Build safer smart contracts with 20+ Web3 DevTools from ConsenSys’ security tooling guide.

Dear Bankless nation,

For our stateside subscribers it is Thanksgiving yet again, which might mean another opportunity for family members to openly question your alternative asset lifestyles at the dinner table.

Stay strong, and remember that every good-hearted question is an opportunity to share the values of going Bankless.

We tapped our resident meme king Michael to tackle a variety of sample questions you might get from crypto-confused relatives this year. Enjoy.

Happy Thanksgiving, y’all.

– Bankless team

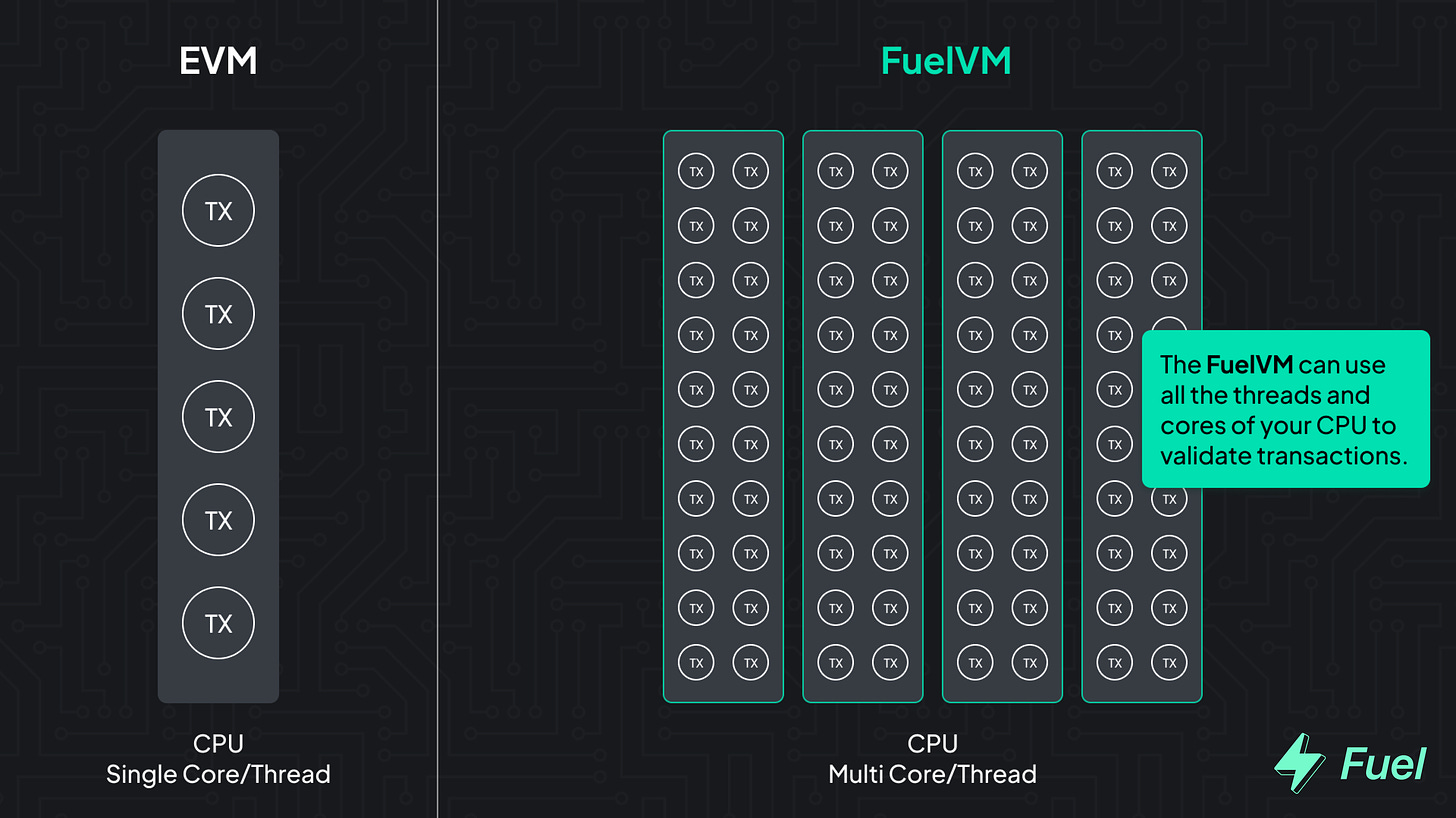

Modular blockchains are the future. L2s alone won’t solve the scaling problem; for this, we need to move toward a modular architecture. Fuel is the fastest execution layer for the modular blockchain stack, enabling maximum security and the highest flexible throughput.

Bankless Writer: Michael Wong, Bankless Memelord

So, now you’re poor and your family wants to know why. They deserve some explanations––after all, you did text the group chat to “back the effing truck up” at the top didn’t you? Grandma’s still tryna get a reply as to what that means.

Many such cases.

This is your guide to walking your various family members through the madness of this past year, and helping them learn a thing or two along the way.

Be patient, don’t be patronizing, and feel free to change the convo whenever it gets too messy or is leading to dead ends. Just because you’re “the crypto cousin,” doesn’t mean you need to be talking about it over turkey.

But also, we need more retail adoption, so uh, do your thing.

I’m still… surviving.

And uh, yeah, I know you fought in the war and all.

…I’m doing fine grandpa.

You know that neighbor lady that’s always bothering you to sign up to sell Mary Kay?

In many ways, that’s how centralized players like Nexo, Celsius, and Voyager were dealing. Advertising attractive, outperforming yields upwards of 10% on deposits, the people being paid in these schemes were often from folks making new deposits.

We were the yield. In Mary Kay world (or any similar pyramid scheme MLM), new sales people pay for someone else’s famed pink BMW. They are the yield.

When things hit the fan, if new participants aren’t quick to exit, there likely is no money to retrieve. Meanwhile, early folks make it out with plenty of gains. It doesn’t help that many platforms were being irresponsible (or criminal) with their customers’ funds.

In the same way that Mary Kay doesn’t reflect the values of the entire beauty industry, some bad faith actors in the crypto industry don’t mean the entire space is unsafe.

Dad, imagine a world where you could create your own savings account for yourself, without going to a bank. Imagine that account not being tied or associated to any bank in particular, it travels with you, and banks and merchants are all standardized to accept everyone’s accounts..

The keys to this proverbial digital safe is a set of words called a ‘seed phrase’.

This seems like a big responsibility, and it is. It’s part of the promise and value proposition of crypto at large: to have agency over your assets in borderless and permissionless ways. And it prevents getting hosed like folks did with Lehman Bros, or more recently FTX.

And by that token, your seed phrase is certainly not something you want to add to your “Passwords and Logins” Excel sheet that you keep on your Compaq PC. And for that matter, no Post-it notes on the monitor either, please. It’s a big responsibility, but it’s worth it.

I know you like a good bargain, auntie.

But like a lot of things, that which seems cheap can end up being quite costly after all is said and done. In the same way there are fake handbags, sneakers or dupe designer labels, “knockoff” coins exist, too. There are network effects (social critical mass) that come with determining why, say, Louis Vuitton purses are worth 50-100x than purses with similar designs at any bargain store.

For dog coins, folks have tried to recreate the success of coins and communities like ETH and BTC. But just like in luxury goods, design alone does not recreate the success of the real thing. Many of these dog coins are scams––easily created, easily manipulated.

All that said, when it comes to doggy coins, $DOGE has more longevity than the rest and is probably top dog.

Making money LOL. “JK”.

A database represents one small part of what a blockchain can provide from a utility standpoint.

Ethereum and Bitcoin are two of the best examples of blockchains with top-flight economics and security, which often go hand in hand, and the possibilities are endless.

For both, their respective flagship coins are money, plus there’s the existence of stable coins (coins pegged to $1 or £1). This might not mean a whole lot to folks in the western world, especially the USA, but it has changed lives radically in communities across Venezuela, Argentina, Kenya, Afghanistan and plenty more. Places where currencies inflate like party balloons and have usurious restrictions placed on withdrawals by government. They stand to gain a lot by using these technologies, they just need an internet connection.

And that’s just the tip of the iceberg, champ.

(Give ‘em a punch on the shoulder for good measure.)

First off, I never told you to “buy it”.

We are collectors after all.

The prices of NFTs are like houses in your neighborhood. The lowest priced home is the floor. Organizations like home owners associations and realty groups work to “defend” the “floor price” of homes in certain neighborhoods. This all comes down to what sellers want to list their assets for.

It’s a game of quality, community, and market conditions, and hey, at least you have something pretty to look at while you wait for the floor to recover (well, unless you bought a BAYC derivative, then it might be best to send that to the Hidden tab.)

I’m gonna keep it real with you, Tanya, there’s no friggin’ complications here, dude is just a big ass scammer who YOLO’d customer deposits like a reckless, feckless punk.

As someone with deep values rooted in this industry, it’s insulting for influential people out there to portray the guy as “controversial”, though I understand how folks not so close to things could buy into that stuff.

It reminds me of the way we sometimes romanticize crime in Hollywood.

BTW, have you seen that new Dahmer show?

Yes.

Become a Premium subscriber to Bankless and get Early Access to podcast episodes like this one.

Listen to other podcast episode | Apple | Spotify | YouTube | RSS Feed

Michael Wong is the “Chief of Culture” at Bankless. Memes, fashion, NFTs, and jobs. Down bad but fresh as hell. Follow @wongisrite on Twitter.

Want to get featured on Bankless? Send your article to submissions@banklesshq.com

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

Read More: newsletter.banklesshq.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  Wrapped stETH

Wrapped stETH  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  WETH

WETH  Monero

Monero  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Wrapped eETH

Wrapped eETH  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Aptos

Aptos  Bittensor

Bittensor  Dai

Dai  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  OKB

OKB  Ondo

Ondo  sUSDS

sUSDS  Official Trump

Official Trump  Gate

Gate  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave