[ad_1]

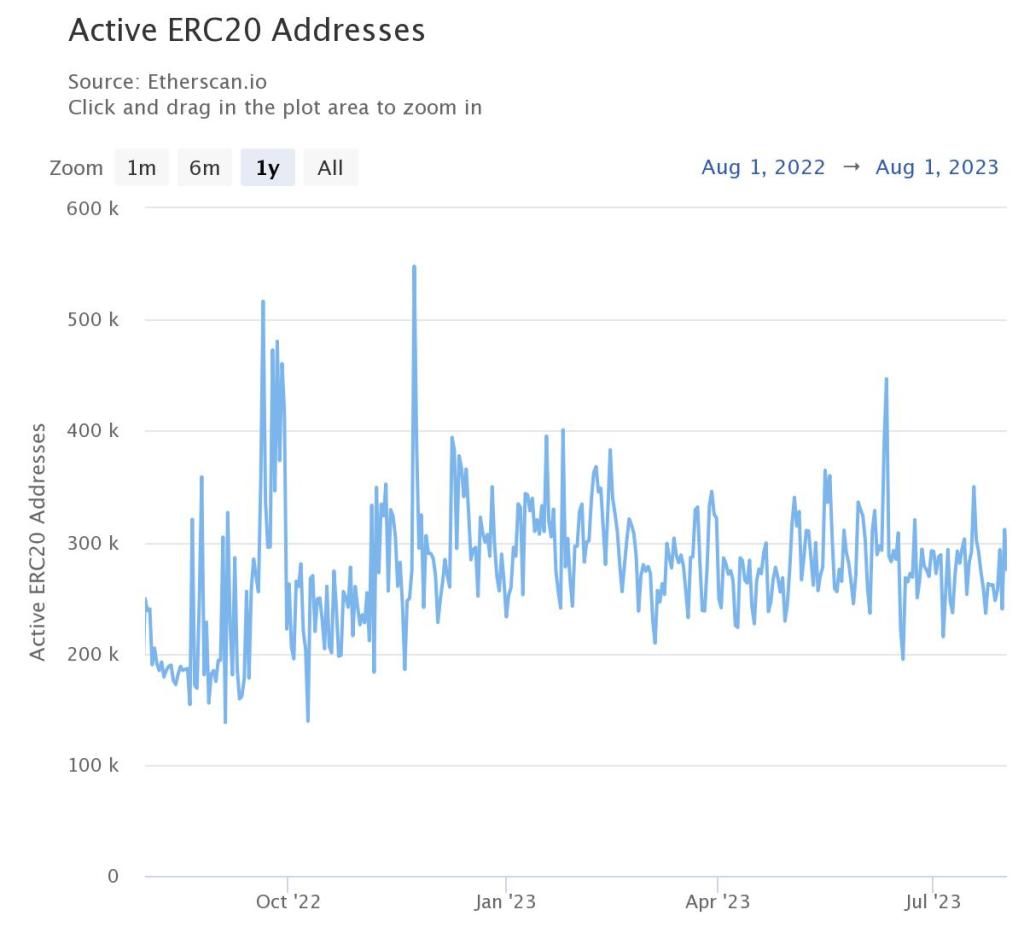

According to Etherscan data, the number of active ERC-20 addresses has not changed much in 2023. It has stayed between 200,000 and 300,000 while Ethereum prices stagnate below July 2023 highs. As of August 2, there were about 275,000 active ERC-20 addresses, up from 156,000 on June 18. Although activity has been low overall, there was a significant increase on June 11, with over 446,000 active ERC-20 addresses.

Ethereum’s price trajectory has been tumultuous in tandem with this activity pattern, looking at the charts. For instance, Ethereum bulls have failed to breach the $2,100 liquidation level posted in the latter stages of H1 2023.

Ethereum Prices Volatile, Few Coins Burned

At the moment, ETH prices hover around the $1,800 range, teetering precariously and likely to drop, looking at candlestick arrangements in the daily chart. Although Ethereum has been bullish in the past two months, bulls have been tamed, and a drop below the $1,800 level may signal a shift from bullish to bearish in the medium term.

With ETH under pressure, the number of active ERC-20 addresses remains constant and relatively lower than the 2021 peaks. This means there is less demand for ETH, which is used to pay transaction fees. As a result, gas fees are lower because there is less competition for block space. Typically, this would encourage more people to participate and even deploy complex contracts in decentralized finance (DeFi).

With EIP-1559 in the equation, low activity means fewer coins are taken out of circulation. Despite low network activity, the protocol continues to issue 2 ETH after each validated block, watering down deflationary effects enforced by EIP-1559.

DeFi Activities Falling

Falling activity could be attributed to the waning interest in decentralized finance (DeFi) activities over recent months. As of August 2, the total value locked (TVL) remains below $50 billion, with a significant portion of assets tied in Ethereum. DeFi projects like LidoDAO, Curve, and Uniswap facilitate the trading of ERC-20 tokens.

Furthermore, on-chain data highlights USDT as the most actively transacted token. Given its position as the third-largest coin by market cap, with substantial circulation in Ethereum and Tron networks, such a trend is expected.

Looking back at ERC-20 transactions from June and July, it is evident that transfers stayed constant despite temporary price increases. Ethereum prices rose from $1,630 to $2,000 between mid-June and mid-July 2023, but ETH is now lower.

On-chain ERC-20 activity has remained stable despite price volatility. It’s unclear whether there will be a change in activity as prices continue to drop. However, lower prices may force token holders to wait and see, leading to less activity.

Feature image from Canva, chart from TradingView

[ad_2]

Read More: www.newsbtc.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Shiba Inu

Shiba Inu  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  Cronos

Cronos  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic