By Francisco Rodrigues (All times ET unless indicated otherwise)

The U.S. inflation report due later today might shift bitcoin (BTC) out of the doldrums that have mired it this week.

In recent years, the January figure has tended to show significant price hikes. Last year, for example, the month’s data put an end to a series of lower readings, repeating a pattern also seen in 2023. That’s because businesses often evaluate their costs and raise prices at the start of the year, as the Wall Street Journal points out.

A higher-than-expected inflation report could suggest “monetary policy has more work to do” Dallas Fed President Lorie Logan said in a speech last week. The Federal Reserve has already indicated it isn’t rushing to adjust interest rates after 100 basis points of reductions last year.

Also playing into the consideration are the Trump administration’s tariffs, with the Federal Reserve Bank of Boston pointing to a potential rise as high as 0.8% to core PCE, the inflation measure the Fed focuses on. Still, in 2018 and 2019 tariffs had negligible effects.

On the other hand, a soft inflation report could be beneficial for risks assets including bitcoin. A lower-than-expected figure will probably raise interest-rate cut expectations, potentially weakening the U.S. dollar index and lowering Treasury yields, CoinDesk’s Omkar Godbole has reported.

Meanwhile, demand for the largest cryptocurrency holds strong. Just this week, Japanese mobile-game studio Gumi revealed plans to accumulate around $6.6 million worth of BTC, while KULR Technology Group increased its crypto holdings to 610.3 bitcoin.

Similarly, Goldman Sachs’ 13F filing shows the banking giant significantly increased its exposure to spot bitcoin and ether ETFs in the fourth quarter. And don’t forget Strategy’s near-weekly bitcoin purchases.

Bitcoin’s Coinbase premium, which measures the difference between BTC’s price on the U.S. exchange and Binance, recently turned negative, suggesting U.S. traders are cautious about the upcoming inflation report.

The caution comes amid growing headwinds for the crypto market, which may have reached the top of its cycle. Research firm BCA Research has recently shared a note with clients suggesting the record ETF inflows and the memecoin craze are warning signals.

Warning signals are present elsewhere, with a recent JPMorgan report pointing out that crypto ecosystem growth slowed last month, while total trading volumes dropped 24%. Activity is nevertheless ahead of where it was before the U.S. elections. Stay alert!

What to Watch

- Crypto:

- Macro

- Feb. 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases January’s Consumer Price Index (CPI) report.

- Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.2%

- Core Inflation Rate YoY Est. 3.1% vs Prev. 3.2%

- Inflation Rate MoM Est. 0.3% vs. Prev. 0.4%

- Inflation Rate YoY Est. 2.9% vs. Prev. 2.9%

- Feb. 12, 10:00 a.m.: Fed Chair Jerome Powell presents his semi-annual report to the U.S. House Committee on Financial Services. Livestream link.

- Feb. 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases January’’s Producer Price Index (PPI) report.

- Core PPI MoM Est. 0.3% vs. Prev. 0%

- Core PPI YoY Est. 3.3% vs. Prev. 3.5%

- PPI MoM Est. 0.3% vs. Prev. 0.2%

- PPI YoY Prev. 3.3%

- Feb. 13, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims report for the week ended Feb. 8.

- Initial Jobless Claims Est. 216K vs. Prev. 219K

- Feb. 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases January’s Consumer Price Index (CPI) report.

- Earnings

- Feb. 12: Hut 8 (HUT), pre-market, $0.05

- Feb. 12: IREN (IREN), post-market, $-0.01

- Feb. 12: Reddit (RDDT), post-market, $0.25

- Feb. 12: Robinhood Markets (HOOD), post-market, $0.41

- Feb. 13: Coinbase Global (COIN), post-market, $1.89

- Feb. 14: Remixpoint (TYO: 3825)

- Feb. 18: CoinShares International (STO: CS), pre-market

- Feb. 18: Semler Scientific (SMLR), post-market

Token Events

- Governance votes & calls

- Morpho DAO is discussing a 25% reduction in MORPHO rewards on both Ethereum and Base after another reduction took effect on Jan. 30.

- DYdX DAO is voting on the dYdX Treasury subDAO taking control over the stDYDX within the protocol’s Community Treasury and any tokens accrued through auto compounding staking rewards.

- Curve DAO is voting on increasing 3pool’s amplification coefficient to 8,000 over 30 days and raise admin fees to 100%. To optimize liquidity, as part of an experiment, 3pool will have higher fees while Strategic Reserves will offer lower fees.

- Feb. 12 2 p.m. : Render (RENDER) to host an AI Scout Discord AMA session.

- Unlocks

- Feb. 12: Aethir (ATH) to unlock 10.21% of circulating supply worth $23.80 million.

- Feb. 14: The Sandbox (SAND) to unlock 8.4% of circulating supply worth $80.2 million.

- Feb. 16: Arbitrum (ARB) to unlock 2.13% of circulating supply worth $42.93 million.

- Feb. 21: Fast Token (FTN) to unlock 4.66% of circulating supply worth $78.8 million.

- Token Launches

Conferences:

CoinDesk’s Consensus to take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Token Talk

By Shaurya Malwa

- The Central African Republic’s CAR token is down 95% from Monday’s peak prices, with a market capitalization now around $40 million.

- CAR was issued late Sunday and promoted by the republic’s President

Faustin-Archange Touadéra as an asset that could help fund public facilities in the impoverished nation. - Touadéra claimed proceeds from CAR token are being used to rebuild and furnish a high school, whose details are not yet public.

This high school has been deteriorating rapidly over the past few years, putting students at risk of losing their access to education. With the help of the $CAR meme, we are able to support the rebuilding and furnishing of the school, giving students a chance for a better future. pic.twitter.com/iFPsBPrSoi

— Faustin-Archange Touadéra (@FA_Touadera) February 10, 2025

Market Movements:

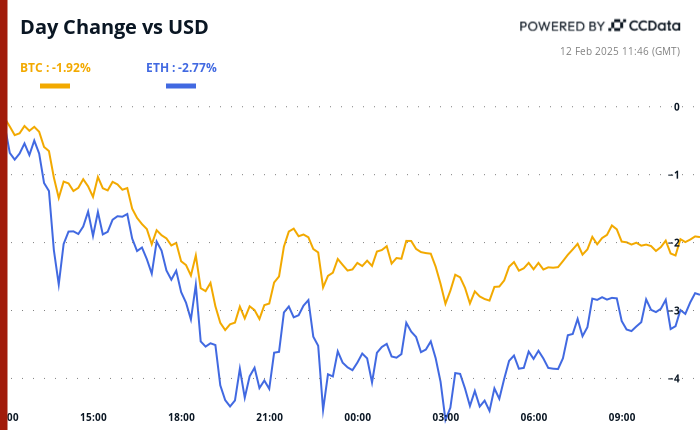

- BTC is down 0.4% from 4 p.m. ET Tuesday to $96,029.62 (24hrs: -1.97%)

- ETH is down 0.17% at $2,619.27 (24hrs: -2.87%)

- CoinDesk 20 is up 0.66% to 3,178.54 (24hrs: -2.74%)

- Ether CESR Composite Staking Rate is up 5 bps to 3.1%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is unchanged at 107.99

- Gold is down 0.15% at $2908.1/oz

- Silver is down 0.22% to $32.16/oz

- Nikkei 225 closed up 0.42% at 38,963.7

- Hang Seng closed +2.64% at 21,857.92

- FTSE is unchanged at 8,781.91

- Euro Stoxx 50 is up 0.1% to 5,396.36

- DJIA closed Tuesday +0.28% at 44,593.65

- S&P 500 closed unchanged at 6,068.5

- Nasdaq closed -0.36% at 19,643.86

- S&P/TSX Composite Index closed -0.11% at 25,631.8

- S&P 40 Latin America closed +0.65% at 2,444.58

- U.S. 10-year Treasury rate was up 1 bps at 4.54%

- E-mini S&P 500 futures are down 0.16% to 6,082.5

- E-mini Nasdaq-100 futures are unchanged at 21,777

- E-mini Dow Jones Industrial Average Index futures are down 0.21% at 44,616

Bitcoin Stats:

- BTC Dominance: 61.32% (+0.06%)

- Ethereum to bitcoin ratio: 0.02728 (+0.33%)

- Hashrate (seven-day moving average): 800 EH/s

- Hashprice (spot): $53.56

- Total Fees: 5.25 BTC / $505,060

- CME Futures Open Interest: 167,470 BTC

- BTC priced in gold: 33.1 oz

- BTC vs gold market cap: 9.4%

Technical Analysis

- Dogecoin reaches a critical point support and resistance at 25 cents, with prices coiling around that level since Feb.3.

- Traders may watch DOGE’s Moving Average Convergence Divergence (MACD) indicator, which tracks the relative changes in prices across specific time periods.

- The indicator is trending upward with net buying volumes since Feb. 3, indicative of a rally if the MACD line crosses above zero.

Crypto Equities

- MicroStrategy (MSTR): closed on Tuesday at $319.46 (-4.53%), up 0.82% at $322.30 in pre-market.

- Coinbase Global (COIN): closed at $266.90 (-4.75%), up 0.88% at $269.25 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$26.54 (-2.57%)

- MARA Holdings (MARA): closed at $16.02 (-4.42%), up 1% at $16.18 in pre-market.

- Riot Platforms (RIOT): closed at $11.14 (-4.21%), up 0.81% at $11.23 in pre-market.

- Core Scientific (CORZ): closed at $12.26 (-4.37%), up 0.24% at $12.29 in pre-market.

- CleanSpark (CLSK): closed at $10.28 (-8.05%), up 0.39% at $10.32 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.34 (-4.94%), up 0.12% at $22.46 in pre-market.

- Semler Scientific (SMLR): closed at $46.98 (-5.3%), unchanged in pre-market.

- Exodus Movement (EXOD): closed at $49.16 (-3.95%), unchanged in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$56.7 million

- Cumulative net flows: $40.46 billion

- Total BTC holdings ~ 1.174 million.

Spot ETH ETFs

- Daily net flow: $12.6 million

- Cumulative net flows: $3.17 billion

- Total ETH holdings ~ 3.785 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

- Ethereum has dropped down to 17th in terms of weekly revenues across all blockchains and applications, with a relatively small $7 million pocketed by network validators.

While You Were Sleeping

- Bitcoin May See Gains from Soft U.S. CPI, Major Risk-On Surge in BTC Appears Unlikely (CoinDesk): Bitcoin and other risk assets may get a boost if today’s CPI report shows soft inflation, but Trump’s tariffs are likely to curb further rate cuts and put the brakes on a sustained rally.

- Trump to Tap Former CFTC Commissioner, a16z Policy Head Brian Quintenz for CFTC Head (CoinDesk): Brian Quintenz, a former commissioner of the Commodity Futures Trading Commission (CFTC) and a crypto advocate, has reportedly been chosen by President Trump to be the agency’s chairman.

- Crypto Custody Firm BitGo Said to Weigh IPO as Soon as This Year (Bloomberg): Crypto custodian BitGo is considering an IPO for the second half of 2025, joining firms such as Gemini and Kraken, which are also expected to go public this year.

- Why Today’s Inflation Report Is Especially Important (The Wall Street Journal): January’s U.S. inflation data — with the CPI released today, PPI tomorrow, and PCE on Feb. 28 — is important for predicting the Fed’s monetary policy because businesses typically raise prices at the start of the year.

- Stocks Steady; Sanguine Powell Knocks Bonds and Gold (Reuters): Fed Chari Powell’s Senate testimony on Tuesday, downplaying rate-cut urgency unless inflation falls or job market weakens, boosted Treasury yields and the dollar, while sending oil and gold prices lower.

- China’s Tech Stocks Enter Bull Market After DeepSeek Breakthrough (Financial Times): Chinese tech stocks have surged 20% in one month after DeepSeek’s AI breakthrough revived investor confidence in internet companies, helping the Hang Seng Tech index to outpace the Nasdaq 100.

In the Ether

Read More: www.coindesk.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Uniswap

Uniswap  Aave

Aave  Bittensor

Bittensor  Ethena Staked USDe

Ethena Staked USDe  Cronos

Cronos  Aptos

Aptos  OKB

OKB  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Internet Computer

Internet Computer  Ondo

Ondo  Ethereum Classic

Ethereum Classic