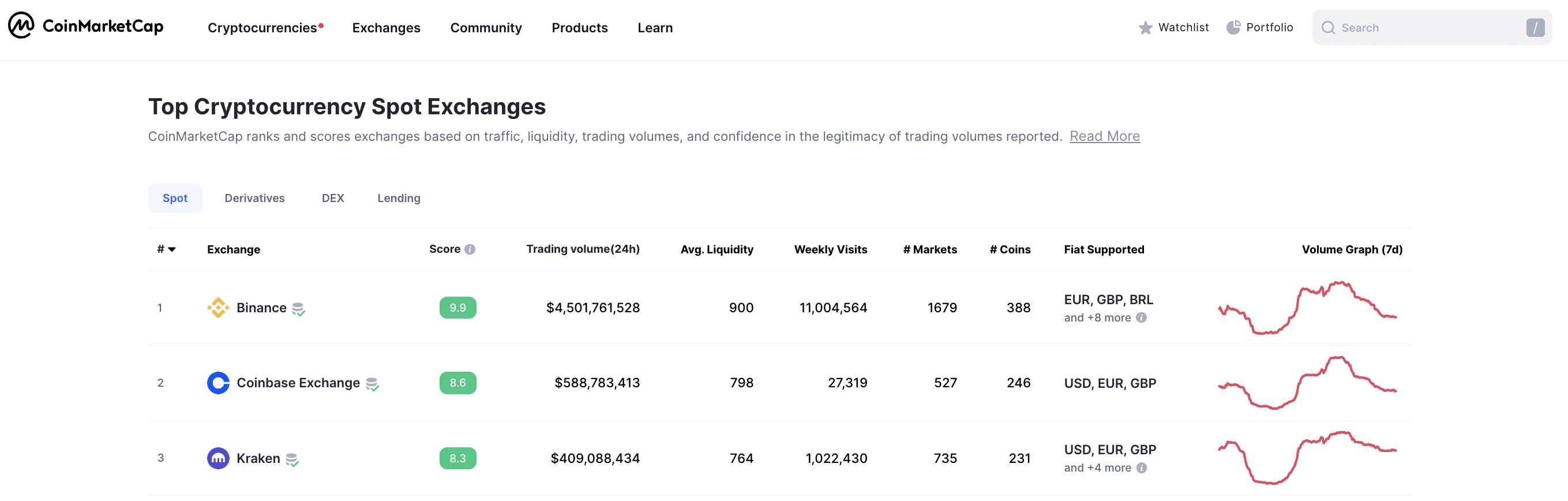

CoinMarketCap data indicates that while Kraken dominates the US altcoin market, Binance and Coinbase rank higher in trading volume and liquidity.

Binance boasts a 24-hour trade volume of $4,501,761,528, whereas Kraken’s is $409,088,434.

Altcoins show greater performance

July was a promising month for altcoins. A Bloomberg report from July 14 highlighted that altcoins like Solana (SOL) and Avalanche (AVAX) outperformed Bitcoin (BTC) after a federal court decision favoring Ripple Labs.

Given that XRP wasn’t considered a security, it bolstered investor confidence in altcoins, especially in the US.

Read More: crypto.news

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Hedera

Hedera  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  Pepe

Pepe  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Ethena USDe

Ethena USDe  USDS

USDS  Aptos

Aptos  Aave

Aave  Mantle

Mantle  Bittensor

Bittensor  Virtuals Protocol

Virtuals Protocol  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Render

Render  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  MANTRA

MANTRA  Arbitrum

Arbitrum  Tokenize Xchange

Tokenize Xchange  Ethena

Ethena  WhiteBIT Coin

WhiteBIT Coin