New FTX CEO John Ray reveals today in a court declaration “the complete failure of corporate controls” at bankrupt crypto exchange FTX.

FTX CEO John Ray lays bare the enormity of the task he faces in finding and securing the property of the debtors as the liquidators seek to unravel the governance and management nightmare that is FTX.

Despite the latest grim news, crypto prices are holding up relatively well, with bitcoin firming at around $16,696, and some bright spots such as Litecoin up 8% at $62 and XRP ticking upwards at $0.38, gaining 2.7%.

The good FTX news: $740m in Crypto and $560m in cash found and secured

So far $740 million in crypto has been secured in cold wallets and $560 million of cash.

It also turns out that some parts of the group may be solvent, such as FTX Capital Markets and LedgerX, both regulated entities, so that’s some good news for creditors.

Wholly owned equity entities Embed Financial Technologies and Embed Clearing are also thought to be solvent.

Custodian FTX Value Trust Company is also solvent, with the proviso Ray uses throughout his document – “based on the information that I have reviewed at this time”.

…but the rest is a horror show of FTX amateurism and possibly criminal behaviour

Also, in his declaration Ray says that $372 million in unauthorised transfers was made in addition to “the dilutive ‘minting’ of approximately $300 million in FTT tokens by an unauthorized source after the Petition Date”.

Other numbers that jump out of the declaration include the $1 billion that Alameda Research, the hedge-fund-turned-trading-desk of the FTX group, loaned to Sam Bankman-Fried and $500 million to Nishad Singh, the former director of engineering at FTX and Alameda Research.

At the top of Ray’s declaration he makes his initial assessment abundantly clear:

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.”

And here are some truly stupendous examples of the lack of control systems and oversight that seem to have been the norm at FTX group:

“Unacceptable management practices included the use of an unsecured group email account as the root user to access confidential private keys and critically sensitive data for the FTX Group companies around the world, the absence of daily reconciliation of positions on the blockchain, the use of software to conceal the misuse of customer funds, the secret exemption of Alameda from certain aspects of FTX.com’s auto-liquidation protocol, and the absence of independent governance as between Alameda (owned 90% by Mr. Bankman-Fried and 10% by Mr. Wang) and the Dotcom Silo (in which third parties had invested).”

You won’t be surprised to hear that the House Financial Service Committee is holding a hearing and wants to hear directly from SBF, Alameda and Binance.

Want to buy a swanky new home? An emoji reply in a chat app will OK company funds for that

And when it came to the little matter of buying homes and other personal items using company money, an emoji was all that was required for authorization:

62. The Debtors did not have the type of disbursement controls that I believe are appropriate for a business enterprise. For example, employees of the FTX Group submitted payment requests through an on-line ‘chat’ platform where a disparate group of supervisors approved disbursements by responding with personalized emojis.

63. In the Bahamas, I understand that corporate funds of the FTX Group were used to purchase homes and other personal items for employees and advisors. I understand that there does not appear to be documentation for certain of these transactions as loans, and that certain real estate was recorded in the personal name of these employees and advisors on the records of the Bahamas.

FTX group was an amateur operation and its depositors and other creditors are now paying the price.

Such is the lack of even basic record-keeping and reconciliations, that none of the debtors have much of an idea which assets belong to which of its many entities, or how to go about finding and securing its digital assets on various blockchains.

To address this and to track down the $372 million unauthorised transfer and what could be many more unauthorised transfer before the filing for chapter 11 took place, Ray reports that the debtors have called in the professionals:

In response, the Debtors have engaged forensic analysts to identify potential Debtor assets on the blockchain, cybersecurity professionals to identify the parties responsible for the unauthorized transactions on and after the Petition Date and investigators to begin the process of identifying what may be very substantial transfers of Debtor property in the days, weeks and months prior to the Petition Date.

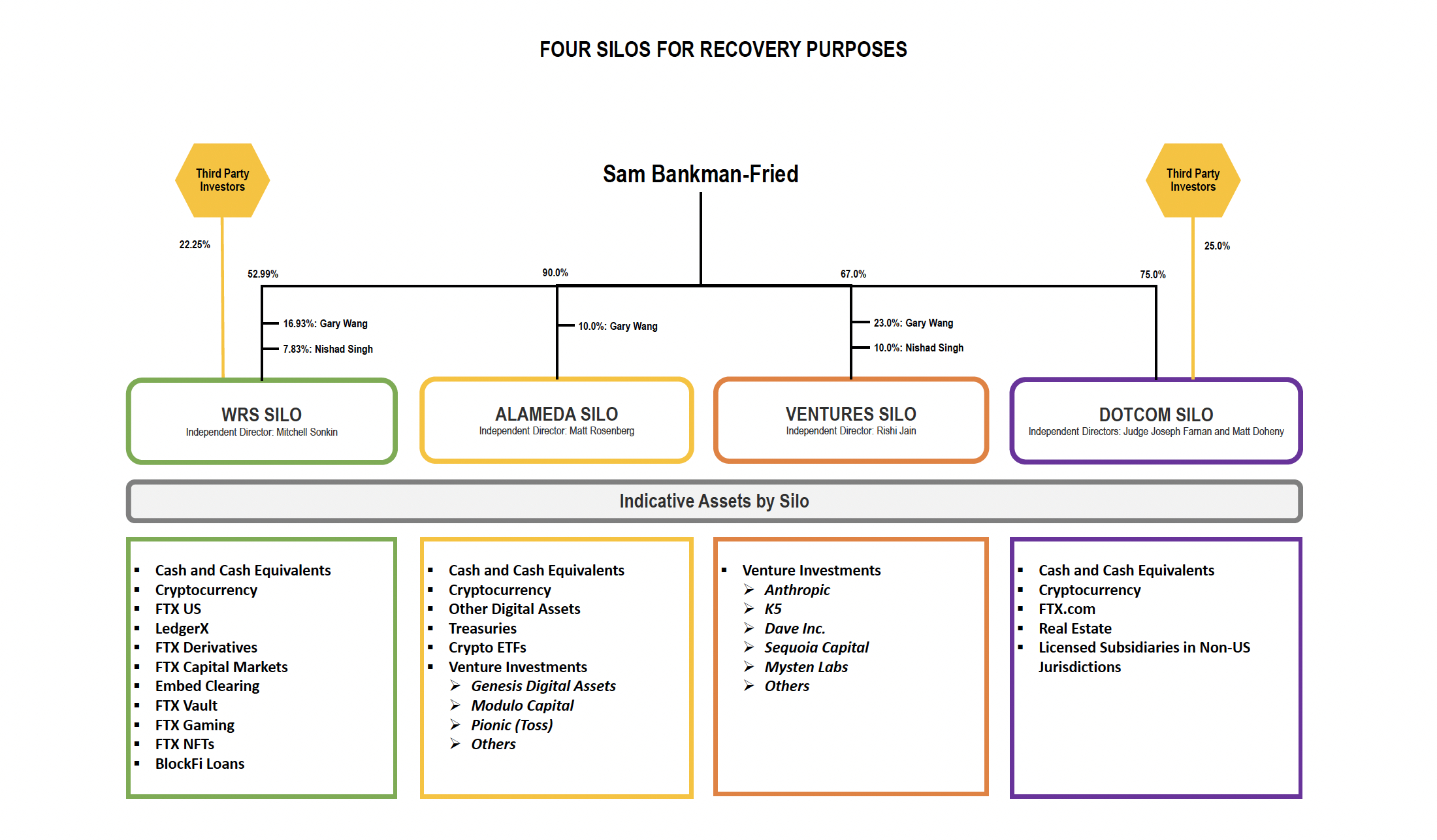

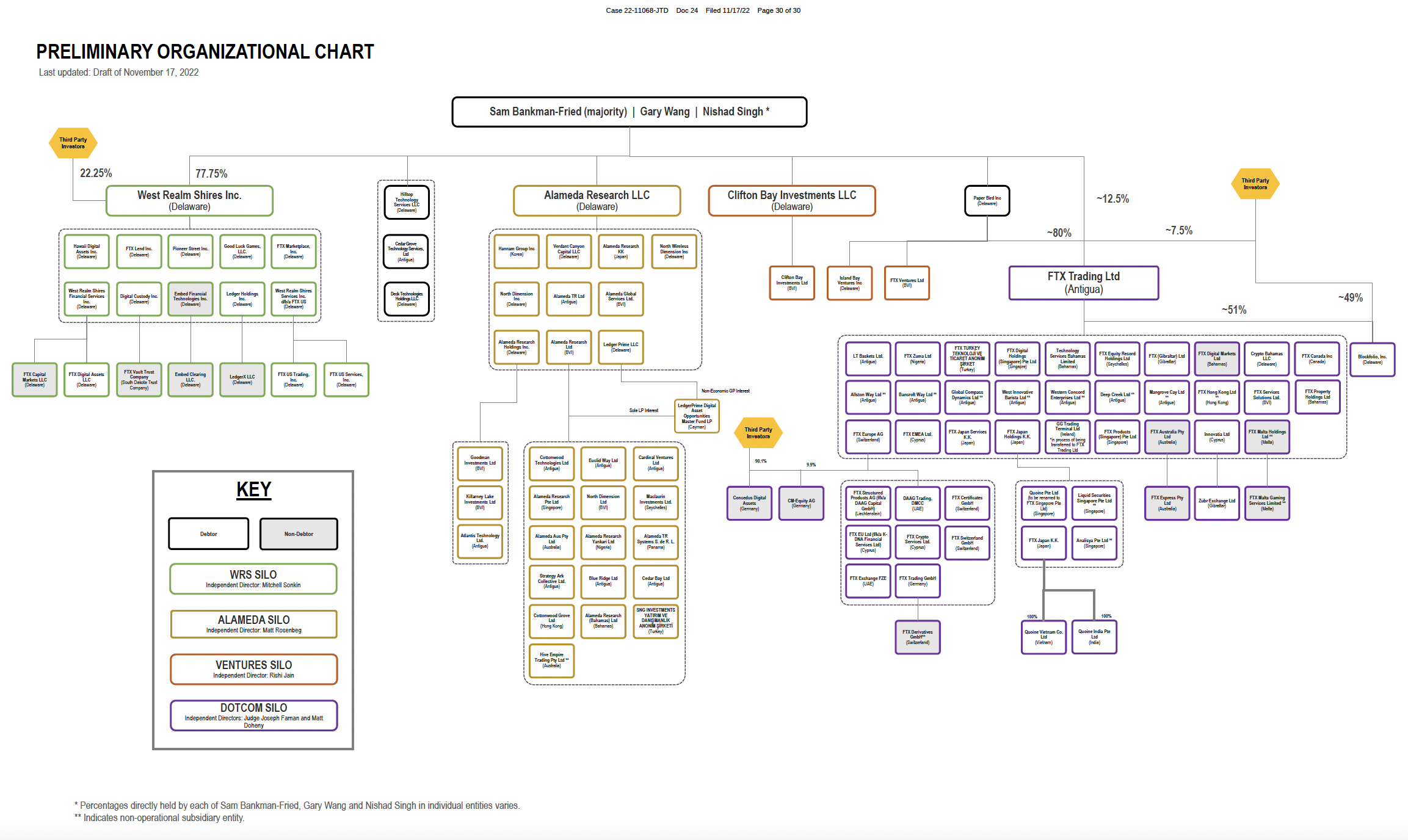

Helpfully, the new CEO has “identified four groups of businesses” for recovery purposes that he has split into four silos:

- West Realm Shires (WRS) Silo, which includes FTX US and Ledger X, FTX Capital Markets. This is where some of the solvent parts of the group are to be found, such as FTX Capital Markets, which is an SEC regulated broker dealer.

- Alameda Silo

- Ventures Silo, which includes Island Bay Ventures, FTX Ventures and Clifton Bay Investments

- Dotcom Silo, which FTX.com and similar exchanges in non-US locales. This silo includes third-party investors.

See the charts below:

Lax or non-existent FTX controls were inevitable prelude to downfall as crypto winter set in

Some of us here in the cryptonews virtual office joked when the crypto winter began that if you wanted to know which firms would go bust first, just check out which ones splurged the most on marketing.

Marketing largesse was exactly a trait that could be associated with FTX, with its stadium sponsorship deals and logo popping up in high profile sports such as Formula 1 racing.

Add to that a penchant for buying real estate and venture investments, in hindsight it is not too difficult to see how that could all be eating away at any buffer the FTX group might have for leaner times.

Adding to the precarious position was Alameda lending to FTX using FTT as collateral, and then loans to crypto lenders going bad in the wake of the TerraUSD and Luna implosion in May, and it was, in retrospect, only a matter of time before the moment of truth arrived.

That moment came when CZ and SBF decided to turn animosity into a bank run – or rather let things get out of hand and crashed the entire industry.

Here’s some more detail, purportedly from an Alameda All Hands meeting, ‘explaining’ how the trading desk lost all its money:

‘F**k regulators’ says SBF in latest interview – he might live to regret saying that

In an interview with VOX’s Kelsey Piper, SBF, when asked if comments he made in a previous interview in happier days about the need for good regulations was all just PR, he replied (in a DM conversation on Twitter):

yeah just PR; fuck regulators; they make everything worse; they don’t protect customers at all.

SBF has subsequently claimed was his online conversation was never intended for publication, but too late now, although VOX is adamant that SBF knew it was for publication.

The casual observer of this enormous crypto catastrophe could be forgiven for surmising that SBF’s cavalier approach to running a business could get him some serious jail time.

The interview is essential reading and some of his throwaway lines are shocking – and like this one, let’s hope don’t turn out to be true:

“Most exchanges did some variant of what we did”.

SBF’s activity elsewhere on Twitter – with his increasingly delusional posts about making customers whole, raising liquidity and vain attempts to distance himself from the “sketchy” behaviour identified in the VOX interview – is not going down well with CEO Ray:

Will Grayscale Bitcoin Trust be forced into liquidation?

In other news, there are rumours that Grayscale Bitcoin Trust be the next to fall victim to FTX contagion. Genesis’ lending problems may require liquidation of GBTC by the Digital Currency Group of which they are both constituent parts.

Such an outcome would actually be good news for the trust’s investors as it currently trades at a 40% discount, and investors would receive the par valuation of their holdings – i.e the full value of bitcoin held.

But for the DCG group conglomerate, which along with Coinbase was last year heralded by Time as one of the top 100 most consequential businesses on the planet, it would be disastrous.

DCG has investments in 114 businesses, including Coinbase, Circle, Ripple, Protocol Labs and many other major crypto firms, according to Messari data (DCG is invested in Messari), and in addition to Genesis and GBTC, is the owner of Foundry, Luno, TradeBlock, HQ and news site Coindesk.

Looking for some coins worth watching? Read on

If you are looking to add some alpha to your portfolio, a good place to start is in the presale sector, and we have two interesting propositions for your watchlist – Dash 2 Trade (D2T) and RobotEra (TORA).

Dash 2 Trade is the perfect antidote for a post-FTX world – its trading intelligence tools, signals and metrics will help traders and investors to spot the problems and steer clear.

In a vote of confidence in the project, LBank and, most recently, BitMart have both signed deals to list the token after its presale ends. You can buy D2T now in presale for $0.0513.

The second project is RobotEra, which could be the next hot metaverse gaming project.

The gaming platform is similar to The Sandbox but better – you build planets using robots. Its TARO token is on sale now for $0.020. Only days into its presale it has already raised $100,000.

Read More: cryptonews.com

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  Pepe

Pepe  Litecoin

Litecoin  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Ethena USDe

Ethena USDe  USDS

USDS  Aptos

Aptos  Aave

Aave  Render

Render  Mantle

Mantle  Bittensor

Bittensor  POL (ex-MATIC)

POL (ex-MATIC)  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  MANTRA

MANTRA  WhiteBIT Coin

WhiteBIT Coin  Arbitrum

Arbitrum  Virtuals Protocol

Virtuals Protocol  Monero

Monero  Tokenize Xchange

Tokenize Xchange