Fees are a boon for those who charge them, and a noose for those who pay them.

Driving the news: Two Grayscale crypto trusts, its bitcoin (GBTC) and ethereum (ETHE) boxes, charge shareholders 2% and 2.5%, annually, respectively.

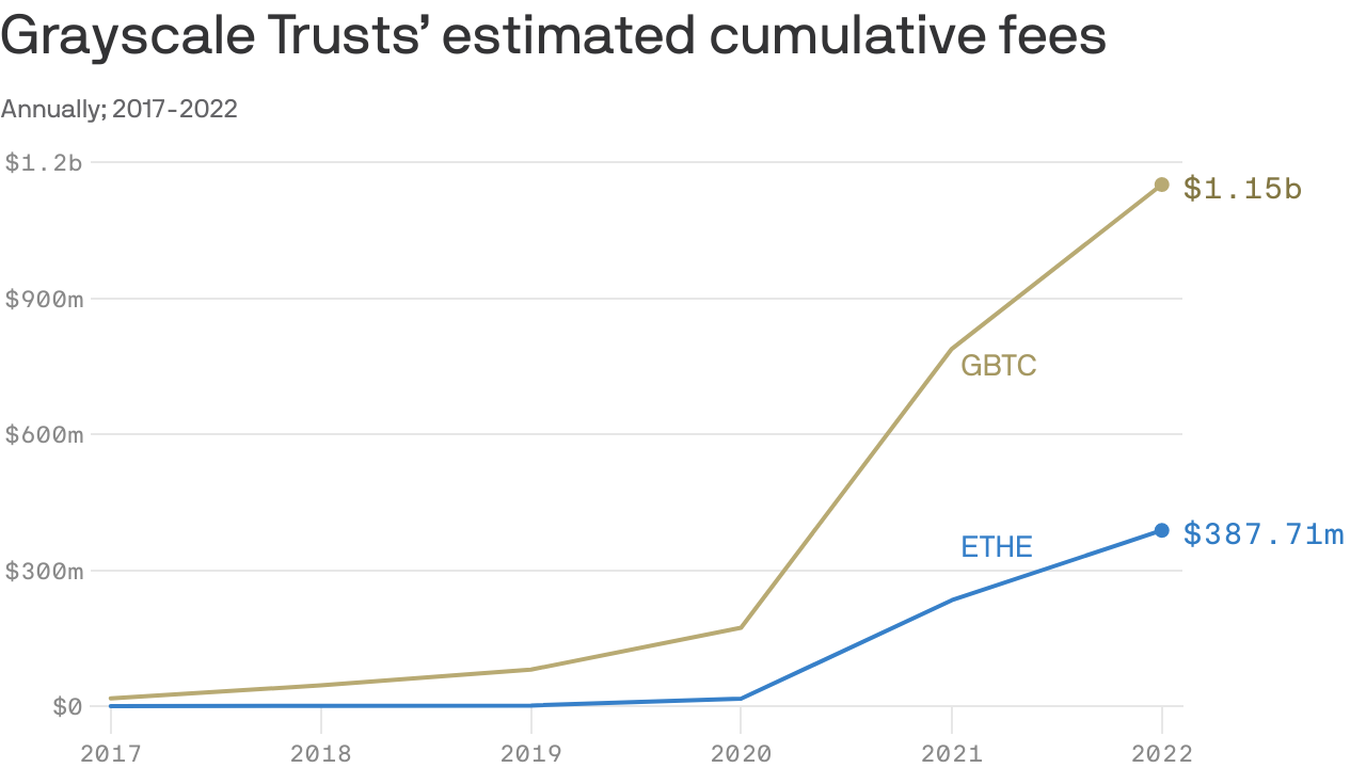

- Over the lifetime of both of those products, investors have paid an estimated $1.2 billion for GBTC and $387 million for ETHE cumulatively, according to Morningstar Research.

- The data assume current annual fees since GBTC started three years before ETHE kicked off in 2017.

Of note: See how those fees rose as a percentage of assets during the start of the most recent crypto bull run in 2020.

Yes, but: If Grayscale were able to convert the trust to a spot bitcoin ETF, fees should be reduced, though that’s unlikely in the near term.

- Recall Grayscale is suing the Securities and Exchange Commission for its decision to deny that application.

The bottom line: That steady, more predictable income stream puts Grayscale on more solid ground than its sister units under parent company Digital Currency Group.

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  Aptos

Aptos  Cronos

Cronos  OKB

OKB  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic  Ondo

Ondo