[ad_1]

Blockchain technology and networks

ipopb

Introduction

Remember when inflation was basically transitory and the US Federal Reserve kept its interest rates near zero for several quarters at a stretch? What relatively calm times those were. And what glorious times they were for crypto and blockchain related stocks.

But now, as governments around the world have embraced aggressive rate hikes, the crypto market has come crashing down. Bitcoin (BTC-USD) itself is 76% down from its all-time highs.

In this article, I share my outlook for Global X’s Blockchain ETF (NASDAQ:BKCH):

BKCH ETF Composition

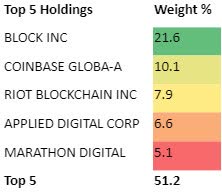

BKCH ETF Top 5 Holdings (BKCH ETF Website, Author’s Analysis)

BKCH’s top five holdings include Block Inc. (SQ), Coinbase Global (COIN), Riot Blockchain (RIOT), Applied Digital Corp. (APLD), and Marathon Digital (MARA). Overall, these top 5 holdings make up 51.2% of the overall exposure. This indicates some moderately high concentration.

Here’s a discussion of some of the fundamental drivers of BKCH:

The Bitcoin Indicator

Though the cryptocurrency and blockchain industries have many moving parts and fundamental drivers, Bitcoin (BTC-USD) is indisputably the single most important factor. If Bitcoin smiles, the market bursts out laughing, and if Bitcoin frowns, agony envelopes the market.

That said, Bitcoin currently trades at painful lows, dragging the entire market into a crypto winter and BKCH to all-time lows.

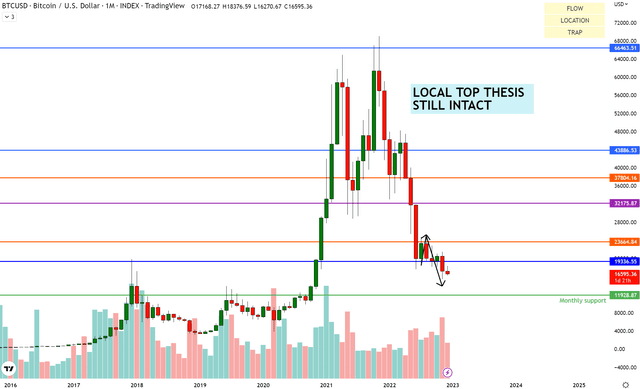

My outlook on Bitcoin has been bearish since November 2021. I have publicly raised caution signals on Twitter about a local top formation. It has so far played out beautifully as per expectations:

BTCUSD (TradingView, Author’s Analysis)

I anticipate prices to continue grinding down to monthly support at close to $12,000.

Market Confidence in the Abyss

Apart from the high-interest rate climate bedeviling the crypto and blockchain markets, the string of unfortunate blowups, layoffs, and bankruptcies seen by crypto companies this year has made a notable dent in investors’ confidence levels. This may take a long time to recover, which is typical for bubble pop recoveries.

Internally too, there are signs of weakness. For example, Coinbase (COIN), a crypto exchange occupying the number two position on the BKCH portfolio with a 10.1% weight, has laid off 1,160 employees in the current crypto winter.

Other companies such as Core Scientific (CORZ), in which the BKCH has a 3.8% weight, recently filed for Chapter 11 bankruptcy protection, with its stock down 98%. The post-bankruptcy vultures are probably watching Michael Saylor’s Marathon Digital Holdings (MARA) with keen interest too.

Risk-Off Mood Remains a Headwind for BKCH

The high-interest rate hikes by the US Fed and other governments has triggered a general risk-off sentiment across the financial markets, causing investors to flip from being adventurous and optimistic to cautious and pessimistic. The crypto and blockchain markets are linked to high speculative activities, which is associated with investors being adventurous and taking risks. Thus, the current market mood is a direct hit on BKCH’s prospects.

The Fed’s interest rate decisions will set the tone for this risk-on or risk-off mood, which will impact whether BKCH will be swimming with or against the tide.

Now let’s have a look at the technicals of BKCH:

If this is your first time reading a Hunting Alpha article using technical analysis, you may want to read this post, which explains how and why I read the charts the way I do, utilizing the principles of Flow, Location, and Trap.

Read of Relative Money Flow

BKCH vs. SPX500 Technical Analysis (TradingView, Author’s Analysis)

The BKCH/SPX500 pair is in a literal free fall at the moment, with no support for the pair to target. While the signs are overwhelmingly bearish, the instrument has yet to meet all of my trade setup criteria. Specifically, I need to see a bull trap to enter the bearish plays. There is no evidence of that yet.

Read of Absolute Money Flow

BKCH Technical Analysis (TradingView, Author’s Analysis)

On the standalone BKCH ETF, it’s a similar story. BKCH floats around $12.80 and is in price discovery mode, creating a decent opening for a sell. However, price is not at the ideal bull trap location currently to prompt a sell position.

If I see a return to the $30.58 monthly resistance followed by a false breakout to the upside, then I would be much more interested to be bearish. Till then, I have a ‘hold’ stance.

Summary

Overall, I recognize that the incumbent flow on BKCH is convincingly bearish. However, to join in on the sells, I need to see a bull trap, and so I continue waiting for the high probability (>70% chance based on my statistics) entries. Meanwhile, keep in mind that a turnaround in the crypto market translates to an immediate turnaround in the BKCH ETF, given the tight correlation shared. And a turnaround in the crypto market in-turn (pardon pun) will follow the drum-beat of central bank policies, which make that a key monitorable.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

[ad_2]

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  USDS

USDS  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  Wrapped eETH

Wrapped eETH  WETH

WETH  Litecoin

Litecoin  Hedera

Hedera  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  Internet Computer

Internet Computer  Cronos

Cronos  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic