FTX is eyeing the completion of its bankruptcy process for the second quarter of next year, according to its Sept. 11 court filings.

As per the filing, the firm is currently involved with ongoing negotiations and mediation with stakeholders over the coming months to resolve open plan issues involving its bankruptcy plans. FTX also revealed that more than 75 firms, including existing crypto exchanges and financial and strategic buyers, have shown interest in it.

The exchange said it began a marketing process for the FTX.com and FTX US exchanges in May. According to the company, the FTX restart process considers varying potential structures, including an acquisition, merger, recapitalization, or other transactions to relaunch the FTX.com and/or FTX US exchanges.

Meanwhile, it further disclosed a comprehensive summary of its assets in a recent court submission, showing approximately $7 billion worth of assets, encompassing cash holdings, cryptocurrency, brokerage, reclaimed government assets, and various recovery endeavors.

Solana dominates FTX crypto holdings

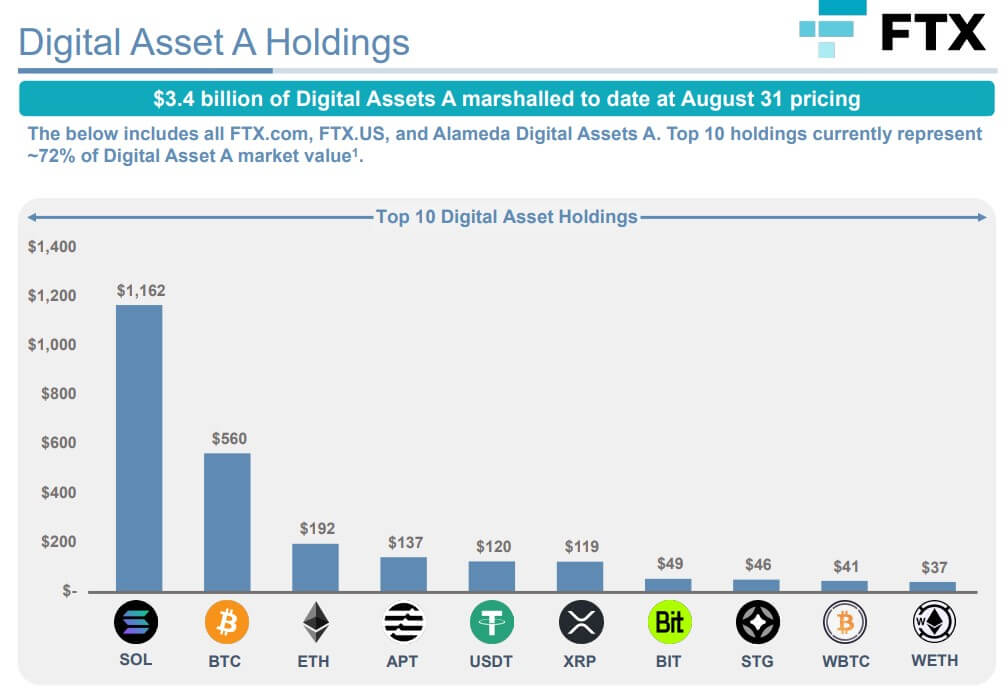

Per the filing, the embattled cryptocurrency company currently possesses a diverse portfolio of digital assets valued at $3.4 billion, with its top 10 holdings accounting for roughly 72% of this valuation.

This portfolio includes $1.16 billion in Solana (SOL), $560 million in Bitcoin (BTC), $192 million in Ethereum (ETH), and $119 million in XRP.

The filing also showed that the firm had hundreds of millions of dollars worth of over 1,300 lesser-known assets “that fail to meet liquidity thresholds and are primarily controlled by it.” Some of the assets in this class include MAPS, Serum (SRM), Bonfida (FIDA), etc.

CryptoSlate previously reported that the bankrupt firm is seeking court approval to allow it to liquidate up to $100 million worth of digital assets weekly, with the ability to increase the limit to $200 million temporarily.

$4.5B worth of venture investments

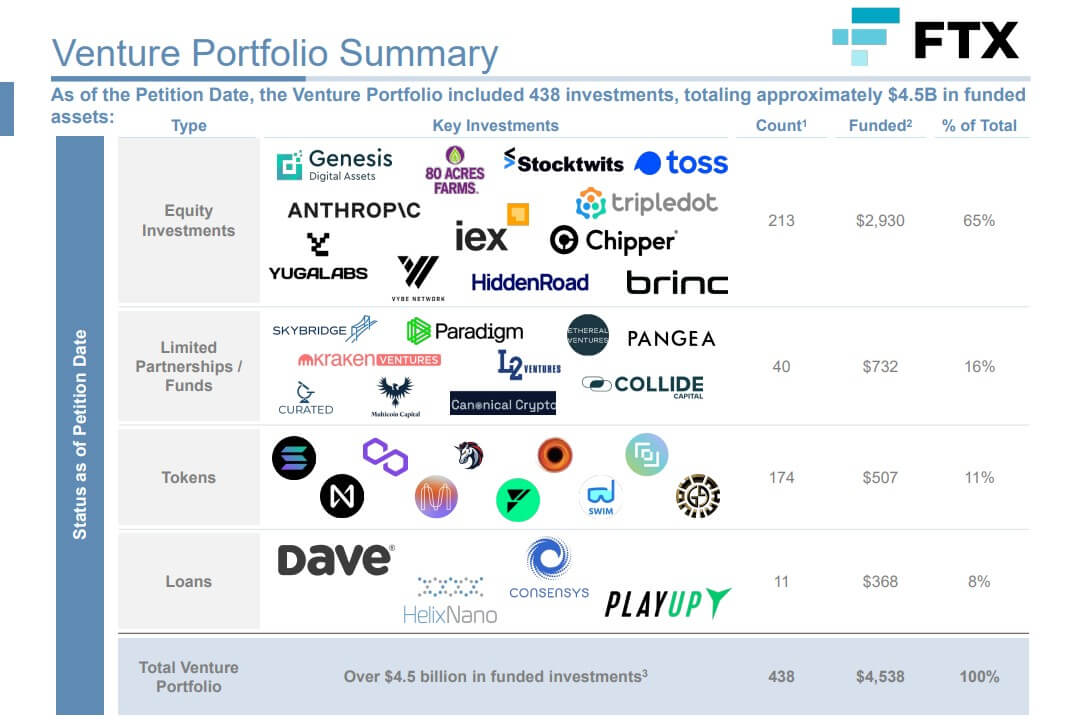

The court filing further showed that FTX had 438 venture investments, totaling approximately $4.5 billion in funded assets.

These investments included equity investments in firms like Yuga Labs, Chipper, Toss, Genesis Digital Assets, etc. It also revealed a partnership with major investment firms such as Kraken Ventures, Skybridge, Paradigm, etc.

Other assets

The filing revealed that the bankrupt firm possesses 38 Bahamian properties, encompassing condominiums, penthouses, and other real estate assets, with an estimated total value of approximately $200 million.

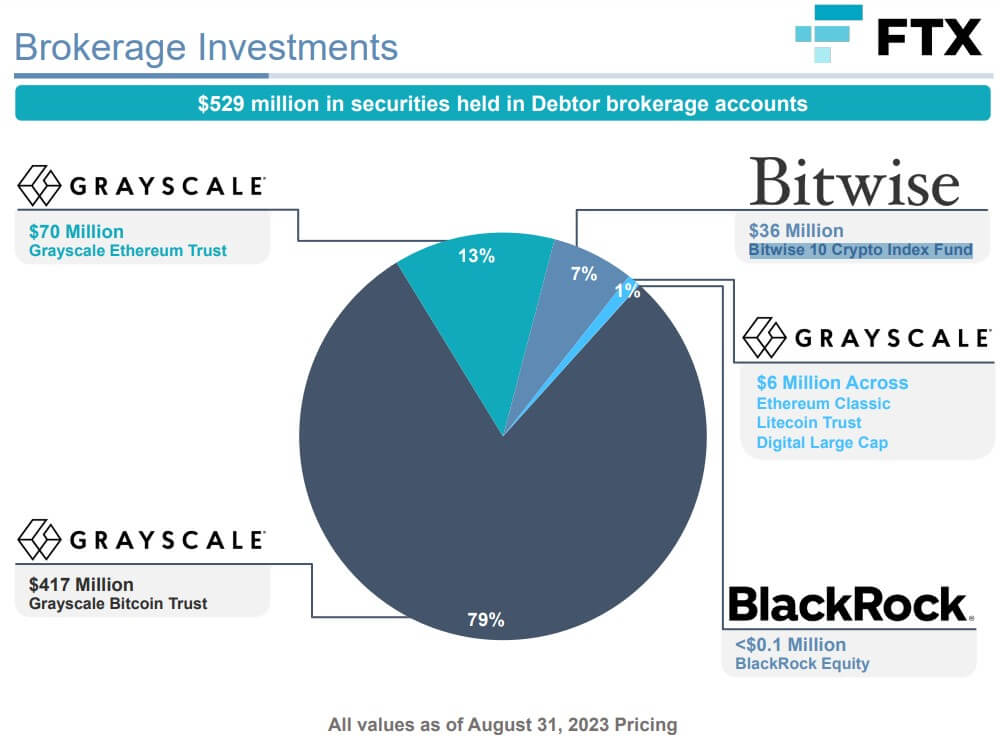

Additionally, the company maintains a significant securities portfolio valued at $529 million, primarily held in brokerage accounts with prominent crypto investment firms such as Grayscale, Bitwise, and BlackRock, the world’s largest asset management company.

A detailed breakdown of these securities holdings indicates that $493 million is invested in various Grayscale products, including their Bitcoin and Ethereum trusts. Furthermore, the firm has allocated $36 million to the Bitwise 10 Crypto Index Fund and has a smaller investment of less than $100,000 in BlackRock’s equity offerings.

Read More: cryptoslate.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Aave

Aave  Bittensor

Bittensor  Uniswap

Uniswap  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  Internet Computer

Internet Computer