A large leveraged position in CRV tokens across major DeFi lending protocols has caught the attention of the space over the last few days.

A wallet known to belong to Michael Egorov, co-founder of the decentralized exchange Curve Finance, has outstanding debt of $60M in stablecoins secured by CRV worth $176M as of June 16.

Egorov has collateralized his CRV on Aave, DeFi’s largest lending protocol, with nearly $8B in total value locked (TVL). While the position currently remains safe from liquidation, Gauntlet, a risk management firm, has recommended that Aave’s governance freeze the CRV market on Aave V2. This would mean that neither Egorov nor anyone else can add any more CRV to be used as collateral on the platform.

CRV is down nearly 30% in the past month amid the rout in altcoins, which may have prompted the renewed concern over a longstanding position.

The danger that Gauntlet is trying to mitigate is the potential for Aave to take on bad debt. This would likely happen if the price of CRV dropped to the point that the Aave protocol must liquidate the position, but isn’t able to do so due to its sheer size.

Too Big To Liquidate

To liquidate a position on Aave, a liquidator must repay the borrowed asset, USDT in this case. They then receive the collateral, CRV in this case, at a discount.

The problem – Egorov’s collateralized CRV in Aave V2 accounts for over 33% of the total circulating supply of the token. This means that if his entire position was to be liquidated, the liquidator wouldn’t be able to sell the CRV profitably due to inadequate on-chain liquidity.

Indeed, attempting to sell 100M CRV on mainnet, equivalent to around a third of Egorov’s position, would crater the price by 70%.

Gauntlet cited reduced liquidity in CRV as increasing the likelihood of disorderly liquidations. The firm declined to comment further on their recommendation when contacted by The Defiant.

Actively Managed Position

Andrew Thurman, the former head of communications at data provider Nansen, doesn’t think it’s likely that Egorov doesn’t plan to pay back his debt, as some people suggested on Gauntlet’s forum post.

“Michael has actively managed that position in the past, including at times paying down portions of the debt,” Thurman told The Defiant over Telegram.

Egorov did not respond to an email from The Defiant requesting comment, but on-chain data show repayments of nearly $3M in the past day.

Aiham Jaabari, the co-founder of Silo Finance, another lending protocol, also thinks the concerns around Aave being left with bad debt are a bit overblown. He thinks that while Gauntlet’s post may have been intended to minimize the risk exposure of Aave V2, other traders have pounced on the narrative in order to push down the price of CRV.

Supporting this theory, funding rates to short CRV skyrocketed on Binance this week, according to the well-known Twitter account DeFiMoon. Funding rates go up when more traders are entering a trade using a derivative called a perpetual swap.

Jaabari told The Defiant he spoke with Egorov on June 14 to talk about Silo. “I’ve been telling him, ‘Hey, give us a shot.’”

Unlike Aave V2, where all assets are pooled together, Silo groups smaller groups of assets to be borrowed and lent against each other. Jaabari said Silo doesn’t yet have enough USDT liquidity for Egorov to migrate his whole Aave V2 position to Silo.

Egorov also has other borrowing positions collateralized by CRV, worth over $10M on lending protocols Frax Finance and Abracadabra, according to DeBank.

Gauntlet’s concerns around leaving Aave with bad debt may have been inspired by a ‘highly profitable trading strategy’ executed last year by Avraham Eisenberg, where the trader pushed down the price of CRV by borrowing the asset against a position of collateralized USDC.

Jaabari said that Eisenberg was trying to liquidate Egorov’s position by pushing the price of CRV down, but ultimately didn’t succeed. “After they saw what happened to Avi, no one is doing this,” Jaabari said.

The SEC charged Eisenberg with market manipulation in January.

Read More: thedefiant.io

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Chainlink

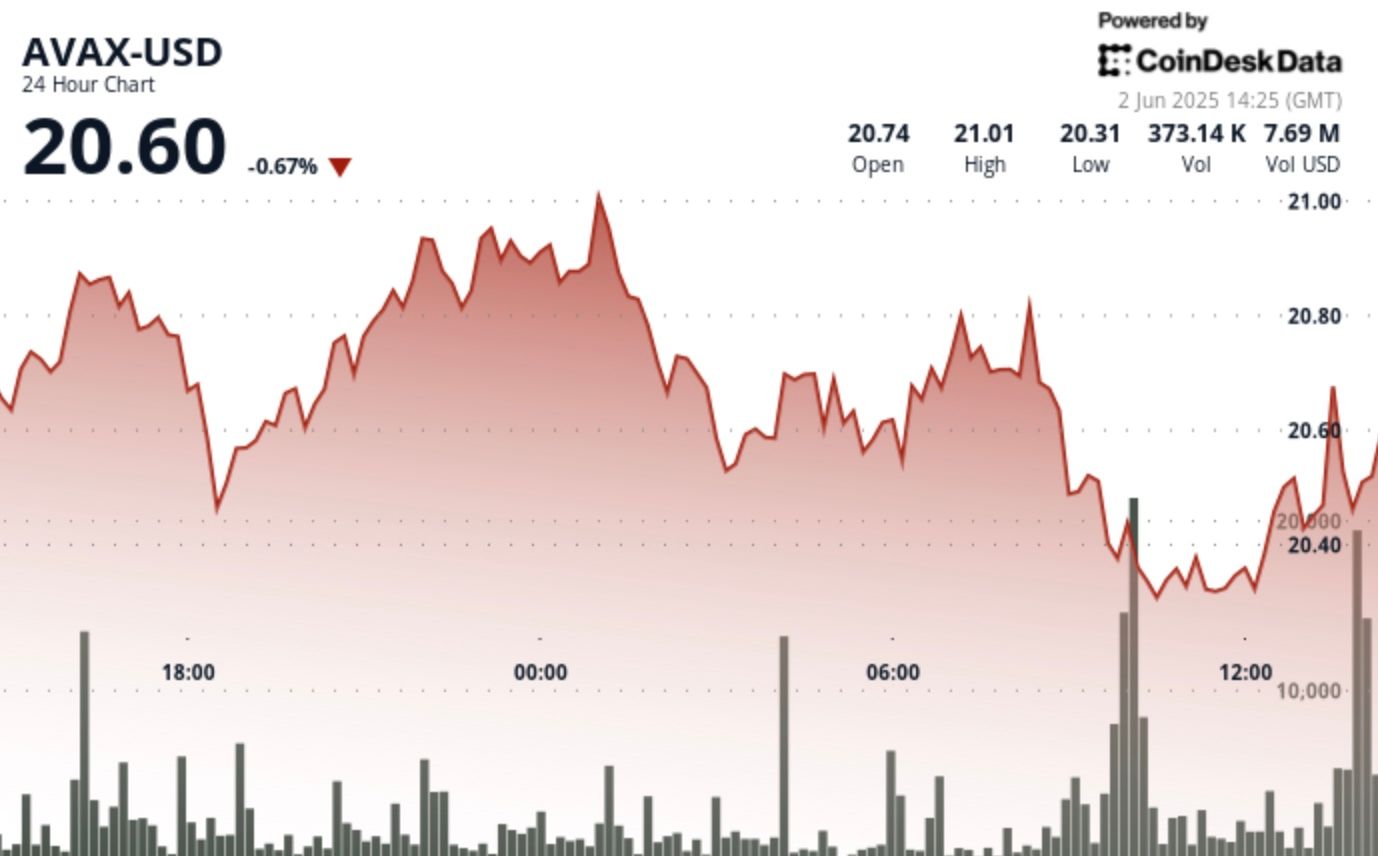

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  LEO Token

LEO Token  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  Monero

Monero  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  Aave

Aave  Uniswap

Uniswap  Bittensor

Bittensor  Ethena Staked USDe

Ethena Staked USDe  Cronos

Cronos  OKB

OKB  Aptos

Aptos  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jito Staked SOL

Jito Staked SOL  Ondo

Ondo  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic