[ad_1]

Cryptocurrency mining is the process of contributing your computer’s processing resources to secure the network consensus on a blockchain while earning cryptocurrency in return. Miners solve complex mathematical equations to verify transactions and add them to the digital ledger. While blockchains that use a Proof-of-Stake consensus mechanism don’t need or enable it, mining is essential on Proof-of-Work blockchains like the Bitcoin blockchain to bring new coins into circulation and maintain the blockchain network’s integrity and security.

While a mining operation provides a solid mechanism for achieving consensus and preventing abuses, it also has significant disadvantages, such as its negative environmental impact. Additionally, mining requires substantial computational power, energy, and technical expertise, making it a challenging task for beginners.

For example, mining crypto on a blockchain like the Bitcoin network has an exceptionally high barrier to entry. Bitcoin miners must invest in specialized equipment and cover increasingly-high energy costs.

This article will explore the fundamentals of crypto mining, introduce different types of mining, and provide a step-by-step guide on how to start mining crypto to earn rewards.

Key Takeaways

- Start with research: Before investing time and money in crypto mining, it’s crucial to do your research. Take the time to learn about different cryptocurrencies and mining devices to make informed decisions and avoid costly mistakes.

- Choose the right equipment: One of the most important decisions you’ll make as a crypto miner is selecting the right equipment. ASIC miners are a popular choice for Bitcoin mining, while GPU miners are better suited for altcoins. Consider your budget, the coin you want to mine, and the mining difficulty when selecting your equipment.

- Join a mining pool: Mining on your own can be challenging, especially for beginners. For example, Bitcoin mining is mainly considered unprofitable for most individual miners. Joining a mining pool allows you to work with other crypto miners and combine your mining efforts to increase your chances of earning rewards.

- Keep an eye on the market: The crypto market is volatile, and the value of coins can fluctuate rapidly. Keep a close eye on the market to make informed decisions on selling your coins or reinvesting in mining equipment.

- Be patient and stay committed:Crypto mining isn’t a get-rich-quick scheme; instead, it takes time, effort, and patience to see results. Stick with it, stay committed to your goals, and you’ll eventually see the rewards of your hard work.

How to Mine Cryptocurrency

Bitcoin mining is the process of adding new transactions to the blockchain, the decentralized ledger that records all Bitcoin transactions. Miners can earn bitcoin as a reward by verifying these transactions and solving complex mathematical problems.

Here’s a step-by-step guide to mining Bitcoin:

1. Get a Bitcoin Wallet:

To start mining, you need a Bitcoin wallet, a digital wallet where you can store your bitcoins. Various types of wallets are available such as hot and cold wallets.

2. Select Your Mining Hardware

Bitcoin mining requires ASICs hardware that significantly increases your chances of success.

3. Choose a Mining Pool

Bitcoin mining is a highly competitive activity, and earning bitcoin on your own is challenging. Mining pools allow you to combine your computing power with other miners to increase your chances of solving a block and earning bitcoin. When choosing a pool, consider the pool’s fees, size, and reputation.

4. Download Mining Software

Download mining software is used to communicate with the mining pool and the blockchain network. Choose one that’s compatible with your hardware and operating system from the various mining software options available.

5. Configure Your Mining Software

Once you’ve downloaded your mining software, you must configure it by setting up your mining hardware and connecting it to the mining pool. Follow the instructions carefully to ensure your mining software is set up correctly.

6. Start Mining

After configuring your mining software, you can start mining. The software will use your hardware to solve complex mathematical problems and verify transactions on the blockchain. You’ll earn bitcoin as a reward if you successfully solve these problems.

7. Monitor Your Mining Activity

Bitcoin mining can be a complex and technical process, so monitoring your mining activity is essential. Keep an eye on your mining pool’s performance and your hardware’s temperature and performance to ensure your mining is successful and profitable.

By following these steps, you can start mining Bitcoin to earn rewards. You can also join a Bitcoin mining pool to increase your chances of reaping mining rewards. Remember that Bitcoin mining is a highly competitive activity, and success requires patience, persistence, and the proper hardware and software.

What Is Cryptocurrency Mining?

Blockchain networks that employ a Proof-of-Work consensus mechanism require computational processing power to solve a mathematical problem to mine new coins. Bitcoin (BTC), Litecoin (LTC), and many other blockchain networks use the Proof of Work (PoW) consensus mechanism to produce and validate new blocks of transactions and safeguard the network. Miners spend substantial computing resources to verify and validate transactions and secure the network from potential attacks and malicious entities.

The Proof-of-Work mechanism provides high security and a decentralized method of verifying transactions. It reaches consensus across all the distributed participants without third-party intermediaries and solves the double-spend problem, preventing the network participants from using the same funds more than once. On the flip side, crypto mining has been criticized for being energy-intensive and requiring high transaction fees and expensive equipment.

The blockchain network rewards miners for their efforts in securing the network. Miners compete by solving complex algorithms with mining hardware to win the right to mine the next block. Rewards are given to the first miner to identify a valid solution and confirm their block of transactions. As a result, the procedure is time-consuming and costly, but it compensates for the efforts.

However, the problem with PoW is that a blockchain can be destabilized with a so-called 51% assault. While extremely uncommon, particularly for bigger blockchain networks, a single company or group may theoretically control more than half of the network’s computational power. With that much mining power, the attacker can purposely exclude or manipulate the order of transactions, as well as reverse their own transactions.

Another major concern with cryptocurrency mining is its long-term viability and high costs. Mining cryptocurrency requires significant investment in hardware and electricity. As a result, many miners, especially those that mine Bitcoin (BTC), spend vast quantities of energy. Furthermore, if a miner doesn’t have access to mining rigs and affordable power, the mining will rarely be profitable.

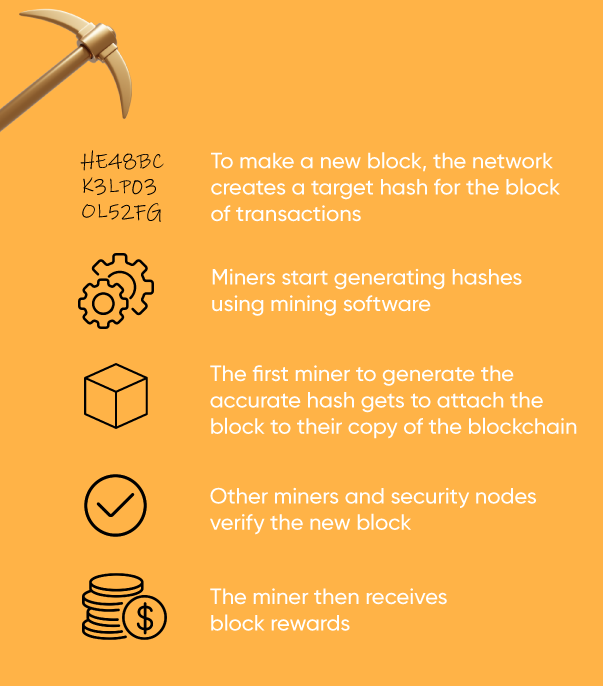

What is a Crypto Hash?

Cryptography refers to the rock-solid procedure of safeguarding blockchain transactions through hashes. A hash is required to complete a block’s worth of transactions. Miners use their devices to create a “hash” that’s randomly generated and has to equal or be lower than the value of the “target hash.” The first miner to generate the hash gets rewarded with newly minted coins.

A hash looks like this:

00000000000000000004b79b7967388e022311e5194547644b119d30220ca19p

Each block has its own unique 64-digit hash, and any change to a single transaction will result in a different hash. Furthermore, each block’s hash is tied to the previous block’s hash. This makes transactions tamper-proof once recorded and the blockchain immutable.

Any attempt to modify anything in a single block would affect the hashes of all following blocks, eventually resulting in a fork or a separate blockchain. Depending on the length of the chain, it may require massive computing power and prove worthless due to being time-consuming and costly.

However, not all forks are caused by flawed individuals; instead, there are also system-generated forks, which may be viewed as updates. For example, the Ethereum London Hard Fork on August 5th, 2021, at 12:33:42 PM +UTC, from block number 12,965,000, was legal. The history of all forks on the Ethereum blockchain can be seen here.

How to Find the Target Hash?

The target hash is a numerical value determined by the network every 2,016 blocks. The aim is to maintain the mining difficulty such that a block is mined every 10 minutes on average. It is the value for which a hashed block header is targeted.

Block headers are 80-byte data strings that act as individual block identifiers. It provides block-specific information such as the bitcoin version number, hash of the preceding block, timestamp, etc.

Therefore, the mining process is nothing more than executing algorithms (for bitcoin mining, the SHA-256 hashing algorithm) to hash the block headers to a number below the target. And the first person to complete the task receives the block prize, similar to winning the lottery.

Mining was simple back in 2009 when you could have mined using your personal computer. However, as Bitcoin gained popularity, its value increased, and more individuals began mining professionally. This has increased the mining difficulty, and to earn the block reward, you now need nothing less than dedicated machines with significant processing capability.

Yet, there are alternatives if you don’t want to spend heavily on mining equipment. Let’s go over the various types of mining to understand this better.

Fast Fact

Not every cryptocurrency can be mined since not all utilize a competitive reward scheme.

Types of Cryptocurrency Mining

Here are several types of Bitcoin mining you can engage in:

ASIC Mining

Mining with an application-specific integrated circuit (ASIC). This mining device is designed to mine a particular coin. It’s expensive but has the greatest hash rate, which means it delivers greater mining power.

CPU Mining

Mining with the central processor unit of a computer (CPU). Although this is the most widely available technique of mining cryptocurrency, CPUs lack the mining power of ASICs and GPUs. As a result, revenues from CPU mining are small.

GPU Mining

Mining with the help of one or more sophisticated graphics processing units (GPUs), often called graphics cards. They, too, give significant mining power, albeit at a relatively hefty initial cost.

Mining Pools

Groups of miners who work together to mine cryptocurrency and share block rewards. Miners pay a modest fraction of the block rewards as a pool fee. Combining your hashing power with a mining pool will earn more than mining alone.

Cloud Mining

Paying a company to mine cryptocurrency on your behalf using their own mining equipment. A contract is required for cloud mining, and the conditions almost usually benefit the company over the miner. In essence, you invest in mining operations managed by another company and reap the rewards based on the hash rate purchased with the contract.

Solo Mining

Mining on your own. Earning block rewards in this manner is far more complex, leaving mining pools as your best option.

Ultimately, the best type of mining is determined by the cryptocurrency and the amount of money you can afford to invest. You need a graphics processing unit (GPU) or an application-specific integrated circuit (ASIC) to set up a mining rig. In most circumstances, ASIC mining or GPU mining with a mining pool is the best choice.

FAQs

Is Cryptocurrency Mining Worth for Beginners?

Crypto mining can be profitable for beginners, depending on factors such as the cryptocurrency being mined, mining difficulty, electricity costs, etc. Initially, Bitcoin mining was highly profitable, but profits decreased as more miners entered the market and mining difficulty increased. The same goes for other popular cryptocurrencies like Ethereum. However, there are still opportunities for profit with less competitive altcoins, such as Monero, Litecoin, or Zcash.

How Many Bitcoins Are There and How Many Are Left to Mine?

As of February 2023, 18.9 million bitcoins have been mined, accounting for about 90% of the total supply, leaving only 2.1 million bitcoins to be mined. Bitcoin mining has slowed down in recent years due to the increasing mining difficulty and halving events. Nevertheless, the recent surge in Bitcoin’s price has reignited interest in mining, with some experts predicting a potential “mining boom.”

How Much Do Bitcoin Miners Make?

The profitability of Bitcoin mining depends on various factors, including the cryptocurrency price, mining difficulty, electricity cost, and equipment efficiency. The current mining reward for a Bitcoin block is 6.25 bitcoins, but mining profitability can be affected by the cost of electricity and expenses for getting Bitcoin mining hardware and Bitcoin mining software. Bitcoin mining rewards are halved every four years, impacting mining profitability. Staying up-to-date with mining trends and adjusting strategies is necessary to become a successful miner.

What Is a Suitable Hash Rate for Mining Bitcoin?

A Bitcoin miner can achieve a hash rate of 10Th/s with a good power supply, mining hardware, and power efficiency. Nevertheless, the profitability of Bitcoin mining is determined by electricity costs, the Bitcoin price, and power usage.

How Much Does It Cost to Start Crypto Mining?

Crypto mining costs depend on the type of cryptocurrency, mining hardware, and electricity cost. A beginner’s mining setup requires a crypto mining rig or ASIC miner, power supply unit, cooling fans, and accessories that cost from a few hundred to several thousand dollars. Electricity is one of the most significant expenses for miners and varies greatly depending on the region. Other potential costs include internet connectivity, rent, and maintenance expenses.

As such, crypto-mining costs range from a few thousand to tens of thousands of dollars, depending on the scale and complexity. Careful research and planning of costs and potential risks are essential before investing in mining equipment.

That said, profitability calculators like CoinWarz show the ratio of profitability, assuming that your hash power – the amount of computational power you’re using to mine crypto is constant.

Closing Thoughts

While cryptocurrency mining offers the potential for significant profits, it doesn’t come without its risks and challenges. Firstly, it requires a certain level of technical skill and a willingness to navigate the unpredictable market of digital currencies. Therefore, testing the waters thoroughly before investing your hard earned money is crucial. One strategy is to start by mining smaller coins before venturing into larger, more well-established cryptocurrencies like Bitcoin. It’s also important to consider all the factors involved in mining, from electricity costs to hardware and software requirements and cooling costs, especially with GPU and ASIC mining rigs.

However, with the right mindset and approach, it’s possible to achieve success and join the ranks of crypto enthusiasts who have made fortunes through crypto mining. So take the time to learn the ropes, stay informed, and approach mining with a cautious but adventurous spirit.

Best of luck on your crypto-mining journey!

[ad_2]

Read More: coinstats.app

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  USDS

USDS  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Hedera

Hedera  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  Internet Computer

Internet Computer  Cronos

Cronos  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic