- Ethereum price is down 3% on the day following a rejection from a crucial support zone.

- Chainlink has initiated a staking protocol on the Ethereum Network.

- A retest of the $1,211 barrier could induce a sweep-the-lows event.

Ethereum price has investors dialing in as Network advancements are arousing speculation. Still, the technicals will need to show forth stronger signals to justify opening a long position.

Ethereum price is in question

Ethereum price is currently down 3% on the day as the bears have flexed a rejection near the mid $1,200 level. At the time of writing, ETH is testing the 21-day simple moving average for support and is submerged below a support zone established in October.

Ethereum price currently auctions at $1,229. The bearish flex comes at an interesting time in the market, as Chainklink has recently launched its early access staking program on the Ethereum network. Staking is a pledge investors can make to provide liquidity for their digital assets’ network and receive a percentage yield.

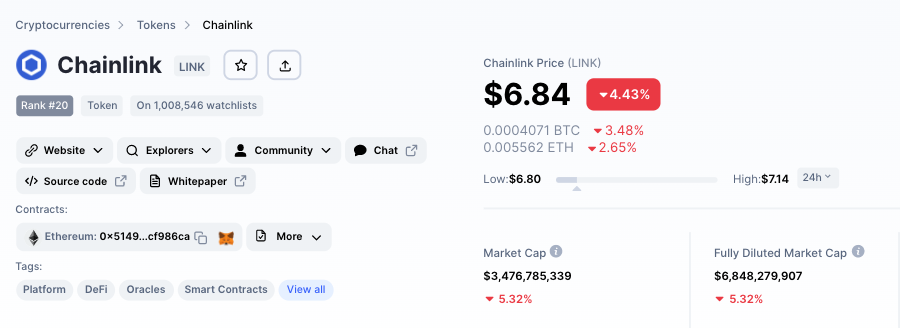

On November 6, Chainlink went live on the Ethereum Network, enabling LINK users to stake up to 7,000 Chainlink tokens per address. According to Coinmarketcap.com, Chainlink is ranked 20th among all cryptocurrencies, with a total market cap of $3,478,182,520. Now with the ability for LINK and ETH users to collaborate amongst both networks, the potential for robust gains for both tokens seems ever more promising.

Still, the ETH price has yet to match the optimistic advancements accomplished on the network. Traders may want to consider remaining sidelined unless the bulls can hurdle the broken support zone above $1,250. A breach of the 1,250 zone could induce the 10% rally into the mid-1,400 zone mentioned in the previous outlook. The same thesis also mentioned that a plummet below $1,211 could induce larger downtrend move, targeting the November low at $1,075. The Ethereum price would decline by 12% if the bearish scenario manifests.

ETH/USDT 1-Day Chart

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  Bitcoin Cash

Bitcoin Cash  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  Aptos

Aptos  OKB

OKB  Cronos

Cronos  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic