[ad_1]

(Bloomberg) — Animoca Brands Corp. is looking to raise about $1 billion this quarter for its new Web3 and metaverse investment fund, sharply scaling back its ambitions during the current crypto industry meltdown.

Most Read from Bloomberg

Animoca Capital is in talks with potential investors and would use the money to support blockchain and metaverse startups, co-founder Yat Siu, who is also the chairman of Animoca Brands, said in a Twitter Spaces chat with Bloomberg in Hong Kong Thursday.

https://t.co/CrFCO1j8iv

— Vlad Savov (@vladsavov) January 5, 2023

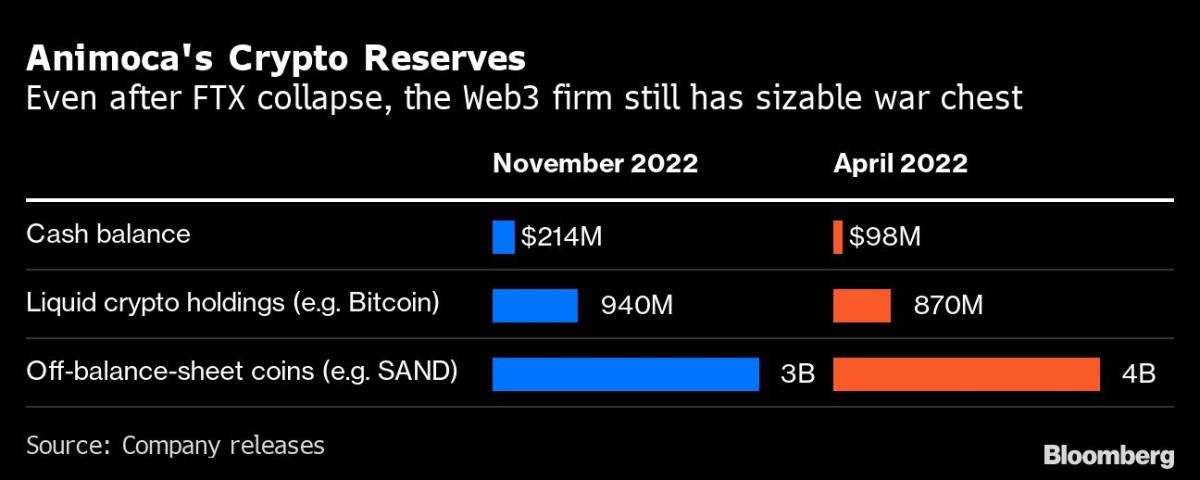

The collapse of the FTX exchange in early November upended the crypto world, triggering bankruptcies and shutdowns among various industry players. Around a dozen of Animoca’s portfolio firms were severely affected by the event, beyond the broader market downturn, Siu said. They included NFT spaceship seller Star Atlas, which had much of its treasury sitting on Sam Bankman-Fried’s now-defunct trading platform.

For Animoca Capital, “Q1 is the goal and then let’s see what happens,” Siu said. “It is fair to say it’s a challenging market. But we have quite a bit of interest.” He added that a shaky market could mean eventually raising slightly lower than the targeted amount.

In November, the Animoca chief said in a Nikkei interview that the company is planning to raise up to $2 billion for the new fund, which will be set up in conjunction with former Morgan Stanley exec Homer Sun.

The effects of that FTX chill and the global economic slowdown have made fundraising harder, but Siu remains optimistic that capital and interest in crypto remain. A number of subsidiaries of Sequoia-backed Animoca have raised money even through the FTX cycle, Siu said, without revealing names or valuations.

Animoca Brands, which has stakes in more than 380 firms, isn’t planning any further fundraising for itself after accepting Temasek’s investment in September, Siu said. Its focus is on developing an ecosystem of complementary crypto firms building the so-called Web3 — a loosely-defined next iteration of the web with fewer intermediaries and more direct interaction between users and service and content providers.

The market turbulence has hit Animoca’s revenues because of the slump in digital asset prices, Siu said. “Because our revenues are based on tokens, the overall revenue in fiat terms will also be affected.”

Online markets for digital tokens crashed in 2022, led by tightening global liquidity, the collapse of the Terra ecosystem and most recently the failure of Bankman-Fried’s FTX and Alameda Research. The largest cryptocurrency, Bitcoin, sank more than 61% over the last year while the second-ranked Ether is down nearly 65%.

–With assistance from Sarah Zheng.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

[ad_2]

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  USDS

USDS  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Uniswap

Uniswap  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Bittensor

Bittensor  Aptos

Aptos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Internet Computer

Internet Computer  sUSDS

sUSDS  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic