Peera_Sathawirawong/iStock via Getty Images

One of the more interesting crypto tokens to explore this crypto winter might be Ethereum Name Service (ENS-USD). It is a domain protocol built on the Ethereum (ETH-USD) blockchain. In this article, we’ll look at what Ethereum Name Service is, the tokenomics of the coin, and the strength of the Ethereum Name Service DAO.

What is Ethereum Name Service?

Simply put, Ethereum Name Service is a domain provider built on public blockchain rails. One can think of it a bit like DNS but for a Web3 environment. The service provides public domains on the blockchain similar to how a company like GoDaddy (GDDY) would provide dot com domains for more traditional Web companies. In addition to building websites with Web3 domains, domain holders can also use the domain addresses for payment routing and ID verification. For instance, Google (GOOG) (GOOGL) or Facebook (META) accounts are often used to sign into Web2 websites. In Web3, users can sign into applications using their domain address through a wallet like Metamask.

ENS uses the .ETH extension which is potentially problematic because “.eth” has actually been reserved for the country of Ethiopia by ICANN – the Internet Corporation for Assigned Names and Numbers. While .eth hasn’t actually been used by Ethiopia, it is potentially a massive collision problem if Ethiopia and/or ICANN decide to make it a problem for some reason. To be clear, I don’t think this is likely, but it is a possibility to consider.

Why Get a Web3 Domain?

I’ve previously covered ENS for my BlockChain Reaction subscribers in an NFT deep dive that I did in August. In that piece, I explained why public blockchain ledger allows peer to peer payment no matter which app the end user chooses:

It doesn’t matter if the user I’m sending it to uses MetaMask, Exodus, Brave, Atomic, Edge or something entirely different. As long as I have the correct wallet address character string, I can send it to that user.

The problem with crypto wallet addresses is that they are long strings of characters and confusing to any non-crypto user. One of my base cases for Web3 domains is for payment routing and username logins. Rather than copy/pasting unreadable character strings, users can instead create human readable domains that route transactions to the correct address in any application that has integration with ENS. For instance, if I owned the domain “mikefay.eth” (I don’t), I could have a friend send me $10 in USDC (USDC-USD) to “mikefay.eth” to pay for some sort of good or service. The funds would arrive to my Ethereum address that is associated with that domain no matter which wallet application my friend uses.

Anyone who has ever used Venmo likely understands the benefit of searchable usernames in a peer to peer payment app. ENS potentially takes the utility of peer to peer payment in something like Venmo or CashApp and decentralizes it at the application layer. It’s a very interesting real world solution built on public blockchain.

Sales, DAO Structure, and Tokenomics

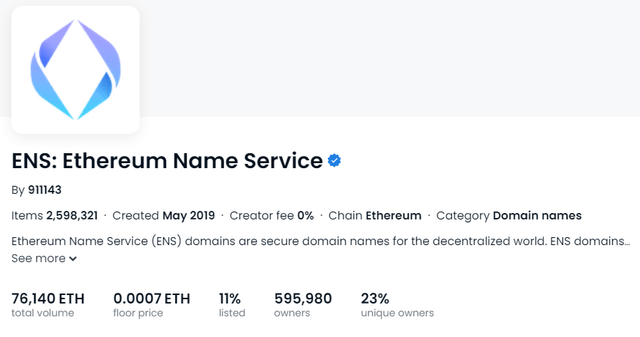

There is plenty of competition in the blockchain domain space. That said, ENS is one of the most successful given the level of domain sales, unique owners, and decentralized governance of the protocol. As of submission, ENS has registered just under 2.6 million domains that are spread out among 596k unique buyers.

This level of domain sales is comparable to an entity like Unstoppable Domains, but there are key differences. One big difference is Unstoppable domains sells them to the user outright and offers over a half dozen different extension options. While ENS focuses on a single extension and operates with a renewal model that supporters say is more sustainable in the long term. Another key difference is Unstoppable Domains is a private business while ENS has a DAO structure. And it’s actually one of the more successful examples of a DAO in my opinion.

| Rank | Organization | Treasury | Lifetime Participants (sorted) |

|---|---|---|---|

| 1 | ENS | $861m | 87.2k |

| 2 | GMX | N/A | 51.8k |

| 3 | PancakeSwap | $11.1K | 49.2k |

| 4 | AAVE | $97.9m | 42.3k |

| 5 | Wonderland | $239.7m | 38.8k |

Source: DeepDAO

According to DeepDAO, ENS has the most lifetime DAO participants with over 87,000 people and it has a top 3 treasury value with $861 million in funds. ENS appears to have a dedicated, loyal base of users and domain holders. Though there are well over a half a million unique domain holders, there are just 64k ENS token holders.

- Holders: 64,233

- Coin Price: $11.27

- Total Supply: 100,000,000

- Circulating Supply: 20,244,862

- Circulating Market Cap: $228 million

- Cap Rank: #103

The biggest issue to the immediate investment thesis with the ENS coin itself may be the amount of supply dilution that is still coming.

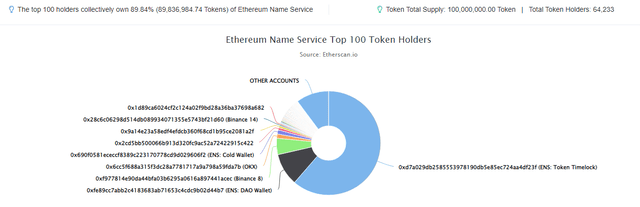

ENS Token Top 100 Wallets (etherscan)

ENS has a total max supply of 100 million coins and there are still more than 61% of them in time lock waiting to be released. The largest single wallet holder is the DAO treasury with 10%. From there, Binance (BNB-USD) and OKX have roughly 7% of the supply. This means out of the 100 million coins, the circulating supply is a little over 20%. That’s not a high number and it means there is going to be a significant amount of dilution when the remaining tokens come out of timelock near the end of 2025.

Risks

If you believe in the future of Web3, Ethereum Name Service is conceivably a community to consider betting on. The problem is potentially with the tokenomics of the ENS coin itself. In addition to the dilution concern, it is not a utility token in any way. Holders of the coin don’t get discounts on domain renewals or any perks from holding. The token exists purely as a governance coin. So if you want to vote on the direction of the ENS ecosystem, then it might make sense to consider buying this one. If that’s not something you’re interested in, you can probably stay away for now.

Summary

I think ENS is one of the most interesting applications of public blockchain in the entire cryptocurrency market. The activity and dedication from members of the community through DAO voting is exceptional and, in my view, one of the more impressive case studies of decentralized autonomous organizations. I can legitimately say I’m personally rooting for ENS to thrive long term but I can’t recommend buying the governance token as an investment right now. All that said, I’m actually incredibly bullish NFT domains long term.

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Hedera

Hedera  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  Pepe

Pepe  Litecoin

Litecoin  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Internet Computer

Internet Computer  USDS

USDS  Aptos

Aptos  Aave

Aave  Render

Render  Mantle

Mantle  Bittensor

Bittensor  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Virtuals Protocol

Virtuals Protocol  WhiteBIT Coin

WhiteBIT Coin  MANTRA

MANTRA  Arbitrum

Arbitrum  Monero

Monero  Tokenize Xchange

Tokenize Xchange