Ethereum blockchain enthusiasts are turning their attention to the blockchain’s big Shanghai upgrade, enabling the first-ever withdrawals of staked ether (ETH) and completing the network’s historic transition to a fully functional proof-of-stake network.

The upgrade (also known as Shapella) is expected to take place around 6:30 p.m. ET (22:30 UTC).

If you’re eager to follow what the experts are expecting from tonight’s upgrade, we have you covered. (We’ll be covering the event live on CoinDesk, with key updates on Twitter (@CoinDesk), and there’s also this mainnet watch party hosted by the Ethereum Cat Herders starting at 5:45 p.m. ET.)

When the Shanghai hard fork goes live

Shanghai will go live at the epoch 194048, around 22:27 UTC (6:27 p.m. ET), allowing stakers to finally put their requests in for ether withdrawals immediately thereafter.

Ethereum developers say they’re feeling confident the upgrade will go smoothly. Developers have run through three different testnet upgrades and all worked smoothly, though the last testnet upgrade did not finalize when it was originally supposed to because not enough nodes upgraded in time.

Although there were some minor hiccups in the last trial run, developers assured CoinDesk there wouldn’t be similar issues on the day of the upgrade.

The Ethereum Foundation doubled its “bug bounty” program awards to $500,000 ahead of Shanghai to encourage individuals to report any vulnerabilities they could find.

“There’s always a chance that there could be unfound bugs, but we feel that we tested the upgrade extensively and weren’t able to find any issues that prevent us from scheduling the upgrade,” said Parithosh Jayanthi, a DevOps engineer at the Ethereum Foundation.

To ensure that stakers can access withdrawals, developers have urged node operators to make sure they are running the latest version of their software clients.

How might the market react?

Crypto market analysts have weighed in on how ether might trade as Shanghai goes live.

According to a report from Coinbase, the performance of ETH will more likely have to do with the risk environment than any idiosyncrasies associated with the upgrade. The Coinbase report says that “if the trading environment sees risk assets selling off, people may decide to unstake and sell ETH just to de-risk, while institutions may not step in as aggressively on the buy side.”

However, there are some technicalities that can limit the amount of ETH that can be unstaked at once.

The first factor is that only 44% of nodes have changed their withdrawal credentials to 0x01 address, which is needed to unstake partial or full withdrawals. Another factor that will be an effect on the price of ether is that only 16 partial withdrawal requests can be put into a single slot (which happens every 12 seconds).

And the final factor that will limit the price of unstaked ether is due to staking services’ timelines. Lido, which holds about 23% of all staked ether, will release withdrawals after the protocol goes through an upgrade in May.

Other crypto analysts suggest the Shanghai upgrade will have limited if any impact on the market for ether.

“My suspicion is that this is going to be a non-event in terms of price,” Brian Mosoff, CEO of technology company Ether Capital, told CoinDesk TV this week. He says that in the longer term the successful implementation of a full, two-way staking system could attract big institutional investors, even if some early stakers move to cash out.

Edited by Bradley Keoun.

Read More: www.btcethereum.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

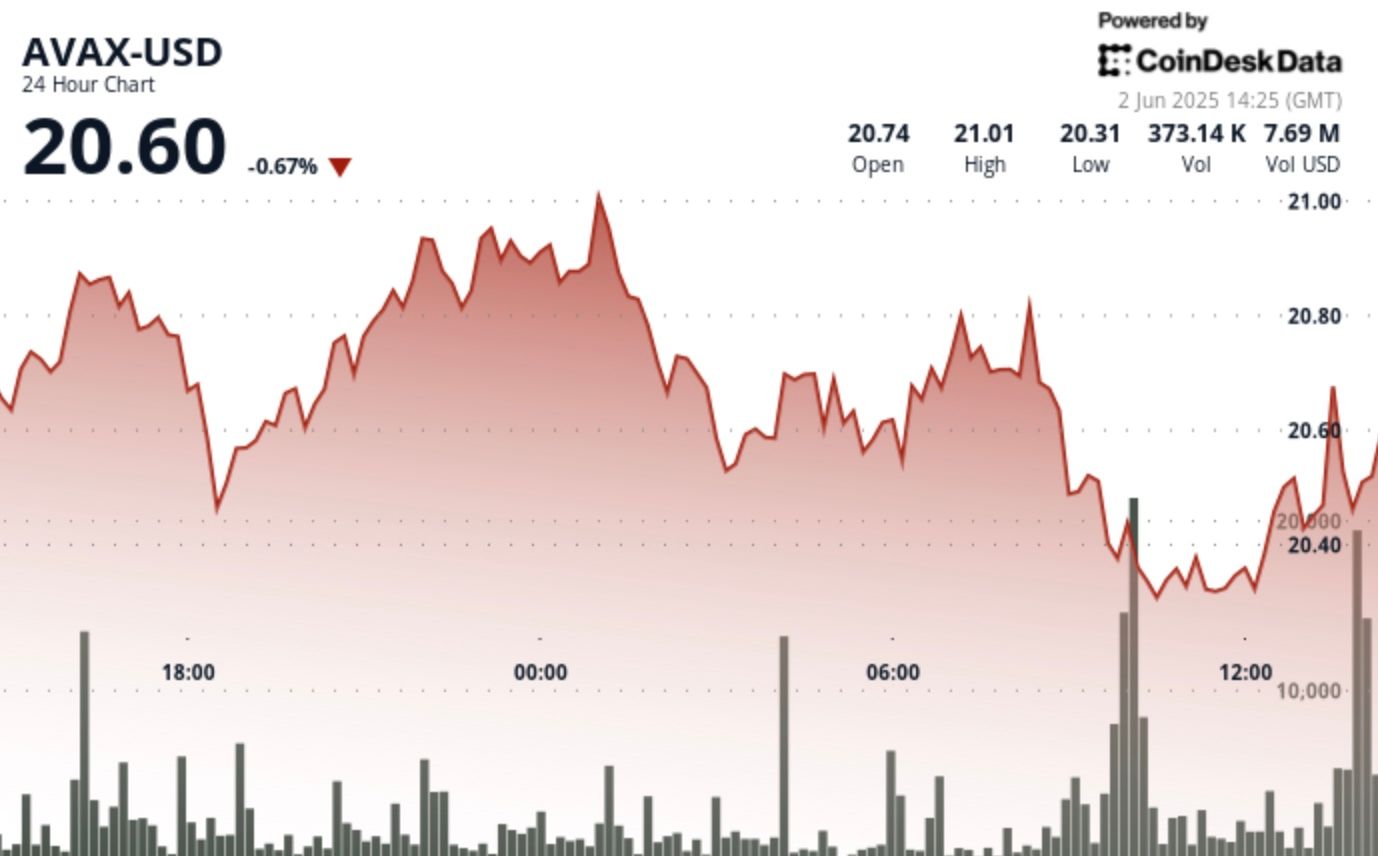

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  LEO Token

LEO Token  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  Litecoin

Litecoin  WETH

WETH  Monero

Monero  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Bittensor

Bittensor  Ethena Staked USDe

Ethena Staked USDe  Cronos

Cronos  Aptos

Aptos  NEAR Protocol

NEAR Protocol  OKB

OKB  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Internet Computer

Internet Computer  Ondo

Ondo  Ethereum Classic

Ethereum Classic