The post Jack Dorsey Reacts on FTX Saga! Reveals Shocking Truth About Sam Bankman-Fried appeared first on Coinpedia Fintech News

Former FTX CEO Sam Bankman-Fried has received a significant share of criticism following the sudden collapse of the FTT token and its subsidiaries. With a congressional hearing on FTX collapse slated for next month, Bitcoin maximalists have taken to the social media stages to advocate for its prowess.

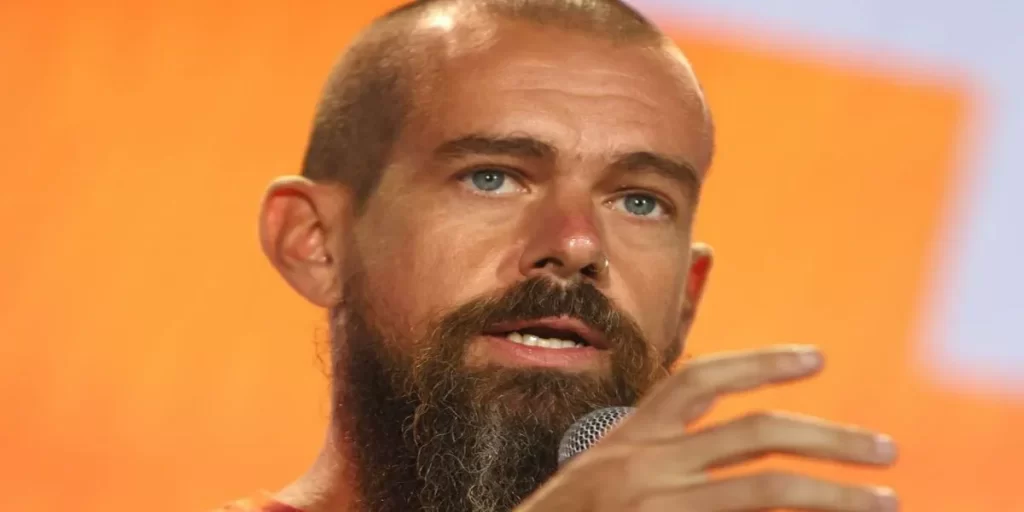

Jack Dorsey – a Bitcoin supporter and advocate – has expressed his disapproval of SBF and FTX’s approach to the digital market. While reiterating the old crypto slang ‘trust no one, ‘ Dorsey admitted that SBF approached him a few days before the FTX meltdown.

However, Dorsey indicated that he reported the text messages as junk to the network provider and Apple team. As such, the conversation did not continue from there, per the public report.

According to a report by Reuters, SBF spent the night before filing for chapter 11 bankruptcy calling deep-pocketed investors to bail out FTX. Among the listed investors requested to cough over $7 billion include Sequoia Capital, Apollo Global Management Inc, and TPG Inc.

Nonetheless, the investors declined SBF’s request, citing gross anomalies in the company’s balance sheet. Moreover, FTX was doing ‘well’ per the public quarterly earnings report until the second quarter of 2022, when the company recorded a net loss of over $161 million.

While SBF, FTX, and Alameda continue to hide behind men in suits through the Delaware court proceedings, an estimated 1 million customers and investors are counting significant losses. Moreover, SBF reportedly used $10 billion in customer funds to prop up its trading business.

While his operations remain unclear, it is reported that SBF used an estimated $40 million to sponsor the 2022 midterm elections in the United States.

Bigger Picture on FTX Meltdown

The FTX meltdown has been a blessing and curse to the cryptocurrency market simultaneously. For instance, rival companies Coinbase Global and Binance crypto exchanges have come together via Trust Wallet to enable safe and fast adoption of Web3 technology.

On the other side, confidence in the crypto market has been severely shaken, despite an ongoing investigation by the U.S. Department of Justice, the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC).

Meanwhile, bearish sentiments have sustained in the crypto market, led by Bitcoin price in the past two weeks. According to our latest crypto price oracles, Bitcoin price is down approximately 1.3 percent in the past 24 hours to trade around $16,500.

Read More: bitcoinwarrior.net

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Cardano

Cardano  Dogecoin

Dogecoin  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Lombard Staked BTC

Lombard Staked BTC  Pi Network

Pi Network  Wrapped Bitcoin

Wrapped Bitcoin  LEO Token

LEO Token  Stellar

Stellar  USDS

USDS  Chainlink

Chainlink  Hedera

Hedera  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  MANTRA

MANTRA  Polkadot

Polkadot  Ethena USDe

Ethena USDe  WETH

WETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Hyperliquid

Hyperliquid  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  sUSDS

sUSDS  Dai

Dai  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Internet Computer

Internet Computer  Aave

Aave  Gate

Gate  OKB

OKB  Mantle

Mantle  Coinbase Wrapped BTC

Coinbase Wrapped BTC