Bitcoin (BTC) has passed Visa, a renowned payment card company, in market value. Despite high volatility levels in the crypto industry, bitcoin is steadily surpassing significant players in the global market.

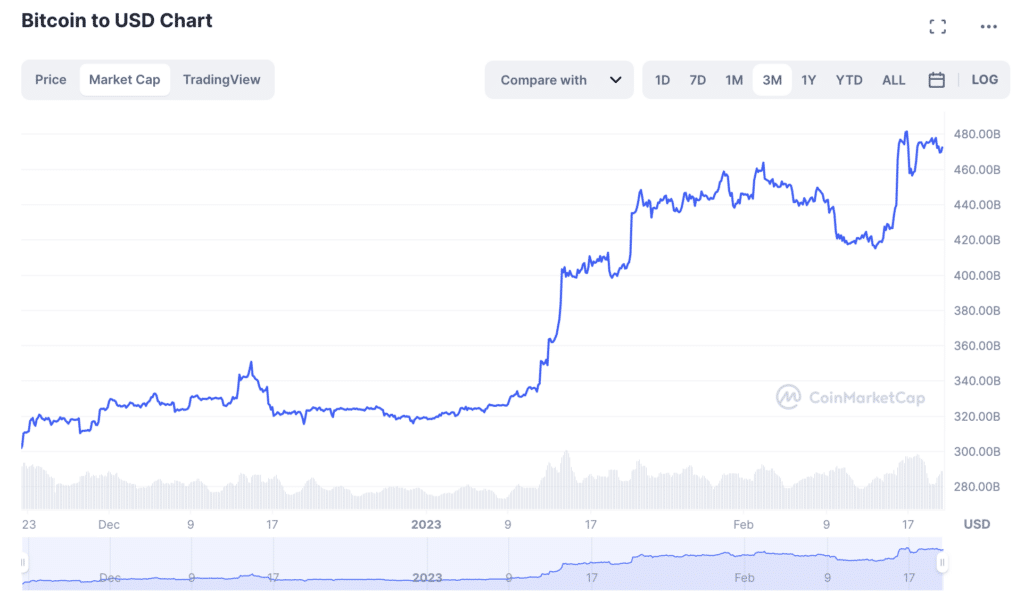

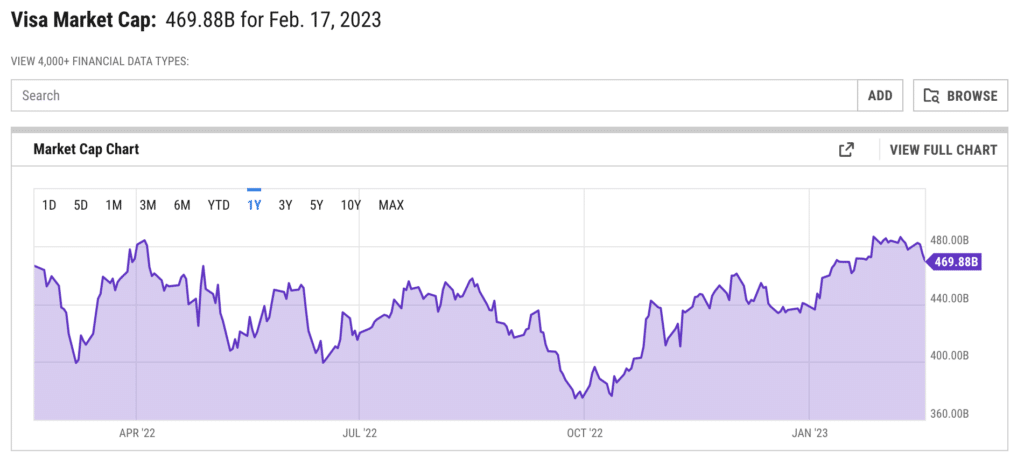

Data from CoinMarketCap shows bitcoin has hit more than $472 billion in market capitalization in the last few days ranking 18th, while tradingeconomics.com reveals Visa’s market capitalization at about $460 billion.

The entry of bitcoin into the financial world has changed several dimensions while attracting debate among economists, investors, and the state. Despite a myriad of skepticism and unpredictability, bitcoin’s market capitalization has rapidly risen since its inception in 2009.

One of the prestigious companies offering international financial services, Visa is now trailing behind bitcoin in market capitalization. The $460 billion market cap Visa originates from its publicly traded shares that measure the company’s worth in the financial markets. It is momentous for bitcoin to outdo such a great company in times of crypto winter.

Although there is a slight decrease in market cap by Visa, the company continues to maintain its grip on the top companies in the world. Well, its announcement to embrace cryptocurrencies would open new avenues for its growth in the future.

Why is bitcoin outperforming flagship companies?

Bitcoin operates through a decentralized mode whereby transactions are not under the control of financial institutions or government entities but depend on peer-to-peer processing through the blockchain.

Not to mention, bitcoin’s limited supply also plays a vital role in driving its growth in the market. In contrast to fiat currencies like the US dollar, under the mercy of the central banks that authorize printing, bitcoin has a limited supply of 21 million coins. Therefore, its scarcity makes it a more attractive investment than devaluing fiat currencies and large stock market shares.

For instance, at the end of January, bitcoin surpassed Johnson and Johnson, one of the world’s largest healthcare companies. NVIDIA Corporation, Berkshire Hathaway Inc, Facebook’s Meta Platforms, Inc, Berkshire Hathaway Inc and Tesla are just a handful of companies on bitcoin’s site.

It is just a matter of time until the flagship crypto hits the rails and achieves new heights. More or so, there has been a high adoption rate of cryptocurrencies over the last ten years.

Read More: crypto.news

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Pepe

Pepe  Ethena USDe

Ethena USDe  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  Uniswap

Uniswap  Aave

Aave  Bittensor

Bittensor  Aptos

Aptos  NEAR Protocol

NEAR Protocol  OKB

OKB  Cronos

Cronos  Jito Staked SOL

Jito Staked SOL  Ethena Staked USDe

Ethena Staked USDe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  Internet Computer

Internet Computer