Build safer smart contracts with 20+ Web3 DevTools from ConsenSys’ security tooling guide.

Dear Bankless nation,

There’s a common theme underlying the year’s biggest crypto blowups.

From 3AC and Celsius to FTX (and perhaps soon Genesis?) — plenty of centralized crypto entities have been blowing up and leaving users holding the bag.

For consumers that want to reject centralized finance and embrace DeFi — the transition can often seem daunting. DeFi tools can often feel harder to navigate and discover than their CeFi counterparts, but the payoffs to this exploration are immense.

This week, we get back to basics with this tutorial by William which shows the best places to get started in DeFi.

– Bankless team

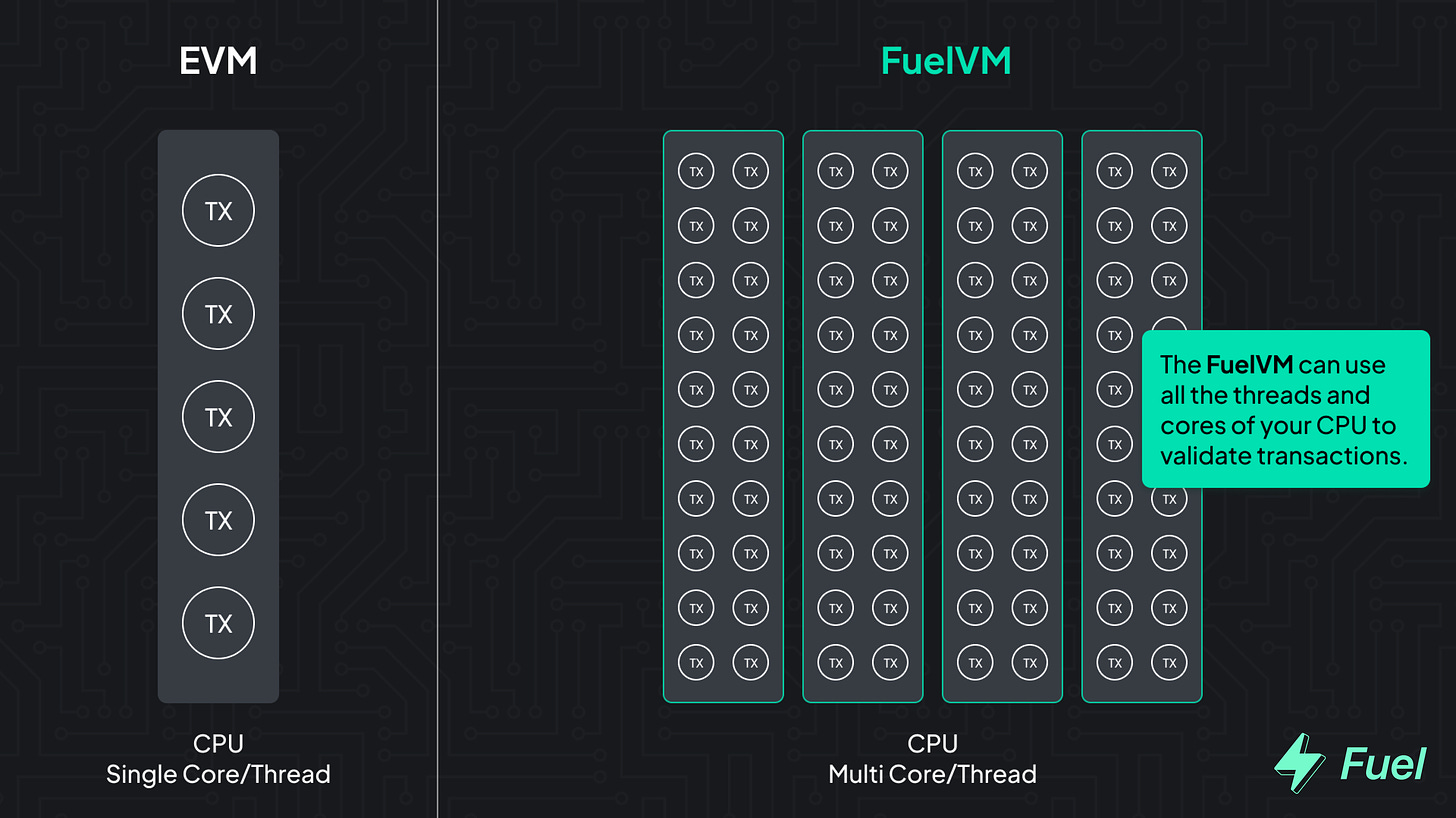

Modular blockchains are the future. L2s alone won’t solve the scaling problem; for this, we need to move toward a modular architecture. Fuel is the fastest execution layer for the modular blockchain stack, enabling maximum security and the highest flexible throughput.

👉 Go beyond the limitations of the EVM: explore the FuelVM

Bankless Writer: William M. Peaster, Bankless contributor and Metaversal writer

Amid the recent FTX-driven turmoil in crypto’s centralized finance sector, the top DeFi projects on Ethereum have been trodding along just fine.

These battle-tested decentralized protocols show us the power of being able to personally manage your own money onchain without having to worry about corrupt intermediaries like FTX’s leadership.

Accordingly, this Bankless tactic will walk you through the best ways to take control of your crypto by doubling down on DeFi using the most proven dapps available today.

-

Goal: Double down on DeFi

-

Skill: Beginner

-

Effort: 1 hour to set up positions

-

ROI: Self-secured onchain money management

In the wake of the FTX collapse, traders who kept money on custodial exchanges have learned the hard way that those actually weren’t their keys, and it’s no longer their crypto.

FTX’s leaders abused their power and seem to have stolen and squandered funds from a lot of people, many of whom were regular, everyday folks just trying to manage and get ahead on their finances.

This is why DeFi is so important.

True DeFi disintermediates power. DeFi gives regular people and institutions alike the ability to manage their money while self-custodying it. Only you can deposit or trade or withdraw your funds when using a decentralized exchange (DEX) like Uniswap, for example.

Managing your money onchain puts the power in your hands. But let’s say you’re newer to DeFi, or it’s been a while since you’ve dove in — what, then, are the most solid apps to focus on in this post-FTX landscape?

No worries, I’ve got you covered! Let’s walk through the three most solid ways to double down on DeFi today ⬇️⬇️⬇️⬇️⬇️

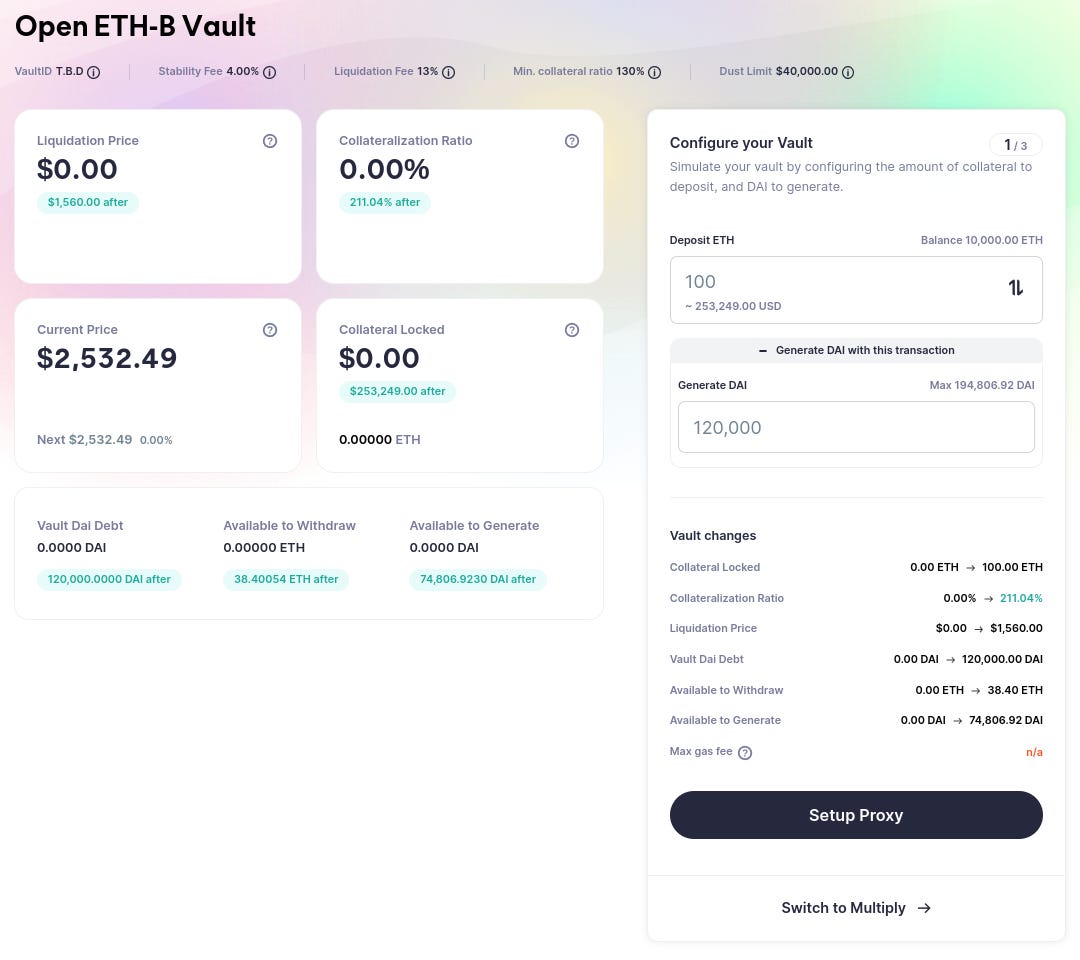

Maker and Oasis are two of the oldest and most proven apps in DeFi.

Maker is a decentralized borrowing protocol where you can collateralize crypto like ETH and then borrow DAI dollar stablecoins against your collateral. Oasis is the leading front-end for setting up a Maker Vault, a.k.a. a borrow position, in just a handful of clicks.

So let’s say you’re long ETH for the long-term and you don’t want to sell any if possible, but you also periodically have life expenses where a little extra liquidity could go a long way.

Here, cue in the Maker + Oasis combo, where you can draw DAI liquidity against your collateral and then sell the DAI as needed and pay back the loan over time on whatever schedule works for you. Check out this complete tutorial for a step-by-step guide to the onboarding process.

The main responsibility you’ll have? Avoiding liquidation by ensuring your Vault remains adequately collateralized along the way. Fortunately, this management has never been easier since Oasis now offers automated buys/sells and stop-loss protection for managing your positions.

For years now, the Bankless theory is that ETH is becoming the settlement layer and risk-free rate of the internet itself.

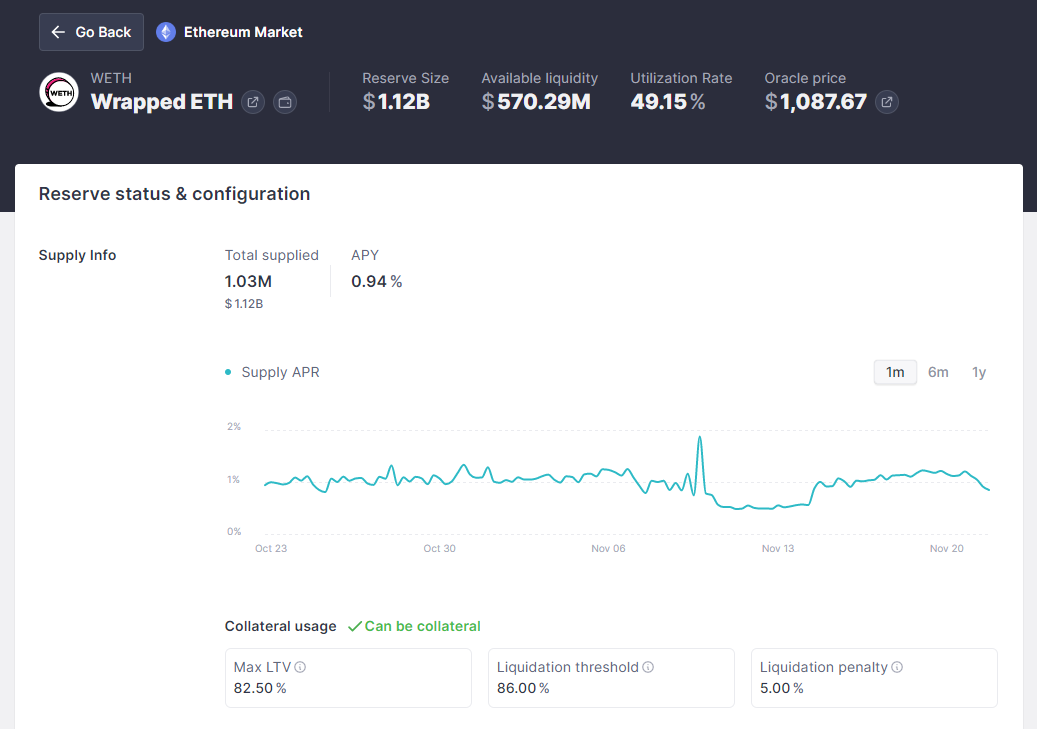

In a similar vein, and as Zerion aptly pointed out in the tweet above, Aave’s ETH lending market is sort of like the native “risk-free” rate of DeFi and typically offers ~1% APY yields.

For the uninitiated, Aave is a decentralized and non-custodial liquidity protocol. This means Aave is a borrowing and lending system where users can borrow against collateral or lend crypto to earn yields from interest.

That said, if you have some ETH you’re hodling for the long-term but wouldn’t mind earning some passive income on top of that, lending on Aave is a very solid avenue to consider. The DeFiSafety team currently scores Aave at 94%, for instance.

To proceed you’d simply head over to app.aave.com, connect your wallet, press “Supply” at the ETH lending market, and then fill out your desired parameters and complete your deposit transaction. Over time, you’ll earn interest from borrower payments accordingly!

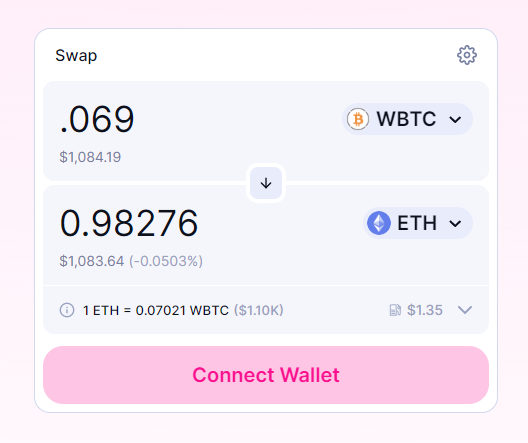

Uniswap is the most successful and battle-tested DEX to date.

The majority of cryptocurrencies are ERC20 tokens on Ethereum Virtual Machine (EVM) blockchains, so you can use Uniswap — which is currently deployed on Ethereum, Polygon, Arbitrum, and Optimism — to trade into and out of just about any crypto that’s out there.

As such, you definitely don’t need to have funds parked on a CEX if you want or need to trade stuff. Using Uniswap with a wallet you personally control will work just fine for most, if not all basically all, of your swapping needs.

As for actually trading on Uniswap, it’s quite easy. Go to app.uniswap.org, connect your wallet, select the token you want to trade into and the token you want to trade out of, and then complete the swap transaction with your wallet.

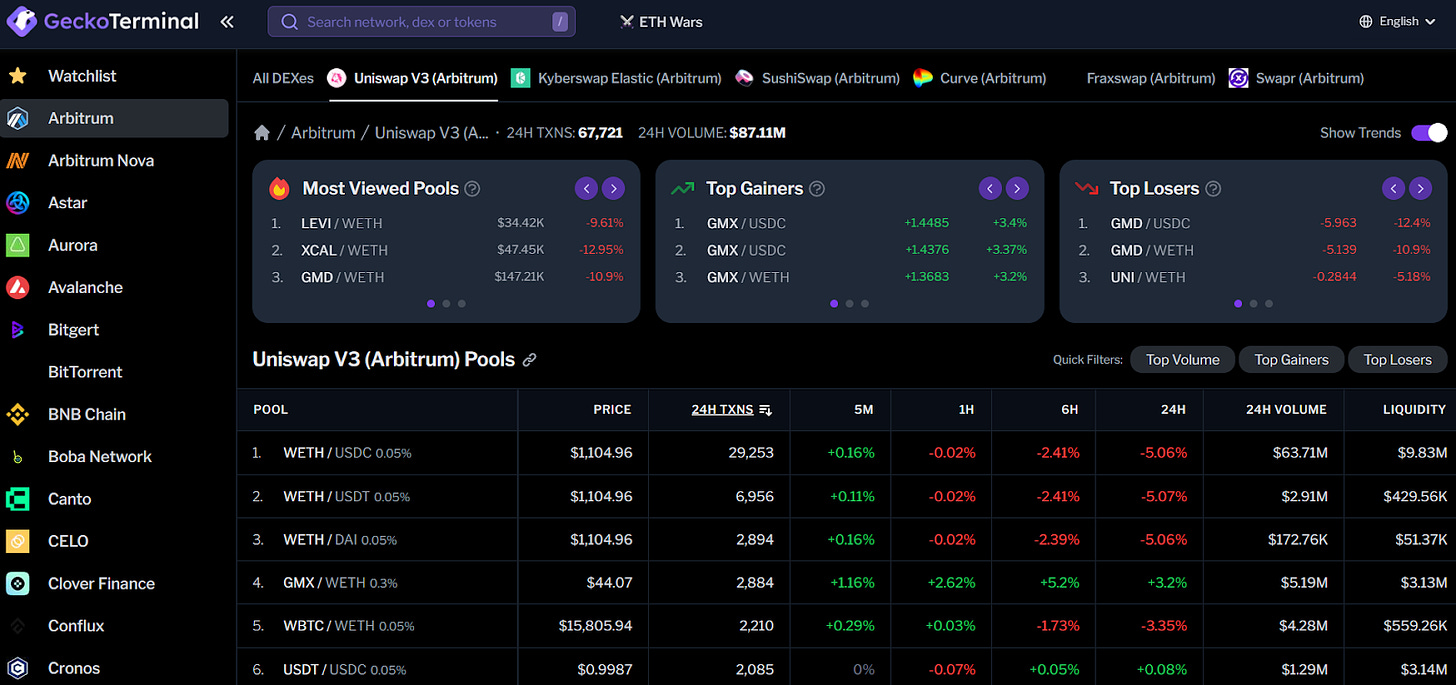

If you run into trouble finding a token that you’re looking for, try searching on a service like GeckoTerminal, which makes it easy to search token pairs by chain and DEX, e.g. Uniswap on Arbitrum.

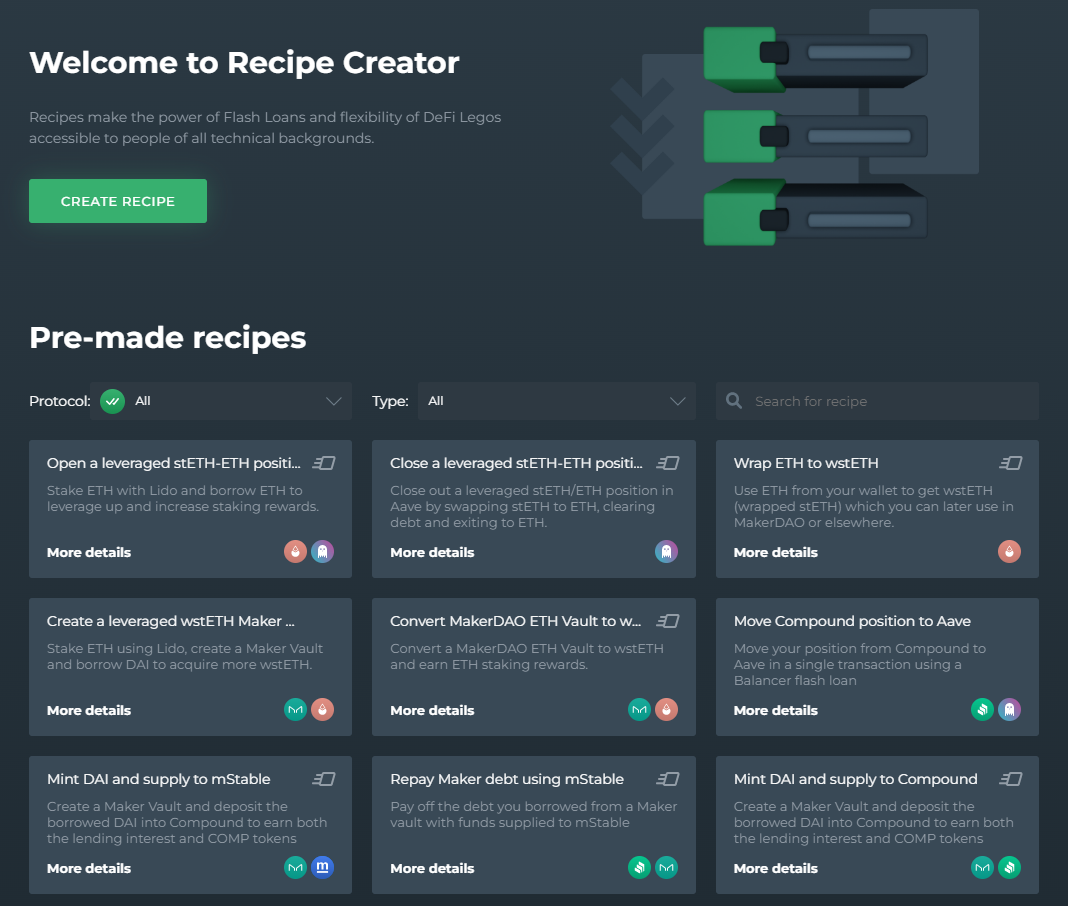

DeFi Saver is an advanced DeFi management platform.

Remember how Oasis was a simple front-end for Maker? In comparison, DeFi Saver is like a pro front-end for multiple top DeFi projects on multiple chains, namely Ethereum, Arbitrum, and Optimism right now.

Indeed, once you’ve learned the ropes of using Maker, Aave, and Uniswap — a great way to step up your DeFi base command game is to import your positions to DeFi Saver so you can have a one-stop hub for automating your increasingly advanced DeFi needs.

Right now the platform supports Maker, Compound, Aave, Reflexer, and Liquity positions. It also offers a LiFi-powered token bridge, an 0x-powered DEX UI, and other compelling features like:

-

Smart Savings — a dashboard of curated DeFi yield opps

-

Loan Shifter — a tool for migrating your DeFi loans between protocols

-

Recipe Creator — a builder UI for creating and executing sequences of DeFi actions within a single transaction

-

Simulation Mode — a sandboxed environment where you can test out DeFi Saver’s features without using real crypto

The DeFi ecosystem isn’t even five years old yet. Of course it still has rough patches and places where we need more advancements, but more progress will come.

And make no mistake: that progress will come through, around, and upon the first DeFi heavyweights like Maker, Aave, and Uniswap that have been battle-tested and gotten the space this far. Using and setting up shop on these decentralized heavyweights today can help you securely steer your onchain journey for years to come.

William M. Peaster is a professional writer and creator of Metaversal—a new Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He’s also recently been contributing content to Bankless, JPG, and beyond!

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

👉 Explore the FuelVM and discover its superior developer experience!

Want to get featured on Bankless? Send your article to submissions@banklesshq.com

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

Read More: news.google.com

Shadow Token

Shadow Token  Euler

Euler  Kujira

Kujira  Alien Worlds

Alien Worlds  Metadium

Metadium  Access Protocol

Access Protocol  Peapods Finance

Peapods Finance  Portal

Portal  OMG Network

OMG Network  Aergo

Aergo  ArbDoge AI

ArbDoge AI  Hoppy

Hoppy  Bertram The Pomeranian

Bertram The Pomeranian  Heroes of Mavia

Heroes of Mavia  YES Money

YES Money  Ethernity Chain

Ethernity Chain  BUSD

BUSD  REI Network

REI Network  Project89

Project89  Gearbox

Gearbox  DIMO

DIMO  Perpetual Protocol

Perpetual Protocol  Onyxcoin

Onyxcoin  Sanctum Infinity

Sanctum Infinity  Orchid Protocol

Orchid Protocol  Opus

Opus  crvUSD

crvUSD  Gemini Dollar

Gemini Dollar  Dione

Dione  USDX

USDX  tokenbot

tokenbot  Keyboard Cat (Base)

Keyboard Cat (Base)  WATCoin

WATCoin  INSURANCE

INSURANCE  Matr1x Fire

Matr1x Fire  Magpie

Magpie  Liquity USD

Liquity USD  OmniFlix Network

OmniFlix Network  Manta mETH

Manta mETH  Mainframe

Mainframe  Save

Save  Vector Smart Gas

Vector Smart Gas  Reef

Reef  TANUKI•WISDOM (Runes)

TANUKI•WISDOM (Runes)  Loom Network (OLD)

Loom Network (OLD)  Contentos

Contentos  GOGGLES

GOGGLES