Get the best data-driven crypto insights and analysis every week:

By: Matías Andrade Cabieses & Tanay Ved

Key Takeaways:

-

The comprehensive exchange flow metrics introduced by Coin Metrics offer a valuable tool for analyzing liquidity, miner involvement, and overall supply and balance information for the cryptocurrency exchange ecosystem.

-

Analyzing the inflows and outflows of Bitcoin (BTC) and Ethereum (ETH) to and from centralized exchanges provides valuable insights into investor behavior, market liquidity, and the overall health of the digital asset market.

-

Miner flows to exchanges have seen an uptick this year, with a notable increase from Kraken and Binance, potentially due to miners securing profits or building cash reserves in anticipation of the Bitcoin halving event.

-

Crypto.com has experienced a significant increase in its market share of spot BTC traded volume, and by analyzing the relationship between flows and volumes, investors and analysts can better understand the health and dynamics of the cryptocurrency market.

-

Focusing on the organic nature of market activity, by aligning flows and volumes, can help investors make more informed decisions and mitigate the risks associated with non-organic or manipulative trading practices.

The inflows and outflows of BTC and ETH to and from exchanges offer a window into the broader cryptocurrency ecosystem. By analyzing these exchange flows, we can gain valuable insights into investor behavior, market liquidity, and the overall health of the digital asset market. This information can be particularly useful for traders, investors, and market analysts seeking to make informed decisions about exchanges and the broader digital asset market, and identify potential trends or market signals.

In this week’s issue of Coin Metrics’ State of the Network, we explore our new product that analyzes flows of Bitcoin (BTC) and Ethereum (ETH) to and from centralized exchanges. Understanding the dynamics of these exchange flows can provide crucial insights into the market sentiment, trading activity, and potential price movements of these digital assets.

In the following sections, we discuss the insights that can be gleaned from the analysis of BTC and ETH exchange flows. We explore the historical trends, seasonal patterns, and key events that have influenced the movements of these assets across exchanges.

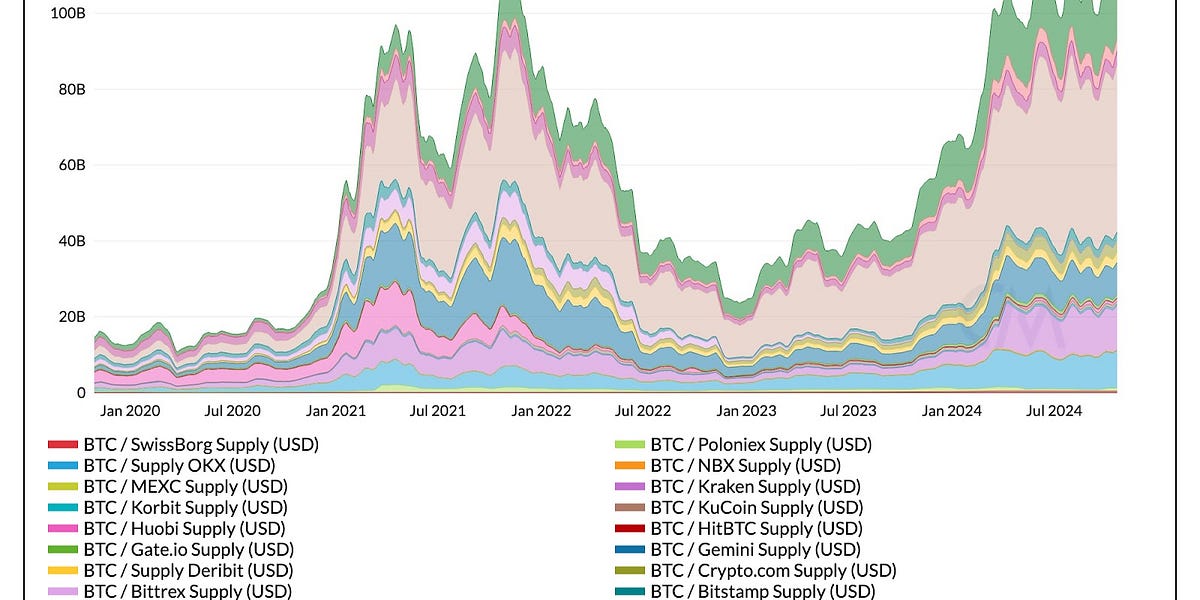

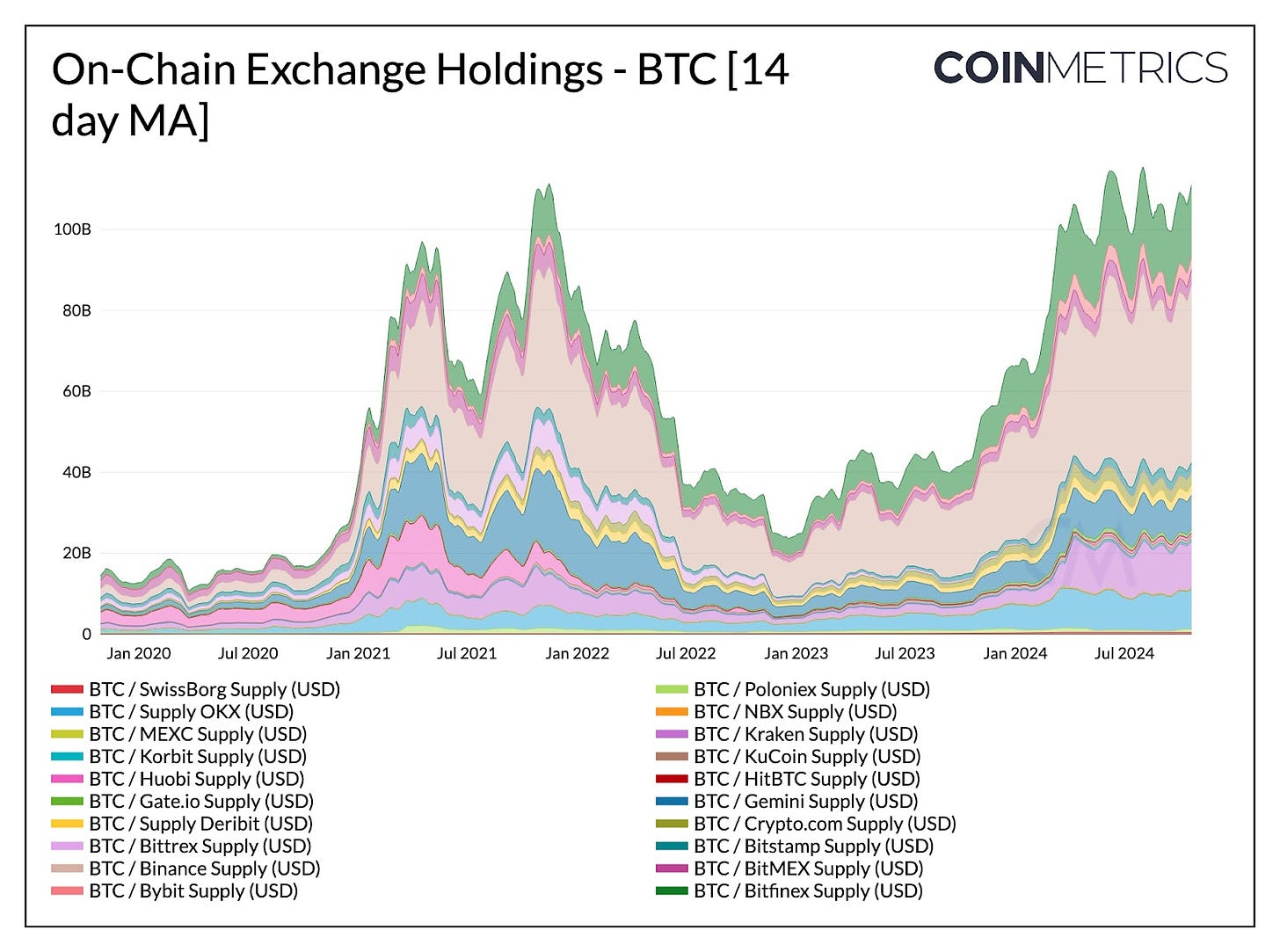

The exchange flow metrics introduced by Coin Metrics track the inflows and outflows to various cryptocurrency exchanges, including in/outflows from miners, net balances and also the total supply of assets held by these exchanges. These metrics cover exchanges such as Binance (BNB), Crypto.com (CRO), Deribit (DER), Gate.io (GIO), Huobi (HBT), Kucoin (KCN), Korbit (KOR), MEXC (MXC), NBX, OKX, and Swissborg (SBG) and others, encompassing 20 exchanges in total.

The specific metrics provided include inflows and outflows for each exchange, both in the native token and USD, for both BTC and ETH. There are also miner inflow and outflow metrics, tracking the movement of funds to and from miners for each exchange. The net balance metrics show the net position for each exchange in both the native token and USD. Additionally, the dataset includes transfer count metrics, which provide the number of transfers into and out of each exchange. Finally, the supply metrics detail the total supply of the native token and USD for each exchange.

Source: Coin Metrics Network Data Pro

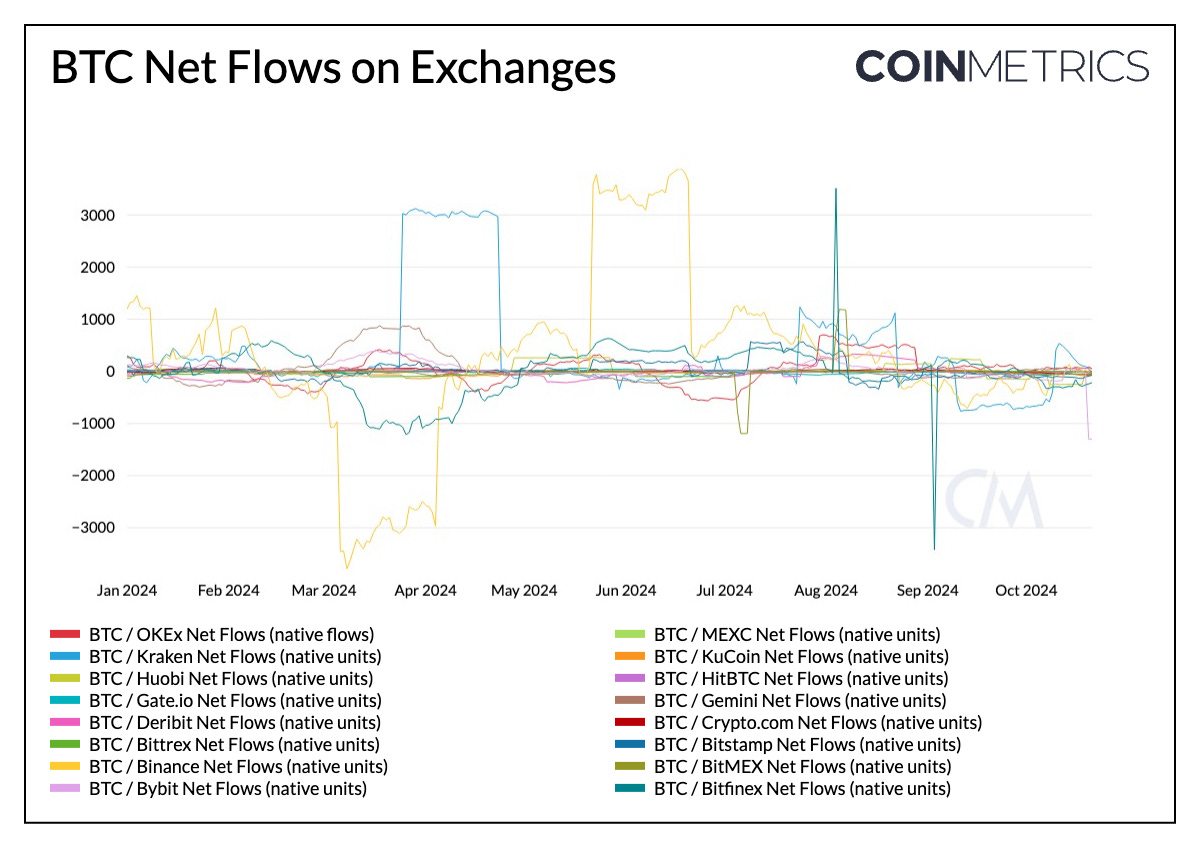

Net flow metrics illustrate the movement patterns of Bitcoin across major exchanges, providing a clearer view into market participant behavior. The metrics are particularly valuable for monitoring significant market events such as Mt. Gox creditor repayments (which have been postponed to October 2025) and notable flow variations visible in periods like the March-April Binance movements and August Bitfinex spike, helping participants track movements that influence overall market dynamics.

Source: Coin Metrics Network Data Pro

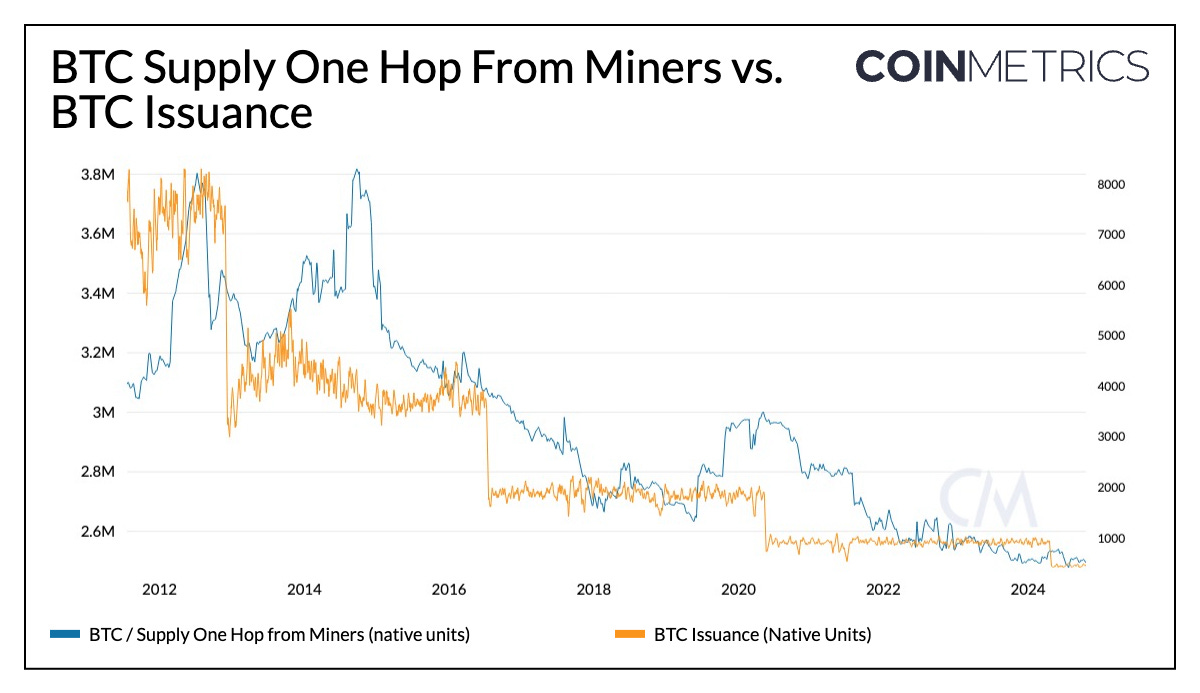

By examining flows, we can better understand miner behavior with regards to Bitcoin’s halving cycles—helping identify periods of BTC accumulation or distribution. While “0-hop” addresses typically identify mining pools as direct recipients of mining rewards (new BTC issuance and transaction fees), “1-hop” addresses often represent individual miners to whom pools distribute earnings. To dive deeper into the relationship between these entities, check out “Following Flows V: Pool Cross Pollination”.

Source: Coin Metrics Network Data Pro

Therefore, activity of 1-hop addresses can help gauge miner sentiment and their influence on market supply and demand. With BTC’s block subsidy halving and issuance reduction roughly every 4 years, there’s a long term decline in BTC supply held 1-hop from miners, currently at 2.5M BTC. This suggests that miners are retaining less of their newly mined coins and potentially distributing them due to economic pressures or for operational strategies with each halving.

Source: Coin Metrics Network Data Pro

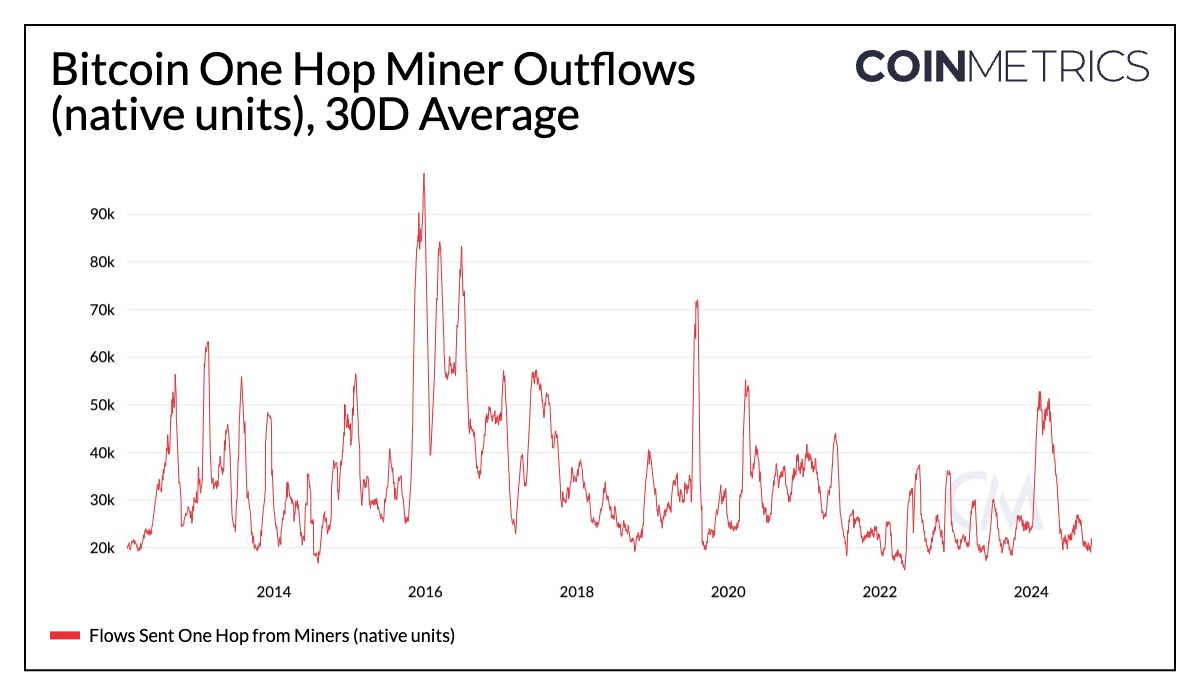

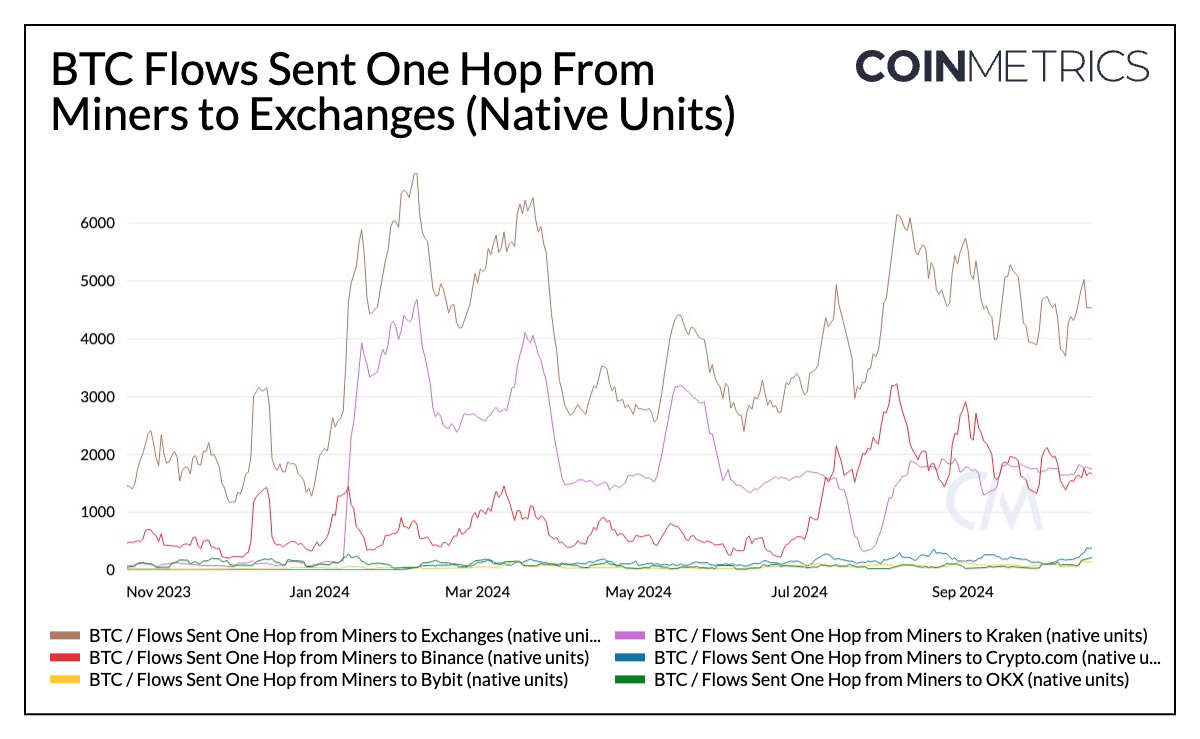

As a result, BTC total flows sent 1-hop from miners and to exchanges have seen an uptick this year, with a high of 59K and 6.8K respectively. Interestingly, the rise occurs 2-3 months before and after the halving, as miners may be securing profits or building cash reserves in anticipation of slashed revenues or gradually realizing the full economic impact of the halving. A notable increase stems from Kraken, representing over 85% of inflows in February as well as Binance, accounting for a high of~3200 BTC (a 60% share of inflows) in early August.

Source: Coin Metrics Network Data Pro

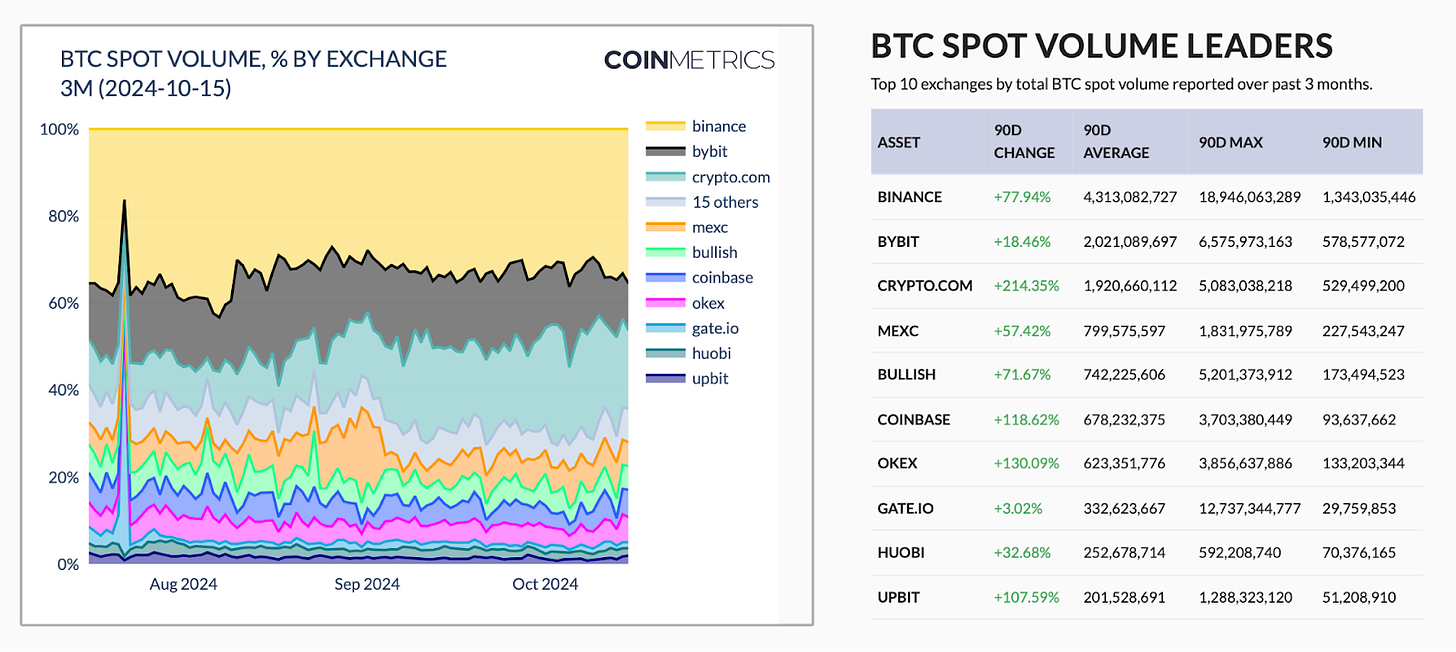

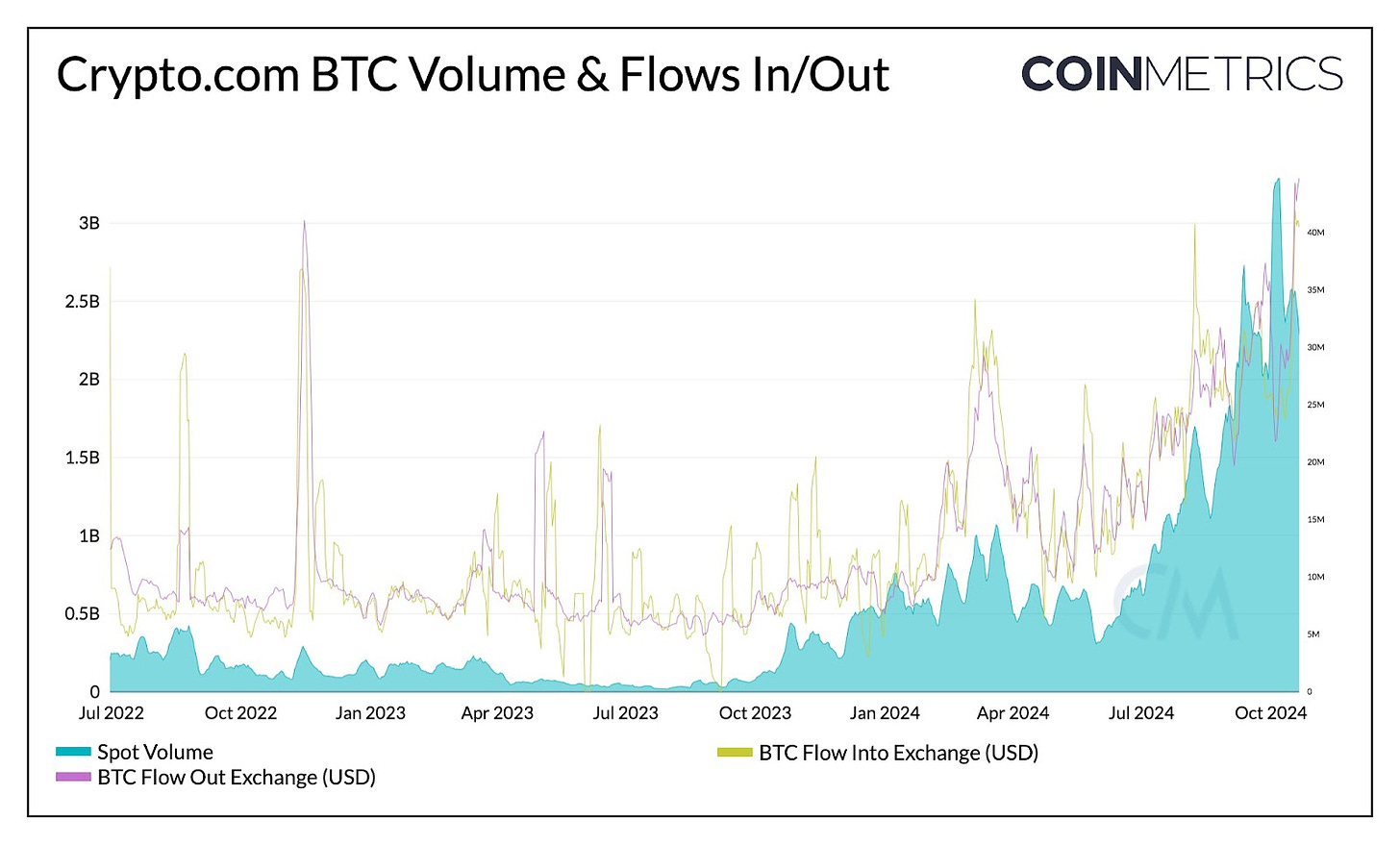

A recent trend in exchange dominance has been taking place over the last few months, with Crypto.com increasing their market share of spot BTC traded volume quite significantly, by over 200% over the last 90 days, this now puts it on the top 3 BTC spot volume leaders tracked by Coin Metrics.

Source: Coin Metrics State of the Market

One of the ways we can use the new flow metrics is to validate whether the activity taking place in an exchange is organic. By comparing the spot BTC volumes traded (in USD) and the BTC flows (similarly priced in BTC), we can gain valuable insights into the nature of the market activity.

Flows, which represent the net movement of BTC in and out of an exchange, are directly aligned with the underlying trading volumes. If the flows are in line with the volumes, it suggests that the activity is organic, meaning that the trades are driven by genuine market demand and not by artificial or manipulative practices. Conversely, if the flows and volumes are misaligned, it could indicate the presence of non-organic activity, such as wash trading or other forms of market manipulation.

Source: Coin Metrics Market Data Feed & Network Data Pro

By analyzing the relationship between flows and volumes, investors and analysts can better understand the health and dynamics of the cryptocurrency market. This information can be particularly useful when assessing the reliability of price movements and trading activity, as it helps to distinguish between genuine market activity and potentially artificial or manipulated behavior. By focusing on the organic nature of the market, investors can make more informed decisions and mitigate the risks associated with non-organic activity.

The analysis of Bitcoin and Ethereum exchange flows metrics provided by Coin Metrics offers a powerful tool for investors, traders, and market analysts to gain crucial insights into the cryptocurrency ecosystem. By understanding the dynamics of inflows and outflows, miner behaviors, and the relationship between trading volumes and organic market activity, stakeholders can make more informed decisions and better navigate the complexities of the digital asset market. The comprehensive data and metrics presented in this report illustrate the value of data-driven analysis in the rapidly evolving cryptocurrency landscape, empowering market participants to identify trends, mitigate risks, and capitalize on emerging opportunities.

Source: Coin Metrics Network Data Pro

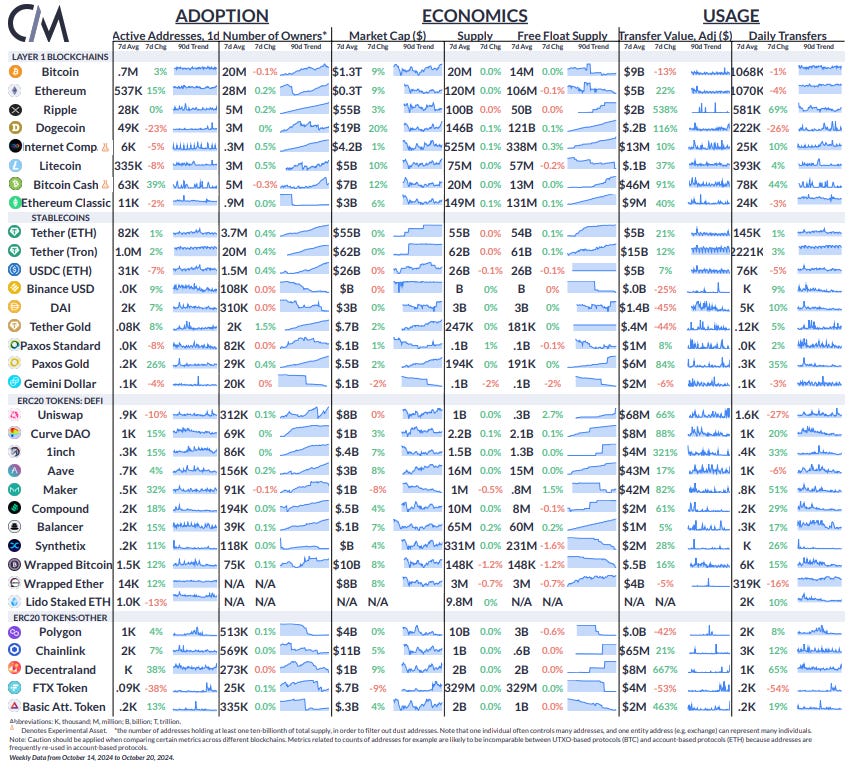

The market capitalization of Bitcoin and Ethereum saw a 9% increase over the past week, as Bitcoin rallied towards $70K for the first time since July. Ethereum’s daily active addresses rose by 15%, while several other ERC-20’s experienced heightened activity amid strong market momentum.

This week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here.

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

© 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.

Read More: coinmetrics.substack.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Shiba Inu

Shiba Inu  Hyperliquid

Hyperliquid  Hedera

Hedera  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Litecoin

Litecoin  Polkadot

Polkadot  USDS

USDS  WETH

WETH  Pi Network

Pi Network  Monero

Monero  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Pepe

Pepe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Uniswap

Uniswap  Dai

Dai  NEAR Protocol

NEAR Protocol  Aave

Aave  Aptos

Aptos  OKB

OKB  Ondo

Ondo  Jito Staked SOL

Jito Staked SOL  Cronos

Cronos  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund