Week 2 of Sam Bankman-Fried’s trial in New York continued after premiere witness accounts from SBF’s inner circle as federal prosecutors pointed the jury to alleged fraudulent schemes masterminded by the FTX founder himself.

Day 4 of SBF’s trial ended a few minutes ahead of schedule, but not before Gary Wang dealt potentially heavy blows to the founder’s defense.

Wang, former Alameda and FTX CTO, told the court of special code written to allow SBF’s hedge fund withdraw without limits, adding that SBF lied to the public about how FTX treated customer cash and assets, per InnerCityPress.

Before that, another childhood friend and ex-FTX developer Adam Yedidia said Bankman-Fried admitted that the crypto exchange was not “bulletproof”. This was after Yedidia became aware of the gaping hole in Alameda’s financials which grew from $500 million to nearly $8 billion in a few months.

So far, the defense’s argument has centered around flying a plane while building it, an analogy synonymous with every startup according to defense attorney Mark Cohen and his four colleagues in charge of SBF’s defense formation.

Indeed, SBF’s lawyers insisted that Alameda’s unorthodox access at FTX was due to its market responsibilities and that the firm was never positioned to defraud users.

Defense lawyers pressed that Bankman-Fried did not steal customer funds for his personal gain, but rather was undermined by Alameda’s poor hedging strategies and crypto volatility.

Cohen and his fellow SBF lawyers also noted that FTX issued “big margin loans” to Alameda, which in turn issued authorized personal loans to staffers and executives like Bankman-Fried.

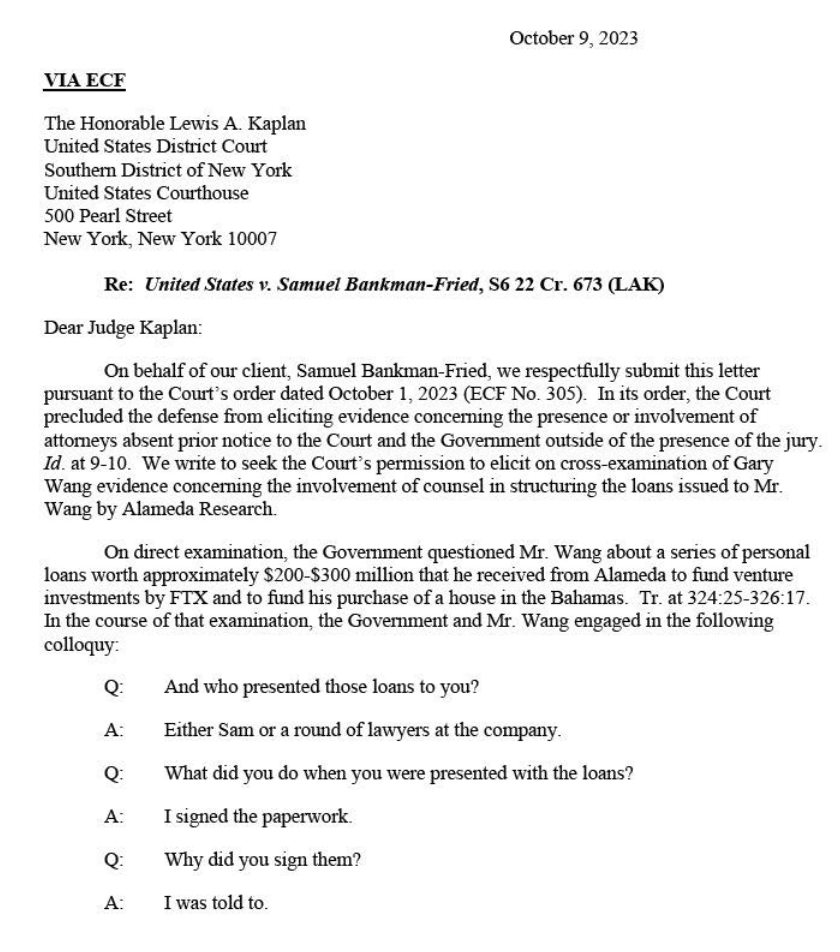

Defense lawyers press on Alameda loans

SBF’s defense attorney Christain Everdell cross-examined Wang on legal advice he received about loans from Alameda Research. Notably, FTX retained a retinue of lawyers from several law firms.

The questioning resumed around 9:40 a.m. New York time on trial day 5 following a request from SBF’s lawyers on Oct. 9.

Everdell leaned into cross examination with inquiries on the code bug flagged in late 2021 which eventually led to Alameda’s $8 billion deficit by mid-2022. This code bug is most likely related to the special code Wang wrote at Bankman-Fried’s request in 2019 when FTX launched.

This intentional addition, according to the witness, gave Alameda unfettered access to FTX customer assets and a multi-billion dollar credit line ($65 billion).

Moving to FTX’s exchange token FTT, former CTO Wang said Alameda traded FTT a lot and that Binance, a rival platform that coincidentally incubated FTX in 2019, also backed SBF’s firm through a “strategic investment” in FTT.

Wang’s responses to questions explained that Alameda withdrawals on FTX were not reflected on fiat account records. The mysterious “Korean friend” account mentioned in Justice Department filings was also exempt from proper accounting under SBF’s leadership, the witness testified.

Further probes into whether or not SBF’s hedge fund fully tapped this line of credit were objected to by prosecutors for being vague or asked and answered by defense attorneys.

SBF’s Everdell shifted the defense’s nuzzle to hedging at Alameda and a bank run on FTX triggered in November 2022.

“Sam was angry Alameda did not hedge its positions,” Wang said, answering questions citing a memo sent by SBF before the great collapse.

“He thought there was a good chance it should be shut down. I wasn’t sure,” the witness continued adding that Ellison was CEO of Alameda Research at the time.

The defense referenced tweets posted in early November 2022 by Binance CEO Changpeng ‘CZ’ Zhao in the days leading up to FTX’s bankruptcy.

“How much was being withdrawn per hour on Nov. 6?”, asked SBF’s Everdell. “About $100 million an hour.” CTO Wang said. “CZ’s tweet had an effect?” the defense attorney continued.

Between CZ’s tweets and Alameda’s leaked balance sheet, Wang testified under his plea deal that he was unsure which spurred mass withdrawals from FTX.

The defense asked Wang about FTX’s solvency and his statement to authorities which supposedly backed SBF’s claims made via tweets. “I said it was true but misleading,” the witness replied, referring to Bankman-Fried reassuring users on social media of the platform’s finances.

SBF’s Everdell then fielded questions about Alameda loans to FTX staffers. Wang confirmed that he received $200 million in loans from Alameda for real estate acquisitions and venture capital investments.

“I used $200,000 for a house.” the witness shared in court. Wang said FTX general counsel Daniel Friedberg advised on promissory notes which authorized the loans. Friedberg reportedly spoke with Federal Bureau of Investigation (FBI) agents either before or after SBF’s exchange blew up.

Defense lawyer Everdell admitted a binder detailing another $35 million and a property in Saint Kitts.

Providing context to the final days at FTX, Wang highlighted that former FTX chief engineer Nishad Singh left the Bahamas on Nov. 9, seeming distraught. He and SBF stayed a few more days and were required to meet with the Securities Commission of the Bahamas (SCB) on Nov. 12 or be held in contempt.

By this time, all bets were off, as FTX was trapped in a downward spiral. Alarmed staffers raced to protect vulnerable customer hackers amid a $400 million hack on FTX while one adviser stashed $500 million on his personal Ledger Nano hard wallet on the company’s behalf.

The witness said they were told to transfer assets, roughly $400 million, to the SCB and they complied. This amount was previously thought to be seized by Bahamian authorities after FTX fell.

A day later on Nov. 13, Wang had engaged lawyers in New York who later flew to the Bahamas after meeting with prosecutors to discuss his cooperation. The witness had five sessions with prosecutors where he signed a proffer agreement.

During these proffer meetings, Wang said he admitted to four criminal charges including three counts of conspiracy with Bankman-Fried, Ellison and Singh. A 5K letter, a standard notice to a court asking for leniency on a witness or defendant, was sent due to his cooperation according to the witness.

When AUSA Sassoon asked about the $35 million house and loans from Alameda Research for the prosecutions redirect, Wang said the funds did indeed come from SBF’s hedge fund.

“I was given them to sign, Sam wanted me to sign them,” Wang said about why he put pen to paper for the loans.

When the AUSA asked where Alameda got the money for those loans, Wang said the firm withdrew up to $8 billion from FTX, noting that the funds were not for market-making purposes which seems to be SBF’s defense approach regarding these transactions.

Judge Kaplan had a few questions of his own, particularly about who signed the $35 million promissory note and where the funds were invested.

“I don’t know. Some company Sam wanted me to invest in. My understanding was that Sam signed a larger note,” Wang replied to the Judge. Wang was excused shortly after.

“We had $9b in loans we couldn’t repay” – Alameda’s Ellison

For the government’s next witness in United States v Sam Bankman-Fried, AUSA Sassoon called Ellison to the stand. SBF’s lawyers alluded to “burning issues”, but Judge Kaplan waved concerns, urging the hearing to advance.

In her responses to the opening questions from prosecutors, Ellison talked through her first contact with SBF at Jane Street, their contentious affair, and her role at Alameda.

Pointing to Bankman-Fried in the courthouse, the witness said they committed fraud together at FTX and Alameda but SBF was the mastermind pulling the strings, Ellison painted to the court.

Bankman-Fried created all the systems needed, according to Caroline, who added that Sam told them (herself, Wang and Singh) to take billions from FTX customer accounts and use these funds for investments.

Ellison’s testimony explained that Alameda took between $10 billion and $14 billion to repay lenders. This is why FTX couldn’t match or process withdrawals after Alameda’s balance sheet leaked to the press, said the witness.

Reports at the time cited SBF’s claims that lenders like Voyager and Genesis were repaid in full. Some of these lenders are now bankrupt and no longer operating in lending markets. The former Alameda CEO also admittedly forged balance sheets to prop up the firm’s finances and appear healthy to the public eye.

Judge Kaplan recessed SBF’s trial on day 5 until 2 p.m. ET before prosecutors examined Ellison’s background. SBF was noted looking straight ahead to the witness stand before walking to his holding cell after the jury was excused.

AUSA Sassoon asked Ellison about her childhood growing up around Boston, attending Stanford, where SBF grew up, and meeting FTX’s founder at Jane Street Capital before being hired as a trader at Alameda Research when the hearing resumed.

By the summer of 2020, the two had entered a sporadic relationship, Ellison told in court. The witness said that Alameda already had losses when she arrived, adding that SBF apologized and boasted he would become President of the United States one day.

Ellison testified that Alameda borrowed huge amounts from FTX and crypto lending desks such as Genesis, Voyager, et al. SBF’s hedge fund received $10 to $20 billion of FTX customer cash in the North Dimension account between 2020 and 2022.

North Dimension was an Alameda account domiciled at Silvergate Bank, crypto.news reported earlier.

About $2 billion of this money was converted to Circle dollar-pegged stablecoin USD Coin (USDC) according to the former Alameda CEO. The rest they allegedly used to repay loans, fund investments, and whatever SBF needed.

To the public, Bankman-Fried presented FTX as a secure and regulated exchange, Ellison said answering prosecutors. Internally, the lines were blurred between customer cash and company liquidity.

Alameda’s line of credit on FTX meant the firm could withdraw customer crypto and liquidate for a profit if the token traded at a higher price on an exchange like Binance. Ellison emphasized that this massive credit line was kept secret and it wasn’t clear if Alameda was expected to replace the withdrawn value.

I thought customers weren’t aware of. But I was just a trader at the time. I asked if it would show up on the audit but he [SBF] said not to worry, auditors won’t be looking at that.

Caroline Ellison, former Alameda CEO

In a supposed discussion between Ellison, SBF and former Alameda co-CEO Sam Trabucco, the three discussed buying back Binance’s $2 billion FTX stock mostly made up of FTT. Bankman-Fried warned the trio of trouble if they failed to purchase the FTT or let the price slip below $1.

At first, FTT was excluded from Alameda’s balance sheet but added sometime in 2021, Ellison said explaining that they needed the token to secure loans from third parties like Genesis.

FTT, like Alameda’s credit line, was also a touchy subject reserved solely for SBF’s inner circle, the witness said. The former Alameda boss recalled SBF’s displeasure after she mentioned FTT trading to Victor Xu, an Alameda trader at the time.

“[Bankman-Fried] was upset at me,” Ellison told Xu over the encrypted messaging app Signal, which SBF purportedly made the default communication platform across FTX and Alameda due to a key auto-delete feature.

The witness also told of “Sam coins” like Solana (SOL) and Serum (SRM) which SBF heavily promoted. Alameda also held large amounts of these tokens including Solana, once hailed as the “Ethereum-killer”.

Ellison became Alameda’s co-CEO in 2021 despite feeling unqualified, she said. Bankman-Fried egged her on and said things, referring to FTX & Alameda, needed to seem separate to the public eye.

The new role came with a bumper compensation package Ellison told court attendees. A $200,000 annual base salary, plus a $20 million bonus and 0.5% equity in FTX. Ellison said she withdrew $10 million to back an unnamed startup, put $2 million in a personal donor-advised fund, and loaned $100,000 to her parents.

One loan of $3.5 million for a gambling company people at FTX wanted to put in my name since I wasn’t on the books of FTX. Money also went to political contributions. Ryan Salame got a $35 million loan.

Caroline Ellison, former Alameda CEO

Ryan Salame, FTX head of settlements who also pled guilty, made donations to Republican political campaigns according to Ellison. “Sam gave $10 million to Biden, he thought it bought him access,” she said.

Speaking to risk management under SBF’s management, the witness claimed that Sam was flexible and willing to take large risks if he thought the reward was worth it.

He [SBF] said it was OK if positive EV, expected value. He talked about being willing to flip a coin and destroy the world, as long as a win would make it twice as good.

Caroline Ellison, former Alameda CEO

Following a 15-minute break, the AUSA veered to personal Google docs kept by the witness direct excerpts from Sam’s own writings. The info hypothesized FTX’s worst-case scenario, with coins like FTT, SOL, and SRM all down 75% along with other significant investments.

FTX was valued at $20 billion at the time and SBF suggested shifting Alameda loans to mitigate risk from his speculative plays, per the witness account. The coins promoted by SBF were worth half of FTX’s market value by this point on paper, according to the former Alameda boss.

Ellison said the tokens were highly illiquid and selling FTT especially would slash loans borrowed from Genesis.

Alameda boasted $9 billion in loans and owed $3 billion on FTX, said the witness after prosecutors presented a company spreadsheet. The sheet noted that Alameda also had $7 billion of customer assets they could dip into. “We had done it before,” Ellison added.

The former Alameda chief said there was a 30% chance, at best she said, that they could repay all the loans, even with user assets allegedly stolen from FTX.

While Ellison advised caution, by her account, Bankman-Fried wanted to expand investments and continue “borrowing” from FTX customer balances to secure term-fixed loans from lending desks.

Judge Kaplan adjourned the court for SBF’s trial day 5 by 4:40 p.m. ET following closing questions from AUSA Sassoon.

The prosecutors plan to call two more witnesses including BlockFi CEO Zac Prince before resting. 7-10 days afterward, defense attorneys will present their case and call witnesses of their own.

Read More: crypto.news

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Cardano

Cardano  Dogecoin

Dogecoin  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  LEO Token

LEO Token  Chainlink

Chainlink  Pi Network

Pi Network  Toncoin

Toncoin  USDS

USDS  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Hedera

Hedera  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Sui

Sui  MANTRA

MANTRA  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  WETH

WETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hyperliquid

Hyperliquid  WhiteBIT Coin

WhiteBIT Coin  Wrapped eETH

Wrapped eETH  Monero

Monero  Uniswap

Uniswap  sUSDS

sUSDS  Dai

Dai  Aptos

Aptos  OKB

OKB  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Internet Computer

Internet Computer  Mantle

Mantle  Gate

Gate  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Tokenize Xchange

Tokenize Xchange  Aave

Aave  Coinbase Wrapped BTC

Coinbase Wrapped BTC